Harvard President Condemns Threat To University's Tax-Exempt Status

Table of Contents

The Nature of the Threat to Harvard's Tax-Exempt Status

The threat to revoke Harvard's tax-exempt status stems from several allegations, primarily focusing on the University's massive endowment and perceived political bias. Critics argue that Harvard's substantial financial resources, amassed over centuries, are not being used in a manner consistent with its non-profit mission. These allegations are fueled by claims of insufficient transparency regarding endowment spending and accusations of partisan political activities on campus.

The legal basis for such a threat rests on Section 501(c)(3) of the Internal Revenue Code, which governs tax-exempt organizations. This section outlines strict requirements for maintaining tax-exempt status, including limitations on political campaigning and a requirement to operate for charitable purposes. Any perceived deviation from these guidelines could lead to the Internal Revenue Service (IRS) initiating a review, potentially culminating in the revocation of the tax-exempt status.

- Specific allegations against Harvard: These include accusations of excessive executive compensation, alleged partisan political endorsements from faculty and students, and a lack of sufficient public accountability regarding endowment allocation.

- Legal precedents related to tax-exempt status revocation: While rare, there have been instances where institutions have lost their tax-exempt status due to violations of IRS regulations. These cases often involve significant political activity or misuse of funds.

- Impact of potential revocation on similar universities: The potential revocation of Harvard's tax-exempt status would send shockwaves throughout the higher education sector, raising concerns about the stability and future of other universities relying on similar non-profit structures.

President's Response and Condemnation

Harvard's President, in a strongly worded statement, vehemently condemned the threat, characterizing it as an attack on the fundamental principles of academic freedom and non-profit higher education. The President's response was assertive, emphasizing Harvard's commitment to its charitable mission and its adherence to all applicable laws and regulations. The statement highlighted Harvard’s extensive philanthropic activities, research contributions, and commitment to providing educational opportunities to students from diverse backgrounds.

The University has pledged to fully cooperate with any investigation and vigorously defend its tax-exempt status. This includes assembling a legal team specializing in tax law and proactively addressing concerns regarding transparency and financial practices.

- Key excerpts from the President's statement: The statement included strong defenses against the allegations and a pledge to maintain transparency and accountability in Harvard's financial operations.

- Harvard's planned legal strategy: Harvard is preparing a robust legal defense, intending to challenge the allegations and demonstrate its compliance with all relevant regulations.

- Public relations efforts by the University: Harvard is launching a multifaceted public relations campaign to clarify its position, emphasizing its commitment to its charitable mission and its contributions to society.

Potential Implications for Harvard and Higher Education

The revocation of Harvard's tax-exempt status would have catastrophic financial consequences. The university would face immediate and significant increases in its tax burden, potentially impacting its budget by billions of dollars. This would necessitate drastic measures, including tuition hikes, reduced financial aid, and cuts to research funding.

The broader implications extend beyond Harvard. It would create uncertainty and fear among other non-profit universities, potentially chilling free speech on campuses and discouraging philanthropy. The ability of universities to attract donations would be severely compromised, further undermining their financial stability and ability to fulfill their missions.

- Estimated financial impact on Harvard's budget: Experts estimate the financial impact could range from hundreds of millions to billions of dollars annually.

- Potential changes in tuition fees and financial aid: Tuition fees would likely increase substantially, while financial aid programs could face significant cuts.

- Impact on research funding and grants: Research funding and grants would likely be affected, potentially hindering scientific advancement and innovation.

- Effect on other non-profit institutions: Other non-profit organizations, especially those in the education sector, would face increased scrutiny and uncertainty.

