GOP Tax Plan Faces Uncertain Future: Conservatives Push Back On Medicaid And Clean Energy Cuts

Table of Contents

Conservative Backlash Against Medicaid Cuts

The proposed cuts to Medicaid within the GOP tax plan represent a significant point of contention, sparking fierce debate within the Republican party. These cuts threaten to drastically alter healthcare access for millions of low-income Americans.

Impact on Vulnerable Populations

The proposed reductions in Medicaid funding will have a devastating impact on vulnerable populations across the nation. The consequences are far-reaching and deeply concerning.

- Increased uninsured rates: Millions could lose their health insurance coverage, leading to a surge in the number of uninsured Americans.

- Reduced access to preventative care: Cuts to preventative services will lead to poorer health outcomes and increased healthcare costs in the long run.

- Potential strain on hospitals: Hospitals, already struggling financially, will face increased burdens from treating more uninsured patients.

These proposed cuts are projected to significantly impact state budgets, forcing many states to make difficult choices between balancing their budgets and providing essential healthcare services to their most vulnerable citizens. States like Texas, Florida, and Arizona, which have large populations relying on Medicaid, are expected to be particularly hard hit. The exact figures vary depending on the final version of the GOP tax plan, but preliminary estimates suggest millions will lose coverage and access to critical care.

Fiscal Responsibility Concerns vs. Social Safety Net

The debate surrounding the Medicaid cuts highlights a fundamental tension within the conservative movement: balancing fiscal responsibility with the preservation of the social safety net.

- Arguments for the cuts: Proponents argue that reducing Medicaid spending is necessary for long-term budget stability and to control the growth of government spending. They point to the program's rising costs as unsustainable.

- Arguments against the cuts: Opponents emphasize the importance of maintaining a robust social safety net to protect vulnerable populations. They argue that the cuts will disproportionately impact low-income families and exacerbate existing health disparities.

Prominent conservatives are on both sides of this issue. Some, like Senator [Insert Name and State of a Conservative Senator supporting cuts], have publicly supported the cuts as a necessary measure to control spending, while others, such as [Insert Name and State of a Conservative Senator opposing cuts], have voiced strong opposition, emphasizing the potential human cost.

Opposition to Clean Energy Provisions

Another major source of opposition to the GOP tax plan stems from proposed changes to clean energy provisions. These cuts threaten to undermine the growth of the renewable energy sector and impede progress towards environmental sustainability.

Environmental Concerns and Economic Impact

The reduction or elimination of clean energy tax credits and subsidies within the GOP tax plan has sparked widespread concern among environmental advocates and economists.

- Job losses in the clean energy industry: The cuts could lead to significant job losses in the rapidly growing renewable energy sector, impacting industries such as solar panel manufacturing and wind turbine production.

- Increased carbon emissions: Reduced investment in renewable energy will likely lead to increased reliance on fossil fuels, resulting in higher carbon emissions and worsening climate change.

- Potential harm to long-term climate goals: The cuts contradict efforts to meet national and international climate goals, potentially hindering progress toward a cleaner energy future.

For example, the proposed elimination of the [Name specific clean energy tax credit] could result in the loss of [Number] jobs in the solar energy sector alone, according to a report by [Source]. This demonstrates the significant economic consequences of these cuts.

Balancing Economic Growth with Environmental Protection

The debate surrounding clean energy provisions highlights the complex relationship between economic growth and environmental protection. Conservatives are divided on how to balance these competing priorities.

- Prioritizing economic growth: Some argue that prioritizing economic growth justifies sacrificing some environmental protections, emphasizing the potential negative economic impacts of stringent environmental regulations.

- Prioritizing environmental protection: Others argue that investing in renewable energy is essential for long-term economic prosperity and environmental sustainability, highlighting the potential for job creation and economic benefits in the clean energy sector.

Finding a compromise that addresses both economic growth and environmental concerns is crucial. This could involve exploring alternative approaches to incentivize renewable energy while also promoting economic growth, such as targeted tax incentives for specific technologies or investments in green infrastructure.

