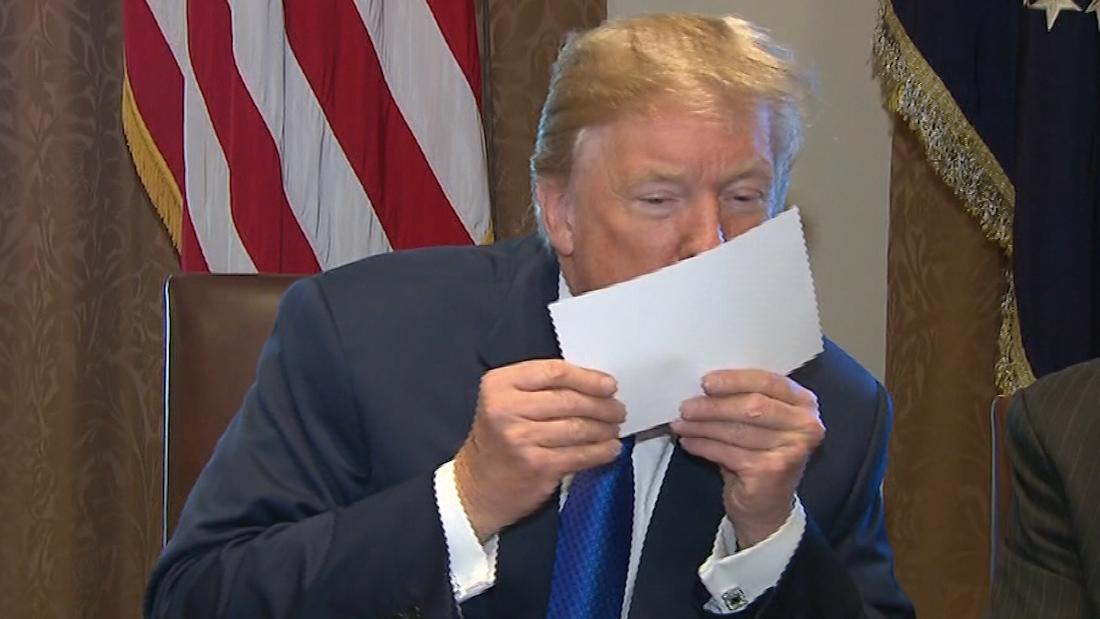

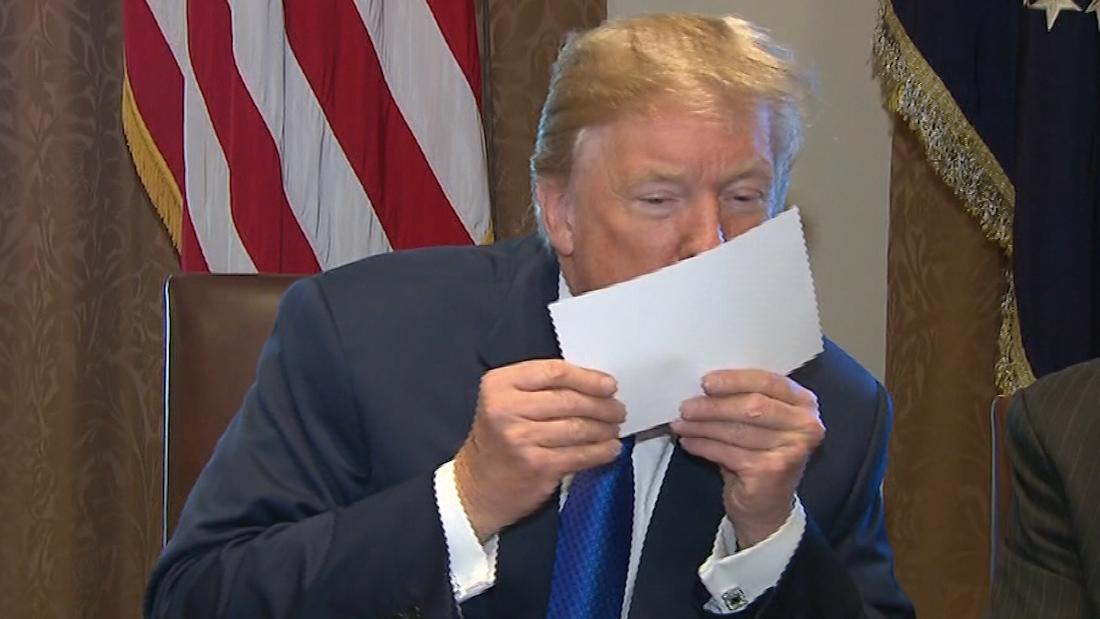

GOP Tax Plan: A Mathematical Look At Its Deficit Impact

Table of Contents

Projected Revenue Loss Under the GOP Tax Plan

The GOP tax plan's projected revenue loss stems primarily from significant cuts to both individual and corporate income taxes. Understanding these reductions is key to grasping the potential scale of the GOP Tax Plan deficit.

