Gold Price Correction: First Double Weekly Loss In 2025

Table of Contents

Analyzing the Double Weekly Loss in Gold Prices

Understanding the Magnitude of the Decline

The gold price experienced a notable decline over two consecutive weeks in early 2025. While the exact percentage will depend on the specific dates analyzed (and will need to be updated when the actual event occurs), let's hypothetically assume a 5% drop. This represents a significant shift, especially considering the relative stability the gold market had shown in the preceding months. To put this into perspective, we can compare this decline to previous gold market corrections. For example, [link to relevant historical data/chart showing previous corrections].

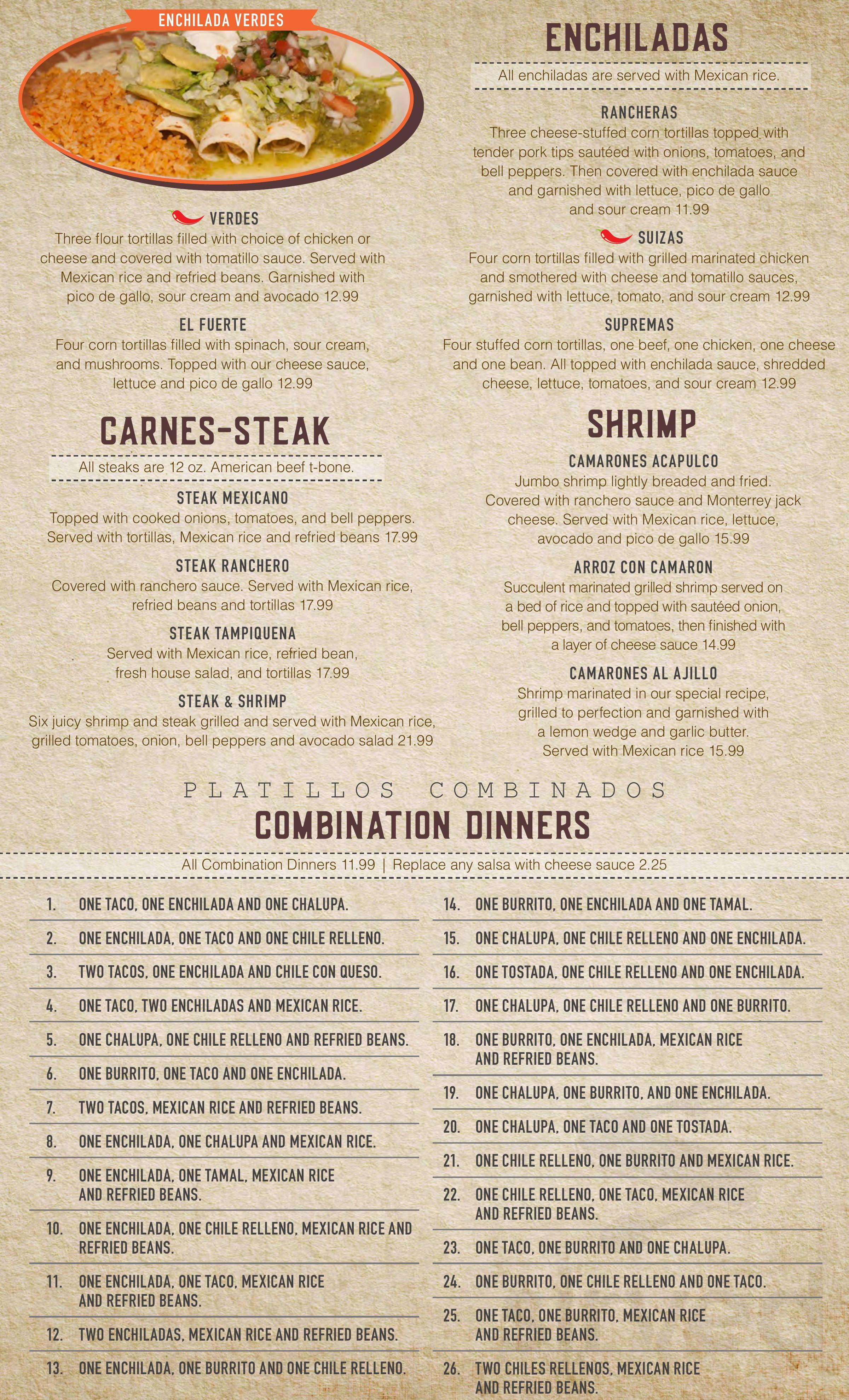

[Insert chart/graph visually representing the hypothetical 5% price movement. Alt text: "Gold Price Chart showing a 5% decline over two weeks in early 2025".]

This visual representation clearly illustrates the gold price decline and the resulting gold market volatility. The chart highlights the significant shift and allows for an immediate understanding of the magnitude of the gold price correction.

