Gold (XAUUSD) Price Rebound: Weak US Data Fuels Rate Cut Expectations

Table of Contents

The price of gold, tracked as XAUUSD (Gold/US Dollar), has experienced a significant rebound in recent days. This surge is largely attributed to disappointing US economic data, fueling speculation that the Federal Reserve will soon begin cutting interest rates. This article delves into the reasons behind this gold price surge and what it could mean for future market movements. Understanding the interplay between US economic indicators and XAUUSD price action is crucial for investors navigating the current market landscape.

Weak US Economic Data Dampens Dollar Strength

The relationship between the US dollar and gold prices is inversely correlated. A weaker dollar typically strengthens the price of gold, as it becomes cheaper for investors holding other currencies to purchase. Recent US economic indicators have painted a less-than-rosy picture, contributing to the dollar's weakening and gold's subsequent rise.

Specific weak economic indicators include:

- Lower-than-expected GDP growth: Slower GDP growth reduces investor confidence in the US economy, making US dollar-denominated assets less attractive. This shift in sentiment often leads investors to seek refuge in safe-haven assets like gold.

- Rising unemployment claims: An increase in unemployment claims signals potential economic slowdown, reducing the likelihood of further interest rate hikes by the Federal Reserve. This dampens the dollar's appeal and supports gold prices.

- Weak consumer confidence: Decreased consumer confidence reflects a pessimistic outlook on the economy, suggesting reduced spending and potential for further economic contraction. This further fuels speculation of rate cuts, benefiting gold.

[Insert chart/graph here showing correlation between US economic data (e.g., GDP, unemployment claims, consumer confidence) and XAUUSD price movements.]

Increased Expectations of Federal Reserve Rate Cuts

Lower interest rates make gold a more attractive investment. Gold, as a non-yielding asset, doesn't pay interest, making it less appealing when interest rates are high. Conversely, lower rates reduce the opportunity cost of holding gold, increasing its attractiveness to investors.

Market sentiment is currently shifting towards expectations of future Fed rate cuts. This anticipation is significantly influencing XAUUSD price action.

- Lower interest rates decrease the opportunity cost of holding gold. With less return available from interest-bearing assets, gold becomes a more competitive investment option.

- Reduced interest rates weaken the dollar, making gold more affordable for international investors. A weaker dollar boosts the price of gold priced in USD for investors using other currencies.

- Many analysts predict further rate cuts in the coming months. These predictions, based on economic indicators and Federal Reserve statements, contribute to the current bullish sentiment surrounding gold.

[Include links to reputable sources such as the Federal Reserve website or financial news outlets.]

Safe-Haven Demand for Gold Amidst Economic Uncertainty

Gold's role as a safe-haven asset is well-established. During times of economic uncertainty and market volatility, investors often flock to gold as a store of value and a hedge against risk. The current geopolitical climate and persistent inflation are contributing factors to this renewed safe-haven demand.

- Investors seek safety in gold during periods of market volatility and economic uncertainty. This flight to safety increases demand and drives up gold prices.

- Geopolitical tensions and global inflation increase demand for gold as a hedge against risk. Uncertainty about the future often prompts investors to seek the relative stability of gold.

- Recent geopolitical events (mention specific events) have heightened investor anxiety, further boosting the demand for safe-haven assets like gold.

[Include data on gold's historical performance during times of economic crisis.]