Individual Income Tax Cuts

The proposed cuts to individual income tax rates represent a substantial reduction in projected tax revenue. These cuts, combined with changes to deductions and exemptions, significantly alter the tax burden for many Americans.

- Lower Tax Brackets: Reductions in the lower tax brackets, while potentially stimulating consumer spending, will decrease government revenue.

- Standard Deduction Increase: The substantial increase in the standard deduction simplifies tax filing but also reduces the number of taxpayers itemizing, leading to lower overall tax revenue.

- Elimination of Personal Exemptions: The elimination of personal exemptions, projected to reduce revenue by hundreds of billions of dollars annually, further contributes to the overall revenue shortfall.

- Changes to Itemized Deductions: Modifications to itemized deductions, such as limitations on state and local tax deductions, will also impact tax revenue. The precise impact is subject to ongoing debate and varying economic models.

Different economic models, employing diverse assumptions about taxpayer behavior and economic growth, produce varying estimations of the revenue loss from these individual income tax cuts. These discrepancies highlight the inherent uncertainties in such projections.

Corporate Tax Rate Reduction

The proposed reduction in the corporate tax rate from 35% to 21% is another major contributor to the projected revenue loss under the GOP Tax Plan. This decrease aims to boost corporate investment and competitiveness.

- Reduced Corporate Tax Revenue: The lower rate will directly translate to a significant decrease in corporate tax revenue collected by the government. Projections for this reduction vary depending on the assumed level of corporate investment and economic growth.

- Repatriation of Overseas Profits: The plan's provisions for the repatriation of overseas profits, while potentially stimulating short-term economic activity, are likely to result in a one-time revenue gain followed by a sustained reduction in future tax revenue from these profits.

- Stimulus Argument: Proponents of the corporate tax cut argue that the increased investment and economic growth it spurs will ultimately offset the initial revenue loss. However, the extent to which this will occur is heavily debated and dependent on numerous factors.

Impact on the National Debt

The projected revenue losses from the GOP tax plan are expected to significantly impact the national debt, both in the short and long term. Accurate prediction, however, presents considerable challenges.

Short-Term vs. Long-Term Projections

Short-term projections tend to focus on the immediate impact of the tax cuts, showing a clear increase in the deficit. Long-term projections, however, are far more complex.

- Uncertain Economic Growth: Accurately predicting long-term economic growth is inherently difficult, given the many factors that influence it. Economic assumptions significantly influence long-term deficit projections.

- Range of Projections: Different models produce a wide range of projected debt increases, reflecting the uncertainty inherent in long-term economic forecasting. Some projections suggest a relatively modest increase, while others predict a dramatic surge in the national debt.

Dynamic Scoring vs. Static Scoring

The debate surrounding the GOP Tax Plan deficit is further complicated by the choice of scoring methodology: static or dynamic.

- Static Scoring: This method estimates revenue changes based solely on the tax code changes, without considering potential impacts on economic growth. It generally projects larger deficits.

- Dynamic Scoring: This method attempts to incorporate the effects of the tax plan on economic growth, leading to potentially lower deficit projections. However, it is highly subjective and prone to manipulation.

- Bias and Uncertainty: Both methods have inherent uncertainties and potential biases. The choice of scoring method can significantly influence the resulting deficit projections.

Alternative Analyses and Perspectives

Understanding the potential GOP Tax Plan deficit requires examining a variety of analyses and considering different perspectives.

Independent Economic Forecasts

Several independent organizations, such as the Congressional Budget Office (CBO) and the Tax Policy Center, have released their own forecasts of the plan's impact on the deficit.

- Varied Projections: These forecasts vary in their projections, often reflecting different underlying assumptions about economic growth and taxpayer behavior.

- Areas of Agreement and Disagreement: While there is general agreement on a significant increase in the deficit, the magnitude of that increase varies substantially across different models.

Counterarguments and Rebuttals

Proponents of the tax plan argue that the cuts will stimulate economic growth, ultimately leading to increased tax revenue and offsetting the initial losses.

- Supply-Side Economics: This argument rests on the principles of supply-side economics, suggesting lower taxes incentivize investment and productivity, boosting overall economic output.

- Evidence and Debate: The validity of these claims is highly debated. Empirical evidence supporting a strong stimulative effect is mixed, with some studies showing little to no effect, while others suggest a modest positive impact.

