Grayscale's XRP ETF Filing: Impact On XRP Price And Potential Record High

Table of Contents

Understanding Grayscale's XRP ETF Filing

An ETF, or Exchange-Traded Fund, is an investment fund traded on stock exchanges, much like stocks. Investing in an XRP ETF offers several benefits compared to directly purchasing XRP, including diversification, regulated trading, and easier accessibility for institutional and retail investors. Grayscale, a prominent digital currency asset manager, has a history of successfully navigating the complex regulatory landscape. Their previous foray into the cryptocurrency ETF space, specifically their Bitcoin ETF, significantly impacted Bitcoin's price and adoption. The significance of this XRP ETF filing is amplified by the ongoing SEC lawsuit against Ripple Labs, the creator of XRP. A successful XRP ETF listing could indirectly influence the SEC's decision regarding XRP's classification as a security.

- Increased accessibility for investors: An ETF makes XRP investment more accessible to a wider range of investors, including those who may be hesitant to engage directly with cryptocurrency exchanges.

- Potential for increased liquidity: The ETF listing on a major exchange could boost XRP's liquidity, making it easier to buy and sell large quantities without significantly impacting its price.

- Regulatory implications and SEC approval process: SEC approval is crucial for the ETF's success. The approval process itself will be closely scrutinized, given the ongoing legal battle surrounding XRP.

- Comparison with other successful crypto ETFs (if any): While few crypto ETFs exist compared to traditional asset ETFs, successful launches of other crypto ETFs could serve as a benchmark for the potential impact of a Grayscale XRP ETF.

Potential Impact on XRP Price

XRP's price is influenced by several factors, including overall market sentiment, regulatory uncertainty surrounding cryptocurrencies, and the rate of adoption by businesses and individuals. A Grayscale XRP ETF would likely introduce a significant influx of institutional investment, potentially driving up demand and consequently, the price. The increased regulatory oversight associated with an ETF could also reduce volatility, making XRP a more attractive investment for risk-averse investors.

- Increased institutional investment: Institutional investors, often hesitant to invest directly in cryptocurrencies due to regulatory and security concerns, are more likely to invest through a regulated ETF.

- Reduced volatility (potentially): The increased liquidity and institutional participation could stabilize XRP's price, leading to potentially lower volatility compared to the current market conditions.

- Impact on trading volume: The launch of an XRP ETF is expected to substantially increase trading volume, further boosting liquidity and potentially driving price increases.

- Comparison to Bitcoin's price movement after ETF approval (if applicable): While no direct comparison exists yet, the price movements of Bitcoin following the approval of Bitcoin ETFs (if and when they occur) could provide insights into potential XRP price trajectories.

The Ripple-SEC Lawsuit and its Influence

The SEC's lawsuit against Ripple Labs alleges that XRP is an unregistered security. The outcome of this lawsuit is critical for XRP's future. A positive resolution, either through a settlement favorable to Ripple or a court ruling in their favor, could significantly boost investor confidence and clear the path for a successful XRP ETF listing, potentially propelling XRP's price to new heights.

- Potential for SEC approval of XRP as a security: Even if deemed a security, SEC approval for an XRP ETF is still possible, though it would likely come with stricter regulations.

- Impact of a settlement or court ruling on the XRP ETF application: The terms of any settlement or the specifics of a court ruling will directly impact the SEC's decision on the XRP ETF application.

- Effect on investor confidence and market sentiment: A positive outcome would greatly enhance investor confidence and lead to a more bullish market sentiment for XRP.

Record High Potential for XRP

Analyzing XRP's historical price data reveals potential resistance levels that could be overcome with increased demand from an ETF. Factors contributing to a new all-time high include widespread adoption of XRP in payment systems, increased institutional investment, and a favorable resolution of the Ripple-SEC lawsuit. Realistic price targets require careful consideration of market conditions and expert opinions, but a significant surge is plausible.

- Technical analysis of XRP price charts: Technical analysis can identify potential support and resistance levels, providing insight into price targets.

- Fundamental analysis of XRP's adoption and utility: Fundamental analysis examines the underlying technology, adoption rate, and utility of XRP to assess its long-term value.

- Comparison with other cryptocurrencies that achieved record highs after major events: Studying how other cryptocurrencies responded to similar catalysts can offer valuable insights into XRP's potential.

Conclusion

Grayscale's XRP ETF filing represents a pivotal moment for XRP, potentially unlocking significant growth and pushing its price towards a record high. While the SEC lawsuit's outcome remains a critical factor, the filing itself signifies growing institutional interest and increased accessibility for investors. The potential impact on XRP's price is substantial, and staying informed about developments in this space is crucial for anyone considering XRP investment. Therefore, continue to monitor news regarding Grayscale's XRP ETF application and the Ripple-SEC lawsuit to make informed decisions about your XRP investments. Stay updated on the latest news surrounding the Grayscale XRP ETF and its potential impact on the XRP price.

