Harvard's Tax-Exempt Status: President's Strong Warning Against Revocation

Table of Contents

Understanding Harvard's Tax-Exempt Status

Harvard University, like many other non-profit educational institutions, operates under a 501(c)(3) tax-exempt status granted by the Internal Revenue Service (IRS). This designation, rooted in Section 501(c)(3) of the Internal Revenue Code, signifies that Harvard is recognized as a public charity. This legal framework offers substantial advantages, influencing its financial operations and overall mission.

The benefits of Harvard's tax-exempt status are multifaceted. It allows the university to receive tax-deductible donations, significantly boosting its funding for research, scholarships, and infrastructure development. This exemption from federal income tax on its investment income and other revenue streams provides critical financial flexibility. However, this privileged status comes with significant responsibilities. Maintaining a 501(c)(3) status necessitates a clear demonstration of public benefit, stringent financial transparency, and adherence to IRS regulations.

- The IRS's Role: The IRS plays a crucial role in overseeing non-profit organizations, ensuring compliance with regulations and maintaining the integrity of the tax-exempt system. Regular audits and reporting requirements are integral to this oversight.

- Criteria for Maintaining 501(c)(3) Status: Key criteria for maintaining this status include demonstrating a charitable purpose, operating exclusively for that purpose, and not benefiting private interests. This involves meticulous record-keeping and transparent financial reporting.

- Penalties for Violations: Violation of tax-exempt status regulations can result in severe penalties, including the loss of tax-exempt status, substantial fines, and even legal repercussions for those responsible.

The President's Warning and its Context

Recently, Harvard's president issued a strong warning regarding the potential revocation of the university's tax-exempt status. This statement followed increasing scrutiny of Harvard's massive endowment, its affordability for students, and its overall commitment to public benefit. The warning served as a stark reminder of the responsibilities inherent in holding this status.

The criticisms leveled against Harvard center on several key points: the immense size of its endowment, concerns about affordability and access for low-income students, and questions regarding the equitable distribution of resources. This debate unfolds within a broader socio-political context marked by growing inequality and increased public pressure for greater accountability from elite institutions.

- President's Statement: “[Insert relevant quote from the President's statement emphasizing concerns about maintaining tax-exempt status].”

- University Response: In response to the warning, Harvard has [mention specific actions taken by the university, e.g., increased financial aid, new transparency initiatives].

- Future Challenges: The university faces ongoing challenges in navigating the complex landscape of public expectations and maintaining its tax-exempt status, including managing its endowment responsibly and enhancing its commitment to affordability and access.

The Role of the Endowment in the Debate

Harvard's substantial endowment, one of the largest in the world, plays a central role in the ongoing debate surrounding its tax-exempt status. The sheer size of the endowment fuels questions about its utilization, particularly regarding its potential to significantly increase financial aid and improve affordability.

Arguments for using a larger portion of the endowment for financial aid emphasize the university's social responsibility and the need to expand access to higher education. Counterarguments often cite the need to preserve the endowment's long-term value to ensure the sustainability of the university's operations and its future ability to provide financial aid and invest in research.

- Endowment Statistics: Harvard's endowment currently stands at [insert current figure] representing [insert percentage] growth in the past [timeframe].

- Arguments for Increased Financial Aid: Proponents argue that leveraging a larger share of the endowment for need-based financial aid would align better with the university's public benefit mission and address concerns about accessibility.

- Ethical Considerations: The ethical debate surrounding endowment management involves considerations of fiduciary responsibility, long-term sustainability, and the social impact of the university's financial resources.

Implications of a Revoked Tax-Exempt Status

The revocation of Harvard's tax-exempt status would have profound and far-reaching consequences. The most immediate impact would be a significant increase in its tax liabilities, potentially impacting its financial stability and its ability to fund crucial programs.

Losing its tax-exempt status would severely curtail Harvard's capacity to attract donations, as charitable contributions would no longer be tax-deductible. This reduction in funding would inevitably affect research initiatives, academic programs, and student support services.

- Increased Tax Liabilities: The loss of tax-exempt status would subject Harvard to significant federal, state, and potentially local taxes on its income and investments.

- Impact on Research and Programs: Reduced funding would force cuts in research projects, academic programs, and other vital initiatives.

- Effect on Student Enrollment and Tuition: A financial squeeze might lead to increased tuition costs or reduced student enrollment.

Conclusion:

The debate surrounding Harvard's tax-exempt status highlights the critical balance between institutional autonomy and societal accountability. President [President's Name]'s strong warning underscores the serious implications of potential revocation. Maintaining this vital status requires not only adherence to stringent regulations but also a proactive commitment to transparency, affordability, and fulfilling its public benefit mission. Understanding the intricacies of Harvard's tax-exempt status is crucial for all stakeholders. We urge readers to stay informed on this ongoing discussion and engage in productive dialogue concerning the future of Harvard's tax-exempt status and its implications for the wider landscape of higher education. The continued viability of Harvard's tax-exempt status is a matter of ongoing importance.

