Gold Price Recovers After US Data Dampens Rate Hike Bets

Table of Contents

Impact of US Economic Data on Gold Prices

The recent release of key US economic data played a pivotal role in the gold price recovery. Specifically, lower-than-expected inflation figures and slower-than-anticipated job growth have dampened expectations for further aggressive interest rate hikes by the Federal Reserve. This data directly impacts gold prices because:

- Lower-than-expected inflation figures: Reduced inflationary pressures reduce the need for the Fed to continue raising interest rates. Higher interest rates typically strengthen the dollar, making gold, priced in dollars, more expensive for international buyers and thus suppressing demand. Lower inflation expectations weaken this pressure.

- Slower-than-anticipated job growth: A cooling labor market suggests a potential slowdown in economic growth, reducing the urgency for aggressive monetary tightening. This reduces the attractiveness of the dollar as a safe haven, benefiting gold.

- Impact on the dollar's strength: The inverse relationship between the US dollar and gold prices is well-established. A weaker dollar, driven by the unexpected economic data, makes gold more affordable for investors holding other currencies, boosting demand.

- Speculation on future Fed policy decisions: The data has fueled speculation that the Fed might adopt a less hawkish stance on future interest rate increases, potentially leading to a reversal of the recent trend of rising interest rates. This uncertainty benefits gold, which is often seen as a hedge against monetary policy uncertainty.

The Role of Safe-Haven Demand in Gold's Recovery

Gold's inherent value as a safe-haven asset significantly contributes to its price recovery. When market uncertainty rises, whether due to economic data or geopolitical factors, investors often flock to gold as a store of value and a hedge against risk. This is precisely what we're seeing now.

- Increased investor anxiety about economic uncertainty: The mixed economic signals from the US have increased investor anxiety, leading many to seek the stability offered by gold.

