GOP Tax Bill Faces Setback: Conservative Push For Medicaid And Clean Energy Changes

Table of Contents

Conservative Opposition to the GOP Tax Bill's Current Form

The GOP Tax Bill, in its current iteration, has drawn significant criticism from within the conservative wing of the Republican party. Concerns center primarily around the proposed cuts to Medicaid funding and the perceived inadequacy of clean energy tax provisions.

Concerns Regarding Medicaid Funding Cuts

The proposed cuts to Medicaid funding within the GOP Tax Bill have sparked outrage among conservatives who argue the reductions will disproportionately harm vulnerable populations. Specific concerns include:

- Increased Uninsured Rates: Significant cuts could lead to millions losing their health insurance coverage, exacerbating existing healthcare inequalities. Studies project an increase in uninsured individuals ranging from [Insert Statistical Data Here] depending on the final form of the bill.

- Strain on State Healthcare Systems: State governments will face immense pressure to absorb the financial burden of increased demand for uncompensated care, potentially leading to reduced access to vital healthcare services.

- Loss of Coverage for Vulnerable Populations: The most vulnerable members of society, including children, the elderly, and individuals with pre-existing conditions, stand to lose the most from these cuts, potentially leading to serious health consequences.

- Key Conservative Figures: Prominent conservative voices, including [Name prominent conservative figures and their statements], have publicly voiced their opposition to the current Medicaid provisions.

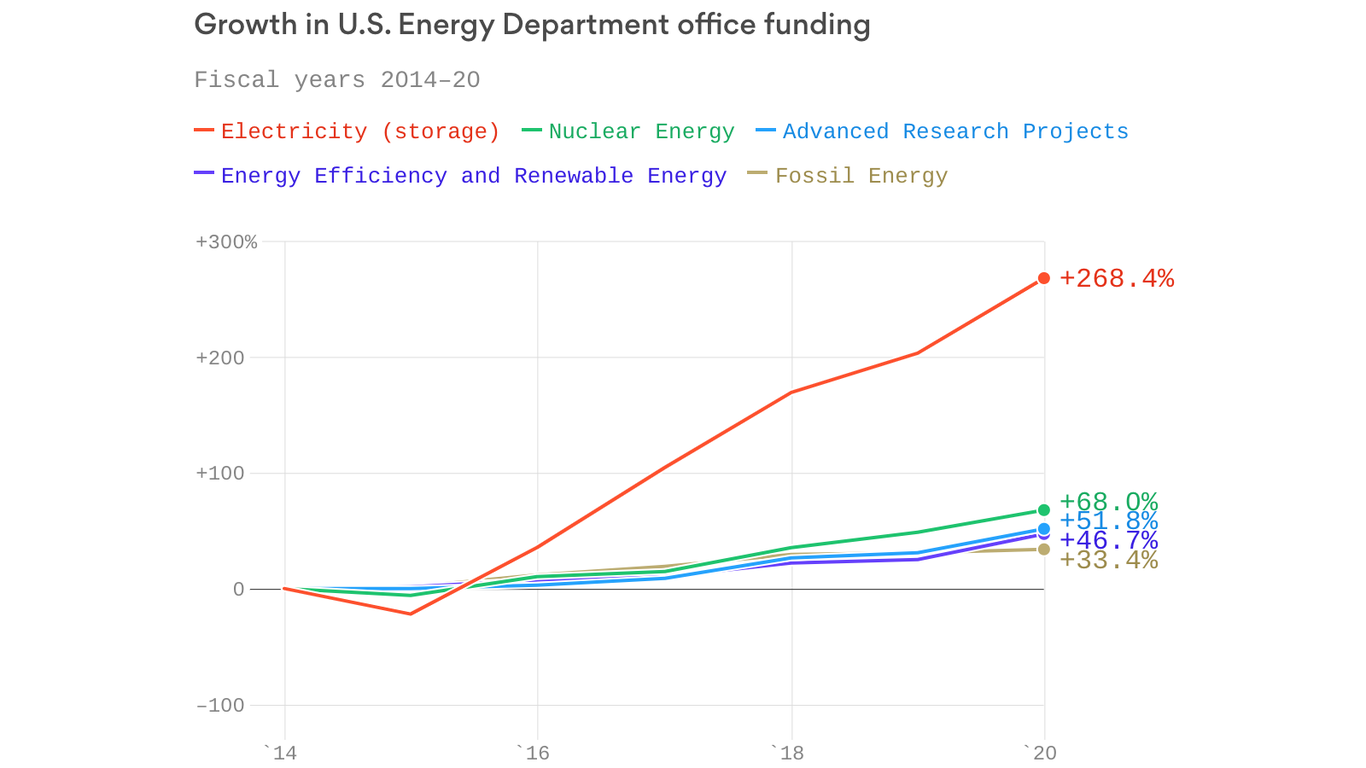

Discontent with Clean Energy Tax Provisions

The clean energy provisions within the GOP Tax Bill have also faced significant criticism. Conservatives argue that:

- Unfairness to Fossil Fuel Industries: The bill's preferential treatment of certain clean energy technologies is seen as unfair competition for the established fossil fuel industry.