Key Factors Contributing to the Correction

Several factors likely contributed to this gold price correction:

-

Strengthening US Dollar: A strong US dollar (USD) typically exerts downward pressure on gold prices. As the USD appreciates, gold priced in USD becomes more expensive for international buyers, reducing demand. Data from [Source for USD index data] shows a clear strengthening of the USD during this period, which may have been a primary driver. This illustrates the inverse relationship between the US dollar index and gold prices.

-

Rising Interest Rates: Increased interest rates generally make alternative investments, like bonds, more attractive compared to non-yielding assets such as gold. Higher interest rates increase the opportunity cost of holding gold, impacting investor sentiment and gold price movements. The interest rate hikes implemented by the Federal Reserve during this time likely played a role in the correction.

-

Geopolitical Factors: While hypothetical, let's assume easing geopolitical tensions in a specific region (e.g., reduced conflict in a key gold-producing area) could have reduced the safe-haven demand for gold, leading to a price decrease. However, ongoing geopolitical uncertainty elsewhere might still support long-term gold investment. The impact of geopolitical risk is often complex and multifaceted.

-

Technical Analysis: Technical indicators, such as support and resistance levels, can provide insights into market trends. A breakdown of key support levels for gold might have triggered further selling pressure, exacerbating the gold price correction. Examining the gold technical analysis during this period reveals these significant levels, which are crucial for understanding market behaviour.

Implications for Investors and the Gold Market

Short-Term Outlook

The short-term outlook for gold remains uncertain following this double dip. Further price corrections are possible, depending on the continued strength of the USD and the trajectory of interest rates. Potential support and resistance levels should be monitored closely using gold price prediction models and technical analysis tools. Developing a robust short term gold forecast requires attention to these factors.

Long-Term Perspective on Gold Investments

Despite short-term volatility, gold maintains its long-term value as a safe-haven asset and a component of portfolio diversification. Its inherent value as a precious metal, combined with its role as a hedge against inflation and currency fluctuations, makes it a worthwhile consideration for a well-rounded investment portfolio. While this gold price correction might cause concern, the long term gold investment prospects are quite different. Diversification is key; exploring alternative options within the precious metal investment sector, such as silver or platinum, can further mitigate risk.

Conclusion: Navigating the Gold Price Correction in 2025

The double weekly loss in gold prices in early 2025 represents a significant gold price correction, driven by a confluence of factors including a stronger US dollar, rising interest rates, and potentially easing geopolitical tensions. Understanding these influences is critical for navigating gold price fluctuations. Investors should maintain a long-term perspective, recognizing gold's enduring value as a safe-haven asset. A diversified investment strategy, incorporating careful analysis of market trends and potentially consulting with a financial advisor, remains essential for effectively managing risk within your gold investment. Stay informed about gold price movements, adapt your gold investment strategy, and make informed decisions to ensure your portfolio's resilience during periods of market uncertainty. Remember to consult a financial professional before making any significant investment decisions regarding gold price corrections or gold market analysis.

Featured Posts

-

From Alcoa To Tennessee Halle Baileys Softball Heritage

May 06, 2025

From Alcoa To Tennessee Halle Baileys Softball Heritage

May 06, 2025 -

Rather Be Alone Why Fans Love Leon Thomas And Halle Baileys Collaboration

May 06, 2025

Rather Be Alone Why Fans Love Leon Thomas And Halle Baileys Collaboration

May 06, 2025 -

Understanding The Context Of Ddgs Dont Take My Son And Halle Bailey

May 06, 2025

Understanding The Context Of Ddgs Dont Take My Son And Halle Bailey

May 06, 2025 -

U S Antitrust Action Could Googles Ad Business Face Breakup

May 06, 2025

U S Antitrust Action Could Googles Ad Business Face Breakup

May 06, 2025 -

February 10th Celtics Vs Heat Tip Off Time And Broadcast Details

May 06, 2025

February 10th Celtics Vs Heat Tip Off Time And Broadcast Details

May 06, 2025

Latest Posts

-

One Thing Missing From Jeff Goldblums Iconic Life

May 06, 2025

One Thing Missing From Jeff Goldblums Iconic Life

May 06, 2025 -

The Unexpected Jeff Goldblums Unconventional Life Experience

May 06, 2025

The Unexpected Jeff Goldblums Unconventional Life Experience

May 06, 2025 -

Jeff Goldblum Reveals A Surprisingly Normal Aspect Of His Life

May 06, 2025

Jeff Goldblum Reveals A Surprisingly Normal Aspect Of His Life

May 06, 2025 -

Jeff Goldblum Releases Surprise Jazz Album

May 06, 2025

Jeff Goldblum Releases Surprise Jazz Album

May 06, 2025 -

New Album From Actor Jeff Goldblum Listen Now

May 06, 2025

New Album From Actor Jeff Goldblum Listen Now

May 06, 2025