Gridlock On GOP Tax Bill: Conservatives Demand Changes To Medicaid And Clean Energy Policies

Table of Contents

Medicaid Funding Cuts Spark Conservative Backlash

The proposed cuts to Medicaid within the GOP tax bill have ignited a furious backlash from conservative lawmakers. These proposed reductions represent a significant threat to millions of Americans reliant on this crucial healthcare safety net.

Proposed Reductions and Their Impact

The tax bill proposes a substantial reduction in federal Medicaid funding, potentially resulting in significant cuts to state programs. The exact figures are still being debated, but estimates suggest that millions could lose coverage.

- Quantifiable data on Medicaid beneficiaries who would lose coverage: Early projections indicate that upwards of 15 million Americans could lose Medicaid coverage under the proposed cuts, disproportionately affecting low-income families and individuals.

- Analysis of the effect on state budgets and healthcare infrastructure: States will face immense pressure to absorb the shortfall, forcing them to make difficult choices that could lead to closures of hospitals and clinics, impacting healthcare access for all residents.

- Quotes from conservative lawmakers expressing concerns about the cuts: “This level of Medicaid cut is unacceptable and will devastate healthcare in our state,” stated Senator [Insert Name], echoing the concerns of many of his conservative colleagues.

Arguments for and Against the Cuts

The debate over Medicaid funding cuts is sharply divided.

- Statements from proponents emphasizing cost savings and fiscal responsibility: Supporters argue that reducing Medicaid spending is crucial for long-term fiscal responsibility and controlling the national debt. They advocate for greater efficiency and market-based healthcare solutions.

- Counterarguments highlighting the potential negative consequences for vulnerable populations: Opponents counter that these cuts would disproportionately impact vulnerable populations, exacerbating existing health disparities and leading to poorer health outcomes. They argue that focusing on cost savings should not come at the expense of essential healthcare services.

- Mention of alternative approaches to achieving fiscal savings without impacting healthcare: Many suggest alternative approaches, like negotiating lower drug prices or streamlining administrative processes, to achieve fiscal savings without jeopardizing healthcare access.

Clean Energy Tax Credits Under Fire

The proposed changes to clean energy tax credits are another major point of contention, pitting fiscal conservatives against environmental advocates.

Details of the Proposed Changes to Clean Energy Incentives

The GOP tax bill proposes significant reductions or eliminations of various tax credits and incentives currently supporting clean energy development, including renewable energy sources like solar and wind power.

- Specific examples of clean energy technologies affected (solar, wind, etc.): The proposed cuts would severely impact the solar panel industry, wind energy farms, and other renewable energy initiatives, hindering future growth and development.

- Analysis of the financial impact of removing or reducing these incentives: The reduction or elimination of these incentives would lead to job losses within the renewable energy sector, potentially slowing down the transition to a cleaner energy future.

- Statements from industry representatives regarding potential job losses: Industry leaders warn that the changes could lead to thousands of job losses and stifle innovation in the renewable energy sector.

Conservative Opposition and Environmental Concerns

Conservative opposition stems from various sources, including concerns about government intervention and the cost-effectiveness of renewable energy.

- Arguments against government intervention in the energy sector: Many conservatives believe that the government should not subsidize specific industries, arguing that the market should determine the most efficient energy sources.

- Concerns about the cost-effectiveness of renewable energy technologies: Some conservatives question the cost-effectiveness of renewable energy compared to traditional fossil fuels, arguing that it's too expensive and inefficient.

- Discussion of the potential environmental consequences of reduced clean energy investment: Environmental groups warn that the reductions will severely hamper the nation's efforts to combat climate change and transition to a sustainable energy future.

The Political Implications of the Gridlock

The current stalemate carries significant political ramifications for the Republican Party and its broader legislative agenda.

Impact on the Republican Party's Legislative Agenda

The internal conflict over the tax bill threatens to unravel the Republican Party’s legislative agenda.

- Potential for the tax bill to fail entirely: The deep divisions within the party risk causing the entire tax bill to fail, representing a significant setback for the Republican majority.

- Damage to the party's image and credibility: The intense infighting damages the party's image and credibility, potentially impacting future legislative efforts.

- Effects on upcoming elections: The internal conflict could negatively impact Republican electoral prospects in upcoming elections, impacting the party’s control of both chambers of Congress.

