Gold's Unexpected Dip: Two Consecutive Weekly Losses For 2025

Table of Contents

The gold market, typically seen as a safe haven, experienced a surprising downturn in 2025, with gold prices suffering two consecutive weeks of losses. This unexpected decline has left many investors questioning the future trajectory of gold investment and the overall gold market. This article will explore the key factors contributing to this gold price drop, analyzing the interplay of macroeconomic forces, technical indicators, and market sentiment.

Rising Interest Rates and Their Impact on Gold Prices

Gold, unlike interest-bearing assets, doesn't offer a yield. Therefore, rising interest rates create an inverse relationship with gold prices. When interest rates increase, investments like government bonds become more attractive, offering higher returns and diverting capital away from non-yielding assets such as gold. This decreased demand directly impacts the gold price, pushing it downward.

- Higher yields on government bonds: The increased attractiveness of bonds directly competes with gold as a safe-haven investment.

- Increased opportunity cost of holding non-yielding gold: Investors are incentivized to shift their funds to higher-yielding alternatives, reducing their exposure to gold.

- Impact on investor sentiment and market psychology: The anticipation of further rate hikes can create a bearish sentiment, further fueling the gold price drop.

[Insert chart here showing correlation between interest rate hikes and gold price movements in 2025]

The Strengthening US Dollar and its Influence on the Gold Market

The US dollar and gold prices share an inverse relationship. A stronger dollar typically leads to a weaker gold price, primarily because gold is priced in US dollars. When the dollar strengthens, it becomes more expensive for those holding other currencies to purchase gold, thus dampening demand and suppressing the price.

In 2025, the US dollar's strength could be attributed to several factors:

- Safe-haven demand for the US dollar: During times of global economic uncertainty, the US dollar often acts as a safe haven, attracting investment and strengthening its value.

- Impact of US monetary policy: The Federal Reserve's monetary policy decisions significantly influence the dollar's strength. Aggressive tightening measures can strengthen the dollar, putting downward pressure on gold.

- Global economic uncertainty and its effect on currency markets: Geopolitical events and global economic instability can contribute to increased demand for the US dollar, leading to a stronger currency and weaker gold prices.

[Insert chart here demonstrating the correlation between the US dollar index and gold prices during the relevant period.]

Technical Analysis: Chart Patterns and Trading Signals

Technical analysis provides another perspective on the gold price drop. Certain chart patterns and technical indicators might have signaled the decline.

- Key support and resistance levels: Breaks below crucial support levels can trigger further downward momentum.

- Volume analysis: Decreasing volume during price declines can indicate weakening selling pressure, while increasing volume can confirm a trend.

- Interpretation of technical indicators: Moving averages, RSI, and other indicators can offer insights into the strength and direction of the trend. For example, a bearish head and shoulders pattern or a bearish flag could have preceded the decline.

[Insert relevant charts and graphs here to visually illustrate technical analysis points, including examples of patterns like head and shoulders or bearish flags.]

Speculative Trading and Market Sentiment

Speculative trading and the overall market sentiment played a significant role in amplifying the gold price decline.

- Impact of large institutional investors: Large institutional investors can significantly impact the market through their trading decisions. A shift in their strategy towards selling gold can accelerate the price drop.

- Role of algorithmic trading: Algorithmic trading can exacerbate price swings, particularly during periods of high volatility.

- Media coverage and its influence on market psychology: Negative media coverage can contribute to bearish sentiment, leading to further selling pressure.

Conclusion

The unexpected dip in gold prices in 2025 was a result of a confluence of factors. Rising interest rates reduced the attractiveness of gold, a stronger US dollar increased the cost for international buyers, technical analysis suggested a bearish trend, and shifts in market sentiment contributed to selling pressure. The interconnectedness of these elements created a perfect storm leading to the observed gold price drop. Understanding these factors behind this recent gold price drop is crucial for navigating the 2025 gold market effectively. Stay informed and make sound decisions regarding your gold investments. For further insights into gold market analysis and investment strategies, [link to relevant resources here].

