High Stock Market Valuations: A BofA Analysis And Why Investors Shouldn't Worry

Table of Contents

BofA's Analysis of Current Market Valuations

Bank of America's market analysis provides valuable insights into current stock market valuation metrics. Their research utilizes several key indicators to assess the market's overall health and potential for future growth. Understanding these metrics is crucial for interpreting the current high valuations.

-

Key Valuation Ratios: BofA's analysis likely incorporates various valuation ratios, including the widely used price-to-earnings ratio (P/E), the cyclically adjusted price-earnings ratio (CAPE), also known as the Shiller PE, and possibly other metrics like price-to-sales or price-to-book ratios. These ratios help compare current market prices to historical averages and company earnings, offering a perspective on whether the market is overvalued or undervalued.

-

Historical Context and Economic Factors: BofA's analysis doesn't simply focus on raw numbers. It considers the historical context of these valuations, comparing current levels to previous periods of high valuations and economic conditions. Factors such as interest rates, inflation, economic growth, and geopolitical events are all crucial considerations in their assessment. They likely account for potential outliers in the data, ensuring a balanced view.

-

Sector-Specific Valuations: The analysis probably also examines valuations across different sectors and industries. Some sectors might show significantly higher valuations than others, reflecting varying growth prospects and investor sentiment. For example, technology stocks often command higher P/E ratios due to expectations of future growth, while more mature sectors might have lower valuations.

Factors Contributing to High Valuations – Beyond Simple Metrics

While high P/E ratios and CAPE ratios might initially suggest overvaluation, several significant factors contribute to the current market conditions. Simply focusing on these metrics alone provides an incomplete picture.

-

Low Interest Rates: Historically low interest rates significantly impact discounted cash flow valuations. Lower discount rates increase the present value of future earnings, thus justifying higher current stock prices. This is a fundamental principle of valuation and explains a portion of the higher valuations.

-

Strong Corporate Earnings: Many companies have reported strong earnings growth in recent years, supporting higher stock prices. Profitable businesses naturally attract higher valuations, as investors are willing to pay a premium for a share in their success.

-

Technological Innovation and Future Growth Expectations: Technological advancements drive significant future growth expectations, boosting market valuations. Investors are willing to pay a premium for companies perceived as leaders in innovative sectors, reflecting their belief in substantial future returns.

-

Inflation Expectations: Inflation expectations influence real returns and valuation multiples. While inflation can erode purchasing power, anticipated inflation might also lead investors to demand higher returns, thereby impacting stock valuations.

-

Investor Sentiment and Market Psychology: Market psychology and investor sentiment play a crucial role. Periods of high confidence and optimism can drive prices upward, irrespective of purely fundamental factors. Conversely, fear and uncertainty can trigger downward pressure.

Addressing Investor Concerns About Overvaluation

The possibility of a market correction is always present. However, predicting the timing of such a correction is notoriously difficult. Focusing solely on market timing is generally a losing strategy.

-

Risk Mitigation Strategies: Investors can mitigate risks through portfolio diversification, spreading investments across various asset classes and sectors to reduce overall volatility. A long-term investment horizon is also critical, allowing investors to ride out short-term market fluctuations.

-

Focus on Company Fundamentals: Instead of fixating solely on overall market valuations, investors should prioritize assessing the fundamental strengths of individual companies. Analyzing a company's financial health, competitive landscape, and growth potential is far more crucial than reacting to broad market indices.

-

Market Timing vs. Asset Allocation: It's crucial to understand the difference between trying to time the market (a difficult if not impossible task) and strategic asset allocation (a more manageable and effective long-term approach).

Opportunities Within a High-Valuation Market

Despite the high valuations, opportunities exist for savvy investors. A blanket approach of avoiding the market altogether ignores the potential for selective investment and long-term growth.

-

Identifying Opportunities: Certain sectors or industries may offer attractive opportunities, even in a seemingly expensive market. Careful research and sector-specific analysis are essential.

-

Value Investing: Value investing strategies focus on identifying undervalued companies that are trading below their intrinsic worth. This approach can yield significant returns even in a high-valuation market.

-

Sector Rotation: Sector rotation involves shifting investments between different sectors based on their relative performance and growth prospects. This dynamic strategy can help capitalize on market shifts and outperform a static approach.

-

Long-Term Growth Potential: Focusing on companies with strong long-term growth potential remains vital. While short-term fluctuations may occur, companies with solid fundamentals and innovative products often outperform the market over the long term.

Conclusion

BofA's analysis, while acknowledging high stock market valuations, suggests that several factors beyond simple metrics contribute to the current situation. These factors, combined with a long-term perspective and strategic investment approaches, mitigate many investor concerns. The key is to focus on individual company fundamentals and diversification rather than panicking over headline-grabbing valuation figures.

Call to Action: Don't let seemingly high stock market valuations deter you from your long-term investment strategy. Conduct thorough research, consider your risk tolerance, and explore the opportunities within this dynamic market. Understand the nuances of your investment portfolio and consider seeking professional advice to ensure your portfolio aligns with your long-term financial goals. Learn more about navigating high stock market valuations and build a robust investment plan today!