Conclusion:

The GOP Tax Plan's potential impact on the national deficit remains a subject of considerable debate. While projections vary depending on the methodology and underlying economic assumptions, analyses consistently indicate a significant increase in the national debt under various scenarios. Understanding the potential long-term fiscal consequences of the GOP Tax Plan Deficit is paramount. Further in-depth research and ongoing analysis are needed to accurately assess its ultimate impact. We urge readers to continue researching the GOP tax plan deficit and engage in informed discussions about its implications for the future of the nation's fiscal health.

Featured Posts

-

Tyazheloe Sostoyanie Shumakhera Drug Podelilsya Trevozhnymi Novostyami

May 20, 2025

Tyazheloe Sostoyanie Shumakhera Drug Podelilsya Trevozhnymi Novostyami

May 20, 2025 -

Us Australia Military Exercises Missile Launcher Deployment And Chinas Response

May 20, 2025

Us Australia Military Exercises Missile Launcher Deployment And Chinas Response

May 20, 2025 -

Exploring The World Of Agatha Christies Hercule Poirot

May 20, 2025

Exploring The World Of Agatha Christies Hercule Poirot

May 20, 2025 -

Bespomoschnoe Polozhenie Shumakhera Pechalnaya Situatsiya O Kotoroy Rasskazal Drug

May 20, 2025

Bespomoschnoe Polozhenie Shumakhera Pechalnaya Situatsiya O Kotoroy Rasskazal Drug

May 20, 2025 -

Hmrc Adopts Voice Recognition Expect Quicker Call Resolution

May 20, 2025

Hmrc Adopts Voice Recognition Expect Quicker Call Resolution

May 20, 2025

Latest Posts

-

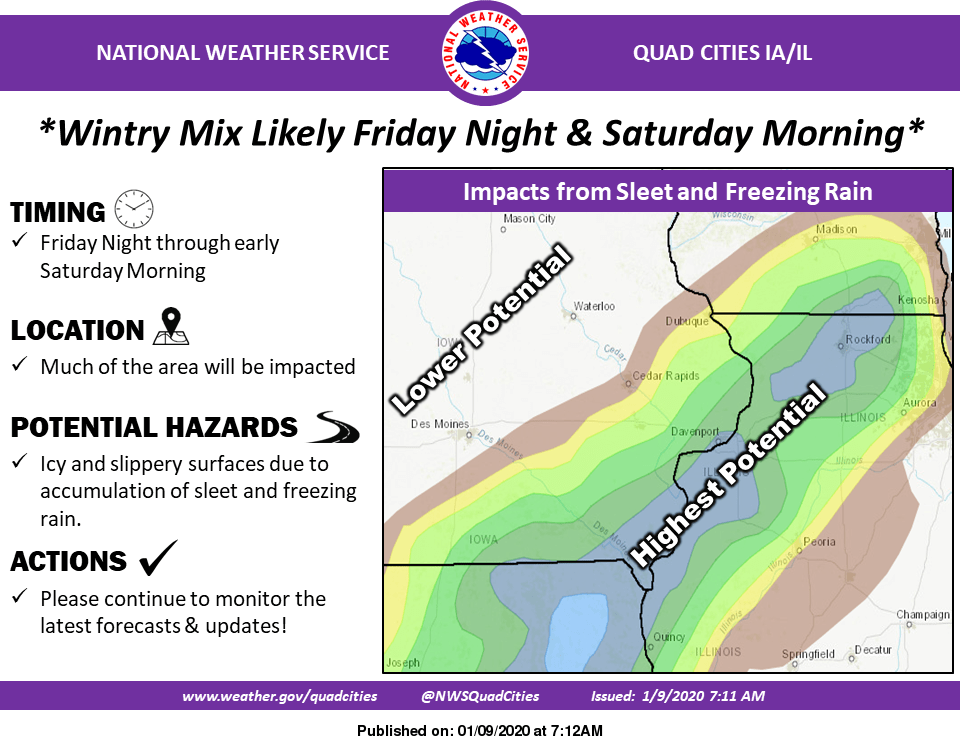

What To Expect During A Wintry Mix Of Rain And Snow

May 20, 2025

What To Expect During A Wintry Mix Of Rain And Snow

May 20, 2025 -

Preparing For A Wintry Mix Of Rain And Snow

May 20, 2025

Preparing For A Wintry Mix Of Rain And Snow

May 20, 2025 -

Understanding A Wintry Mix Of Rain And Snow

May 20, 2025

Understanding A Wintry Mix Of Rain And Snow

May 20, 2025 -

Wintry Mix Rain And Snow Forecast

May 20, 2025

Wintry Mix Rain And Snow Forecast

May 20, 2025 -

Drier Weather Ahead Tips For Water Conservation And Drought Preparedness

May 20, 2025

Drier Weather Ahead Tips For Water Conservation And Drought Preparedness

May 20, 2025