The Path Forward for the GOP Tax Plan

The path forward for the GOP tax plan is fraught with uncertainty. The significant internal opposition detailed above makes the passage of the plan in its current form highly improbable.

Negotiations and Compromises

The likelihood of the GOP tax plan passing without significant changes is slim. Negotiations and compromises will be essential to garner enough support within the party and potentially from across the aisle.

- Potential compromises: Possible compromises could involve scaling back the proposed cuts to Medicaid and clean energy programs, or finding alternative ways to achieve fiscal savings.

- Possible amendments: Amendments to the plan could be introduced to address the concerns raised by conservative opponents, potentially leading to a revised version that gains broader support.

- Likelihood of bipartisan support: The extent to which Democrats are willing to support aspects of the GOP tax plan will also play a role in its fate.

Several scenarios are possible, from significant amendments leading to a modified plan to the complete failure of the legislation.

Political Ramifications of Failure

The failure of the GOP tax plan would carry significant political ramifications for the Republican Party.

- Potential impact on voter confidence: Failure could damage voter confidence in the party's ability to govern effectively.

- Damage to the party's image: The internal divisions exposed by the debate could further erode the party's image.

- Influence on future policy decisions: The outcome will significantly influence future policy debates and the party's legislative agenda.

The political risks associated with the plan's failure are substantial, potentially impacting upcoming elections and the party's standing with voters.

Conclusion

The future of the GOP tax plan remains highly uncertain. Strong internal opposition to proposed cuts in Medicaid and clean energy funding has created significant obstacles to its passage. The coming weeks will be crucial in determining whether negotiations can bridge the divides within the party and lead to a compromise. The ultimate fate of this ambitious legislation will have profound consequences for the American economy and the nation's social and environmental policies. Understanding the complexities of the GOP tax plan and its potential impact is crucial for informed political engagement. Stay informed about the evolving situation and follow the latest developments regarding the GOP tax plan debate.

