GPB Capital Founder's Fraud Conviction: David Gentile Gets 7 Years

Table of Contents

The GPB Capital Fraud Scheme

GPB Capital's fraudulent activities involved a complex web of misrepresentations and deceptive practices targeting investors seeking high returns. The company primarily focused on investments in automotive dealerships and waste management companies, presenting these ventures as stable and highly profitable. However, investigations revealed a significantly different reality. The scheme involved systematically misleading investors through:

- Misrepresentation of Assets Under Management (AUM): GPB Capital significantly inflated its reported AUM, creating a false impression of the firm's success and stability. This artificially boosted investor confidence and attracted further investments.

- Inflated Valuations: The valuations of the underlying assets were grossly overstated, concealing significant losses and financial instability within the portfolio. This practice allowed GPB Capital to continue attracting investors despite its deteriorating financial position.

- Diversion of Funds: Significant sums of investor money were diverted for purposes other than the stated investments, including personal enrichment of key individuals within the company.

- Obstruction of Justice: Efforts were made to obstruct investigations into the fraudulent activities, hindering regulatory scrutiny and delaying the exposure of the scheme.

David Gentile's Role in the Scheme

David Gentile, as the founder and CEO of GPB Capital, played a central role in orchestrating and perpetuating the fraudulent scheme. Evidence presented during the trial implicated him in:

- Direct Involvement in Misrepresentation: Gentile was directly involved in creating and disseminating misleading information to potential investors, actively participating in the deception.

- Approval of Fraudulent Transactions: He approved numerous transactions that were integral to the fraudulent activities, demonstrating his knowledge and complicity in the scheme.

- Personal Enrichment from the Scheme: Gentile personally benefited financially from the fraudulent activities, using investor funds for personal gain.

Multiple co-conspirators were also implicated, contributing to the overall fraudulent operation, though Gentile remained the central figure.

The Sentencing and its Implications

David Gentile's seven-year prison sentence, coupled with potential financial penalties and restitution orders, represents a significant victory for justice and investor protection. The implications of this conviction are far-reaching:

- Financial Recovery for Victims: While full recovery for all victims is unlikely, the conviction opens avenues for legal recourse and potential compensation.

- Deterrent Effect on Future Fraudulent Activity: The severity of the sentence serves as a strong deterrent against similar fraudulent schemes in the private equity industry.

- Increased Regulatory Scrutiny of Private Equity Firms: The GPB Capital case has intensified regulatory scrutiny of private equity firms, prompting increased oversight and stricter compliance requirements.

Lessons Learned from the GPB Capital Case

The GPB Capital Founder's fraud conviction offers critical lessons for investors, emphasizing the need for vigilance and thorough due diligence:

- Thorough Research Before Investing: Never invest in any opportunity without conducting thorough research into the company, its management, and its investment strategy.

- Verification of Fund Performance Claims: Always independently verify performance claims made by investment firms, seeking confirmation from reputable and independent sources.

- Seeking Professional Financial Advice: Consult with a qualified financial advisor before making significant investment decisions. An experienced advisor can help assess risk and identify potential red flags.

Conclusion

The GPB Capital Founder's fraud conviction marks a significant turning point in the fight against investment fraud. David Gentile's seven-year sentence serves as a strong message that such actions will not go unpunished. The details of this case, from the complex nature of the fraud scheme to the severe consequences faced by its perpetrator, underscore the importance of investor education and due diligence. Understanding the specifics of the GPB Capital Founder's Fraud Conviction is crucial for protecting yourself from similar scams. Learn more about protecting your investments by visiting the SEC website [link to SEC website] and other investor protection organizations [link to relevant organizations]. Don't become another victim; understand the risks involved in private equity investments and always practice thorough due diligence.