Featured Posts

-

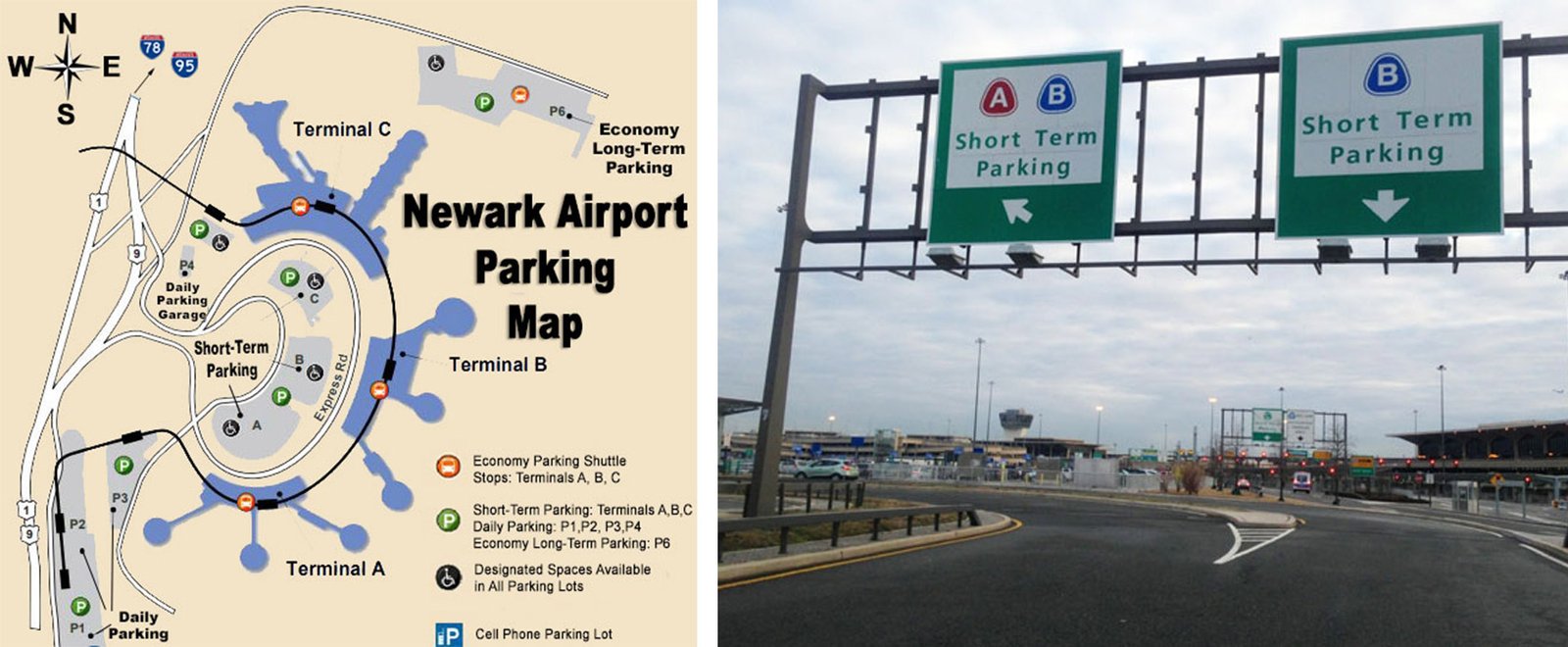

United Airlines Cancels Flights Newark Airport Disruptions Due To Faa Staff

May 04, 2025

United Airlines Cancels Flights Newark Airport Disruptions Due To Faa Staff

May 04, 2025 -

Cruella Trailer Emma Stone Vs Emma Thompsons Baroness Von Hellman

May 04, 2025

Cruella Trailer Emma Stone Vs Emma Thompsons Baroness Von Hellman

May 04, 2025 -

The Paddy Pimblett Dustin Poirier Retirement Debate

May 04, 2025

The Paddy Pimblett Dustin Poirier Retirement Debate

May 04, 2025 -

Au Roeulx Eneco Lance Le Plus Grand Parc De Batteries De Belgique

May 04, 2025

Au Roeulx Eneco Lance Le Plus Grand Parc De Batteries De Belgique

May 04, 2025 -

Stanley Cup Playoffs Ratings Dip Despite International Interest

May 04, 2025

Stanley Cup Playoffs Ratings Dip Despite International Interest

May 04, 2025

Latest Posts

-

Dr Ethan Choi Returns In Chicago Med Season 10 Episode 14

May 04, 2025

Dr Ethan Choi Returns In Chicago Med Season 10 Episode 14

May 04, 2025 -

Raiwaqa Fire Claims Womans Life

May 04, 2025

Raiwaqa Fire Claims Womans Life

May 04, 2025 -

A 390 000 Prize For Nelson Dong Apo Main Event Win

May 04, 2025

A 390 000 Prize For Nelson Dong Apo Main Event Win

May 04, 2025 -

Brian Tee Returns To Chicago Med Season 10 Episode 14

May 04, 2025

Brian Tee Returns To Chicago Med Season 10 Episode 14

May 04, 2025 -

Nelson Dongs A 390 000 Apo Main Event Victory

May 04, 2025

Nelson Dongs A 390 000 Apo Main Event Victory

May 04, 2025