Gold Market: Understanding The Recent Two-Week Decline In 2025

Table of Contents

Macroeconomic Factors Influencing the Recent Gold Price Decline

Several macroeconomic factors contributed to the recent gold price decline. These factors are interconnected and often influence each other, creating a complex interplay that impacts gold's value.

Rising Interest Rates and Their Impact on Gold

Rising interest rates represent a significant headwind for gold. Gold is a non-interest-bearing asset; therefore, when interest rates increase, the opportunity cost of holding gold increases. Investors may find higher returns in interest-bearing instruments like bonds or high-yield savings accounts, leading them to shift funds away from gold.

- Reduced attractiveness: Rising rates make holding gold less attractive compared to interest-bearing alternatives.

- Increased opportunity cost: The potential returns from interest-bearing investments outweigh the perceived benefits of holding gold.

- Investor sentiment: Increased interest rates often signal a stronger economy, potentially diminishing the safe-haven appeal of gold.

- Data correlation: Historical data consistently demonstrates a negative correlation between interest rate hikes and gold prices. For example, the Federal Reserve's rate hikes in the first half of 2025 were followed by a noticeable dip in the gold price.

Strengthening US Dollar and its Effect on Gold Prices

The US dollar and gold prices typically exhibit an inverse relationship. A stronger dollar makes gold more expensive for buyers using other currencies, reducing global demand and consequently putting downward pressure on the gold price.

- Inverse relationship: A strengthening dollar usually translates to a weaker gold price, and vice versa.

- International demand: A stronger dollar reduces the purchasing power of international investors, impacting gold demand.

- Dollar Index correlation: Charts showing the correlation between the US Dollar Index (DXY) and gold prices during the two-week decline clearly demonstrate this inverse relationship.

- Investment strategies: Investors often adjust their gold investment strategies based on US dollar strength, potentially reducing exposure during periods of a strong dollar.

Geopolitical Events and Their Role in the Gold Market Dip

Geopolitical events often significantly influence gold prices, as it is seen as a safe-haven asset during times of uncertainty. However, a decrease in geopolitical tensions can lead to reduced demand for gold.

Resolution or De-escalation of Geopolitical Tensions

Reduced geopolitical uncertainty can lead to a decrease in the safe-haven demand for gold. Investors may move away from gold, seeking higher-return investments as risk aversion diminishes.

- Reduced safe-haven demand: A lessening of geopolitical risks can reduce the appeal of gold as a safe haven.

- Event examples: Specific geopolitical events, such as the easing of trade tensions or a diplomatic breakthrough, might have contributed to the recent decline.

- Fluctuating safe-haven role: Gold's role as a safe haven asset is not static and depends on the prevailing global environment.

Unexpected Shifts in Global Market Sentiment

Changes in investor risk appetite can impact gold's performance. Positive economic news or improved market sentiment can lead investors to move towards assets perceived as having higher growth potential, potentially reducing gold demand.

- Risk appetite shifts: Increased risk tolerance often translates to lower demand for safe-haven assets like gold.

- Positive economic news: Strong economic data can boost investor confidence, driving funds away from gold.

- Market events: Unexpected positive developments in specific markets could have contributed to a shift in investor sentiment, impacting gold prices.

