Gold Fields' A$3.7 Billion Gold Road Acquisition: Implications For Investors

Table of Contents

Enhanced Gold Production and Reserves

The Gold Fields' A$3.7 Billion Gold Road Acquisition significantly boosts the company's gold production capacity and reserves. The integration of Gold Road's assets, particularly the Gruyere gold mine, adds considerable heft to Gold Fields' existing portfolio. This translates to a substantial increase in gold output and extends the lifespan of key operational mines.

- Increased yearly gold output: The acquisition is projected to increase Gold Fields' annual gold production by a substantial amount, bolstering its overall output and revenue streams. Specific figures will need to be released pending the completion of the acquisition and full integration.

- Significant expansion of mine life: The addition of Gold Road's resources extends the operational lifespan of existing mines, providing a longer-term outlook for production and profitability for Gold Fields.

- Diversification of production across multiple geographic locations: This acquisition further diversifies Gold Fields' geographic footprint, mitigating risks associated with concentrating operations in specific regions. The Gruyere gold mine in Western Australia is a particularly valuable addition.

Market Share and Competitive Landscape

The Gold Fields' A$3.7 Billion Gold Road Acquisition dramatically alters the competitive landscape of the global gold mining industry. By absorbing Gold Road, Gold Fields strengthens its position, particularly within the Australian market. This increased scale allows for greater bargaining power with suppliers, leading to potential cost reductions and improved operational efficiency.

- Increased market share in Australia: The acquisition propels Gold Fields into a leading position within the Australian gold mining sector, expanding its influence and market dominance.

- Improved bargaining power with suppliers: Gold Fields now commands greater negotiating leverage with suppliers, potentially securing more favorable contracts and reducing operational costs.

- Potential for strategic partnerships: The enhanced market position allows for strategic alliances with other companies in the industry, furthering growth opportunities. This includes potential collaboration on exploration, development and resource management.

Financial Implications for Investors

The financial implications of the Gold Fields' A$3.7 Billion Gold Road Acquisition are multifaceted and crucial for investors. While the deal represents a significant investment, it also presents opportunities for increased shareholder value and potential returns.

- Potential for increased earnings per share (EPS): The expanded production and operational efficiencies are expected to lead to higher earnings per share, benefiting investors.

- Impact on debt-to-equity ratio: The acquisition's financing methods and the subsequent integration process will influence the company's debt-to-equity ratio. Careful monitoring of this key financial metric is crucial.

- Long-term return on investment (ROI) projections: While long-term projections are subject to market fluctuations and unforeseen circumstances, a robust assessment of the acquisition's ROI is essential for investors.

Risks and Challenges Associated with the Acquisition

While the Gold Fields' A$3.7 Billion Gold Road Acquisition offers significant potential, investors must acknowledge associated risks and challenges. Successful integration of Gold Road's operations requires careful planning and execution.

- Integration challenges and associated costs: Merging two distinct mining operations presents logistical and operational challenges that can result in unforeseen costs and delays.

- Potential for regulatory delays: The acquisition is subject to regulatory approvals, and any delays could impact the timeline and overall costs of the integration process.

- Fluctuations in gold prices: Gold prices are inherently volatile, and unfavorable price movements could affect the profitability of the acquired assets and the overall return on investment.

Conclusion: Evaluating the Long-Term Impact of Gold Fields' A$3.7 Billion Gold Road Acquisition

The Gold Fields' A$3.7 Billion Gold Road Acquisition represents a bold strategic move with the potential to significantly enhance Gold Fields' position in the global gold mining market. The acquisition promises increased production, expanded reserves, and a stronger competitive stance. However, investors must remain cognizant of the associated risks, including integration challenges, regulatory hurdles, and price volatility. A thorough understanding of these factors is crucial before making any investment decisions related to Gold Fields. Before investing, conduct your own thorough research and, if necessary, seek the advice of a qualified financial advisor to evaluate the implications of the Gold Fields' A$3.7 Billion Gold Road Acquisition on your personal investment strategy.