Featured Posts

-

Nicolai Tangen And The Impact Of Trumps Tariffs On Global Investment

May 05, 2025

Nicolai Tangen And The Impact Of Trumps Tariffs On Global Investment

May 05, 2025 -

Singapore Election 2024 A Test Of The Paps Grip On Power

May 05, 2025

Singapore Election 2024 A Test Of The Paps Grip On Power

May 05, 2025 -

Subtle Signals Decoding Anna Kendricks Body Language With Blake Lively

May 05, 2025

Subtle Signals Decoding Anna Kendricks Body Language With Blake Lively

May 05, 2025 -

Saturdays Nhl Action Playoff Implications And Standings Update

May 05, 2025

Saturdays Nhl Action Playoff Implications And Standings Update

May 05, 2025 -

U S Government Seeks To Dismantle Googles Dominance In Online Advertising

May 05, 2025

U S Government Seeks To Dismantle Googles Dominance In Online Advertising

May 05, 2025

Latest Posts

-

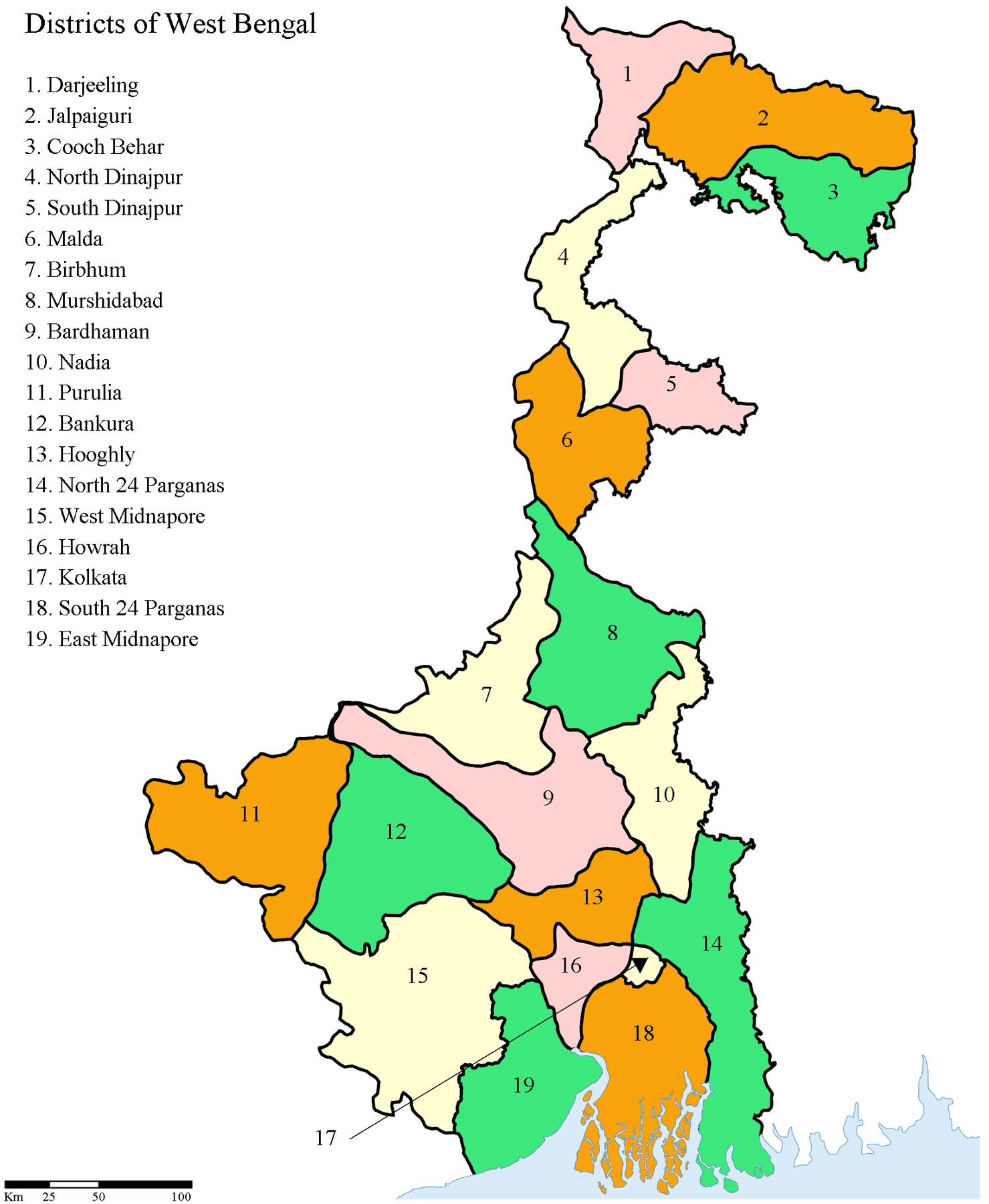

Weather Update Heatwave Warning Issued For 5 South Bengal Districts

May 05, 2025

Weather Update Heatwave Warning Issued For 5 South Bengal Districts

May 05, 2025 -

Urgent Weather Update Heatwave Sweeps Across Four West Bengal Districts

May 05, 2025

Urgent Weather Update Heatwave Sweeps Across Four West Bengal Districts

May 05, 2025 -

Bengal Heatwave Update 5 Districts Under Severe Warning

May 05, 2025

Bengal Heatwave Update 5 Districts Under Severe Warning

May 05, 2025 -

West Bengal Braces For Heatwave Four Districts Issued Warning

May 05, 2025

West Bengal Braces For Heatwave Four Districts Issued Warning

May 05, 2025 -

Heatwave Sweeps Across 5 South Bengal Districts Stay Safe

May 05, 2025

Heatwave Sweeps Across 5 South Bengal Districts Stay Safe

May 05, 2025