Gold's Record High: Understanding The Trade War Impact On Bullion

Table of Contents

Trade Wars and Global Economic Uncertainty

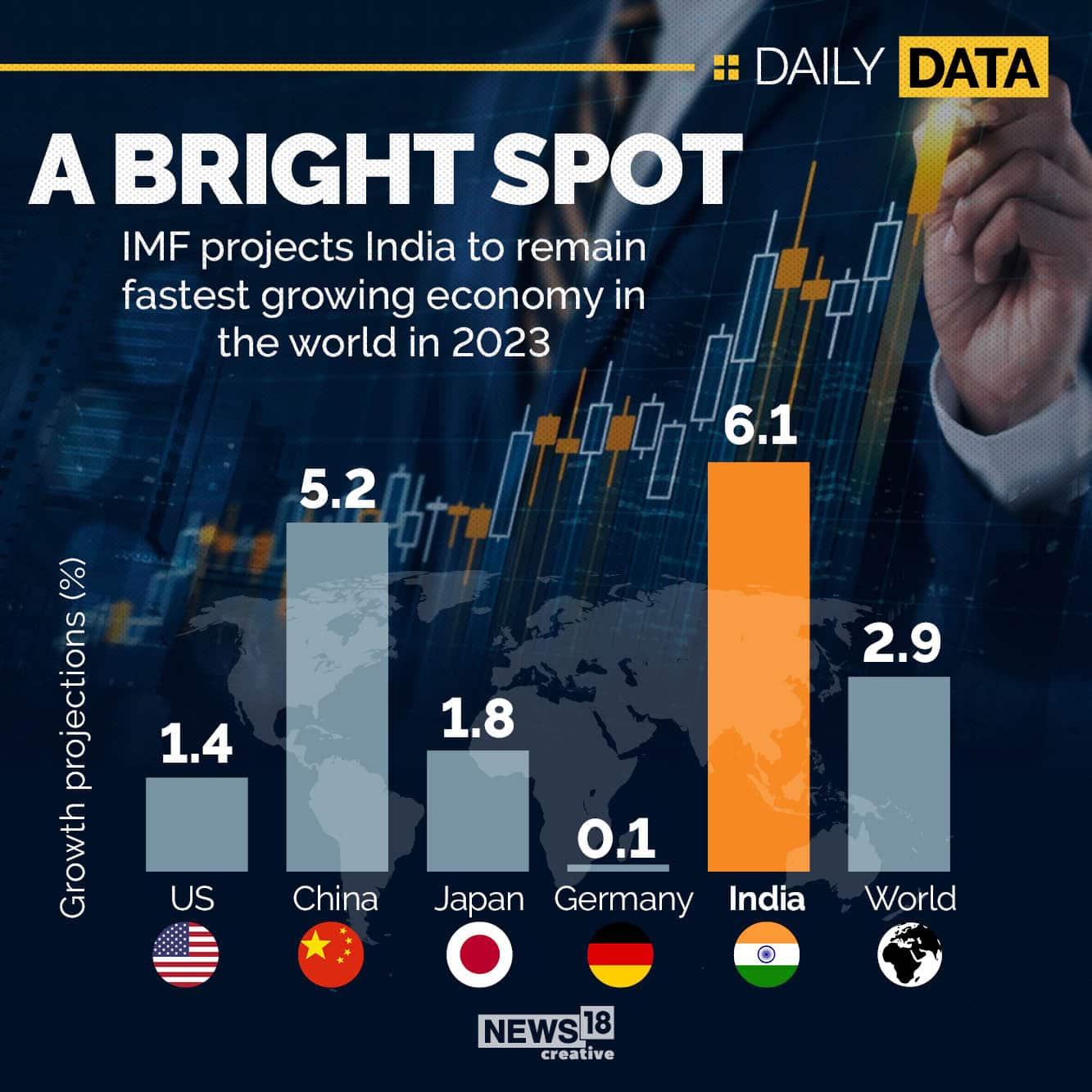

Trade wars, characterized by escalating tariffs and trade restrictions between nations, inject significant uncertainty into the global economy. This uncertainty undermines investor confidence, leading to increased market volatility and impacting various economic sectors.

