Gold Slumps: Facing First Double-Digit Weekly Losses Of 2025

Table of Contents

Understanding the Magnitude of the Gold Slump

The gold market witnessed a substantial downturn this week, with prices experiencing a staggering 12% drop. This represents the first double-digit weekly decline of 2025 and is one of the most significant weekly falls in recent years. To put this into perspective, the last comparable decline occurred during the [insert relevant historical event/period and percentage drop]. This severe slump has immediately impacted the portfolios of many gold investors, leading to substantial losses for those heavily invested in gold. The psychological impact on investor confidence cannot be ignored, potentially fueling further selling pressure.

- Specific price figures: Gold fell from $1,950 to $1,710 per ounce.

- Comparison to previous market downturns: This decline surpasses the [percentage]% drop seen in [month, year] and is comparable to the [percentage]% decline during the [year] financial crisis.

- Psychological impact: The unexpected nature and severity of the drop have shaken investor confidence, potentially triggering further sell-offs.

Key Factors Contributing to the Gold Price Drop

Several intertwined factors contributed to this dramatic gold slump.

Strengthening US Dollar

The US dollar and gold prices typically share an inverse relationship. As the US dollar strengthens, gold becomes more expensive for holders of other currencies, leading to decreased demand and lower prices. Recent positive US economic indicators, such as [mention specific economic data, e.g., strong employment figures, rising consumer confidence], have bolstered the dollar, consequently putting downward pressure on gold prices.

Rising Interest Rates

Rising interest rates make holding non-yielding assets like gold less attractive. When interest rates increase, investors can earn higher returns on alternative investments like bonds and treasury bills, reducing the appeal of gold, which doesn't offer any yield. The recent interest rate hikes by the Federal Reserve have likely contributed to the decline in gold prices.

Geopolitical Factors

While geopolitical uncertainty often drives investors towards safe-haven assets like gold, recent developments suggest a possible reduction in such uncertainty. [Mention specific geopolitical events that may have contributed to a decrease in investor anxiety, e.g., de-escalation of a conflict, positive diplomatic developments]. This shift in perception may have lessened the demand for gold as a hedge against geopolitical risk.

Increased Supply

Increased gold mining production or other factors impacting supply and demand dynamics may also contribute to price fluctuations. [Mention any recent reports on increased gold mining output or shifts in supply chain dynamics that could have influenced the market]. A surplus in supply, relative to demand, would exert downward pressure on prices.

Investor Reactions and Market Outlook

The gold slump has triggered a wave of selling pressure, as investors react to the sudden price drop. Many are reassessing their investment strategies, considering hedging strategies or diversifying their portfolios. Financial analysts offer varied predictions. Some foresee a short-term recovery, while others suggest a more prolonged period of low gold prices.

- Expert opinions: "The recent gold slump highlights the inherent volatility of the precious metals market," says [Name of financial analyst]. "However, long-term prospects for gold remain positive."

- Technical indicators: Technical analysis suggests [mention key technical indicators, e.g., support and resistance levels, moving averages] which could influence near-term price movements.

- Future scenarios: Potential scenarios include a gradual recovery, a further price decline, or a period of consolidation before a significant price movement in either direction.

In light of this situation, investors should consider diversifying their portfolios to mitigate risk and potentially explore alternative investments to offset potential gold-related losses. Holding onto gold may still be a viable strategy for long-term investors with a high-risk tolerance.

Conclusion: Navigating the Gold Slumps and Charting a Course Forward

The significant gold price drop this week is attributable to a confluence of factors, including a strengthening US dollar, rising interest rates, shifts in geopolitical sentiment, and potential increases in supply. This "gold slump" has resulted in substantial losses for many investors and has highlighted the volatility inherent in the gold market. While the short-term outlook remains uncertain, long-term investors may need to adapt their strategies to navigate potential future gold slumps. Stay informed about market fluctuations and consider consulting with a financial advisor to develop a robust investment strategy that accounts for potential future gold slumps and price volatility in precious metals.

