Greg Abel: The Man Set To Lead Berkshire Hathaway After Buffett

Table of Contents

Greg Abel's Rise Through Berkshire Hathaway

Greg Abel's journey to becoming the likely successor to Warren Buffett is a story of dedication, skill, and consistent achievement within Berkshire Hathaway. His rise reflects the company's internal promotion culture and highlights the importance of identifying and nurturing future leaders.

Early Career and Key Roles

Abel's career at Berkshire Hathaway began in 1992. His steady climb through the ranks showcased his dedication and expertise.

- Start Date at Berkshire: 1992

- Key Roles: Initially working in various roles, Abel steadily progressed to become CEO of Berkshire Hathaway Energy (BHE), a crucial subsidiary responsible for a vast energy portfolio.

- Successful Projects: Under Abel's leadership, BHE experienced significant growth, expanding its renewable energy portfolio considerably. This includes substantial investments in wind and solar power.

- Notable Achievements: The massive expansion and profitability of BHE under Abel's leadership is perhaps his most significant accomplishment, demonstrating his ability to manage and grow a complex business within the Berkshire Hathaway umbrella. His success in this area directly influenced his rise to the top.

Demonstrated Leadership and Management Skills

Abel's success isn't just about financial results; it's about effective leadership and management. His style, while differing from Buffett's in some aspects, demonstrates a strong understanding of Berkshire's principles.

- Examples of Successful Leadership: Navigating the complex regulatory landscape of the energy sector, leading teams to achieve ambitious goals within budget and schedule, and consistently delivering strong financial performance for BHE all highlight his leadership.

- His Management Style: While details on his precise style are limited, reports suggest a collaborative and results-oriented approach.

- Evidence of Strategic Decision-Making: His strategic investments in renewable energy demonstrate foresight and a long-term perspective, aligning with the values of sustainable growth that are becoming increasingly vital in the business world.

Abel's Investment Strategy and Approach

Understanding Abel's investment strategy is crucial for anticipating the future direction of Berkshire Hathaway. While maintaining some continuity with Buffett's legacy is expected, some differences are also likely.

Comparison with Buffett's Style

Abel's approach is expected to share some similarities with Buffett’s well-known value investing philosophy. However, his experience in the energy sector indicates a potential emphasis on long-term infrastructure investments, potentially diverging slightly from Buffett's more opportunistic style in certain areas.

- Similarities and Differences in Investment Philosophies: Both prioritize long-term value creation, but Abel might show a greater emphasis on sustainable and technologically advanced industries.

- Abel's Understanding of Value Investing: He clearly understands the core principles of value investing, evidenced by his success at BHE.

- Potential Adjustments to Berkshire's Portfolio: A shift towards a larger allocation in renewable energy and technology is anticipated, reflecting current market trends and long-term growth opportunities.

Focus on Renewable Energy and Sustainability

Abel's leadership of Berkshire Hathaway Energy has placed a significant emphasis on renewable energy sources. This focus is likely to influence Berkshire Hathaway's overall investment strategy and corporate social responsibility.

- Berkshire Hathaway Energy’s Renewable Energy Investments: BHE has already made substantial investments in wind, solar, and other renewable energy projects under Abel's leadership.

- Abel’s Commitment to Sustainability: This commitment is clear and will likely shape Berkshire Hathaway's approach to environmental, social, and governance (ESG) factors.

- Potential Future Investments in Green Technologies: Increased investments in green technologies and sustainable infrastructure are highly probable under Abel's leadership.

The Implications for Berkshire Hathaway Shareholders

The transition to Greg Abel as CEO carries significant implications for Berkshire Hathaway's future and its shareholders.

Potential for Growth and Innovation

Abel's leadership is expected to drive continued growth and innovation within Berkshire Hathaway. His experience suggests a focus on strategic acquisitions and expansion into new sectors.

- Potential for New Acquisitions: Abel is expected to continue Buffett’s strategy of acquiring undervalued businesses with strong potential.

- Exploration of New Markets: Expansion into new, growth-oriented markets like renewable energy and technology is highly likely.

- Strategies for Continued Profitability: Abel’s proven track record suggests he has the skills to maintain and increase profitability.