Featured Posts

-

Analyzing Palantirs Performance High Valuation In The Context Of Past Blowouts

May 07, 2025

Analyzing Palantirs Performance High Valuation In The Context Of Past Blowouts

May 07, 2025 -

Third Ldc Future Forum Building Resilience In Least Developed Countries

May 07, 2025

Third Ldc Future Forum Building Resilience In Least Developed Countries

May 07, 2025 -

Increased Manufacturing Incentives Ontario Budget Highlights

May 07, 2025

Increased Manufacturing Incentives Ontario Budget Highlights

May 07, 2025 -

Turning Poop Into Prose An Ai Powered Podcast Revolution

May 07, 2025

Turning Poop Into Prose An Ai Powered Podcast Revolution

May 07, 2025 -

Pei Legislature Reviews 500 000 Bill For Nhl Face Off Event

May 07, 2025

Pei Legislature Reviews 500 000 Bill For Nhl Face Off Event

May 07, 2025

Latest Posts

-

Deandre Dzordan Otkriva Zasto Se On I Nikola Jokic Ljube Tri Puta

May 08, 2025

Deandre Dzordan Otkriva Zasto Se On I Nikola Jokic Ljube Tri Puta

May 08, 2025 -

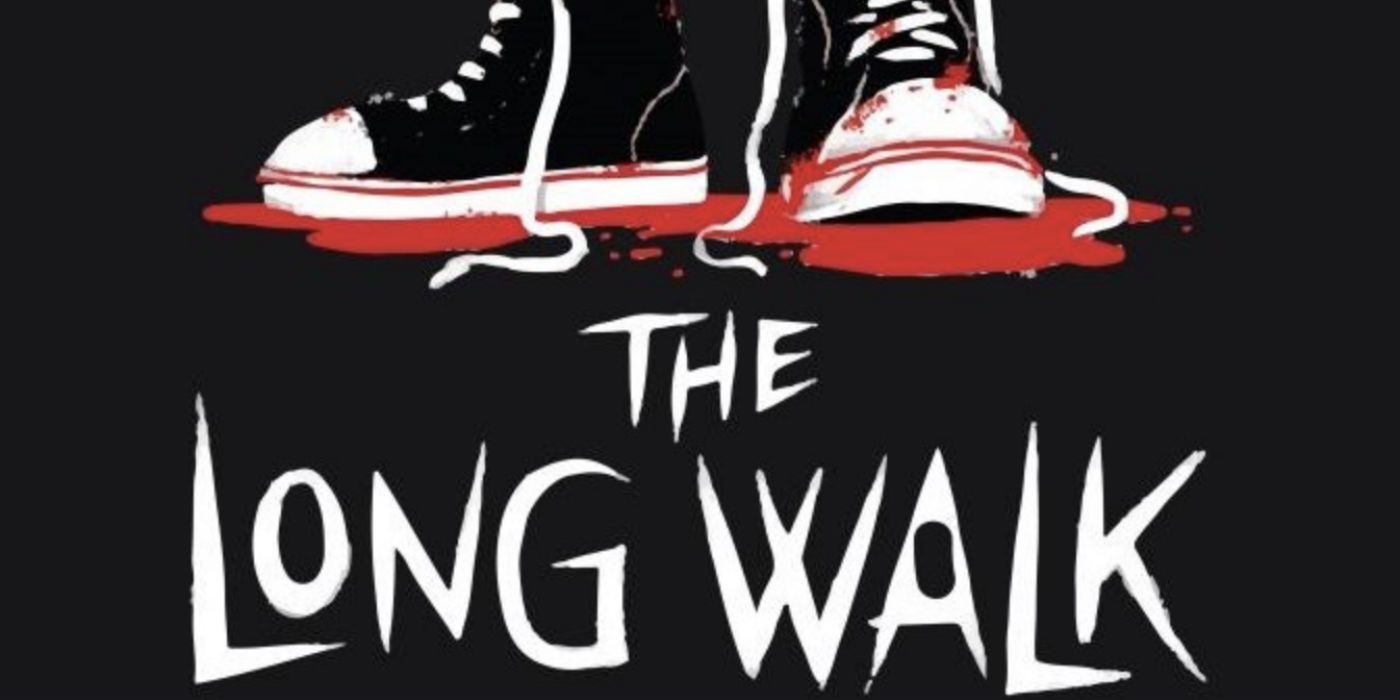

First Look The Long Walk Trailer Adapts Stephen King Story

May 08, 2025

First Look The Long Walk Trailer Adapts Stephen King Story

May 08, 2025 -

Stephen Kings The Long Walk Gets A Chilling New Trailer

May 08, 2025

Stephen Kings The Long Walk Gets A Chilling New Trailer

May 08, 2025 -

The Long Walk New Trailer Adapting Stephen Kings Novel

May 08, 2025

The Long Walk New Trailer Adapting Stephen Kings Novel

May 08, 2025 -

The Long Walk Trailer A Different Kind Of Hamill Performance

May 08, 2025

The Long Walk Trailer A Different Kind Of Hamill Performance

May 08, 2025