Gold Investment Soars On Fears Of Trump's EU Trade Actions

Table of Contents

Trade War Uncertainty Fuels Gold Investment Demand

The direct link between escalating trade tensions and increased demand for gold is undeniable. As geopolitical uncertainty rises, investors seek the security of assets historically proven to retain their value during times of economic turmoil. This flight to safety is a key driver of the current surge in gold investment.

- Increased market volatility leads to capital flight into safe-haven assets: When markets become unpredictable, investors often withdraw funds from riskier investments and move them into assets perceived as less volatile, such as gold. This reduces overall portfolio risk.

- Gold's historical performance during economic uncertainty highlights its reliability: Throughout history, gold has served as a reliable store of value during periods of economic and political upheaval. Its consistent performance strengthens investor confidence.

- Concerns over weakening currencies further bolster gold's appeal: Trade wars can weaken currencies, making gold, priced in US dollars, a more attractive investment for those holding depreciating assets. This is particularly relevant in the current climate.

- Institutional investors are increasing their gold holdings: Large institutional investors, including central banks and hedge funds, are recognizing the strategic value of gold as a portfolio diversifier and are significantly increasing their holdings. This adds to the upward pressure on gold prices.

Impact of Trump's EU Trade Actions on Global Markets

President Trump's trade actions against the European Union, including tariffs on various goods, are creating significant uncertainty in the global economy. These actions have far-reaching consequences:

- Tariffs on EU goods and potential retaliatory measures: The imposition of tariffs creates increased costs for businesses and consumers on both sides of the Atlantic, impacting profitability and potentially triggering retaliatory measures that further exacerbate the situation.

- Disruption of global supply chains and increased production costs: Trade disputes disrupt established supply chains, leading to delays, increased costs, and potential shortages of goods. This uncertainty fuels investor anxiety.

- Negative impact on consumer confidence and spending: Uncertainty about the economic future often leads to decreased consumer confidence and reduced spending, potentially triggering a slowdown in economic growth.

- Potential slowdown in global economic growth: The combined effects of trade tensions, reduced consumer spending, and disruptions to global supply chains contribute to a potential significant slowdown in global economic growth. This further increases the appeal of gold as a safe haven.

Analyzing Gold Investment Strategies in the Current Climate

For investors seeking to navigate the current market volatility, incorporating gold into their portfolio can be a strategic move. However, a thoughtful approach is crucial.

- Different ways to invest in gold: Investors have several avenues for gold investment, including physical gold (bullion, coins), gold Exchange Traded Funds (ETFs), and gold mining stocks. Each option presents unique risk and reward profiles.

- Risk assessment and diversification strategies: Gold investment should be part of a well-diversified portfolio, reducing overall risk exposure. It's essential to assess your risk tolerance before making any investment decisions.

- Long-term versus short-term gold investment approaches: Gold's value tends to appreciate over the long term, making it suitable for long-term investment strategies. Short-term trading can be more volatile.

- Importance of consulting a financial advisor: Before making any significant investment decisions, it is crucial to consult with a qualified financial advisor who can help you develop a personalized strategy.

Gold ETFs: A Convenient Way to Invest in Gold

Gold ETFs offer a convenient and cost-effective way to gain exposure to gold without the complexities of physical storage.

- Liquidity and ease of trading: ETFs are traded on stock exchanges, offering high liquidity and ease of buying and selling.

- Lower storage and security costs compared to physical gold: Investors avoid the costs and risks associated with storing and securing physical gold.

- Transparency and diversification opportunities: ETFs provide transparency regarding their holdings and offer diversification opportunities within the gold market.

- Potential for tracking errors and expense ratios: While generally efficient, ETFs may experience tracking errors and incur expense ratios, impacting overall returns.

Physical Gold: The Traditional Approach

Investing in physical gold, such as bullion or coins, offers a tangible asset with inherent value.

- Tangible asset with inherent value: Physical gold provides a sense of security and represents a tangible asset independent of market fluctuations.

- Storage and security considerations: Safe and secure storage is crucial for physical gold, requiring specialized facilities or insurance.

- Potential for premiums and transaction costs: Buying and selling physical gold involves premiums and transaction costs, which can affect overall profitability.

- Liquidity can be a concern compared to ETFs: Selling physical gold may take more time and effort compared to liquid ETFs.

Conclusion

The recent surge in gold investment is largely driven by fears surrounding President Trump's EU trade actions and the resulting market uncertainty. This increased volatility highlights the strategic importance of considering gold investment as a key component of a diversified portfolio to mitigate risk and protect against economic downturns. The various gold investment options, including ETFs and physical gold, offer diverse approaches catering to different risk tolerances and investment strategies.

Are you considering adding a safe haven asset to your investment strategy? Learn more about the benefits of gold investment and explore different investment options to protect your portfolio from market volatility. Contact a financial advisor today to discuss your options and develop a sound gold investment strategy tailored to your specific needs.