- Modernization of Berkshire's Operations: Expect a gradual modernization of Berkshire's operations to enhance efficiency and competitiveness.

Maintaining Berkshire Hathaway's Culture and Values

Preserving Berkshire Hathaway's unique culture and values is paramount during the transition. Abel is tasked with navigating this delicate balance effectively.

- Maintaining Buffett's Principles: Maintaining a focus on long-term value creation, integrity, and a decentralized management style are crucial.

- Employee Relations: A strong focus on fostering a positive and productive work environment will be essential for continued success.

- Corporate Social Responsibility: Increasing attention to ESG factors and sustainable business practices will be a priority.

- Long-term Investment Strategy: The long-term focus and patient investment strategy that define Berkshire Hathaway will continue to be a cornerstone of the company's approach.

Conclusion

Greg Abel's rise within Berkshire Hathaway represents a carefully planned and well-executed succession plan. His proven leadership skills, strategic vision, and focus on sustainable growth make him a strong candidate to lead the company into the future. While his style may differ subtly from Warren Buffett's, the core principles of long-term value creation and prudent investment will likely remain central to Berkshire Hathaway's strategy under his leadership. The potential for continued growth and innovation is high, paving the way for a promising future for the company and its shareholders.

Call to Action: Learn more about Greg Abel and his vision for Berkshire Hathaway's future. Stay informed about the next chapter of this iconic company and the leadership of Greg Abel, the man set to lead Berkshire Hathaway after Buffett. Follow us for updates on Berkshire Hathaway’s strategic direction under its new CEO, Greg Abel.

