Gold Price Forecast: Impact Of Back-to-Back Weekly Losses In 2025

Table of Contents

Analyzing the Causes of Consecutive Weekly Gold Price Drops in 2025

Several interconnected factors contributed to the consecutive weekly declines in gold prices during 2025. Understanding these underlying causes is essential for predicting future trends and making sound investment choices.

The Strengthening US Dollar:

The inverse relationship between the US dollar (USD) and gold prices is well-established. A strong USD typically translates to lower gold prices, as investors tend to shift towards dollar-denominated assets. In 2025, several factors likely contributed to the dollar's strength:

- Aggressive Interest Rate Hikes: Central banks, in response to persistent inflation, implemented several interest rate hikes, increasing the attractiveness of dollar-denominated investments. The higher yields on US Treasury bonds made them more appealing compared to non-yielding assets like gold.

- Robust Economic Recovery: A stronger-than-expected economic recovery in the US boosted investor confidence, leading to a flight to the safety of the dollar.

- Geopolitical Stability (relative): A period of relative geopolitical calm, compared to previous years, reduced the demand for safe-haven assets like gold.

Analyzing the "gold vs dollar" relationship through the dollar index (DXY) reveals a clear correlation between its rise and gold's decline in 2025. For example, a 10% increase in the DXY often correlated with a 5-7% drop in gold prices. This highlights the significant influence of USD strength on the gold market forecast.

Rising Interest Rates and Their Effect on Gold Investment:

Higher interest rates directly impact gold investment decisions. Gold is a non-yielding asset; it doesn't pay interest. When interest rates rise, alternative investments like bonds become more attractive due to their higher yields. This shift in investor preference often leads to decreased demand for gold, resulting in lower prices.

- Central Bank Policies: The policies adopted by central banks around the world played a significant role. Their decisions on interest rate hikes influenced bond yields and, consequently, the attractiveness of gold as an investment.

- Opportunity Cost: The opportunity cost of holding gold increases when interest rates are high. Investors might opt for higher-yielding alternatives, reducing the demand and price of gold.

- Correlation Analysis: A strong negative correlation between interest rate hikes and gold price movements was observed in 2025, further emphasizing this factor's influence on the gold price prediction.

Geopolitical Factors and Their Influence on the Gold Market:

While 2025 saw periods of relative calm, lingering geopolitical uncertainties still impacted investor sentiment toward gold.

- Trade Tensions: Although major conflicts may have subsided, simmering trade tensions between various countries could introduce volatility. Uncertainty often drives investors toward safe haven assets, including gold.

- Regional Instability: Instability in certain regions can create a flight to safety, temporarily boosting gold prices, but if these instabilities resolve, it can lead to sell-offs. Analyzing this dynamic is crucial for a comprehensive gold price prediction.

- Gold as a Safe Haven: Gold's role as a safe haven asset remained significant. However, in 2025, the strength of the dollar seemed to outweigh the influence of geopolitical risk on investor decisions.

