Gold Price Surge: Trump's EU Threats Fuel Trade War Fears

Table of Contents

Understanding the Gold Price Surge and its Correlation to Trade Wars

Gold prices typically exhibit an inverse relationship with economic stability. When economic uncertainty rises, investors often flock to gold as a safe haven asset, pushing prices upward. This is because gold is seen as a store of value that holds its worth even during times of market turmoil.

-

Increased uncertainty leads to higher demand for gold as a safe haven asset. The fear of economic downturn, coupled with the unpredictable nature of trade wars, makes gold an attractive option for investors seeking to protect their capital.

-

Trade wars disrupt global supply chains, impacting economic growth. Tariffs and trade restrictions create uncertainty for businesses, leading to slower economic growth and potentially a recession. This fuels investor anxiety and further increases demand for gold.

-

Investors seek refuge in gold during times of geopolitical instability. The ongoing trade dispute between the US and the EU is just one example of geopolitical instability that can drive investors towards the perceived safety of gold. Other global conflicts and political uncertainties can also contribute to this trend.

-

Historical examples of gold price increases during periods of trade conflict. Throughout history, periods of trade conflict and economic uncertainty have frequently coincided with significant increases in gold prices. The 1970s oil crisis and the 2008 financial crisis are prime examples of this phenomenon.

Trump's Threats and the EU's Response: A Catalyst for Market Volatility

President Trump's threats towards the EU have been a significant catalyst for the recent market volatility and the subsequent gold price surge. These threats have created a climate of uncertainty, impacting investor confidence and driving demand for safe haven assets like gold.

-

Tariffs imposed or threatened on European goods. The threat and imposition of tariffs on European goods have disrupted trade flows and fueled fears of a wider trade war, creating uncertainty in global markets.

-

Retaliatory measures from the EU. The EU's retaliatory measures against US tariffs have further escalated tensions and contributed to the instability in the market, enhancing the appeal of gold as a safe haven.

-

Escalation of rhetoric and the potential for further actions. The ongoing rhetoric between the US and the EU, coupled with the potential for further trade actions, contributes to a climate of uncertainty, benefiting gold's safe-haven status.

-

Analysis of the impact of these actions on investor confidence. The actions of both the US and the EU have significantly eroded investor confidence, leading to a flight from riskier assets and into safer investments like gold.

Safe Haven Assets: Why Investors are Turning to Gold

Gold's status as a safe haven asset stems from its historical performance during economic downturns and its inherent characteristics. Unlike other asset classes, gold's price is typically not directly correlated with the performance of stocks or bonds, making it an effective tool for diversification.

-

Gold's historical performance during economic downturns. Gold has historically performed well during periods of economic uncertainty and market volatility, offering a degree of protection for investors' portfolios.

-

Its inherent value and lack of correlation to other asset classes. Gold's value is not tied to the performance of other assets, making it a useful tool to mitigate risk in a diversified portfolio.

-

The role of gold in diversifying investment portfolios. Investing in gold can help reduce overall portfolio risk by providing a hedge against market downturns.

-

Compare gold's performance to other safe haven assets like the US dollar or government bonds. While the US dollar and government bonds are also considered safe havens, gold often offers superior protection during extreme market events.

Predicting Future Gold Prices: Trade War Outlook and Market Analysis

Predicting the future trajectory of gold prices is challenging, but analyzing current trade war developments and market sentiment offers some insight.

-

Analysis of market sentiment and expert opinions. Many market analysts believe that the ongoing trade war uncertainty will continue to support gold prices in the near term.

-

Factors that could potentially drive further price increases (or decreases). A further escalation of the trade war could drive prices higher, while a resolution to the conflict could lead to a price decrease.

-

Discussion of potential resolutions to the trade conflict. The possibility of a negotiated settlement or de-escalation of tensions could impact gold prices negatively.

-

Mention alternative investment strategies related to the gold market (e.g., gold ETFs). Investors can access the gold market through various means, including gold ETFs which offer exposure to gold without the need for physical storage.

Conclusion: Navigating the Gold Price Surge in a Time of Trade War Uncertainty

The surge in gold prices is directly linked to the escalating trade war between the US and the EU. President Trump's threats and the EU's response have created market volatility and driven investors towards the safety of gold. Understanding this relationship is crucial for making informed investment decisions. Gold's role as a safe haven asset remains paramount during times of economic and political uncertainty, offering investors a potential hedge against market downturns. Understanding the dynamics of the gold price surge and its relation to the ongoing trade war is crucial for investors. Stay informed on the latest developments and consider diversifying your portfolio with gold to mitigate risks in this volatile market. Learn more about investing in gold and protecting your assets amidst trade war uncertainty.

