Heineken Revenue Surpasses Forecasts, Outlook Remains Strong Despite Trade Tensions

Table of Contents

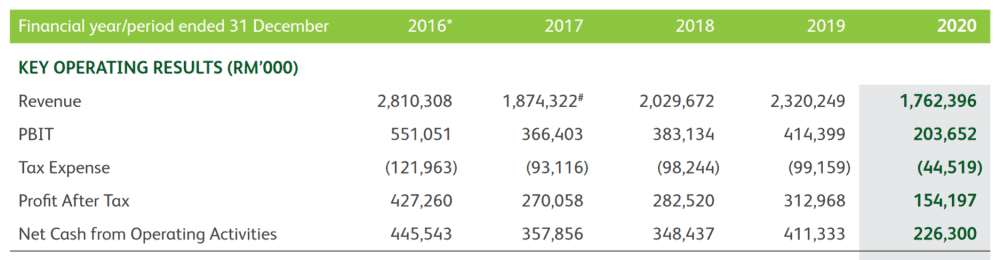

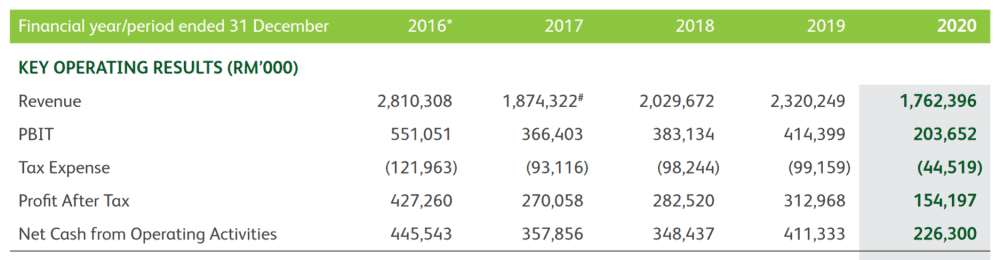

Heineken Revenue Exceeds Expectations: A Detailed Look at the Financials

Heineken's recent financial report reveals a robust performance, exceeding internal projections and analyst expectations. This strong performance is a testament to the company's strategic focus and effective execution across various markets.

Stronger-than-anticipated sales growth across key markets.

Heineken experienced impressive sales growth across its key regions:

- Asia: Reported a 15% increase in revenue, driven by strong demand in China and Vietnam. [Source: Heineken Q3 2024 Financial Report]

- Europe: Achieved an 8% revenue growth, boosted by the success of premium brands in Western Europe and Eastern Europe. [Source: Heineken Q3 2024 Financial Report]

- Americas: Showed a 12% increase, with particularly strong performance in Mexico and Brazil. [Source: Heineken Q3 2024 Financial Report]

This broad-based growth was further fueled by the success of specific product lines, including premium offerings such as Heineken 0.0 and various craft beer acquisitions, showcasing the effectiveness of Heineken’s diversified portfolio.

Premiumization strategy driving profit margins.

Heineken's strategic focus on premiumization has significantly contributed to improved profit margins. By emphasizing higher-margin products and innovative offerings, the company has successfully increased its average selling price while maintaining strong sales volume. This is evident in the exceptional performance of brands like Heineken Silver and its various craft beer acquisitions. Furthermore, targeted pricing strategies, adjusting prices to reflect increased production costs and market demand, have also enhanced profitability.

Navigating Global Trade Tensions: Heineken's Resilience

Despite facing significant headwinds from global trade tensions, including tariffs and trade wars, Heineken demonstrated remarkable resilience.

Impact of tariffs and trade wars on Heineken's operations.

Tariffs imposed on imported beer in certain markets undoubtedly created challenges for Heineken. Increased logistical costs and potential disruptions to supply chains were among the key concerns. Specific regions experienced varying degrees of impact, requiring agile responses from the company.

Heineken's successful adaptation to changing market conditions.

Heineken effectively mitigated these risks through several strategic initiatives:

- Diversification of sourcing: Shifting production to local breweries in affected regions minimized reliance on imported goods.

- Strategic partnerships: Collaborations with local distributors and suppliers provided access to alternative distribution channels and resources.

- Optimization of supply chains: Streamlining logistics and leveraging technological advancements to reduce costs and enhance efficiency.

These proactive measures enabled Heineken to maintain its market share and profitability even in the face of adverse trade conditions, highlighting the company's adaptability and resilience.

Positive Outlook for Heineken: Future Growth and Strategies

Heineken's strong financial performance and strategic agility position the company for continued growth and expansion.

Heineken's growth projections and investment plans.

Heineken projects sustained revenue growth in the coming years, driven by continued expansion in key markets and strategic investments. The company plans significant investments in:

- New market penetration: Targeting emerging markets with high growth potential.

- Product innovation: Developing new and exciting products to cater to evolving consumer preferences.

- Marketing campaigns: Enhancing brand awareness and customer loyalty through targeted marketing strategies.

Furthermore, strategic acquisitions are likely to further expand Heineken's market reach and product portfolio.

Sustainability initiatives and their role in long-term success.

Heineken's commitment to sustainability is integral to its long-term success. The company has implemented various initiatives to reduce its environmental footprint, including:

- Reducing carbon emissions: Investing in renewable energy and sustainable packaging.

- Optimizing water usage: Implementing water conservation measures in its brewing processes.

These initiatives contribute to a positive brand image, attract environmentally conscious consumers, and enhance long-term sustainability. Heineken's dedication to responsible brewing practices has been recognized through several industry awards and certifications.

