Harvard President: Tax-Exempt Status Revoking Would Be Illegal

Table of Contents

Legal Basis for Harvard's Tax-Exempt Status

Harvard University's tax-exempt status is grounded in federal law, specifically within the framework of the Internal Revenue Code. Understanding this legal foundation is crucial to grasping why revoking this status would be a legally complex and potentially impossible undertaking.

Section 501(c)(3) of the Internal Revenue Code

Section 501(c)(3) of the Internal Revenue Code grants tax-exempt status to organizations operating for religious, charitable, scientific, literary, or educational purposes. Harvard, as a leading educational institution, falls under this provision. Maintaining this status requires strict adherence to several key requirements:

- Public Benefit: The organization must demonstrably serve a public benefit. For Harvard, this includes providing education to students, conducting groundbreaking research, and contributing to the broader intellectual community.

- Non-profit Activities: Harvard, as a non-profit institution, cannot distribute profits to its shareholders or private individuals. Any surplus revenue must be reinvested into the institution's mission.

- Political Neutrality: The institution is prohibited from engaging in substantial political campaigning or lobbying activities.

- Compliance with IRS Regulations: Strict adherence to all Internal Revenue Service regulations and reporting requirements is mandatory for maintaining 501(c)(3) status.

The process of obtaining and maintaining this status involves meticulous documentation, regular audits, and ongoing compliance with IRS guidelines. Failure to meet these requirements can lead to the loss of tax-exempt status.

Judicial Precedent and Case Law

Numerous court cases have established legal precedent upholding the tax-exempt status of similar educational institutions. These rulings emphasize the importance of these institutions to society and the legal challenges involved in revoking such a designation. Landmark cases, though specific details are beyond the scope of this article, have consistently affirmed the right of institutions meeting the criteria of Section 501(c)(3) to maintain tax-exempt status. The legal burden of proof to revoke such a status is extremely high, requiring substantial evidence of non-compliance. Challenging this established legal precedent would be a difficult and lengthy process.

Harvard's Compliance with Tax-Exempt Requirements

Harvard University actively demonstrates its commitment to complying with the requirements for tax-exempt status. This commitment is evident in its transparency, its robust charitable activities, and its substantial contribution to the public good.

Transparency and Accountability

Harvard maintains a high level of transparency in its financial dealings. Annual reports, publicly available audited financial statements, and detailed disclosures regarding its finances are readily accessible online. This commitment to transparency helps build public trust and allows external scrutiny of its financial practices, strengthening its position to maintain its tax-exempt status. Common misconceptions about Harvard's finances often stem from a lack of understanding of its complex operations and the nature of non-profit accounting practices.

Charitable Activities and Public Benefit

Harvard's commitment to its educational mission extends far beyond the classroom. Its research contributes significantly to scientific and technological advancements. Its faculty engage in community outreach programs, offering expertise and resources to address societal challenges. Specific examples include:

- Groundbreaking research in various fields benefiting public health and environmental sustainability.

- Numerous scholarships and financial aid programs ensuring access to education for deserving students regardless of financial background.

- Community engagement initiatives supporting local schools and organizations.

These activities, and many more, highlight the extensive public benefit Harvard provides, bolstering its claim to tax-exempt status under Section 501(c)(3).

Potential Consequences of Revoking Harvard's Tax-Exempt Status

Revoking Harvard's tax-exempt status would have far-reaching and severe consequences, not only for the university itself but also for the broader higher education landscape.

Financial Implications for Harvard

The immediate impact would be a dramatic increase in Harvard's operational costs. The loss of tax exemptions would necessitate a significant increase in tuition fees to offset the sudden loss of revenue. This would drastically reduce access to higher education, disproportionately affecting low-income students and limiting social mobility. Research funding would be severely impacted, potentially stifling scientific progress and innovation. The overall operational efficiency and prestige of Harvard would be greatly diminished.

Wider Implications for Higher Education

The successful revocation of Harvard's tax-exempt status would set a dangerous precedent, potentially challenging the tax-exempt status of countless other non-profit educational institutions. This could lead to a chilling effect on philanthropy, dissuading donors from supporting higher education. The accessibility and affordability of higher education would be significantly undermined, potentially impacting social mobility and national progress.