The ramifications of trade wars are far-reaching:

- Decreased global trade volume: Tariffs and trade barriers directly reduce the volume of goods and services exchanged internationally, hindering economic growth.

- Increased risk of recession: The uncertainty and decreased trade can trigger a domino effect, increasing the risk of a global or regional recession.

- Weakening of global currencies: Currency fluctuations become more pronounced as investors seek safer havens, potentially devaluing certain currencies.

- Increased inflation concerns: Trade disruptions can lead to supply chain bottlenecks and higher prices for goods, fueling inflation.

These factors collectively contribute to a climate of fear and uncertainty, driving investors towards traditionally safe assets like gold as a hedge against potential losses. The price of gold often rises in response to these anxieties, reflecting its role as a safe-haven investment.

Gold as a Safe Haven Asset During Trade Wars

Gold has historically served as a reliable hedge against economic and political instability. Its value is largely independent of fluctuating currency values and stock market performance, making it an attractive option during times of crisis. This phenomenon is often referred to as a "flight to safety."

Several characteristics make gold a compelling safe-haven asset:

- Gold's non-correlated nature with other assets: Unlike stocks or bonds, gold's price movements are often inversely correlated with other asset classes, offering diversification benefits during market downturns.

- Gold's inherent value and limited supply: Gold's scarcity and enduring appeal as a precious metal underpin its value, ensuring its long-term relevance as a store of value.

- Gold's historical performance during periods of uncertainty: Historical data consistently shows gold outperforming other assets during periods of geopolitical instability and economic recession.

- Increased demand for physical gold and gold ETFs: During times of uncertainty, investors increase their holdings of physical gold bars and coins, as well as gold exchange-traded funds (ETFs).

Central Bank Activity and Gold Reserves

Central banks worldwide have significantly increased their gold reserves in recent years, reflecting a growing recognition of gold's importance as a strategic asset. This shift in policy underlines the concerns about global economic stability and the potential for future crises.

The reasons for this increased accumulation of gold reserves are multifold:

- Diversification of foreign exchange reserves: Central banks are diversifying their holdings away from US dollars and other fiat currencies to reduce risk.

- Hedge against currency devaluation: Gold serves as a hedge against currency devaluation and inflation, protecting the value of central bank assets.

- Increased geopolitical risk: Growing geopolitical tensions and uncertainties further bolster the appeal of gold as a safe haven.

- Reduced reliance on the US dollar: The increasing use of gold signifies a move towards a less dollar-centric global financial system.

Geopolitical Factors and Gold Prices

Geopolitical events significantly influence gold prices. Periods of political instability, international conflicts, and heightened uncertainty often lead to a surge in gold demand.

Several geopolitical factors can impact gold prices:

- Impact of specific trade disputes: Major trade disputes, like the ongoing US-China trade war, can increase market volatility and drive investors to gold.

- Influence of international conflicts: Armed conflicts and political instability in various regions heighten uncertainty and boost gold's appeal as a safe haven.

- Uncertainty surrounding political elections: Periods of political transition and uncertainty surrounding elections can also increase demand for gold.

- Sanctions and trade restrictions: International sanctions and trade restrictions often lead to increased market uncertainty and higher gold prices.

Investing in Gold During Trade War Uncertainty

Investors seeking to mitigate risks associated with trade wars have several options for investing in gold:

- Physical gold: Purchasing physical gold bars or coins offers direct ownership of the asset, but involves storage costs and security considerations.

- Gold ETFs: Gold exchange-traded funds (ETFs) provide exposure to gold without the need for physical storage, offering liquidity and lower costs.

- Gold mining stocks: Investing in gold mining companies offers leverage to gold price movements, but carries higher risk due to the volatility of the mining sector.

Each investment strategy comes with its own set of advantages and disadvantages:

- Storage costs of physical gold: Secure storage of physical gold can be expensive.

- Expense ratios of gold ETFs: ETFs charge management fees, impacting overall returns.

- Volatility of gold mining stocks: Mining stocks can be significantly more volatile than the price of gold itself.

- Diversification strategies: A diversified portfolio that includes gold can help reduce overall risk.