Featured Posts

-

Liverpool En Oranje Kaartjes Voor E4000 Is Het De Moeite Waard

May 29, 2025

Liverpool En Oranje Kaartjes Voor E4000 Is Het De Moeite Waard

May 29, 2025 -

Joshlin Disappearance Kelly Smiths Reaction To Implication

May 29, 2025

Joshlin Disappearance Kelly Smiths Reaction To Implication

May 29, 2025 -

Vitoria De Musk Space X Instala Base Em Nova Cidade Texana

May 29, 2025

Vitoria De Musk Space X Instala Base Em Nova Cidade Texana

May 29, 2025 -

Smith Denies Selling Joshlin Blames Lombaard And Letoni

May 29, 2025

Smith Denies Selling Joshlin Blames Lombaard And Letoni

May 29, 2025 -

Combating Drug Trafficking In France The Role Of Phone Seizures

May 29, 2025

Combating Drug Trafficking In France The Role Of Phone Seizures

May 29, 2025

Latest Posts

-

2025 Pro Motocross Championship A Season Preview

May 31, 2025

2025 Pro Motocross Championship A Season Preview

May 31, 2025 -

Nikola Jokics One Handed Highlight Key To Nuggets Blowout Win Over Jazz

May 31, 2025

Nikola Jokics One Handed Highlight Key To Nuggets Blowout Win Over Jazz

May 31, 2025 -

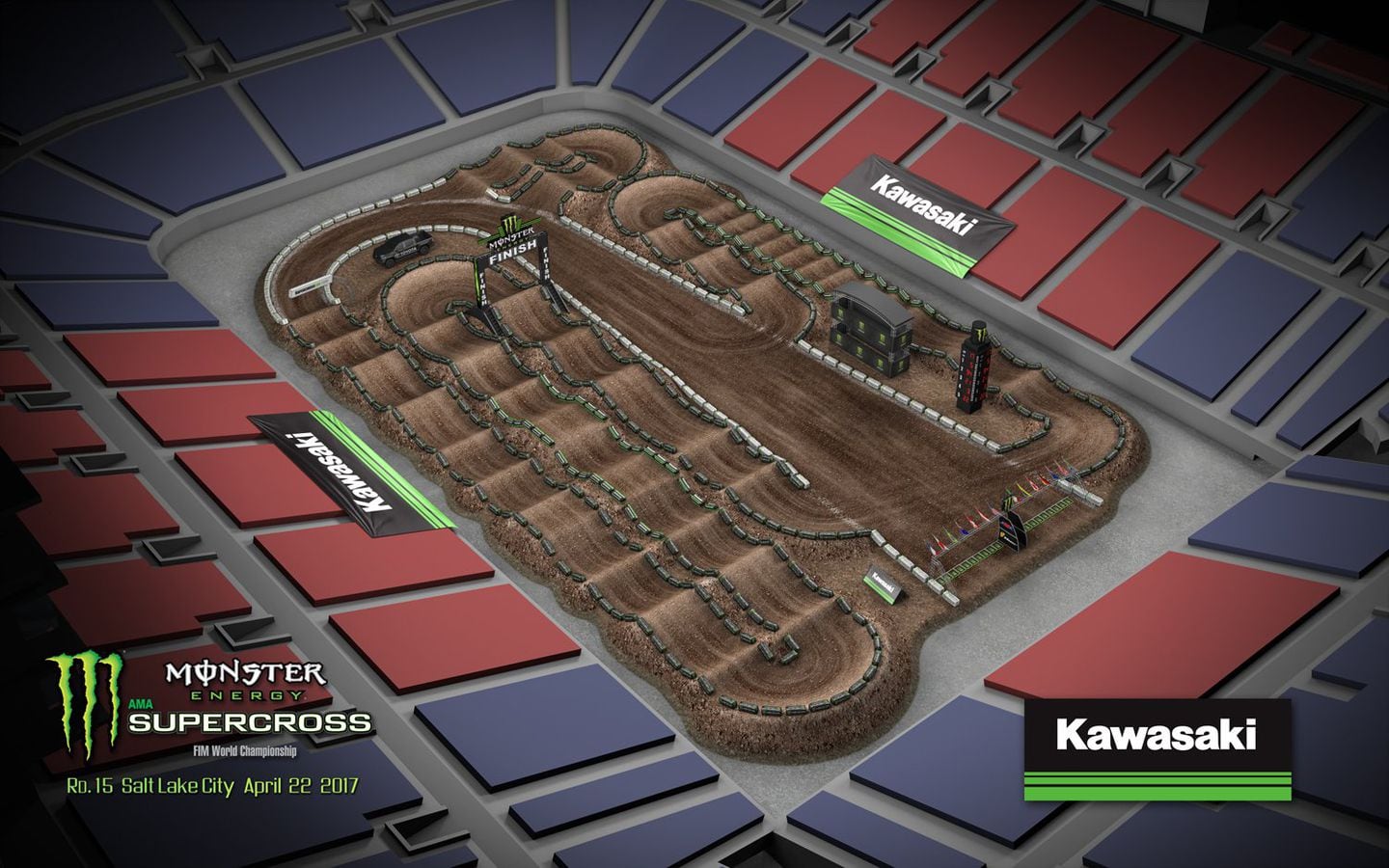

Supercross In Salt Lake City A Riders Guide To The Event

May 31, 2025

Supercross In Salt Lake City A Riders Guide To The Event

May 31, 2025 -

Dominant Nuggets Win Jokics One Handed Flick A Game Highlight

May 31, 2025

Dominant Nuggets Win Jokics One Handed Flick A Game Highlight

May 31, 2025 -

Supercross Returns To Salt Lake City Dates Tickets And What To Expect

May 31, 2025

Supercross Returns To Salt Lake City Dates Tickets And What To Expect

May 31, 2025