Conclusion

The assertion by Harvard's president that revoking its tax-exempt status would be illegal is supported by a strong legal foundation, demonstrated compliance with IRS regulations, and an understanding of the profound consequences such an action would have. The legal precedents, Harvard's commitment to public benefit, and the significant negative consequences for higher education all strongly support maintaining Harvard's tax-exempt status. Understanding the intricacies of Harvard's tax-exempt status is crucial for informed discussion on the future of higher education funding. Continue learning about the legal framework surrounding Harvard's tax-exempt status and the importance of maintaining such designations for non-profit educational institutions. Further research into the complexities of Section 501(c)(3) and its application to higher education is encouraged.

Featured Posts

-

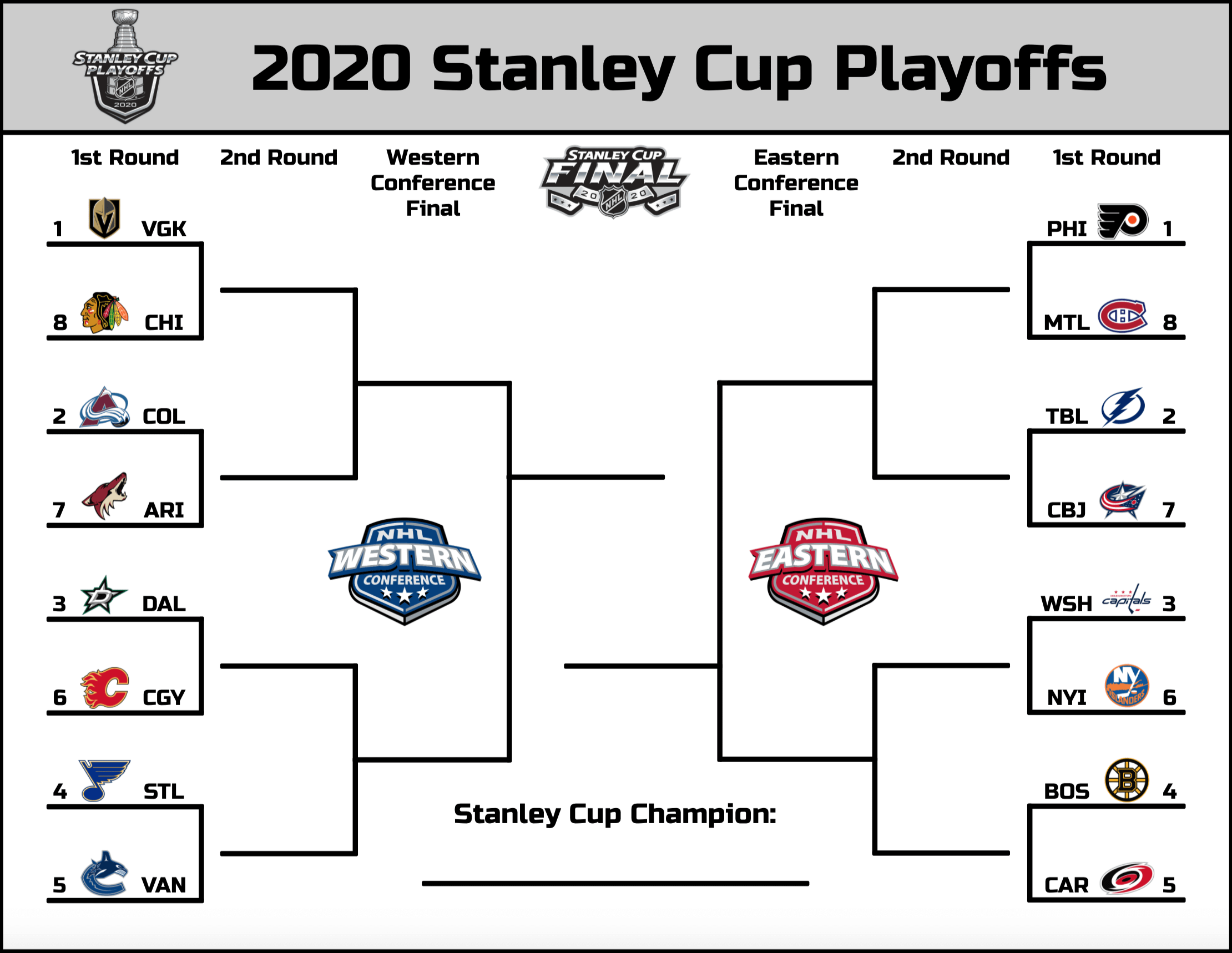

Decoding The First Round Your Guide To The Nhl Stanley Cup Playoffs

May 05, 2025

Decoding The First Round Your Guide To The Nhl Stanley Cup Playoffs

May 05, 2025 -

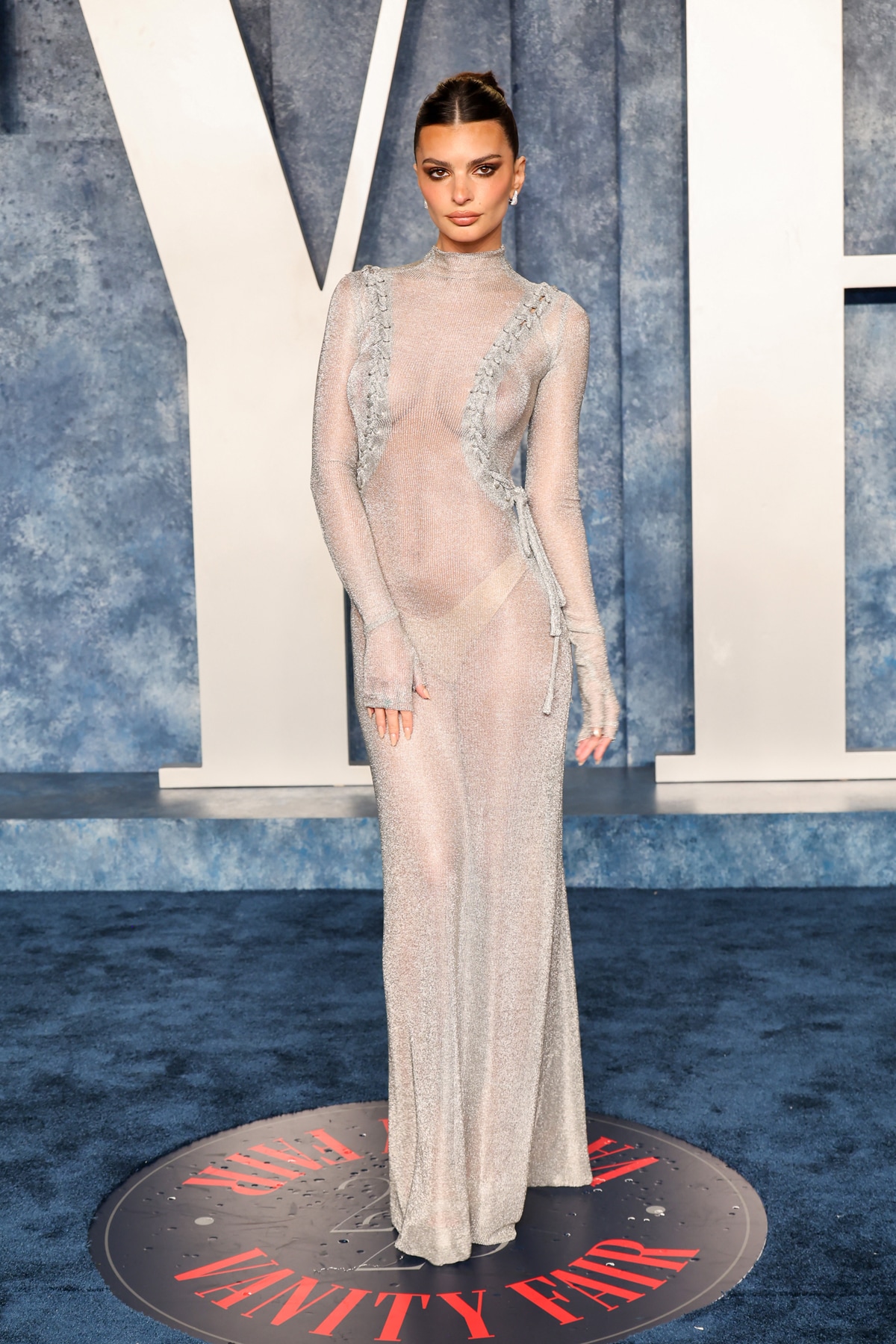

Emma Stones Daring Oscars 2025 Look Sequin Louis Vuitton And Pixie Cut

May 05, 2025

Emma Stones Daring Oscars 2025 Look Sequin Louis Vuitton And Pixie Cut

May 05, 2025 -

Alexander Volkanovski Vs Diego Lopes Ufc 314 Fight Card Analysis

May 05, 2025

Alexander Volkanovski Vs Diego Lopes Ufc 314 Fight Card Analysis

May 05, 2025 -

Summer Style Inspiration Anna Kendricks Shell Crop Top

May 05, 2025

Summer Style Inspiration Anna Kendricks Shell Crop Top

May 05, 2025 -

Distad Named Head Of Foxs Direct To Consumer Streaming Business

May 05, 2025