Featured Posts

-

White Lotus Patrik Svarceneger O Izazovima Slave

May 06, 2025

White Lotus Patrik Svarceneger O Izazovima Slave

May 06, 2025 -

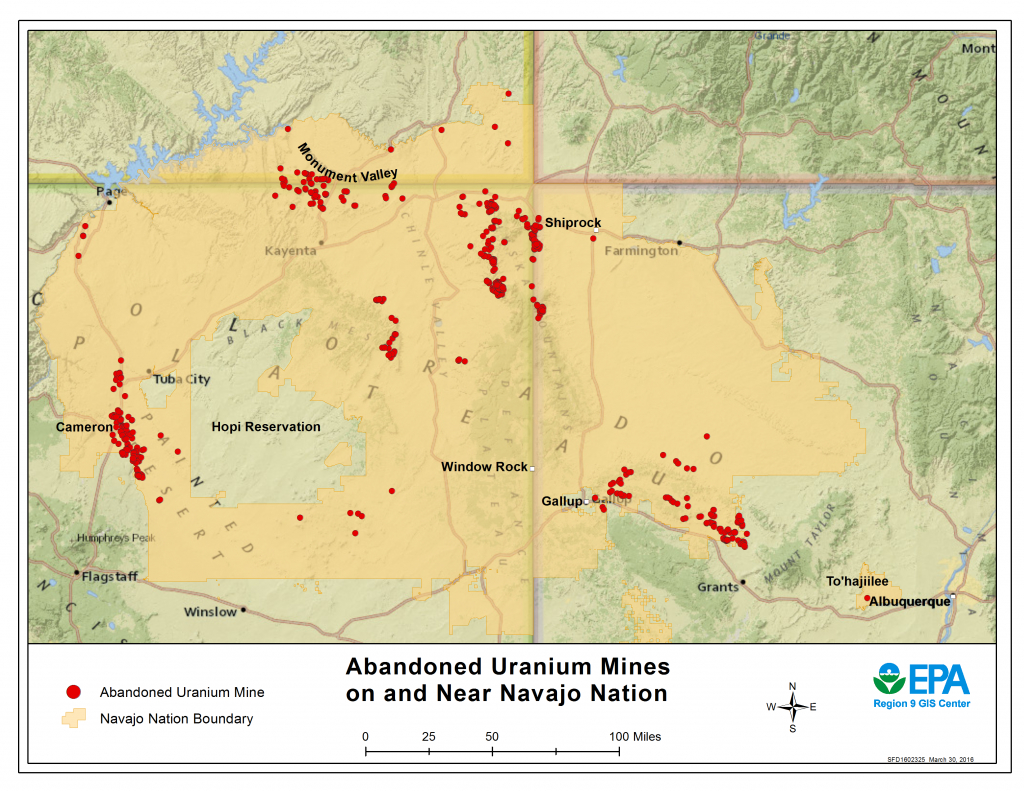

Assessing The Risks Investigating Pollution In Abandoned Gold Mines

May 06, 2025

Assessing The Risks Investigating Pollution In Abandoned Gold Mines

May 06, 2025 -

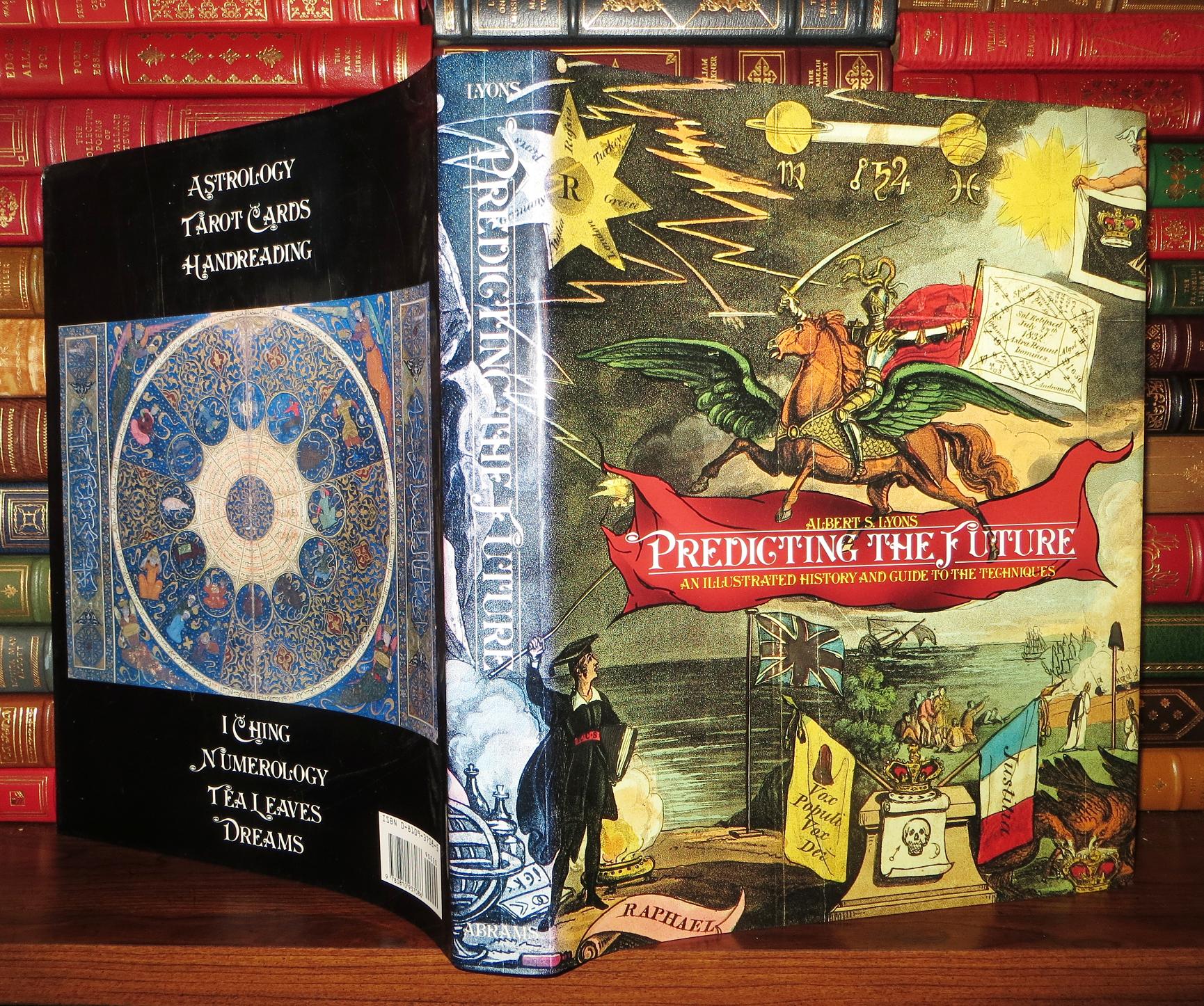

Choosing A Papal Name Understanding The History And Predicting The Future

May 06, 2025

Choosing A Papal Name Understanding The History And Predicting The Future

May 06, 2025 -

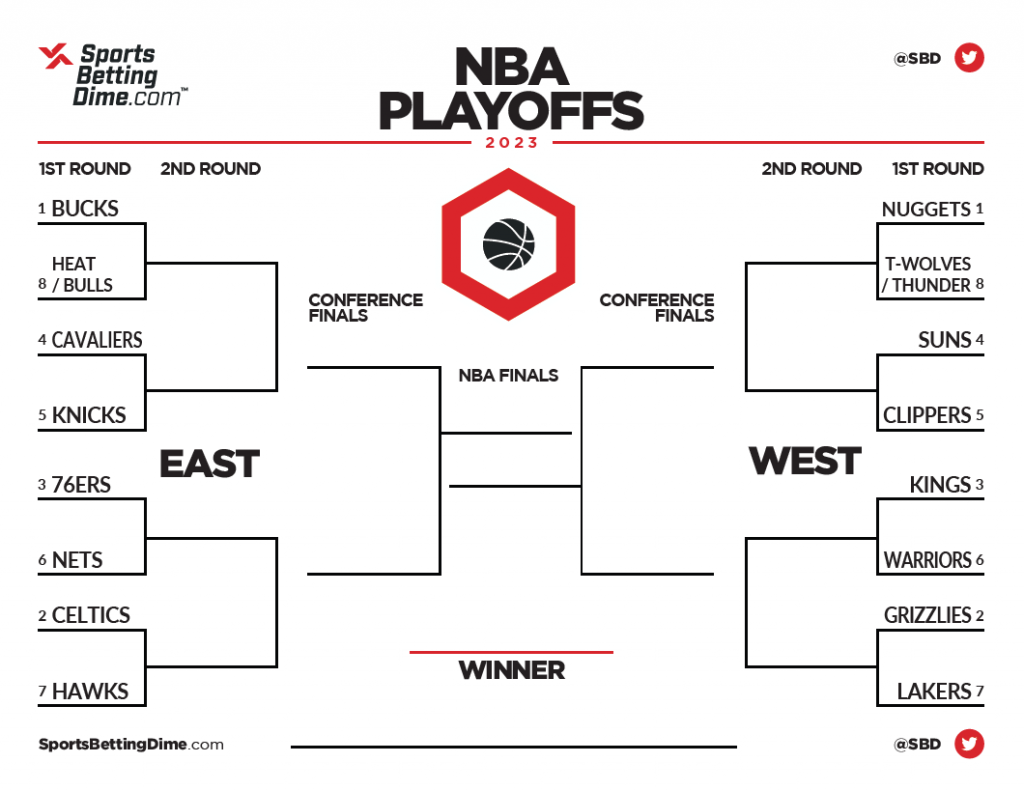