Potential Compromise and Future Negotiations

The path forward remains uncertain, with several potential scenarios.

- Potential scenarios for resolving the impasse: Negotiations will need to focus on finding compromises that address the concerns of both moderate and conservative factions within the party.

- Predictions about the final version of the bill (if any): It's uncertain whether the bill will pass in its current form, a significantly modified version, or fail altogether.

- Discussion of the long-term consequences for the GOP and its policy agenda: The outcome will greatly impact the long-term direction of the GOP and its policy priorities, shaping the political landscape for years to come.

Conclusion

The gridlock surrounding the GOP tax bill dramatically highlights deep divisions within the party regarding Medicaid and clean energy policies. Conservative demands for major changes present a formidable obstacle to the bill's passage. The potential consequences of this stalemate range from legislative failure to significant damage to the Republican Party’s image and long-term policy goals. The coming weeks will be critical in determining if a compromise can be achieved, or if the bill will be defeated. The future of the GOP tax bill and its impact on critical social programs and environmental policies remains deeply uncertain. Stay informed and monitor the ongoing developments surrounding this crucial legislation.

Featured Posts

-

Bowen Yang Addresses Backlash Following Ego Nwodims Viral Snl Sketch

May 18, 2025

Bowen Yang Addresses Backlash Following Ego Nwodims Viral Snl Sketch

May 18, 2025 -

Canada Post On The Brink A Report Recommends Ending Door To Door Mail Service

May 18, 2025

Canada Post On The Brink A Report Recommends Ending Door To Door Mail Service

May 18, 2025 -

Alt 104 5 Maneskins Damiano Davids Electrifying Jimmy Kimmel Live Performance

May 18, 2025

Alt 104 5 Maneskins Damiano Davids Electrifying Jimmy Kimmel Live Performance

May 18, 2025 -

Mit Disavows Students Ai Research Paper

May 18, 2025

Mit Disavows Students Ai Research Paper

May 18, 2025 -

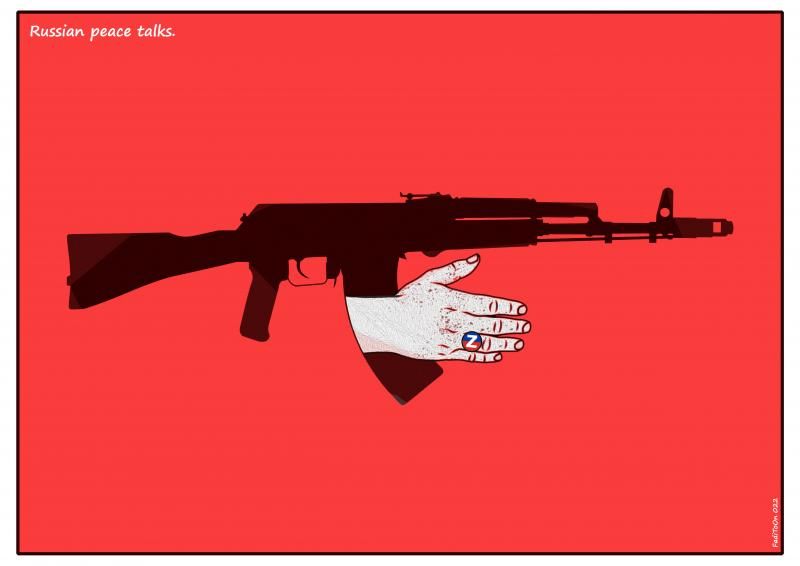

Putins Peace Talks Initiative A Diplomatic Failure

May 18, 2025

Putins Peace Talks Initiative A Diplomatic Failure

May 18, 2025

Latest Posts

-

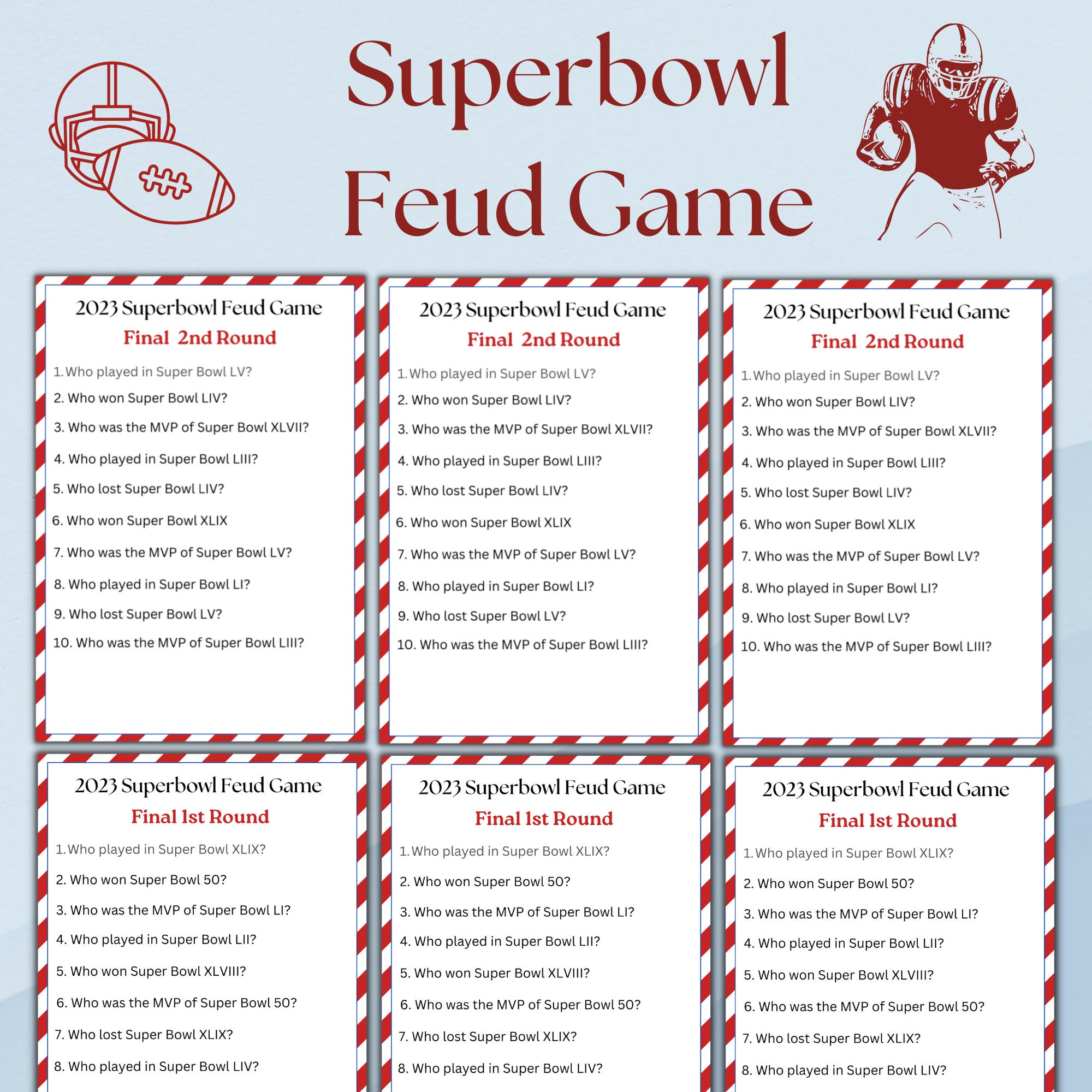

The Taylor Swift Kanye West Super Bowl Feud A Deeper Look

May 18, 2025

The Taylor Swift Kanye West Super Bowl Feud A Deeper Look

May 18, 2025 -

Scho Stalosya Mizh Kanye Vestom Ta B Yankoyu Tsenzori

May 18, 2025

Scho Stalosya Mizh Kanye Vestom Ta B Yankoyu Tsenzori

May 18, 2025 -

The Truth About Kanye West Seeing His Kids Addressing The Controversy

May 18, 2025

The Truth About Kanye West Seeing His Kids Addressing The Controversy

May 18, 2025 -

Super Bowl Controversy Kanye West Blames Taylor Swift For Exclusion

May 18, 2025

Super Bowl Controversy Kanye West Blames Taylor Swift For Exclusion

May 18, 2025 -

Reports On Kanye Wests Interactions With His Children A Comprehensive Overview

May 18, 2025

Reports On Kanye Wests Interactions With His Children A Comprehensive Overview

May 18, 2025