Conclusion: Navigating the Future of Gold and Trade Wars

The strong correlation between escalating trade wars, heightened economic uncertainty, and the surge in gold prices is undeniable. Gold's role as a crucial safe-haven asset during periods of global instability has been firmly established. Understanding how to incorporate gold into your investment strategy is vital for mitigating the risks associated with the ongoing trade tensions and global economic uncertainties. Learn more about protecting your portfolio with gold bullion investments today!

Featured Posts

-

Zuckerberg And Trump A New Era For Tech And Politics

Apr 26, 2025

Zuckerberg And Trump A New Era For Tech And Politics

Apr 26, 2025 -

Country Name S Emerging Business Landscapes A Comprehensive Map

Apr 26, 2025

Country Name S Emerging Business Landscapes A Comprehensive Map

Apr 26, 2025 -

Nintendos Intervention Ryujinx Switch Emulator Development Ceases

Apr 26, 2025

Nintendos Intervention Ryujinx Switch Emulator Development Ceases

Apr 26, 2025 -

World Economic Ranking Shift California Overtakes Japan

Apr 26, 2025

World Economic Ranking Shift California Overtakes Japan

Apr 26, 2025 -

Ryujinx Emulator Development Halted Official Statement Following Nintendo Contact

Apr 26, 2025

Ryujinx Emulator Development Halted Official Statement Following Nintendo Contact

Apr 26, 2025

Latest Posts

-

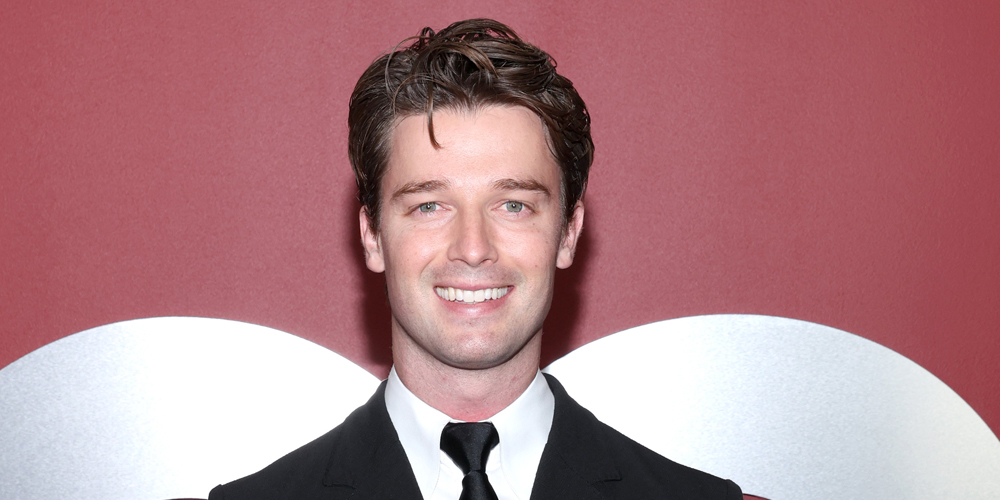

Patrick Schwarzeneggers White Lotus Role A Surprise Ariana Grande Music Video Appearance

Apr 27, 2025

Patrick Schwarzeneggers White Lotus Role A Surprise Ariana Grande Music Video Appearance

Apr 27, 2025 -

Forgotten Cameo Patrick Schwarzenegger In Ariana Grandes Video And White Lotus

Apr 27, 2025

Forgotten Cameo Patrick Schwarzenegger In Ariana Grandes Video And White Lotus

Apr 27, 2025 -

Ariana Grande Music Video Features Unexpected White Lotus Star Patrick Schwarzenegger

Apr 27, 2025

Ariana Grande Music Video Features Unexpected White Lotus Star Patrick Schwarzenegger

Apr 27, 2025 -

Patrick Schwarzeneggers Unseen Appearance In Ariana Grandes Music Video A White Lotus Connection

Apr 27, 2025

Patrick Schwarzeneggers Unseen Appearance In Ariana Grandes Music Video A White Lotus Connection

Apr 27, 2025 -

Patrick Schwarzeneggers Forgotten White Lotus Role In Ariana Grande Music Video

Apr 27, 2025

Patrick Schwarzeneggers Forgotten White Lotus Role In Ariana Grande Music Video

Apr 27, 2025