Nba Playoffs Game 1 Knicks Vs Celtics Prediction And Best Betting Options

May 06, 2025

Nba Playoffs Game 1 Knicks Vs Celtics Prediction And Best Betting Options

May 06, 2025 -

Celtics Vs Knicks Game 1 Playoff Prediction Betting Analysis And Picks

May 06, 2025

Celtics Vs Knicks Game 1 Playoff Prediction Betting Analysis And Picks

May 06, 2025

Latest Posts

-

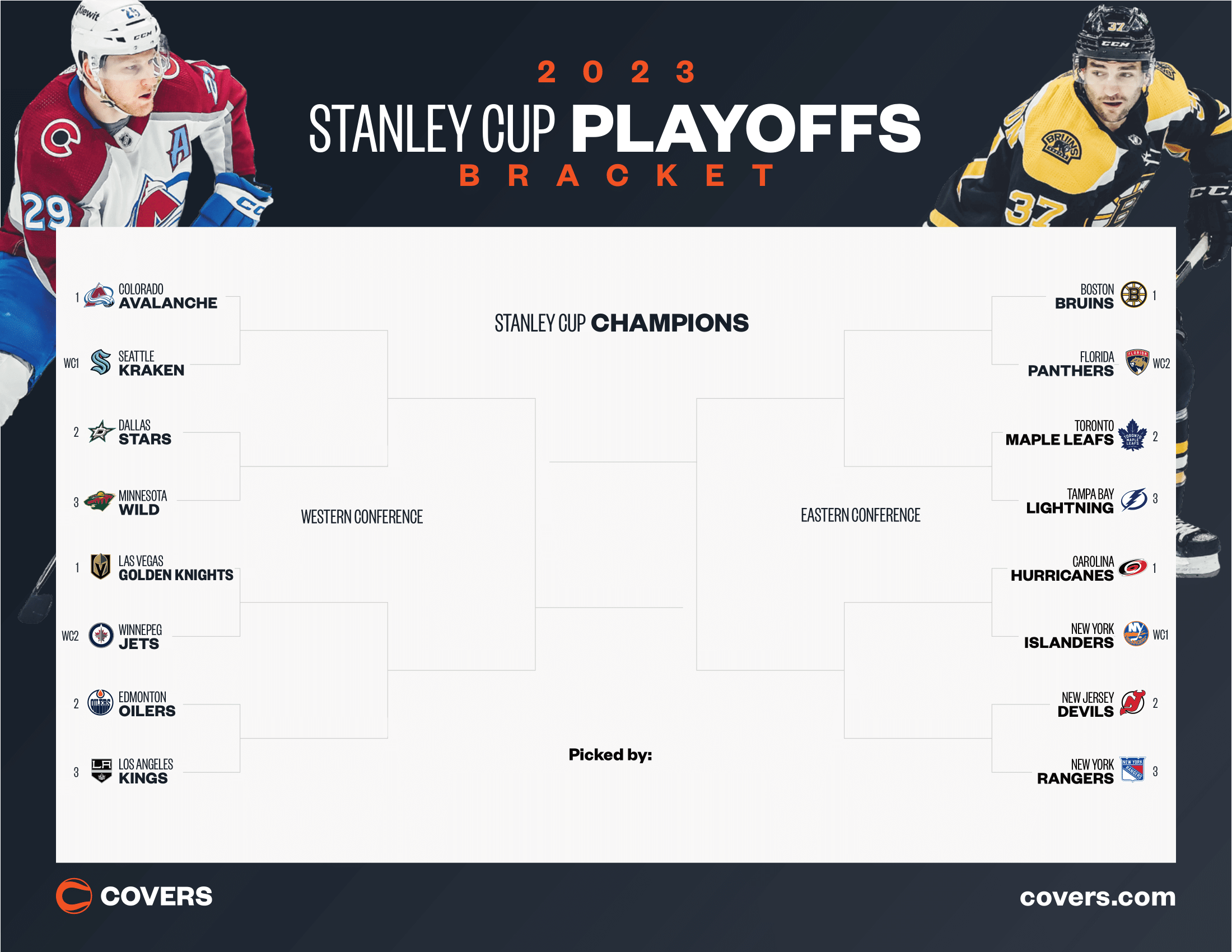

How To Watch March Madness Online Stream Every Game Without Cable

May 06, 2025

How To Watch March Madness Online Stream Every Game Without Cable

May 06, 2025 -

Your Guide To The 2025 Nba Playoffs Round 1 Bracket And Tv Schedule

May 06, 2025

Your Guide To The 2025 Nba Playoffs Round 1 Bracket And Tv Schedule

May 06, 2025 -

Nba Round 1 Playoffs 2025 Full Bracket And Tv Schedule Guide

May 06, 2025

Nba Round 1 Playoffs 2025 Full Bracket And Tv Schedule Guide

May 06, 2025 -

Nba Playoffs 2025 Complete Round 1 Bracket And Tv Schedule

May 06, 2025

Nba Playoffs 2025 Complete Round 1 Bracket And Tv Schedule

May 06, 2025 -

2025 Nba Playoffs Full Round 1 Bracket And Tv Listings

May 06, 2025

2025 Nba Playoffs Full Round 1 Bracket And Tv Listings

May 06, 2025