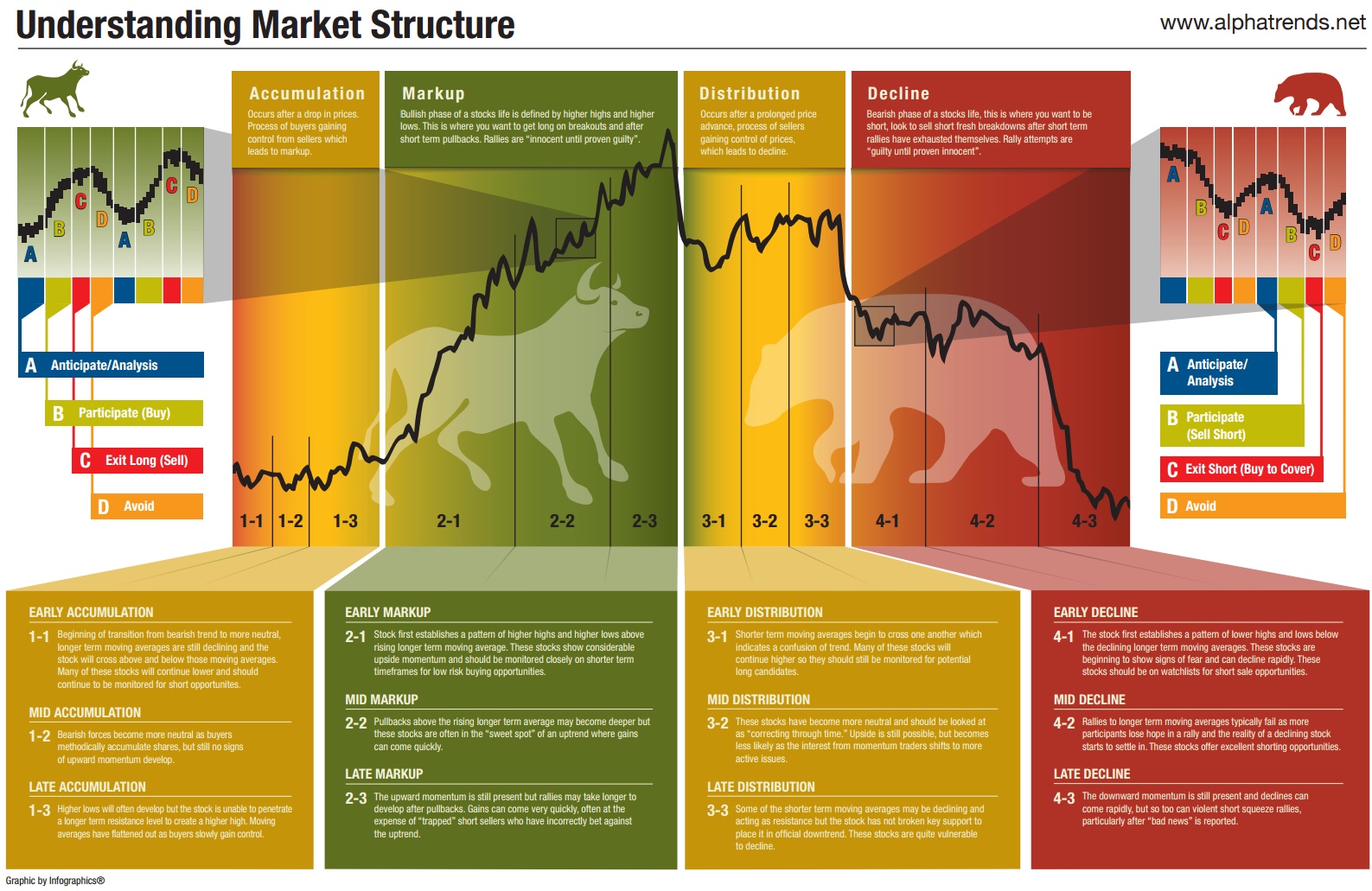

Technical Analysis of the Two-Week Gold Price Decline

Technical analysis provides further insights into the recent gold price movements. Examining chart patterns and indicators can help understand the price action and potential future trends.

Chart Patterns and Indicators

Technical analysis of the two-week gold price decline revealed several key patterns and indicators.

- Chart patterns: Analysis of charts might have revealed patterns like a "head and shoulders" or "double top" formation, suggesting a potential price reversal.

- Key indicators: Indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) might have signaled oversold conditions or bearish momentum.

- Visual representation: Charts and graphs are essential tools for visualizing the technical analysis and supporting the conclusions drawn.

Support and Resistance Levels

Identifying support and resistance levels is crucial for understanding price movements.

- Breached levels: The price decline may have breached significant support levels, indicating further potential downside.

- Rebound or decline: The proximity to support and resistance levels can help predict potential price rebounds or further declines.

- Future price movements: Technical analysis forecasts often incorporate support and resistance levels to predict potential future price trajectories.

Impact on Different Gold Investment Vehicles

The recent gold price decline has impacted various gold investment vehicles differently.

Physical Gold

The price decline directly affects the value of physical gold holdings. However, physical gold remains a tangible asset, offering some downside protection against inflation.

Gold ETFs

Gold Exchange Traded Funds (ETFs) also experienced a price drop mirroring the overall gold market decline. Trading volume in gold ETFs might have increased during the decline as investors reacted to the price movement.

Gold Mining Stocks

The performance of gold mining companies' stock prices is often correlated with the gold price. Therefore, the recent decline likely impacted the valuations of these companies.

Conclusion

The recent two-week decline in the gold market in 2025 is a result of a complex interplay of macroeconomic factors, geopolitical events, and market sentiment. Rising interest rates, a strengthening US dollar, and shifts in investor risk appetite all contributed to the price drop. Technical analysis provides further support for the observed price movements. Understanding these dynamics is crucial for navigating the complexities of the gold market. For investors interested in learning more about gold price fluctuations and developing effective investment strategies, continuous monitoring of macroeconomic indicators, geopolitical events, and technical analysis is vital. Stay informed about the latest developments in the gold market to make well-informed decisions regarding your gold investment strategy. Consider diversifying your portfolio to mitigate risks associated with gold price volatility and consult with a financial advisor before making any investment decisions.