Featured Posts

-

Verstappen On Fatherhood His First Post Baby Interview

May 05, 2025

Verstappen On Fatherhood His First Post Baby Interview

May 05, 2025 -

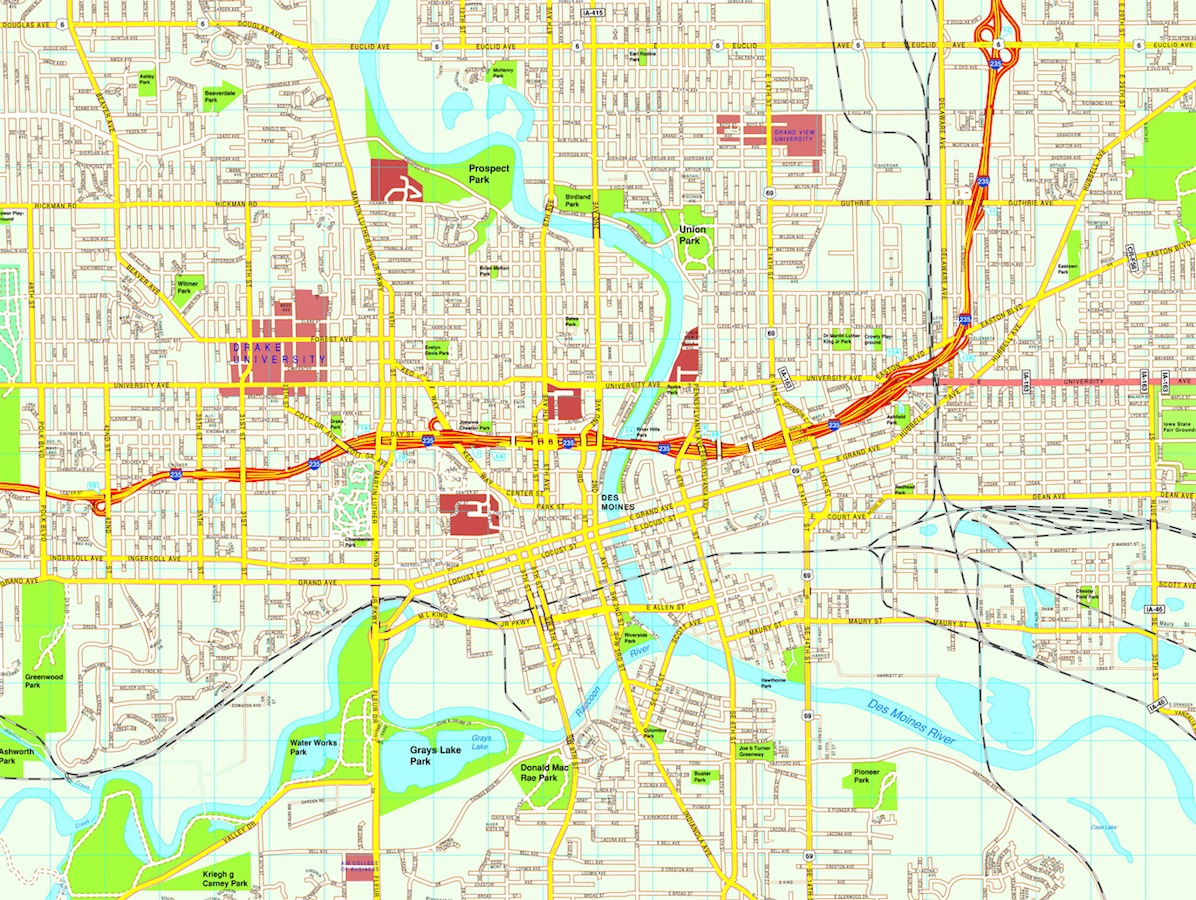

Predicting The Winners At Ufc Des Moines A Comprehensive Guide

May 05, 2025

Predicting The Winners At Ufc Des Moines A Comprehensive Guide

May 05, 2025 -

Carte Ufc Des Moines Mise A Jour Sidey Et Robertson Du Canada Presents

May 05, 2025

Carte Ufc Des Moines Mise A Jour Sidey Et Robertson Du Canada Presents

May 05, 2025 -

Lily Piquet Verstappen The Latest Addition To The Motor Racing Family

May 05, 2025

Lily Piquet Verstappen The Latest Addition To The Motor Racing Family

May 05, 2025 -

Ufc Des Moines Predictions Best Mma Bets And Odds For Today

May 05, 2025

Ufc Des Moines Predictions Best Mma Bets And Odds For Today

May 05, 2025

Latest Posts

-

New The Librarians Sequel Series Tnt Releases Trailer Poster And Premiere Date

May 06, 2025

New The Librarians Sequel Series Tnt Releases Trailer Poster And Premiere Date

May 06, 2025 -

The Librarians The Next Chapter New Trailer Poster And Premiere Date Announced By Tnt

May 06, 2025

The Librarians The Next Chapter New Trailer Poster And Premiere Date Announced By Tnt

May 06, 2025 -

Tnts The Librarians The Next Chapter Premiere Date Trailer And Poster Revealed

May 06, 2025

Tnts The Librarians The Next Chapter Premiere Date Trailer And Poster Revealed

May 06, 2025 -

Hos Kokunun Oetesinde Ueruen Kalitesi Ve Itibar

May 06, 2025

Hos Kokunun Oetesinde Ueruen Kalitesi Ve Itibar

May 06, 2025 -

1 1 Billion At Stake Warner Bros Discovery And The Absence Of Nba Advertising

May 06, 2025

1 1 Billion At Stake Warner Bros Discovery And The Absence Of Nba Advertising

May 06, 2025