Gold Market Update: Back-to-Back Weekly Declines In 2025

Table of Contents

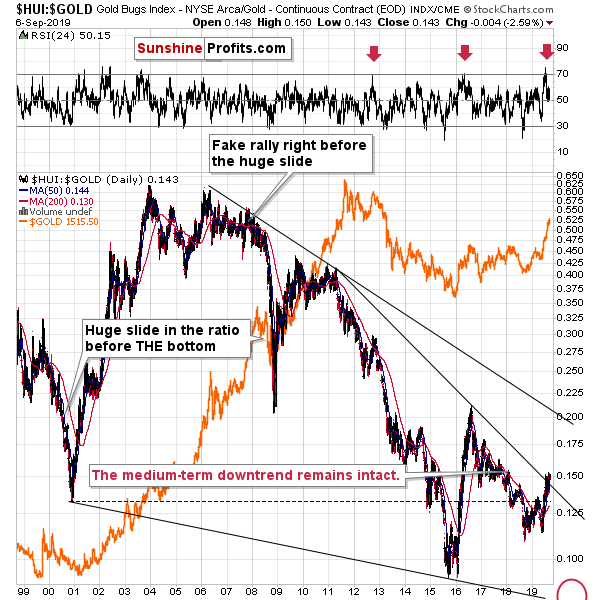

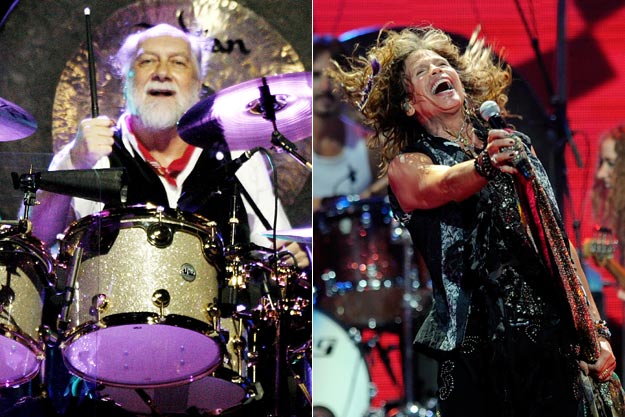

Analyzing the Recent Gold Price Dip

The gold market witnessed a significant dip during the weeks of [Insert Specific Dates of Declines], with gold prices falling by [Insert Percentage]% and reaching a low of [Insert Price per troy ounce]. This represents a substantial drop compared to the previous period's [Insert Previous Price per troy ounce] and has raised concerns among investors about the short-term and long-term outlook for gold investment. This unexpected volatility highlights the inherent risks associated with precious metals trading and the importance of a well-defined gold investment strategy.

Factors Contributing to the Decline

Several factors likely contributed to this decline in gold prices. Understanding these factors is crucial for informed gold investment decisions and effective gold portfolio management.

- Increased Interest Rates: Rising interest rates, implemented by central banks like the Federal Reserve, often lead to a stronger US dollar, making gold, priced in USD, less attractive to international investors. This inverse relationship between interest rates and gold prices is a key factor in gold market trends.

- Strengthening US Dollar: A strong US dollar generally exerts downward pressure on gold prices, as it increases the cost of gold for buyers using other currencies. This effect is particularly pronounced for international investors engaged in gold trading.

- Shift in Investor Sentiment: A change in investor sentiment, perhaps driven by positive economic news or increased risk appetite in other asset classes, can lead to investors selling gold to allocate funds elsewhere. This often reflects broader gold market trends impacting gold price.

- Geopolitical Factors: While gold is often seen as a safe haven asset during times of geopolitical uncertainty, periods of relative stability or positive diplomatic developments can reduce demand, contributing to price decreases. [Mention specific events if applicable, e.g., resolution of a trade dispute].

- Changes in Gold Supply and Demand: Fluctuations in the supply of gold from mining operations or shifts in global demand from jewelry manufacturers and central banks can influence gold prices. These factors impact the overall gold market dynamics.

Examining the Impact on Investors

The recent gold price dip has had a varied impact on different types of investors. Individual investors holding physical gold may experience a decrease in the value of their holdings, while those invested in gold ETFs (Exchange Traded Funds) or mutual funds saw similar declines reflected in their portfolio values.

The effect on gold ETFs and mutual funds has been substantial, with many experiencing negative returns during the period of the decline. Hedging strategies that relied on gold as a safe haven asset also experienced reduced effectiveness during this period, highlighting the importance of diversifying hedging strategies to mitigate the risk of significant losses.

Strategies for Navigating Market Volatility

Navigating the volatility inherent in the gold market requires a strategic approach. Here are some strategies to consider:

- Diversification of Investment Portfolio: Don't put all your eggs in one basket! Diversifying your investment portfolio across various asset classes (stocks, bonds, real estate, etc.) helps reduce risk and mitigate losses in any single asset.

- Dollar-Cost Averaging: This strategy involves investing a fixed amount of money at regular intervals, regardless of price fluctuations. This approach mitigates the risk of investing a large sum at a market peak.

- Long-Term Investment Strategy: Gold is often considered a long-term investment. A long-term perspective can help weather short-term price volatility.