Featured Posts

-

Las Vegas Golden Knights A Strong Stanley Cup Contender

May 04, 2025

Las Vegas Golden Knights A Strong Stanley Cup Contender

May 04, 2025 -

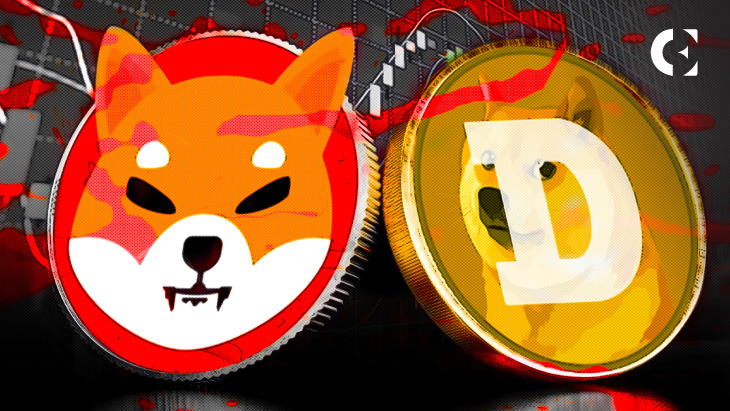

Lion Storages 1 4 G Wh Bess Project In The Netherlands Financial Close Announced

May 04, 2025

Lion Storages 1 4 G Wh Bess Project In The Netherlands Financial Close Announced

May 04, 2025 -

Fitness Trainer Shaun T Critiques Lizzos Ozempic Comments

May 04, 2025

Fitness Trainer Shaun T Critiques Lizzos Ozempic Comments

May 04, 2025 -

Emma Stones Popcorn Butt Lift Dress Snl Red Carpet Look Sparks Online Debate

May 04, 2025

Emma Stones Popcorn Butt Lift Dress Snl Red Carpet Look Sparks Online Debate

May 04, 2025 -

Lizzos Its About Damn Time Tour Ticket Prices And Where To Buy

May 04, 2025

Lizzos Its About Damn Time Tour Ticket Prices And Where To Buy

May 04, 2025

Latest Posts

-

Gibonni Posjeta Sarajevskom Sajmu Knjiga

May 04, 2025

Gibonni Posjeta Sarajevskom Sajmu Knjiga

May 04, 2025 -

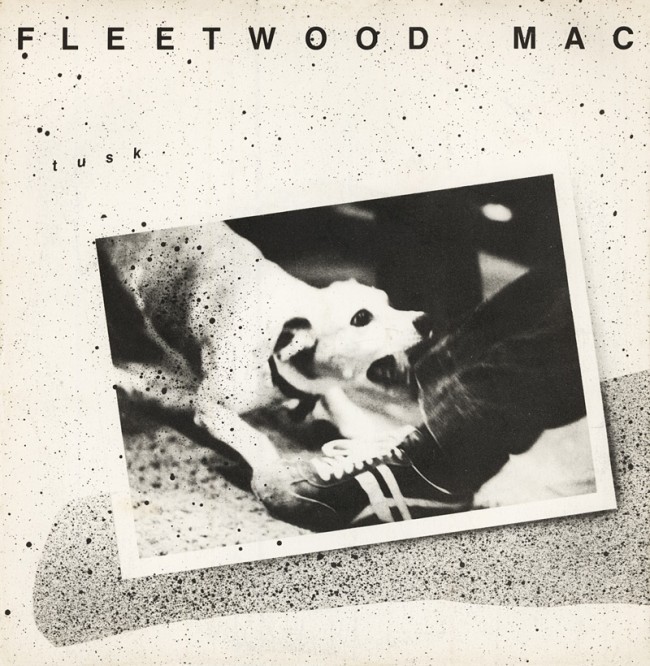

Fleetwood Macs Influence Defining The Supergroup Genre

May 04, 2025

Fleetwood Macs Influence Defining The Supergroup Genre

May 04, 2025 -

Fleetwood Macs Rumours 48 Years Ago A Broken Band Created An Iconic Album

May 04, 2025

Fleetwood Macs Rumours 48 Years Ago A Broken Band Created An Iconic Album

May 04, 2025 -

Fleetwood Macs Buckingham And Fleetwood Back Together In The Studio

May 04, 2025

Fleetwood Macs Buckingham And Fleetwood Back Together In The Studio

May 04, 2025 -

Sarajevski Sajam Knjiga Gibonni Predstavlja Novo Djelo

May 04, 2025

Sarajevski Sajam Knjiga Gibonni Predstavlja Novo Djelo

May 04, 2025