Public Opinion and Reaction

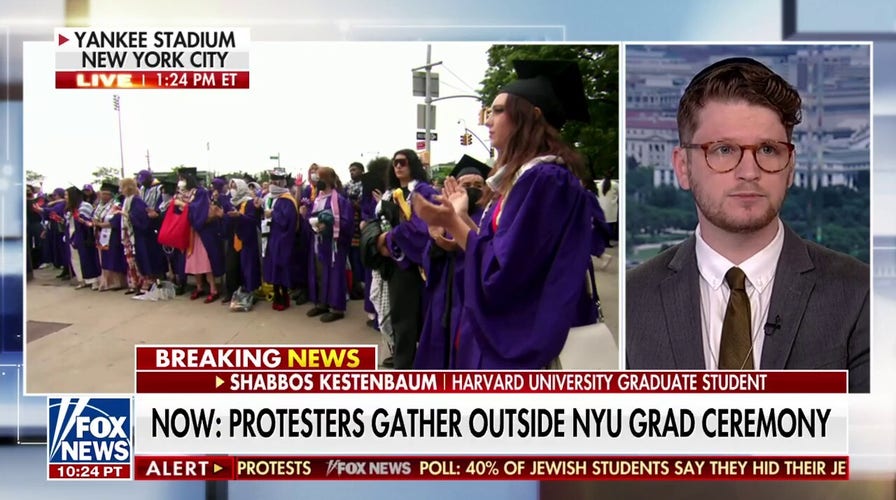

Public reaction has been mixed, with some supporting the threat, citing concerns about equity and transparency, and others vehemently opposing it, arguing it jeopardizes academic freedom and the future of higher education. Media coverage has been extensive, with many outlets providing in-depth analysis of the legal and political aspects of the situation. The political context is undeniable, with partisan viewpoints heavily influencing the debate.

- Media coverage and public sentiment: The threat has sparked a national debate, dividing public opinion and prompting extensive media coverage.

- Reactions from other universities and educational organizations: Many universities have expressed their support for Harvard, emphasizing the importance of protecting academic freedom and the tax-exempt status of non-profit institutions.

- Political commentary and analysis: The issue has become highly politicized, with commentators offering diverse perspectives and opinions.

Conclusion: Harvard President Condemns Threat to University's Tax-Exempt Status – What's Next?

The threat to revoke Harvard's tax-exempt status is a significant event with far-reaching implications for Harvard itself and the entire higher education landscape. The President's condemnation underscores the gravity of the situation, and the potential financial and academic ramifications are substantial. The outcome remains uncertain, hinging on the legal proceedings and the broader political climate.

It is crucial for individuals concerned about the future of higher education and the protection of non-profit institutions to stay informed about this evolving situation. Understanding the complexities surrounding the tax-exempt status of universities, and engaging in thoughtful discussions about transparency and accountability within higher education, is essential. Contact your representatives to voice your opinion on the preservation of the tax-exempt status of universities like Harvard and its vital role in society.

Featured Posts

-

Analyzing Chunk Of Golds Chances In The 2025 Kentucky Derby

May 04, 2025

Analyzing Chunk Of Golds Chances In The 2025 Kentucky Derby

May 04, 2025 -

Myke Wright Lizzos Partner His Net Worth Profession And Relationship

May 04, 2025

Myke Wright Lizzos Partner His Net Worth Profession And Relationship

May 04, 2025 -

Reintroducing Ow Subsidies A Dutch Plan To Encourage Bidding

May 04, 2025

Reintroducing Ow Subsidies A Dutch Plan To Encourage Bidding

May 04, 2025 -

Kanye West And Bianca Censori Rekindling Their Relationship After Grammys Split

May 04, 2025

Kanye West And Bianca Censori Rekindling Their Relationship After Grammys Split

May 04, 2025 -

Germanys Esc 2025 Heat One A Look At The Viewing Figures

May 04, 2025

Germanys Esc 2025 Heat One A Look At The Viewing Figures

May 04, 2025

Latest Posts

-

Ufc Fight Night Sandhagen Vs Figueiredo Prediction Analysis And Best Odds

May 04, 2025

Ufc Fight Night Sandhagen Vs Figueiredo Prediction Analysis And Best Odds

May 04, 2025 -

Cory Sandhagen Vs Deiveson Figueiredo Fight Night Predictions And Betting Odds

May 04, 2025

Cory Sandhagen Vs Deiveson Figueiredo Fight Night Predictions And Betting Odds

May 04, 2025 -

Ufc Fight Night Predictions Sandhagen Vs Figueiredo Expert Picks And Odds

May 04, 2025

Ufc Fight Night Predictions Sandhagen Vs Figueiredo Expert Picks And Odds

May 04, 2025 -

Year Long Hiatus Ends Former Ufc Champion Fights Bantamweight Veteran May 3rd

May 04, 2025

Year Long Hiatus Ends Former Ufc Champion Fights Bantamweight Veteran May 3rd

May 04, 2025 -

One Last Fight Former Ufc Champ Returns From Hiatus On May 3rd

May 04, 2025

One Last Fight Former Ufc Champ Returns From Hiatus On May 3rd

May 04, 2025