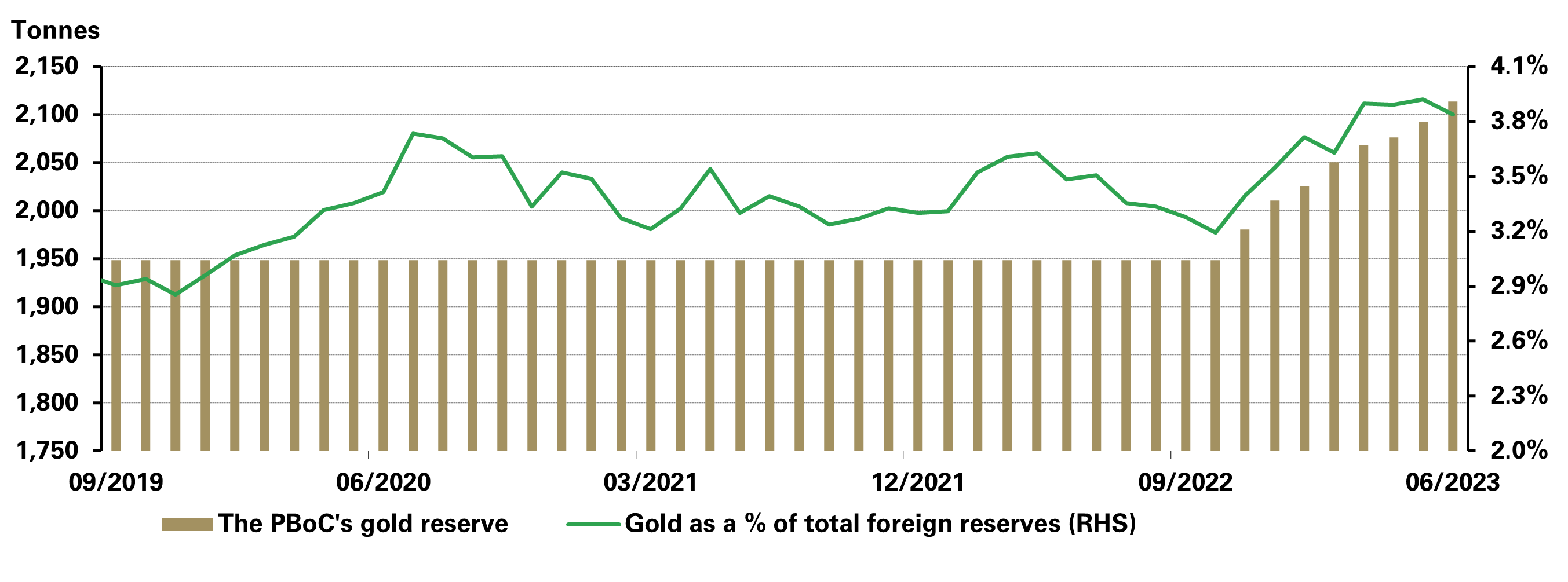

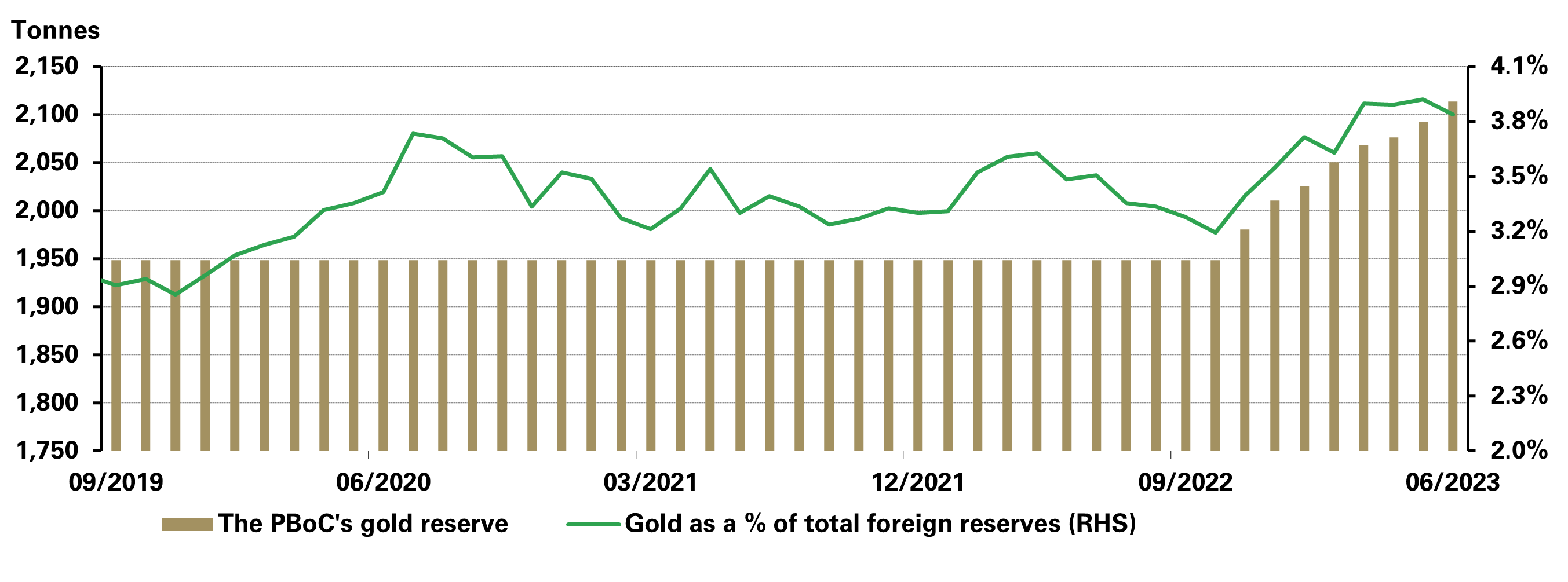

Increased Gold Supply and its Impact on Prices:

Increased gold supply can exert downward pressure on prices.

- Technological Advancements in Gold Mining: Improvements in gold mining technology potentially led to increased production, adding to market supply.

- Gold Production Levels: An increase in overall gold production from various countries contributed to the excess supply, impacting the gold supply and demand equation.

- Supply and Demand Dynamics: The basic principles of supply and demand fundamentally impact pricing. Increased supply, in the absence of a corresponding increase in demand, tends to depress prices.

Gold Price Forecast Models and Predictions for 2025 and Beyond

Predicting gold prices requires a multifaceted approach, combining technical and fundamental analysis with expert opinion.