Conclusion: Heineken Revenue and a Strong Future Outlook

In conclusion, Heineken's recent financial performance demonstrates exceptional resilience and strategic acumen. The company's Heineken revenue has not only surpassed expectations but also showcased its ability to navigate challenging global trade conditions effectively. The positive outlook for future growth, fueled by strategic investments and a commitment to sustainability, further reinforces Heineken's position as a leading player in the global beverage industry. To learn more about Heineken's success story and future plans, visit their investor relations website or explore further articles on Heineken Revenue, Heineken Financial Performance, and Heineken's Global Strategy.

Featured Posts

-

Severe Delays On M56 Cheshire And Deeside Motorway Traffic Disrupted

May 25, 2025

Severe Delays On M56 Cheshire And Deeside Motorway Traffic Disrupted

May 25, 2025 -

40 Svadeb Na Kharkovschine Kakaya Data Stala Stol Populyarnoy Foto

May 25, 2025

40 Svadeb Na Kharkovschine Kakaya Data Stala Stol Populyarnoy Foto

May 25, 2025 -

Wall Street Comeback Threat Or Opportunity For The Rising Dax

May 25, 2025

Wall Street Comeback Threat Or Opportunity For The Rising Dax

May 25, 2025 -

Annie Kilners Posts Following Kyle Walker Night Out Allegations Of Poisoning

May 25, 2025

Annie Kilners Posts Following Kyle Walker Night Out Allegations Of Poisoning

May 25, 2025 -

From Fame To Shame 17 Celebrity Downfalls

May 25, 2025

From Fame To Shame 17 Celebrity Downfalls

May 25, 2025

Latest Posts

-

Addressing The Housing Crisis Gregor Robertsons Perspective On Affordability

May 25, 2025

Addressing The Housing Crisis Gregor Robertsons Perspective On Affordability

May 25, 2025 -

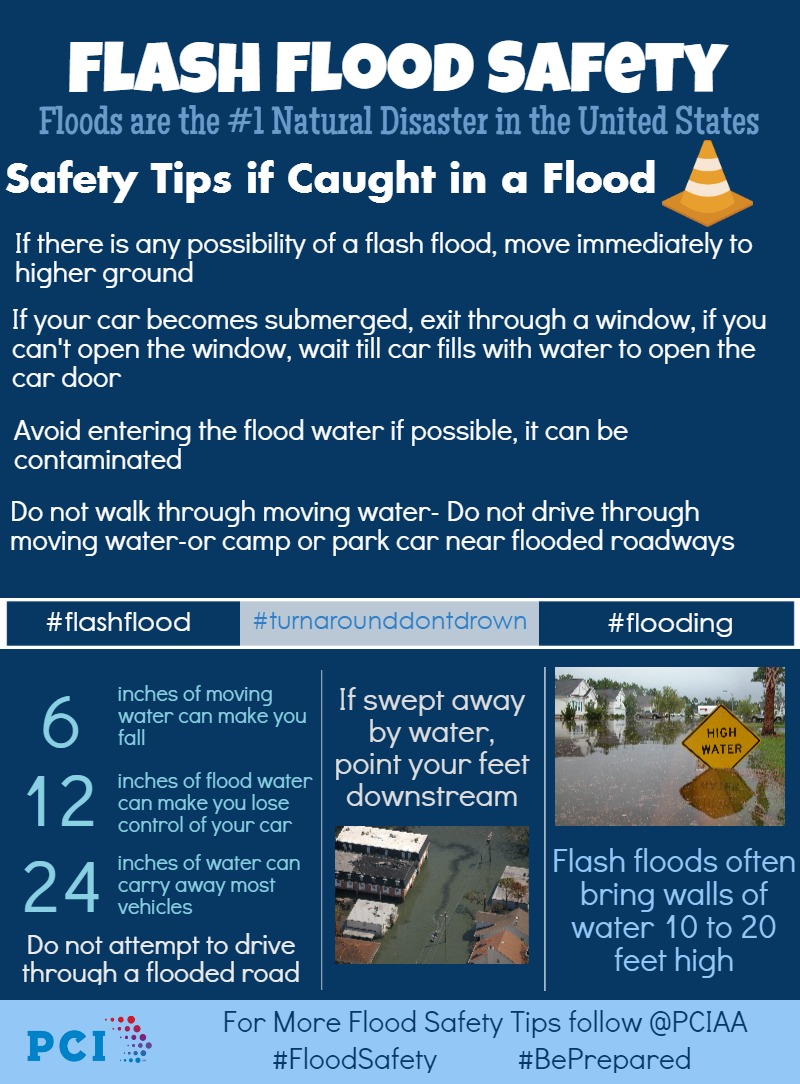

Severe Weather And Flooding Miami Valley Under Flood Advisory

May 25, 2025

Severe Weather And Flooding Miami Valley Under Flood Advisory

May 25, 2025 -

Flash Flood And Tornado Situation Report April 4 2025

May 25, 2025

Flash Flood And Tornado Situation Report April 4 2025

May 25, 2025 -

How To Prepare For And Respond To Flash Flood Warnings And Alerts

May 25, 2025

How To Prepare For And Respond To Flash Flood Warnings And Alerts

May 25, 2025 -

Severe Weather Awareness Essential Flood Safety Guidelines For Day 5

May 25, 2025

Severe Weather Awareness Essential Flood Safety Guidelines For Day 5

May 25, 2025