Hanwha And OCI Capitalize On US Solar Import Tariffs

Table of Contents

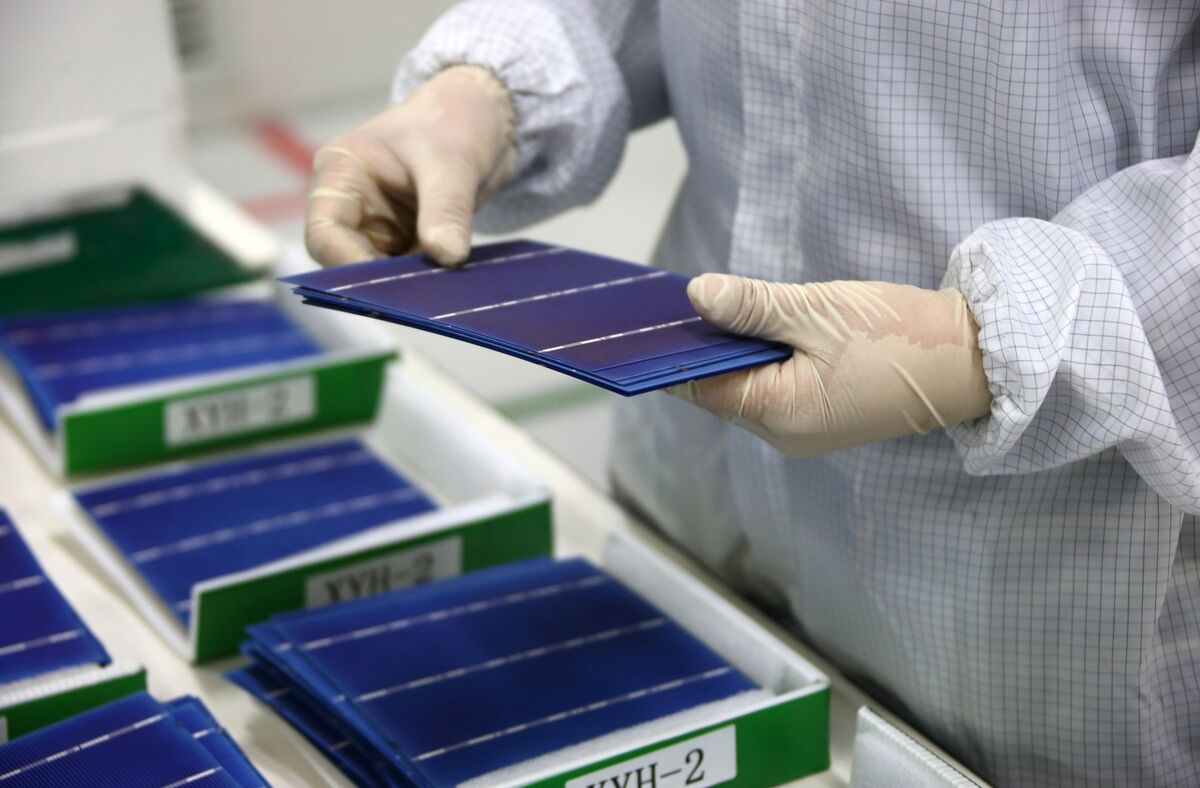

Hanwha's Strategic Advantage: Domestic Polysilicon Production

Hanwha, a global leader in the solar industry through its subsidiary Hanwha Q CELLS, possesses a significant competitive edge due to its substantial polysilicon production capacity within the United States. Polysilicon, a crucial raw material in solar panel manufacturing, is often imported, making manufacturers vulnerable to tariffs. Hanwha's strategic investment in domestic polysilicon production mitigates this risk, providing a significant cost advantage and supply chain resilience.

- US-based Polysilicon Manufacturing Facilities: Hanwha operates several polysilicon manufacturing facilities within the US, strategically positioned to serve the domestic market. The exact locations and capacities are often kept confidential for competitive reasons, but their presence is a key factor in their success.

- Production Capacity and Recent Investments: While precise figures aren't publicly available for all facilities, Hanwha has consistently invested in expanding its US polysilicon production capacity, reflecting a commitment to domestic manufacturing. This ongoing investment further solidifies their position and reduces dependence on fluctuating global markets.

- Cost Advantage: By producing polysilicon domestically, Hanwha avoids the tariffs levied on imported materials, reducing production costs significantly compared to competitors who rely heavily on foreign polysilicon sources. This translates directly into greater profitability and competitive pricing in the US market.

- Supply Chain Resilience: In a volatile global market, Hanwha’s domestic polysilicon production ensures a stable and reliable supply chain, less susceptible to disruptions caused by geopolitical events or international trade conflicts.

OCI's Polysilicon Dominance and Market Positioning

OCI, a major player in the polysilicon market, benefits immensely from the US solar import tariffs. Their established US operations are ideally positioned to capitalize on increased demand and reduced competition from foreign suppliers.