Featured Posts

-

Aritzias Stance On Price Increases Amidst Trump Tariffs

May 06, 2025

Aritzias Stance On Price Increases Amidst Trump Tariffs

May 06, 2025 -

Father Of Crypto Entrepreneur Rescued After Kidnapping Finger Severed

May 06, 2025

Father Of Crypto Entrepreneur Rescued After Kidnapping Finger Severed

May 06, 2025 -

Relacionamento De Mindy Kaling Com Ex Colega De The Office A Revelacao

May 06, 2025

Relacionamento De Mindy Kaling Com Ex Colega De The Office A Revelacao

May 06, 2025 -

Cusmas Fate Hangs In The Balance As Carney Meets Trump

May 06, 2025

Cusmas Fate Hangs In The Balance As Carney Meets Trump

May 06, 2025 -

Tracee Ellis Ross A Stunning Runway Comeback

May 06, 2025

Tracee Ellis Ross A Stunning Runway Comeback

May 06, 2025

Latest Posts

-

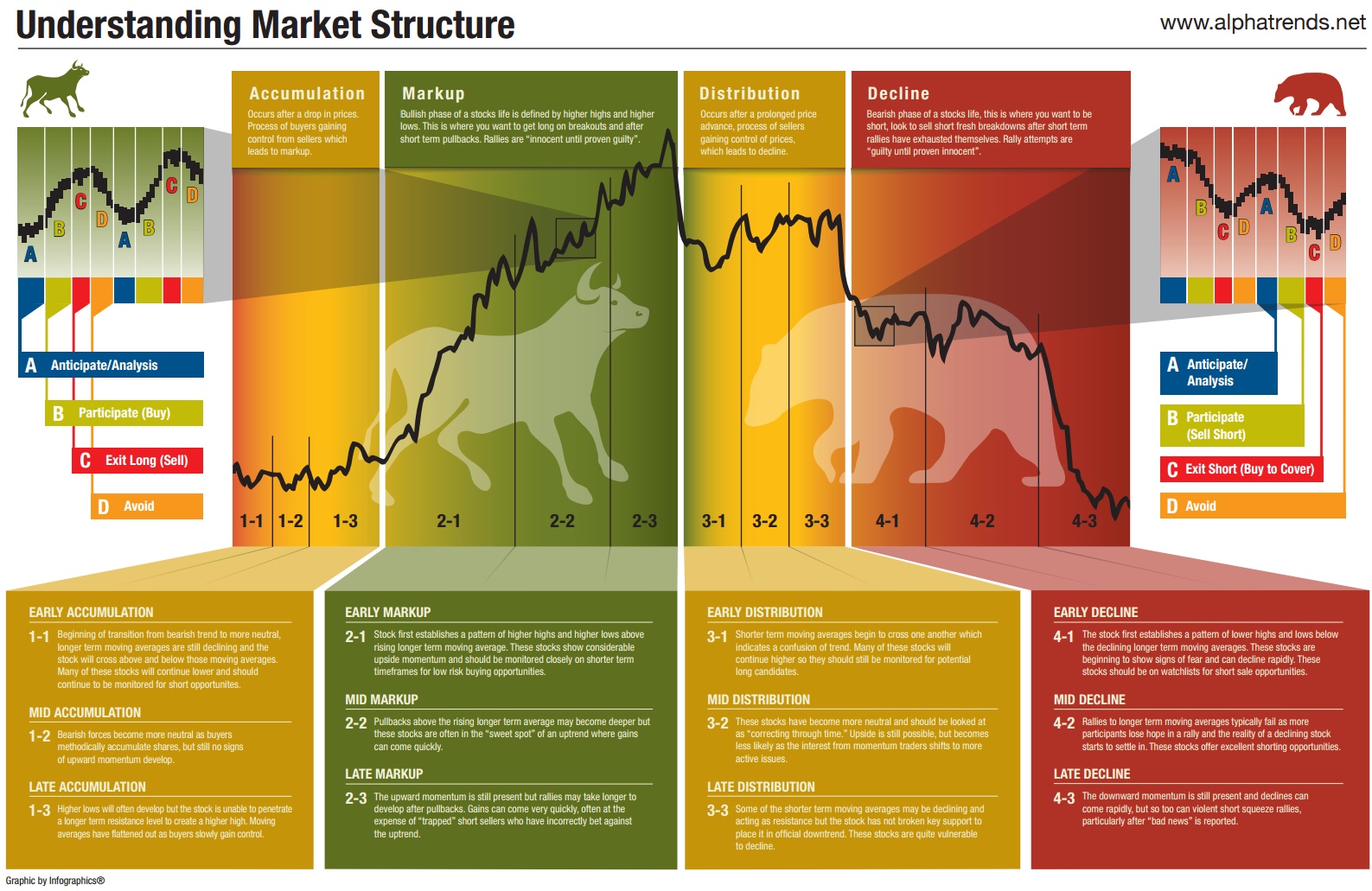

Amanda Holden Speaks Out Addressing The Buzz After Her Separation From Les Dennis

May 06, 2025

Amanda Holden Speaks Out Addressing The Buzz After Her Separation From Les Dennis

May 06, 2025 -

Amanda Holden Breaks Silence On Post Les Dennis Split Rumours

May 06, 2025

Amanda Holden Breaks Silence On Post Les Dennis Split Rumours

May 06, 2025 -

The Wiz Junes Highly Anticipated Criterion Release

May 06, 2025

The Wiz Junes Highly Anticipated Criterion Release

May 06, 2025 -

Criterion Collection Adds The Wiz In June Release

May 06, 2025

Criterion Collection Adds The Wiz In June Release

May 06, 2025 -

Diana Ross I Ll Never Retire Declares Iconic Singer During Nyc Show

May 06, 2025

Diana Ross I Ll Never Retire Declares Iconic Singer During Nyc Show

May 06, 2025