- Monitoring Market Indicators Closely: Staying informed about economic indicators, geopolitical events, and gold market trends helps make better-informed investment decisions.

Predictions and Future Outlook for the Gold Market

Predicting future gold prices is inherently challenging due to the complex interplay of economic and geopolitical factors. However, based on the current market conditions, a cautious outlook is warranted. Several scenarios are possible, ranging from a continued price decline to a gradual recovery.

Expert opinions are divided; some analysts predict a further decline in gold prices in the short term, while others believe that the current low prices represent a buying opportunity for long-term investors. The ongoing uncertainty makes it crucial to monitor the gold price forecast and gold price prediction carefully.

Key Factors to Watch

Several key factors will shape the future direction of the gold market:

- Federal Reserve Policy: The Federal Reserve's monetary policy decisions regarding interest rates and quantitative easing will significantly influence the US dollar and, consequently, gold prices.

- Inflation Rates: High inflation often drives demand for gold as a hedge against inflation, while low inflation can reduce this demand.

- Global Economic Growth: Strong global economic growth can reduce the perceived need for safe-haven assets like gold, while economic slowdowns or recessions can boost demand.

- Geopolitical Stability: Increased geopolitical uncertainty often leads to increased demand for gold, acting as a safe haven.

Conclusion: Gold Market Update: Back-to-Back Weekly Declines in 2025 – What’s Next?

The back-to-back weekly declines in the gold market during 2025 highlight the dynamic and unpredictable nature of precious metals investment. Understanding the factors driving these price movements, as well as implementing effective gold investment strategies, is crucial for navigating market volatility. By monitoring key economic indicators, diversifying your portfolio, and adopting a long-term perspective, you can better manage risk and potentially benefit from future opportunities within the gold market. Stay updated on future gold market updates and monitor gold price fluctuations closely. Learn more about effective gold investment strategies to make informed decisions. [Link to related resources if available]

Featured Posts

-

Ohio Train Derailment Lingering Toxic Chemicals In Buildings

May 04, 2025

Ohio Train Derailment Lingering Toxic Chemicals In Buildings

May 04, 2025 -

Nhl Playoff Standings Whats At Stake In Fridays Games

May 04, 2025

Nhl Playoff Standings Whats At Stake In Fridays Games

May 04, 2025 -

Perkins Coie Law Firm Wins Case Against Trump Administration Order

May 04, 2025

Perkins Coie Law Firm Wins Case Against Trump Administration Order

May 04, 2025 -

16 Year Old Stepsons Murder Stepfather Accused Of Brutal Abuse Neglect And Homicide

May 04, 2025

16 Year Old Stepsons Murder Stepfather Accused Of Brutal Abuse Neglect And Homicide

May 04, 2025 -

Eight Hour Treetop Escape Migrants Flight From Ice

May 04, 2025

Eight Hour Treetop Escape Migrants Flight From Ice

May 04, 2025

Latest Posts

-

The Story Behind Fleetwood Macs Rumours 48 Years Of Success And Internal Conflict

May 04, 2025

The Story Behind Fleetwood Macs Rumours 48 Years Of Success And Internal Conflict

May 04, 2025 -

Were Fleetwood Mac Truly The Worlds First Supergroup A Deep Dive

May 04, 2025

Were Fleetwood Mac Truly The Worlds First Supergroup A Deep Dive

May 04, 2025 -

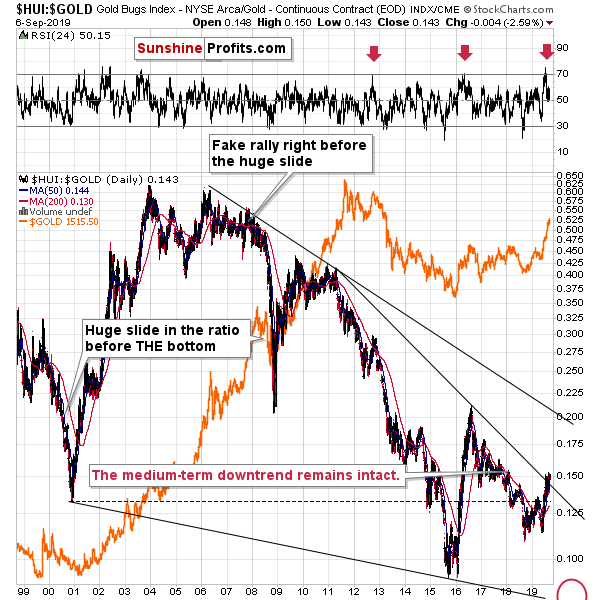

Novo Izdanje Gibonija Predstavljeno Na Sajmu Knjiga U Sarajevu

May 04, 2025

Novo Izdanje Gibonija Predstavljeno Na Sajmu Knjiga U Sarajevu

May 04, 2025 -

Gibonni Posjeta Sarajevskom Sajmu Knjiga

May 04, 2025

Gibonni Posjeta Sarajevskom Sajmu Knjiga

May 04, 2025 -

Fleetwood Macs Influence Defining The Supergroup Genre

May 04, 2025

Fleetwood Macs Influence Defining The Supergroup Genre

May 04, 2025