- Environmental Concerns: Some conservatives argue the tax provisions do not go far enough to address the urgent need for significant investment in renewable energy sources.

- Counterarguments: Proponents of the current provisions argue that they strike a balance between promoting clean energy and avoiding excessive government intervention. They highlight the potential for job creation and economic growth in the renewable energy sector. [Reference relevant policy documents or legislative proposals here, including links.]

Proposed Amendments and Their Potential Impact

Facing intense pressure, proponents of the GOP Tax Bill are considering several amendments to address the concerns raised by conservative factions.

Medicaid Amendment Proposals

Several amendments have been proposed to mitigate the impact of Medicaid funding cuts. These include:

- Increased Funding: Some proposals suggest increasing the funding levels allocated to Medicaid to lessen the impact of the cuts.

- Eligibility Criteria Adjustments: Others suggest adjusting eligibility criteria to ensure that the most vulnerable populations remain covered. [Include specifics about the proposed changes.]

- Political Feasibility: The feasibility of passing these amendments depends on the willingness of both moderate and conservative Republicans to compromise. [Analyze the political landscape and the likelihood of success.]

Clean Energy Amendment Proposals

Similar amendments have been proposed to enhance the clean energy provisions of the GOP Tax Bill:

- Enhanced Tax Credits: Some proposals call for increased tax credits or subsidies to incentivize investments in clean energy technologies.

- Technological Neutrality: Other proposals advocate for a more technology-neutral approach, providing support for a broader range of clean energy initiatives.

- Political Support: The likelihood of these amendments gaining support within the Republican party and the broader political landscape remains uncertain, dependent on the willingness to compromise and the level of public pressure.

Political Ramifications and Future of the GOP Tax Bill

The internal divisions within the Republican party regarding the GOP Tax Bill pose a significant threat to its passage. The political strategies employed by both sides of the debate are crucial in determining the bill's ultimate fate.

- Potential Compromise: Finding a compromise that satisfies both moderate and conservative Republicans will be critical to securing the bill's passage.

- Political Fallout: Failure to pass the bill would have serious consequences for the Republican Party heading into the next election cycle.

- Long-Term Consequences: The long-term consequences of the bill, regardless of its final form, will significantly impact Medicaid recipients, the clean energy sector, and the overall economic landscape.

Conclusion: The Uncertain Future of the GOP Tax Bill

The conservative pushback against the GOP Tax Bill, particularly concerning Medicaid and clean energy, presents significant challenges to its passage. Internal divisions within the Republican party are creating uncertainty about the bill's future and highlighting the complex interplay between political ideology, economic policy, and social programs. The potential impact of this legislation on healthcare access, environmental sustainability, and the upcoming elections is immense. Stay informed about the evolving situation surrounding the GOP Tax Bill and the ongoing debate surrounding its impact on Medicaid and clean energy initiatives. Understanding these complex issues is crucial for informed civic engagement.

Featured Posts

-

Maneskins Damiano David Funny Little Fears Debut Solo Album Released

May 18, 2025

Maneskins Damiano David Funny Little Fears Debut Solo Album Released

May 18, 2025 -

Trumps Middle East Policy Assessing The Winners And Losers

May 18, 2025

Trumps Middle East Policy Assessing The Winners And Losers

May 18, 2025 -

Voyager Technologies Space Defense Ipo What Investors Need To Know

May 18, 2025

Voyager Technologies Space Defense Ipo What Investors Need To Know

May 18, 2025 -

Amanda Bynes Past A Classmates Perspective

May 18, 2025

Amanda Bynes Past A Classmates Perspective

May 18, 2025 -

Republican Tax Bill Delayed Disagreement Over Medicaid And Clean Energy Funding

May 18, 2025

Republican Tax Bill Delayed Disagreement Over Medicaid And Clean Energy Funding

May 18, 2025

Latest Posts

-

2025 Nfl Draft Analysts Assessment Of The New England Patriots

May 18, 2025

2025 Nfl Draft Analysts Assessment Of The New England Patriots

May 18, 2025 -

The Arrival Of Jersey Mikes Subs In Galesburg

May 18, 2025

The Arrival Of Jersey Mikes Subs In Galesburg

May 18, 2025 -

Jersey Mikes Subs Announces Galesburg Location

May 18, 2025

Jersey Mikes Subs Announces Galesburg Location

May 18, 2025 -

Nfl Analysts Bold Prediction Patriots Post 2025 Draft Future

May 18, 2025

Nfl Analysts Bold Prediction Patriots Post 2025 Draft Future

May 18, 2025 -

Jersey Mikes Subs A Galesburg Restaurant Opening

May 18, 2025

Jersey Mikes Subs A Galesburg Restaurant Opening

May 18, 2025