Technical Analysis:

Technical analysis uses past price movements and trading volume to predict future trends. In 2025, several technical indicators suggested further downward pressure on gold:

- Moving Averages: The 50-day and 200-day moving averages demonstrated a bearish trend, suggesting further price declines. (Illustrate with a chart).

- Support and Resistance Levels: Key support levels were repeatedly broken, indicating a weakening of gold's price. (Illustrate with a chart).

- Chart Patterns: Certain chart patterns, such as head-and-shoulders formations, hinted at further price corrections. (Illustrate with a chart).

Fundamental Analysis:

Fundamental analysis considers macroeconomic factors to predict long-term trends. In 2025:

- Inflation Rates: While inflation might remain a concern, its trajectory and the central bank's response will impact gold's appeal as an inflation hedge.

- Economic Growth: Strong economic growth in major economies could reduce the demand for safe-haven assets.

- Interest Rate Outlook: The future path of interest rates will continue to influence gold's attractiveness compared to interest-bearing assets.

Expert Opinions and Market Sentiment:

Many analysts anticipated a period of consolidation or slight decline in gold prices in the short-to-medium term for 2025, given the prevailing macroeconomic environment. Negative market sentiment towards gold, partly due to the strong dollar, contributed to the price decline.

Investment Strategies in Light of Recent Gold Price Volatility

Given the volatility, investors need to carefully consider their investment strategies:

Hedging Strategies for Investors:

Gold can act as a hedge against inflation and market downturns. However, in 2025, its traditional role as a hedge was challenged by the strong dollar. Diversification remains crucial; investors should avoid overexposure to gold.

Long-Term vs. Short-Term Gold Investment Strategies:

Long-term investors may view the price drop as a buying opportunity, while short-term traders might focus on exploiting price fluctuations. Risk tolerance and financial goals should guide the choice.

Conclusion: Navigating the Future of Gold Prices After Back-to-Back Losses

The consecutive weekly gold price drops in 2025 were primarily driven by a strong US dollar, rising interest rates, and a relatively stable geopolitical environment, despite some lingering uncertainties. While gold’s role as a safe haven remains significant, the strength of the dollar and higher interest rates overshadowed other factors in 2025. Future gold price forecasts depend on the interplay of these factors and others, such as inflation and economic growth. It is crucial to monitor gold market trends closely and adjust investment strategies accordingly. To stay updated on the latest gold price forecast and analysis, subscribe to our newsletter, follow us on social media, and regularly check our website for further updates on the impact of back-to-back weekly losses in 2025 and beyond. Learn more about gold investment strategies and monitor gold market trends to make informed decisions.

Featured Posts

-

Belgiums Energy Landscape Funding Opportunities For 270 M Wh Bess Projects

May 04, 2025

Belgiums Energy Landscape Funding Opportunities For 270 M Wh Bess Projects

May 04, 2025 -

Federal Investigation Cybercriminal Made Millions Targeting Executive Office365

May 04, 2025

Federal Investigation Cybercriminal Made Millions Targeting Executive Office365

May 04, 2025 -

Australia Votes Albaneses Labor Leads In Election Polls

May 04, 2025

Australia Votes Albaneses Labor Leads In Election Polls

May 04, 2025 -

Largest Heat Pump System Launched A Collaboration Between Innomotics Eneco And Johnson Controls

May 04, 2025

Largest Heat Pump System Launched A Collaboration Between Innomotics Eneco And Johnson Controls

May 04, 2025 -

White House Meeting Scheduled Between Mark Carney And President Trump

May 04, 2025

White House Meeting Scheduled Between Mark Carney And President Trump

May 04, 2025

Latest Posts

-

Ufc 314 Main Event Volkanovski Vs Lopes Opening Odds Analysis

May 04, 2025

Ufc 314 Main Event Volkanovski Vs Lopes Opening Odds Analysis

May 04, 2025 -

Paddy Pimblett Celebrates Ufc 314 Victory With Private Yacht Dance Party

May 04, 2025

Paddy Pimblett Celebrates Ufc 314 Victory With Private Yacht Dance Party

May 04, 2025 -

Ufc 314 Volkanovski Lopes Main Event And Full Fight Card Preview

May 04, 2025

Ufc 314 Volkanovski Lopes Main Event And Full Fight Card Preview

May 04, 2025 -

Ufc 314 Complete Fight Card And Predictions For Volkanovski Vs Lopes

May 04, 2025

Ufc 314 Complete Fight Card And Predictions For Volkanovski Vs Lopes

May 04, 2025 -

Tensions Rise Bryce Mitchell And Jean Silva Clash Verbally Ahead Of Ufc 314 Bout

May 04, 2025

Tensions Rise Bryce Mitchell And Jean Silva Clash Verbally Ahead Of Ufc 314 Bout

May 04, 2025