Featured Posts

-

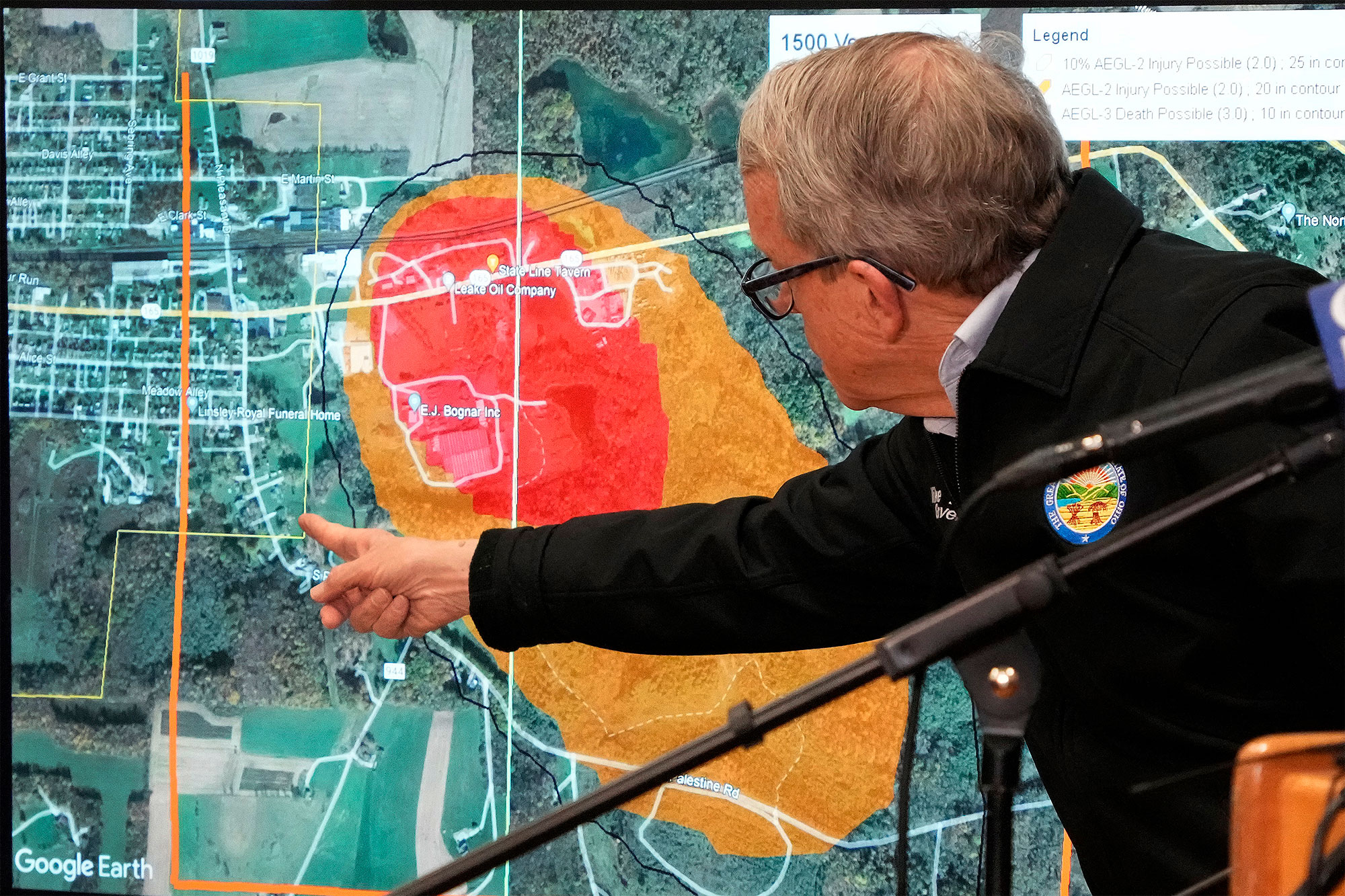

Investigation Reveals Prolonged Presence Of Toxic Chemicals In Buildings Following Ohio Derailment

May 27, 2025

Investigation Reveals Prolonged Presence Of Toxic Chemicals In Buildings Following Ohio Derailment

May 27, 2025 -

Nimetska Viyskova Dopomoga Ukrayini Yake Ozbroyennya Peredano

May 27, 2025

Nimetska Viyskova Dopomoga Ukrayini Yake Ozbroyennya Peredano

May 27, 2025 -

J And K Vs Goa Cricket Match Goa Emerges Victorious

May 27, 2025

J And K Vs Goa Cricket Match Goa Emerges Victorious

May 27, 2025 -

Jennifer Lopez American Music Awards Host For The May Event

May 27, 2025

Jennifer Lopez American Music Awards Host For The May Event

May 27, 2025 -

Szas Sesame Street Debut Singing About Gratitude With Elmo

May 27, 2025

Szas Sesame Street Debut Singing About Gratitude With Elmo

May 27, 2025

Latest Posts

-

Danske Chefer Under Kritik Stjerne Beskylder For Mangel Pa Respekt

May 30, 2025

Danske Chefer Under Kritik Stjerne Beskylder For Mangel Pa Respekt

May 30, 2025 -

Kasper Dolberg Faktorer Bag Den Store Interesse

May 30, 2025

Kasper Dolberg Faktorer Bag Den Store Interesse

May 30, 2025 -

Risiko Og Belonning Anderlechts Beslutning Om Et Godt Tilbud

May 30, 2025

Risiko Og Belonning Anderlechts Beslutning Om Et Godt Tilbud

May 30, 2025 -

Stjernes Vrede Kritik Af Dansk Leder Manglende Respekt

May 30, 2025

Stjernes Vrede Kritik Af Dansk Leder Manglende Respekt

May 30, 2025 -

Chokskifte Eller Realisme Dolbergs 25 Malssaeson

May 30, 2025

Chokskifte Eller Realisme Dolbergs 25 Malssaeson

May 30, 2025