Gold Price Dip: Profit-Taking After US-China Trade Deal Optimism

Table of Contents

Understanding the Recent Gold Price Decline

The recent drop in gold prices is significant. Between [Insert Specific Date] and [Insert Specific Date], the price of gold fell by approximately [Insert Percentage]% – a considerable shift for this precious metal. This gold price dip can be partly attributed to profit-taking by investors who had positioned themselves for a less favorable outcome in the US-China trade talks. Many had anticipated continued uncertainty and held gold as a hedge against risk. With the perceived progress in trade negotiations, some investors decided to secure their profits, leading to increased selling pressure.

- Date of the price dip: [Insert Specific Date]

- Percentage drop in gold prices: [Insert Percentage]%

- Key price levels breached: [Insert Specific Support and Resistance Levels]

The Influence of US-China Trade Deal Optimism

The positive market sentiment following perceived progress in US-China trade talks played a significant role in the gold price dip. Increased optimism fueled a rise in risk appetite among investors.

- Positive news regarding the trade deal: [Insert Specific Examples, e.g., "announcement of a 'Phase One' trade deal," "positive statements from negotiators," etc.]

- Investor confidence and gold prices: Increased confidence in the global economy leads investors to move away from safe-haven assets like gold and into higher-yielding investments such as stocks.

- Correlation between the stock market and gold price movements: A rising stock market generally indicates reduced risk aversion, which negatively correlates with gold prices. The recent stock market rally coincided with the gold price dip.

Other Contributing Factors to the Gold Price Dip

While the US-China trade deal optimism was a major factor, other elements also contributed to the recent gold price dip.

- Changes in the US dollar's strength: A strengthening US dollar typically puts downward pressure on gold prices, as gold is priced in USD. [Insert data on USD strength during the period].

- Central bank activities and their gold holdings: Central bank actions, such as buying or selling gold reserves, can influence market sentiment and prices. [Insert information on recent central bank activity concerning gold].

- Geopolitical events: While trade tensions eased, other geopolitical events might have had a subtle impact. [Include relevant information on any geopolitical events that might have reduced overall risk aversion].

Analyzing the Implications for Investors

The future trajectory of gold prices remains uncertain. While the current gold price dip might present opportunities for some investors, it's crucial to adopt a cautious approach.

- Short-term vs. long-term investment strategies: Short-term traders may seek to capitalize on price fluctuations, while long-term investors might view this as a buying opportunity if they believe the current dip is temporary.

- Portfolio diversification: Diversifying your investment portfolio across different asset classes is crucial to mitigate risk.

- Risk tolerance: Assess your personal risk tolerance and adjust your investment strategy accordingly.

Potential scenarios for gold prices and suggested actions for investors:

- Scenario 1: Continued optimism: If positive trade sentiment persists, the gold price dip may continue, offering potential buying opportunities for long-term investors.

- Scenario 2: Renewed uncertainty: If trade talks falter, gold prices could rebound as investors seek safe-haven assets.

Gold Price Dip – Navigating the Market Fluctuations

In summary, the recent gold price dip is primarily driven by profit-taking following optimism surrounding the US-China trade deal. Increased risk appetite and a strengthening US dollar also contributed. Investors need to carefully consider these factors when making decisions about their gold holdings. Understanding gold price movements and gold market trends is vital. Staying informed about the latest developments affecting gold price fluctuations and consulting with a financial advisor are crucial steps to make informed investment decisions regarding gold and other assets. Remember to diversify your portfolio and consider your own risk tolerance before making any investment choices in the volatile gold market.

Featured Posts

-

Super Bowl Snub Kanye West Blames Taylor Swift

May 18, 2025

Super Bowl Snub Kanye West Blames Taylor Swift

May 18, 2025 -

Stephen Millers National Security Advisor Bid Examining His Qualifications

May 18, 2025

Stephen Millers National Security Advisor Bid Examining His Qualifications

May 18, 2025 -

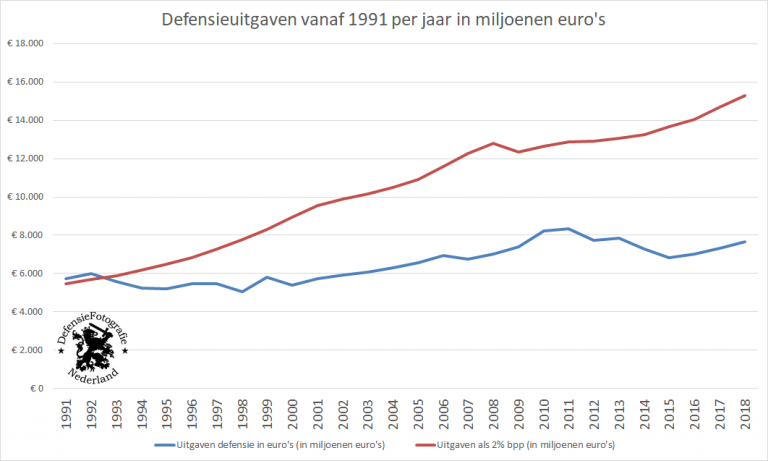

Toenemende Internationale Steun Voor Nederlandse Defensie

May 18, 2025

Toenemende Internationale Steun Voor Nederlandse Defensie

May 18, 2025 -

Meta Faces Ftcs Monopoly Case Defense Strategy Takes Center Stage

May 18, 2025

Meta Faces Ftcs Monopoly Case Defense Strategy Takes Center Stage

May 18, 2025 -

The Kardashian Censori West Feud A New Chapter

May 18, 2025

The Kardashian Censori West Feud A New Chapter

May 18, 2025

Latest Posts

-

Shrek On Bbc Three Episode Guide And Tv Schedule

May 18, 2025

Shrek On Bbc Three Episode Guide And Tv Schedule

May 18, 2025 -

Mike Myers Three Word Reaction To Shrek Role

May 18, 2025

Mike Myers Three Word Reaction To Shrek Role

May 18, 2025 -

Mike Myers Patriotic Snl Shirt Canada Is Not For Sale Explained

May 18, 2025

Mike Myers Patriotic Snl Shirt Canada Is Not For Sale Explained

May 18, 2025 -

Mike Myers And Mark Carneys Trump Criticism Sparks Ketchup Chip Controversy

May 18, 2025

Mike Myers And Mark Carneys Trump Criticism Sparks Ketchup Chip Controversy

May 18, 2025 -

The Hardys And Moose Post Sacrifice Injury Report And Next Steps

May 18, 2025

The Hardys And Moose Post Sacrifice Injury Report And Next Steps

May 18, 2025