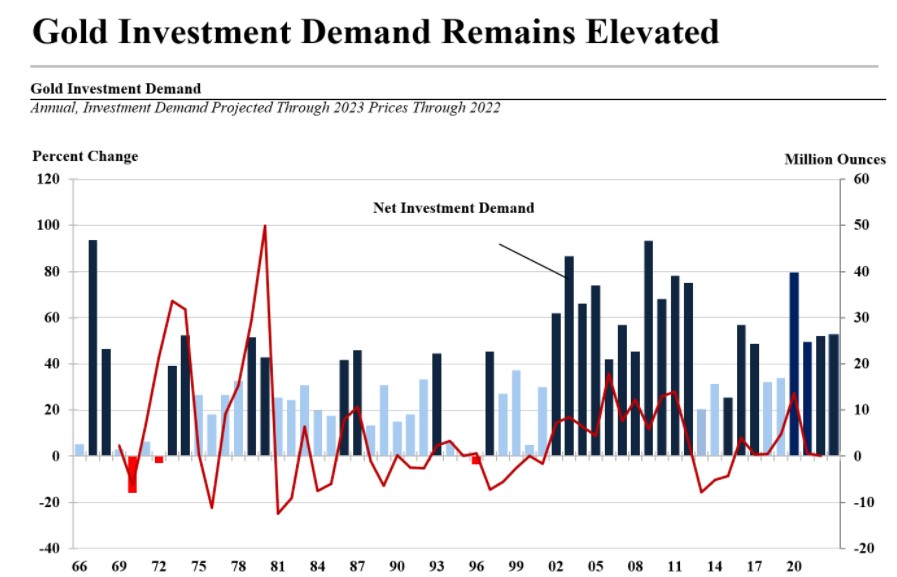

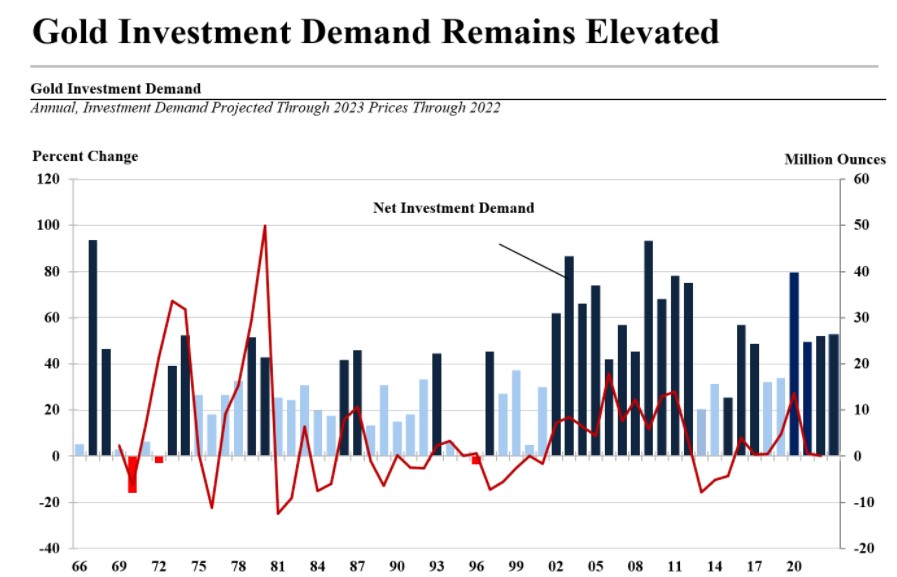

- Gold's historical performance as a hedge against inflation and economic downturns: Gold has historically held its value during periods of economic instability and inflation, solidifying its reputation as a reliable safe-haven asset.

- Shifting investor sentiment towards risk aversion: The unexpected economic data has prompted a shift in investor sentiment from risk-on to risk-off, with investors moving away from higher-yielding but riskier assets and towards safer options like gold.

Analysis of Current Gold Market Trends and Predictions

The current gold price movement shows a clear upward trend, with analysts identifying key support and resistance levels. While short-term price fluctuations are expected, the overall sentiment remains cautiously optimistic.

- Short-term price forecast (bullish/bearish): Many analysts predict a bullish short-term outlook for gold, anticipating further price increases as investors continue to assess the implications of the latest US economic data. However, the overall market remains volatile and subject to abrupt changes.

- Long-term outlook for gold prices: The long-term outlook for gold prices depends on several factors, including the trajectory of inflation, global economic growth, and geopolitical events. Many experts believe that gold will continue to hold its value as a hedge against uncertainty.

- Factors that could influence future price changes: Future gold price movements will be significantly influenced by changes in interest rates, inflation levels, geopolitical stability, and shifts in investor sentiment. Continuous monitoring of these factors is crucial for informed investment decisions.

Conclusion

In summary, the gold price recovery is largely attributable to the impact of recent US economic data on rate hike bets. The lower-than-expected inflation and slower job growth have dampened expectations for aggressive interest rate increases, leading to a weaker dollar and increased safe-haven demand for gold. The analysis suggests a bullish short-term outlook, though long-term price movements remain dependent on numerous factors. This gold price recovery highlights the importance of monitoring US economic data and understanding its impact on gold investment strategies. Stay tuned for further updates on gold price movements and consider diversifying your portfolio with gold investments to mitigate risks. Keep an eye on future reports on US economic data and its impact on gold price recovery.