- US Polysilicon Production Facilities and Capacity: OCI operates large-scale polysilicon production facilities within the US, contributing substantially to the nation's polysilicon supply. The scale of their operations allows them to achieve economies of scale, further strengthening their market position.

- Market Share in US Polysilicon Market: OCI holds a significant market share in the US polysilicon market, giving them considerable pricing power. Their ability to meet a large portion of the domestic demand makes them a crucial player in the US solar energy sector.

- Price Increases: While specific price adjustments aren't always publicly announced, it's reasonable to assume OCI, like other domestic polysilicon producers, has benefited from the increased demand and potentially implemented price increases due to reduced foreign competition.

- Strategies for Maintaining Market Leadership: OCI’s strategies likely focus on maintaining production efficiency, expanding capacity, and securing long-term contracts with downstream solar panel manufacturers to solidify its position as a dominant force in the US polysilicon market.

Impact on the US Solar Industry and Consumers

The success of Hanwha and OCI, driven in part by the US solar import tariffs, has significant implications for the US solar industry and its consumers.

- Potential Price Impacts for US Consumers: While some might fear increased prices due to reduced competition, the increased domestic production could lead to greater efficiency and potentially offset some cost increases in the long run.

- Effects on US Job Creation in the Solar Sector: The expansion of domestic polysilicon production by companies like Hanwha and OCI supports job creation within the US, contributing to economic growth in the solar energy sector.

- Long-Term Implications for US Energy Independence: By reducing reliance on foreign suppliers for crucial solar materials, the US moves closer to energy independence, improving national security and resilience.

- Government Policies Supporting Domestic Solar Manufacturing: Government policies that incentivize domestic solar manufacturing, including the tariffs themselves, play a critical role in fostering growth and competitiveness in this sector.

Potential Challenges and Future Outlook

Despite their current success, Hanwha and OCI face potential challenges in maintaining their market dominance.

- Increased Competition: New entrants to the US polysilicon market or increased investment from existing players could intensify competition, potentially impacting pricing and market share.

- Shifts in Global Polysilicon Markets: Fluctuations in the global polysilicon market, including technological advancements or shifts in supply from other countries, could affect the long-term viability of current strategies.

- Tariff Changes or New Trade Agreements: Future changes in US trade policy could alter the competitive landscape, impacting the relative advantages enjoyed by domestic manufacturers.

- Technological Advancements: Advancements in polysilicon production technology could disrupt existing market dynamics, necessitating continuous investment in innovation to maintain a competitive edge.

Conclusion: Hanwha and OCI's Strategic Gains from US Solar Import Tariffs

Hanwha and OCI have skillfully leveraged US solar import tariffs to strengthen their market positions in the US solar industry. Their investments in domestic polysilicon production have yielded significant cost advantages, supply chain resilience, and increased market share. This success has broader implications for the US, impacting job creation, energy independence, and consumer prices. However, long-term success depends on adapting to evolving market conditions, technological advancements, and potential changes in global trade policy. Learn more about the impact of US solar tariffs and the strategic responses of key players in the solar energy market – investigate how companies like Hanwha and OCI are capitalizing on US solar import tariffs – read more today!

Featured Posts

-

Malaysia Included In Us Solar Panel Import Duty Announcement

May 30, 2025

Malaysia Included In Us Solar Panel Import Duty Announcement

May 30, 2025 -

Manchester United E Bruno Fernandes Uma Relacao De Sucesso

May 30, 2025

Manchester United E Bruno Fernandes Uma Relacao De Sucesso

May 30, 2025 -

Elon Musk Denies Paternity The Amber Heard Twins Controversy

May 30, 2025

Elon Musk Denies Paternity The Amber Heard Twins Controversy

May 30, 2025 -

New Measles Cases In Texas Beyond The Initial Outbreak

May 30, 2025

New Measles Cases In Texas Beyond The Initial Outbreak

May 30, 2025 -

La Guerra De Trump Contra Ticketmaster Nueva Orden Ejecutiva Para Regular La Reventa De Boletos

May 30, 2025

La Guerra De Trump Contra Ticketmaster Nueva Orden Ejecutiva Para Regular La Reventa De Boletos

May 30, 2025

Latest Posts

-

Finding The Good Life Strategies For Happiness And Fulfillment

May 31, 2025

Finding The Good Life Strategies For Happiness And Fulfillment

May 31, 2025 -

How To Achieve The Good Life Steps To A Meaningful Existence

May 31, 2025

How To Achieve The Good Life Steps To A Meaningful Existence

May 31, 2025 -

Living The Good Life Prioritizing Health Relationships And Purpose

May 31, 2025

Living The Good Life Prioritizing Health Relationships And Purpose

May 31, 2025 -

Defining The Good Life A Practical Guide To Happiness And Fulfillment

May 31, 2025

Defining The Good Life A Practical Guide To Happiness And Fulfillment

May 31, 2025 -

The Pursuit Of The Good Life A Balanced Approach To Wellbeing

May 31, 2025

The Pursuit Of The Good Life A Balanced Approach To Wellbeing

May 31, 2025