Featured Posts

-

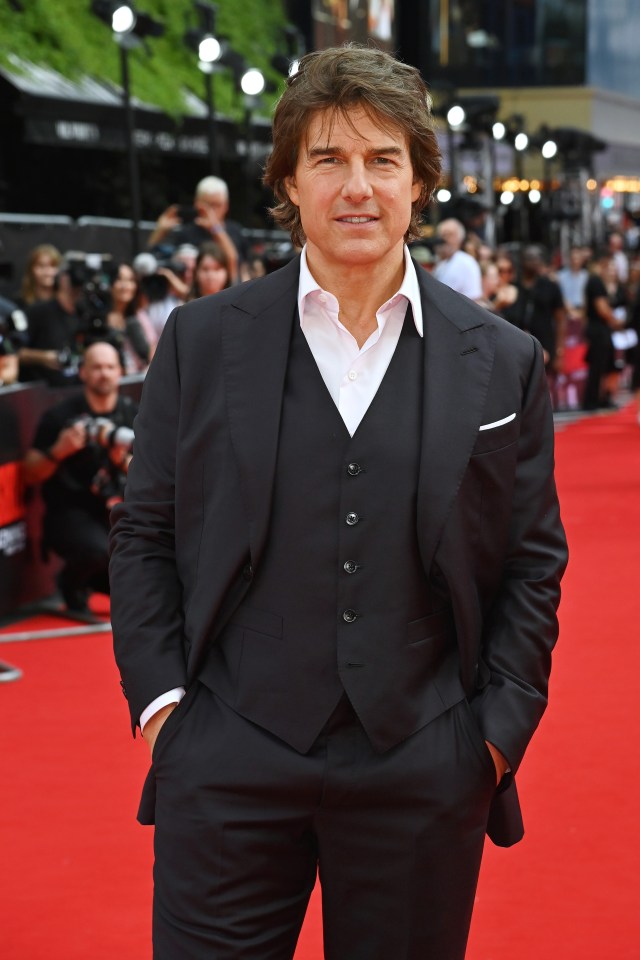

Tom Cruises Unique Gesture After Suri Cruises Birth

May 11, 2025

Tom Cruises Unique Gesture After Suri Cruises Birth

May 11, 2025 -

Early Season Mlb Powerhouse Chisholms Stats Eclipse Judges

May 11, 2025

Early Season Mlb Powerhouse Chisholms Stats Eclipse Judges

May 11, 2025 -

Barber Motorsports Park Colton Hertas Quest For Qualifying And Race Pace

May 11, 2025

Barber Motorsports Park Colton Hertas Quest For Qualifying And Race Pace

May 11, 2025 -

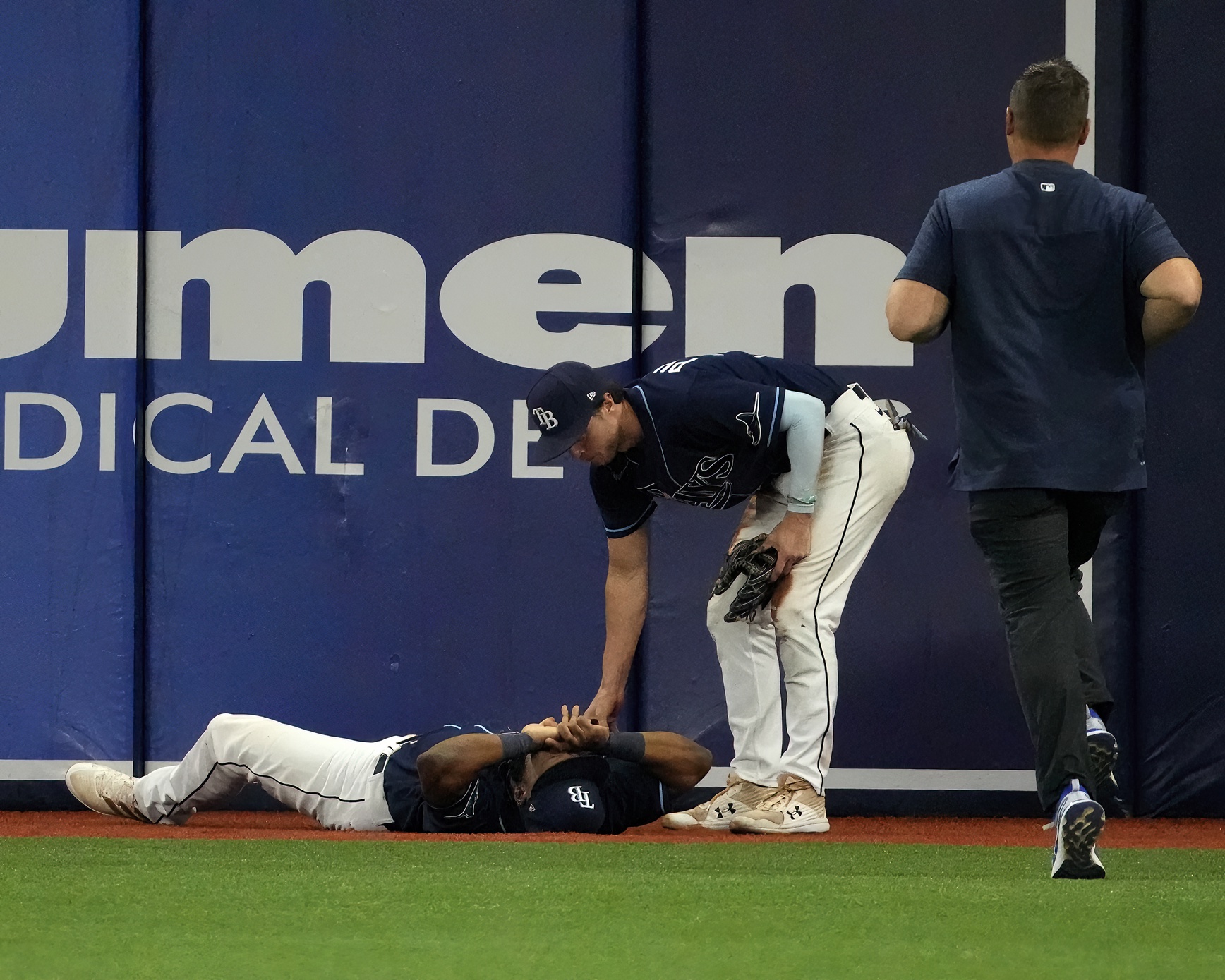

Injury Concerns Cloud Rays Vs Yankees Series April 17 20

May 11, 2025

Injury Concerns Cloud Rays Vs Yankees Series April 17 20

May 11, 2025 -

The Impact Of Jurickson Profars 80 Game Ped Suspension On His Team

May 11, 2025

The Impact Of Jurickson Profars 80 Game Ped Suspension On His Team

May 11, 2025