Has The Bitcoin Bear Market Ended? Analyzing The Recent Rebound

Table of Contents

Recent Price Action and Volatility

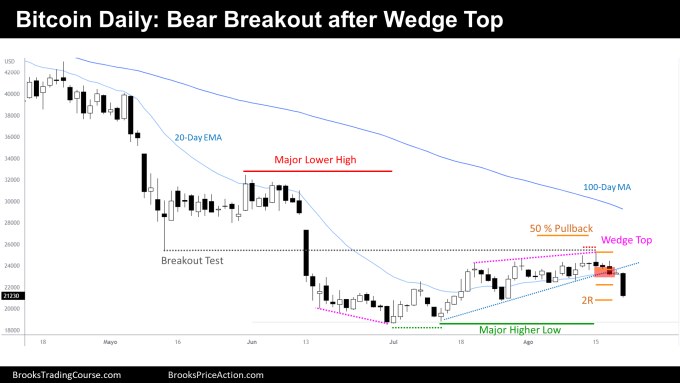

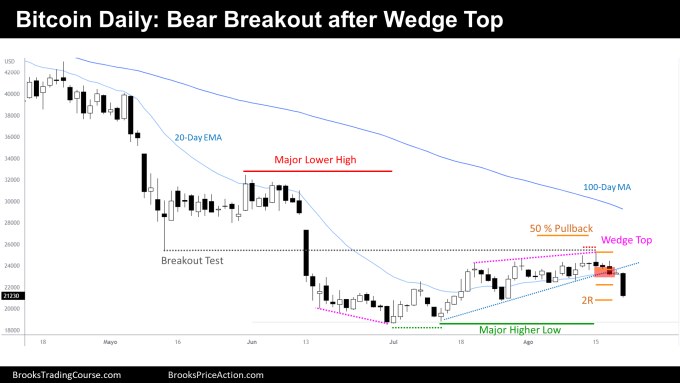

The recent price movements of Bitcoin offer a complex picture. While we've seen a noticeable rebound from the lows of [Insert Date and Price], it's crucial to analyze the volatility surrounding this increase. Comparing current price levels to previous bear market lows and highs reveals a mixed signal. For instance, while the price has recovered from [Percentage]% from its all-time low, it's still [Percentage]% below its all-time high.

- Specific date ranges of price increases and decreases: From [Start Date] to [End Date], Bitcoin experienced a [Percentage]% increase, followed by a [Percentage]% correction between [Start Date] and [End Date].

- Percentage change in Bitcoin price over a defined period: Over the last three months, Bitcoin's price has fluctuated by approximately [Percentage]%, showcasing the continued volatility even during this rebound.

- Comparison to historical volatility patterns: Compared to previous bear market recoveries, the current volatility is [Higher/Lower/Similar], suggesting [Inference about market stability].

- Mention of any significant price spikes or drops: The sudden price spike on [Date] could be attributed to [Reason, e.g., positive news, market manipulation]. Similarly, the drop on [Date] might reflect [Reason, e.g., negative news, profit-taking].

On-Chain Metrics and Indicators

Analyzing on-chain data provides valuable insights into the health of the Bitcoin network and potential future price movements. Metrics like transaction volume, mining difficulty, and network hash rate offer a more objective view than price alone. A sustained increase in transaction volume, despite price fluctuations, could signal growing user adoption and a potentially healthy market. Similarly, a stable or increasing network hash rate indicates a resilient mining ecosystem.

- Explanation of specific on-chain metrics and their significance: High mining difficulty suggests a strong network, resisting attacks and confirming the network's security. High transaction volume signifies increased network usage.

- Charts visualizing on-chain data and its correlation with price movements: [Insert relevant charts showing correlations between on-chain metrics and Bitcoin price].

- Interpretation of current on-chain data regarding potential bull/bear market trends: Current on-chain data suggests [Interpretation - e.g., a potential transition out of the bear market, or continued uncertainty].

Macroeconomic Factors and Their Influence

Global macroeconomic conditions significantly impact Bitcoin's price. High inflation, rising interest rates, and recession fears can lead investors to seek safe haven assets, potentially impacting Bitcoin's price negatively. Conversely, regulatory clarity and favorable government policies can boost investor confidence and drive price increases.

- Specific examples of macroeconomic events and their impact on Bitcoin: The recent interest rate hikes by the Federal Reserve led to [Impact on Bitcoin price].

- Analysis of regulatory announcements and their effect on investor sentiment: Positive regulatory developments in [Country/Region] have had a [Positive/Negative] impact on Bitcoin's price.

- Discussion of potential correlations between Bitcoin and traditional assets: Bitcoin's correlation with traditional markets has [Increased/Decreased/Remained stable] recently, suggesting [Interpretation].

Sentiment Analysis and Investor Behavior

Gauging investor sentiment is crucial for predicting market trends. Analyzing social media sentiment, trading volume, and market capitalization provides insights into investor behavior. Increased trading volume alongside positive sentiment might indicate a bullish trend. However, high trading volume with negative sentiment could point to a potential market correction. Institutional investment activity also plays a significant role.

- Examples of social media sentiment indicators (e.g., Google Trends, Twitter sentiment): Google Trends data shows a [Increase/Decrease] in searches for "Bitcoin," suggesting [Interpretation].

- Charts illustrating trading volume and market capitalization fluctuations: [Insert charts showing trading volume and market cap fluctuations].

- Discussion of recent institutional investment activity in Bitcoin: Recent institutional purchases of Bitcoin suggest [Interpretation about their confidence in the market].

The Role of Whales and Large Holders

The actions of "whales" – large Bitcoin holders – can significantly influence market movements. Accumulation (buying) by whales can signal bullish sentiment, while distribution (selling) can trigger price drops. Analyzing their on-chain activity provides critical insights into potential market direction. Monitoring large-scale transactions and their impact on the order book is vital in understanding this influence.

Conclusion

Determining whether the Bitcoin bear market has definitively ended remains complex. While the recent price rebound is encouraging, several factors warrant caution. The volatility persists, and macroeconomic conditions remain uncertain. On-chain metrics offer a mixed signal, and investor sentiment remains somewhat fragile. Careful monitoring of price action, on-chain data, macroeconomic factors, and investor behavior is crucial. The role of whales and large holders adds another layer of complexity to this assessment. It's crucial to remain informed and conduct your own research. Continue researching and monitoring the Bitcoin bear market situation, stay informed about developments in the cryptocurrency market, and share your own perspectives – has the Bitcoin bear market truly concluded?

Featured Posts

-

Major Breakthrough In Shreveport Arrests Made In Large Scale Vehicle Theft

May 08, 2025

Major Breakthrough In Shreveport Arrests Made In Large Scale Vehicle Theft

May 08, 2025 -

Celtics Vs Nets Will Jayson Tatum Play Tonight Injury Update

May 08, 2025

Celtics Vs Nets Will Jayson Tatum Play Tonight Injury Update

May 08, 2025 -

Hetimi I Uefa S Ndaj Arsenalit Per Ndeshjen Me Psg Cfare Ndodhi

May 08, 2025

Hetimi I Uefa S Ndaj Arsenalit Per Ndeshjen Me Psg Cfare Ndodhi

May 08, 2025 -

De Andre Jordans Historic Performance Nuggets Vs Bulls

May 08, 2025

De Andre Jordans Historic Performance Nuggets Vs Bulls

May 08, 2025 -

Lahwr Myn Gwsht Ky Qymtwn Ka Bhran Hl Ky Tlash Myn

May 08, 2025

Lahwr Myn Gwsht Ky Qymtwn Ka Bhran Hl Ky Tlash Myn

May 08, 2025