Featured Posts

-

New Insights Into Yellowstones Magma Reservoir And Future Eruptions

May 27, 2025

New Insights Into Yellowstones Magma Reservoir And Future Eruptions

May 27, 2025 -

Understanding Georgias Hemp Laws What You Can Legally Buy Now

May 27, 2025

Understanding Georgias Hemp Laws What You Can Legally Buy Now

May 27, 2025 -

Armet Gjermane Per Ukrainen Nje Veshtrim I Afert Ne Ndihmen Ushtarake

May 27, 2025

Armet Gjermane Per Ukrainen Nje Veshtrim I Afert Ne Ndihmen Ushtarake

May 27, 2025 -

Sukesh Chandrashekhar Extortion Case Nora Fatehis Brother In Law Confesses Bmw Seized

May 27, 2025

Sukesh Chandrashekhar Extortion Case Nora Fatehis Brother In Law Confesses Bmw Seized

May 27, 2025 -

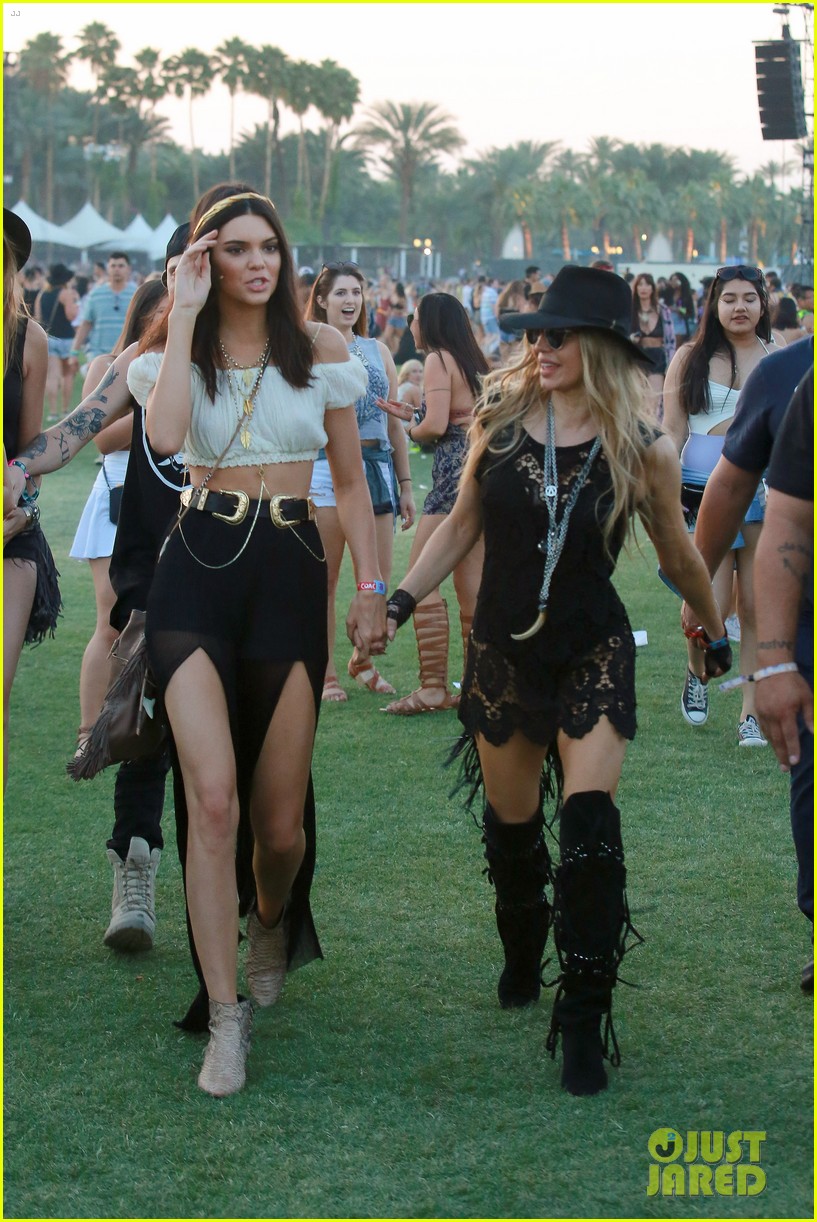

Megan Thee Stallion And Justin Bieber At Coachella After Party Risky Outfit Details

May 27, 2025

Megan Thee Stallion And Justin Bieber At Coachella After Party Risky Outfit Details

May 27, 2025

Latest Posts

-

Six U Conn Teams Achieve Perfect Multi Year Apr Scores

May 31, 2025

Six U Conn Teams Achieve Perfect Multi Year Apr Scores

May 31, 2025 -

Sophia Huynh Tran Con Duong Thanh Cong Trong The Gioi Pickleball

May 31, 2025

Sophia Huynh Tran Con Duong Thanh Cong Trong The Gioi Pickleball

May 31, 2025 -

Alcaraz Rut Lui Khoi Ban Ket Indian Wells Masters

May 31, 2025

Alcaraz Rut Lui Khoi Ban Ket Indian Wells Masters

May 31, 2025 -

Ban Ket Indian Wells Hanh Trinh Cua Alcaraz Ket Thuc

May 31, 2025

Ban Ket Indian Wells Hanh Trinh Cua Alcaraz Ket Thuc

May 31, 2025 -

Sophia Huynh Tran Co Gai Gia The Lung Danh Trong Lang Pickleball Viet Nam

May 31, 2025

Sophia Huynh Tran Co Gai Gia The Lung Danh Trong Lang Pickleball Viet Nam

May 31, 2025