Distad Named Head Of Foxs Direct To Consumer Streaming Business

May 05, 2025

Latest Posts

-

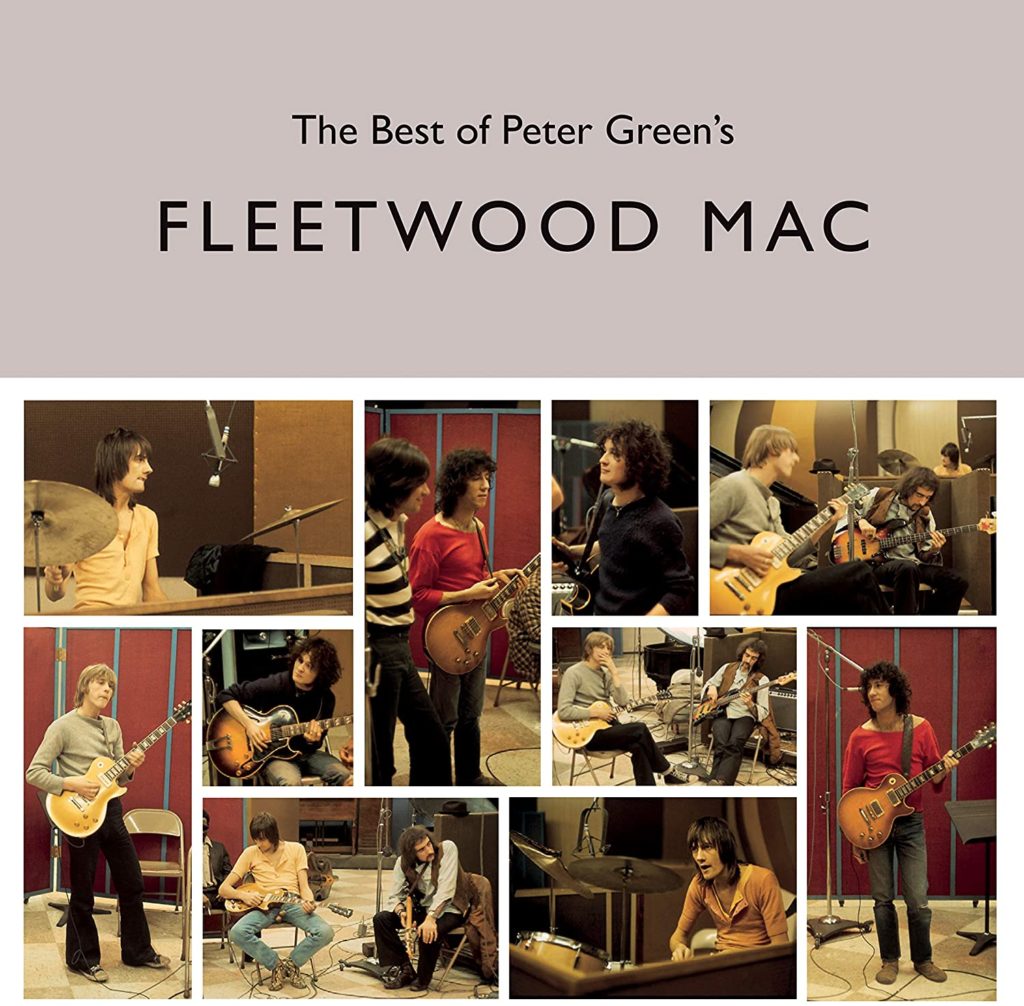

The Enduring Appeal Of Fleetwood Macs Top Songs

May 05, 2025

The Enduring Appeal Of Fleetwood Macs Top Songs

May 05, 2025 -

Fleetwood Macs Biggest Hits A Testament To Enduring Popularity

May 05, 2025

Fleetwood Macs Biggest Hits A Testament To Enduring Popularity

May 05, 2025 -

96 1 The Rocket A Deep Dive Into Peter Greens Fleetwood Mac Era

May 05, 2025

96 1 The Rocket A Deep Dive Into Peter Greens Fleetwood Mac Era

May 05, 2025 -

Fleetwood Mac Chart Success With New Album Of Familiar Favorites

May 05, 2025

Fleetwood Mac Chart Success With New Album Of Familiar Favorites

May 05, 2025 -

New Fleetwood Mac Album Chart Projections And Fan Reactions

May 05, 2025

New Fleetwood Mac Album Chart Projections And Fan Reactions

May 05, 2025