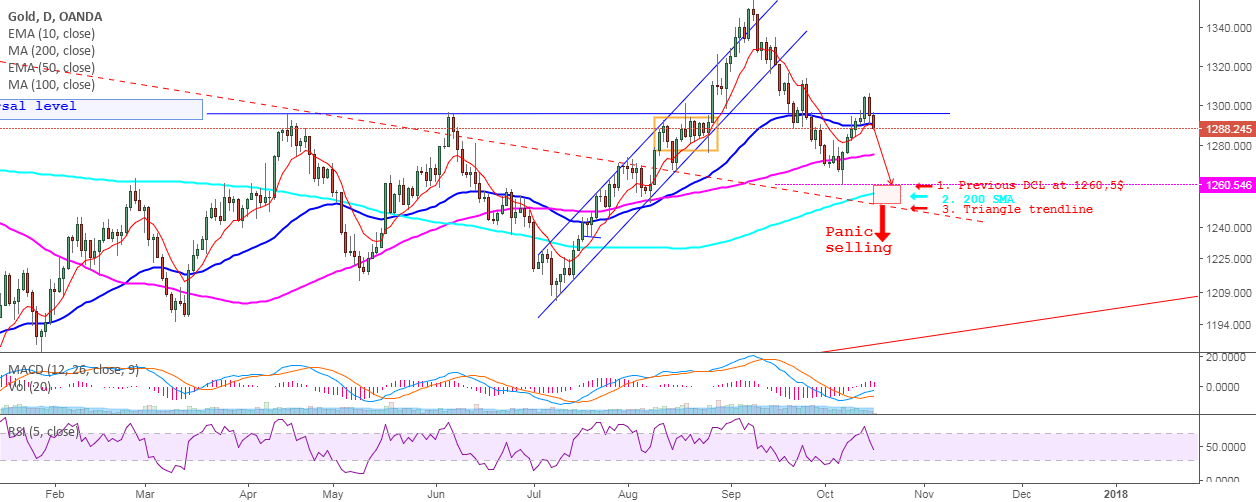

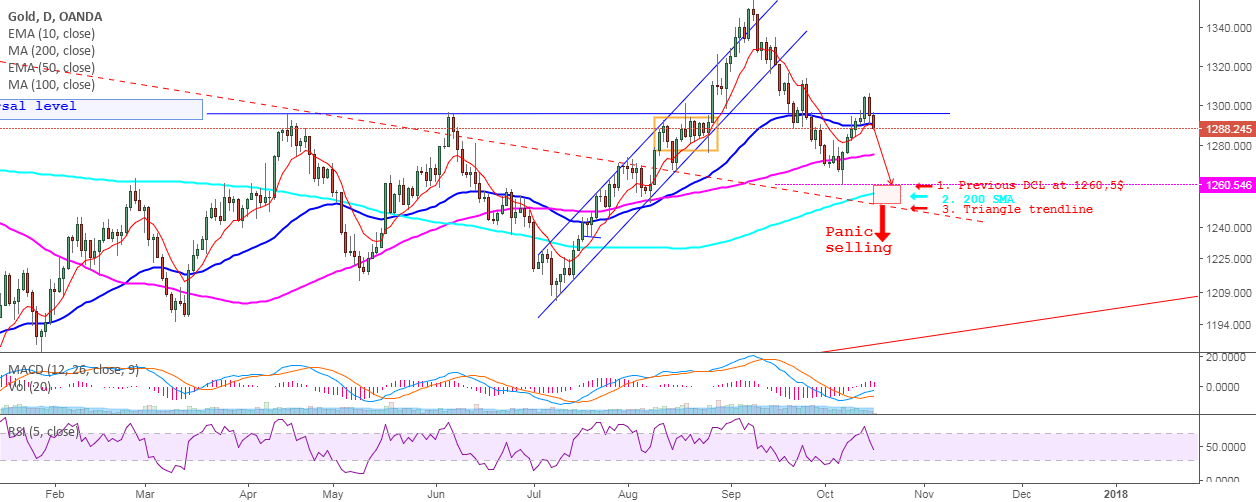

Technical Analysis of the XAUUSD Price Chart

A brief technical analysis of the XAUUSD chart reveals key support and resistance levels. The current upward trend suggests potential for further price appreciation.

- Important technical indicators (e.g., moving averages, RSI, MACD) support the bullish outlook. [Briefly explain the signals from these indicators].

- Chart patterns (e.g., bullish flags, head and shoulders) can indicate the continuation or reversal of trends. [Discuss relevant chart patterns].

- Disclaimer: Trading involves risk, and past performance is not indicative of future results.

Conclusion

The recent rebound in the XAUUSD price is largely driven by weak US economic data, increasing expectations for Federal Reserve rate cuts, and a renewed safe-haven demand for gold. These factors have combined to create a bullish environment for the precious metal. Understanding these interconnected forces is critical for navigating the XAUUSD market effectively.

Call to Action: Stay informed about the evolving situation of XAUUSD price movement and its correlation with US economic data. Keep monitoring the market and consider incorporating gold into your investment portfolio as a hedge against economic uncertainty. Learn more about XAUUSD trading strategies and potential opportunities to capitalize on the current gold price rebound. Don't miss out on the potential of XAUUSD; stay informed and adapt your strategy accordingly.

Featured Posts

-

The Importance Of Reviewing Proxy Statements Form Def 14 A

May 17, 2025

The Importance Of Reviewing Proxy Statements Form Def 14 A

May 17, 2025 -

Fortnite New Icon Skin Officially Unveiled

May 17, 2025

Fortnite New Icon Skin Officially Unveiled

May 17, 2025 -

University Of Utahs New Hospital And Medical Campus In West Valley City

May 17, 2025

University Of Utahs New Hospital And Medical Campus In West Valley City

May 17, 2025 -

Examining The Effects Of Trumps Student Loan Policies On Black Americans

May 17, 2025

Examining The Effects Of Trumps Student Loan Policies On Black Americans

May 17, 2025 -

Boston Celtics 6 1 Billion Sale A New Era For The Franchise

May 17, 2025

Boston Celtics 6 1 Billion Sale A New Era For The Franchise

May 17, 2025