Featured Posts

-

Rome Trip For State Officials Questions Raised Over Corporate Funding

May 18, 2025

Rome Trip For State Officials Questions Raised Over Corporate Funding

May 18, 2025 -

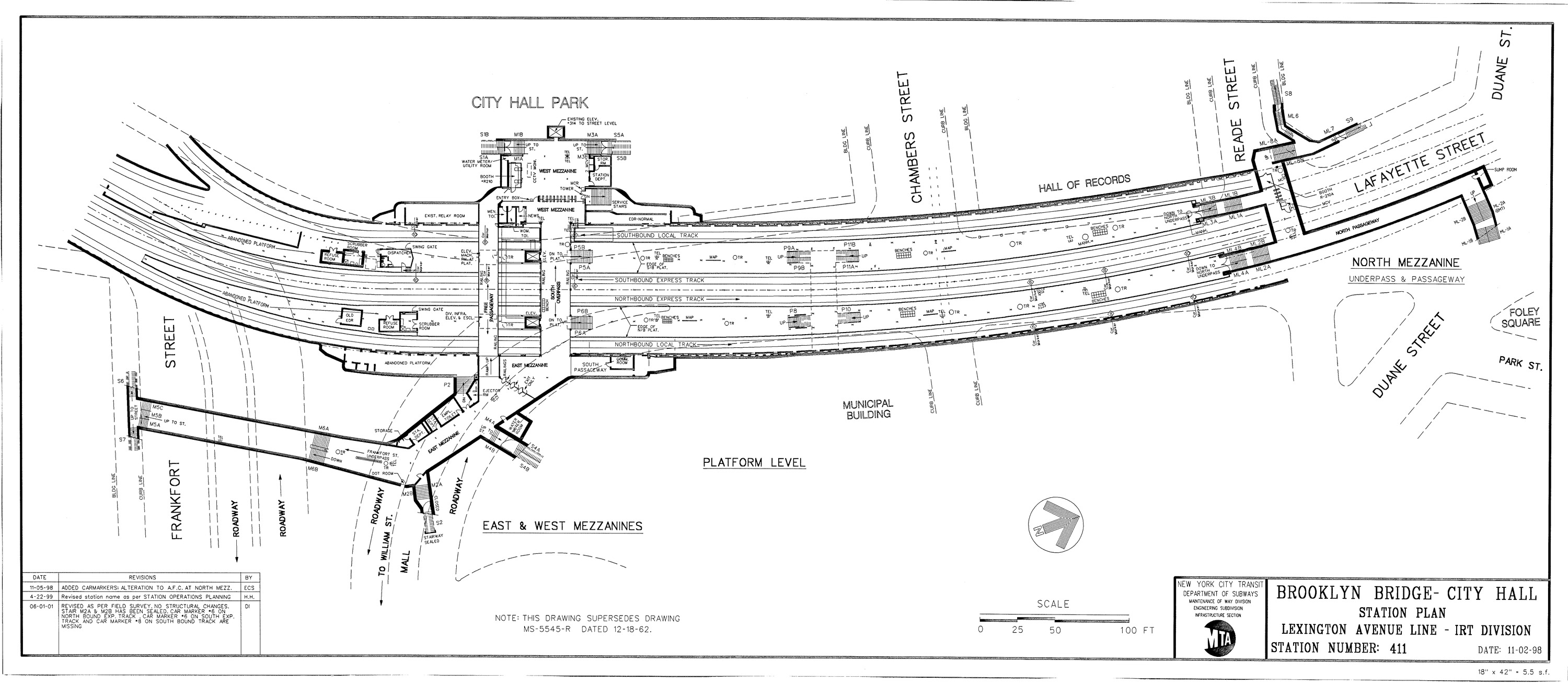

Nyc Subway Stabbing Man Attacked Near Brooklyn Bridge City Hall Station During Rush Hour

May 18, 2025

Nyc Subway Stabbing Man Attacked Near Brooklyn Bridge City Hall Station During Rush Hour

May 18, 2025 -

The Ultimate Guide To Uk Vip Casinos For High Stakes Players

May 18, 2025

The Ultimate Guide To Uk Vip Casinos For High Stakes Players

May 18, 2025 -

Best Online Casinos Canada Why 7 Bit Casino Leads

May 18, 2025

Best Online Casinos Canada Why 7 Bit Casino Leads

May 18, 2025 -

Michael Confortos Early Spring Challenges And How He Addressed Them

May 18, 2025

Michael Confortos Early Spring Challenges And How He Addressed Them

May 18, 2025

Latest Posts

-

I Omilia Toy Kasselaki Prokliseis Kai Eykairies Gia Ti Naytilia Kai Tin Nisiotiki Politiki

May 18, 2025

I Omilia Toy Kasselaki Prokliseis Kai Eykairies Gia Ti Naytilia Kai Tin Nisiotiki Politiki

May 18, 2025 -

The Division 2 Sixth Anniversary Remembering The Past Embracing The Future

May 18, 2025

The Division 2 Sixth Anniversary Remembering The Past Embracing The Future

May 18, 2025 -

Eyropaiki Naytilia Gigantiaia Megethi Kai Statistika

May 18, 2025

Eyropaiki Naytilia Gigantiaia Megethi Kai Statistika

May 18, 2025 -

Kasselakis Stin Ekdilosi Naytilia Kai Nisiotiki Politiki I Naytilia Os Kommati Tis Ethnikis Taytotitas

May 18, 2025

Kasselakis Stin Ekdilosi Naytilia Kai Nisiotiki Politiki I Naytilia Os Kommati Tis Ethnikis Taytotitas

May 18, 2025 -

Tom Clancys The Division 2 Celebrating Six Years Of Post Apocalyptic Warfare

May 18, 2025

Tom Clancys The Division 2 Celebrating Six Years Of Post Apocalyptic Warfare

May 18, 2025