Featured Posts

-

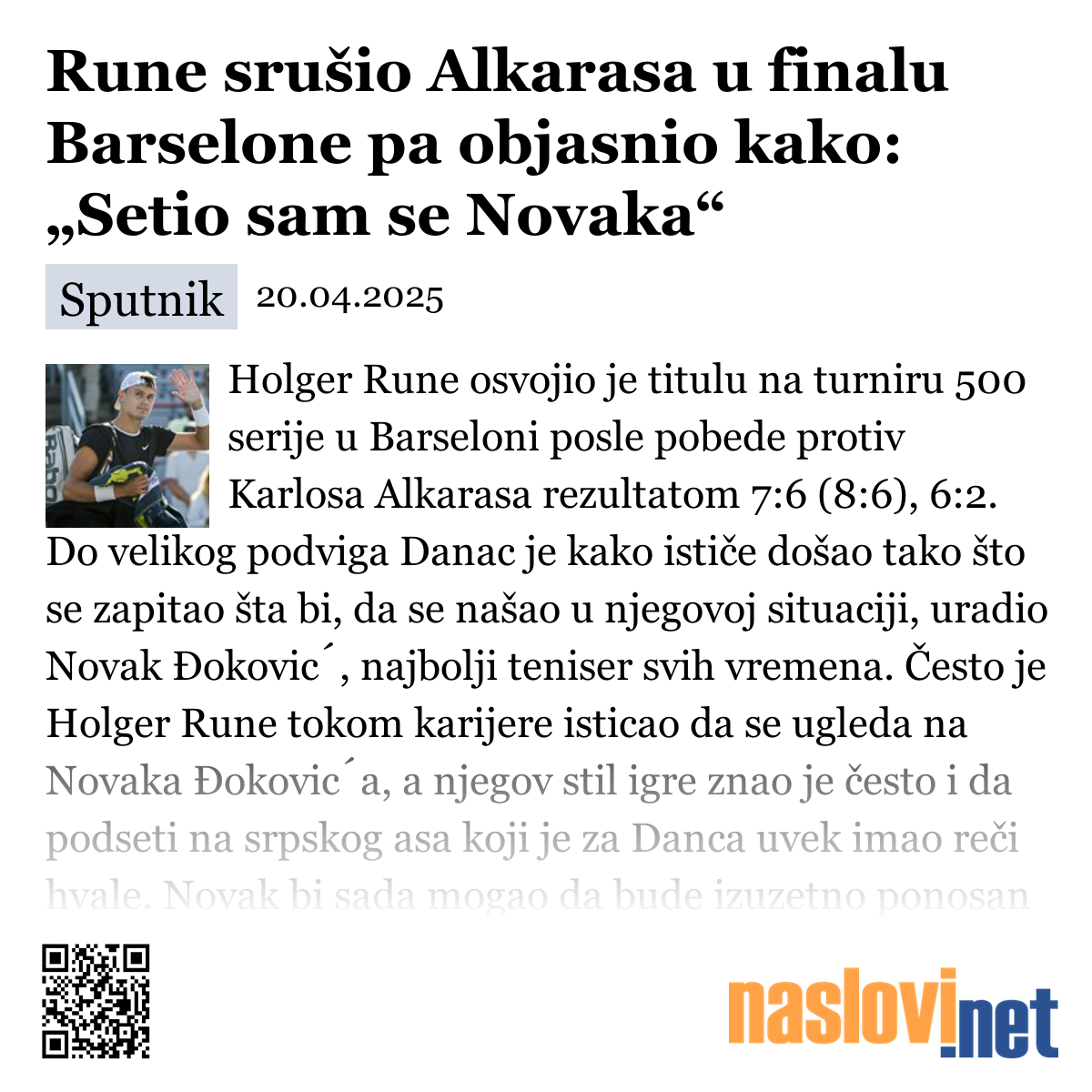

Rune Pobeduje Alkarasa U Finalu Barcelone Analiza Meca

May 17, 2025

Rune Pobeduje Alkarasa U Finalu Barcelone Analiza Meca

May 17, 2025 -

Top 10 Tv Shows Cut Short A Shameful Waste Of Potential

May 17, 2025

Top 10 Tv Shows Cut Short A Shameful Waste Of Potential

May 17, 2025 -

7 Bit Casino A Leading Online Casino In New Zealand For Real Money

May 17, 2025

7 Bit Casino A Leading Online Casino In New Zealand For Real Money

May 17, 2025 -

48 20 000 Ultraviolette Tesseract

May 17, 2025

48 20 000 Ultraviolette Tesseract

May 17, 2025 -

Cassie Ventura And Alex Fines Red Carpet Appearance Pregnant Cassies Debut

May 17, 2025

Cassie Ventura And Alex Fines Red Carpet Appearance Pregnant Cassies Debut

May 17, 2025