High Stock Market Valuations: BofA's Analysis And Investor Reassurance

Table of Contents

BofA's Assessment of Current High Stock Market Valuations

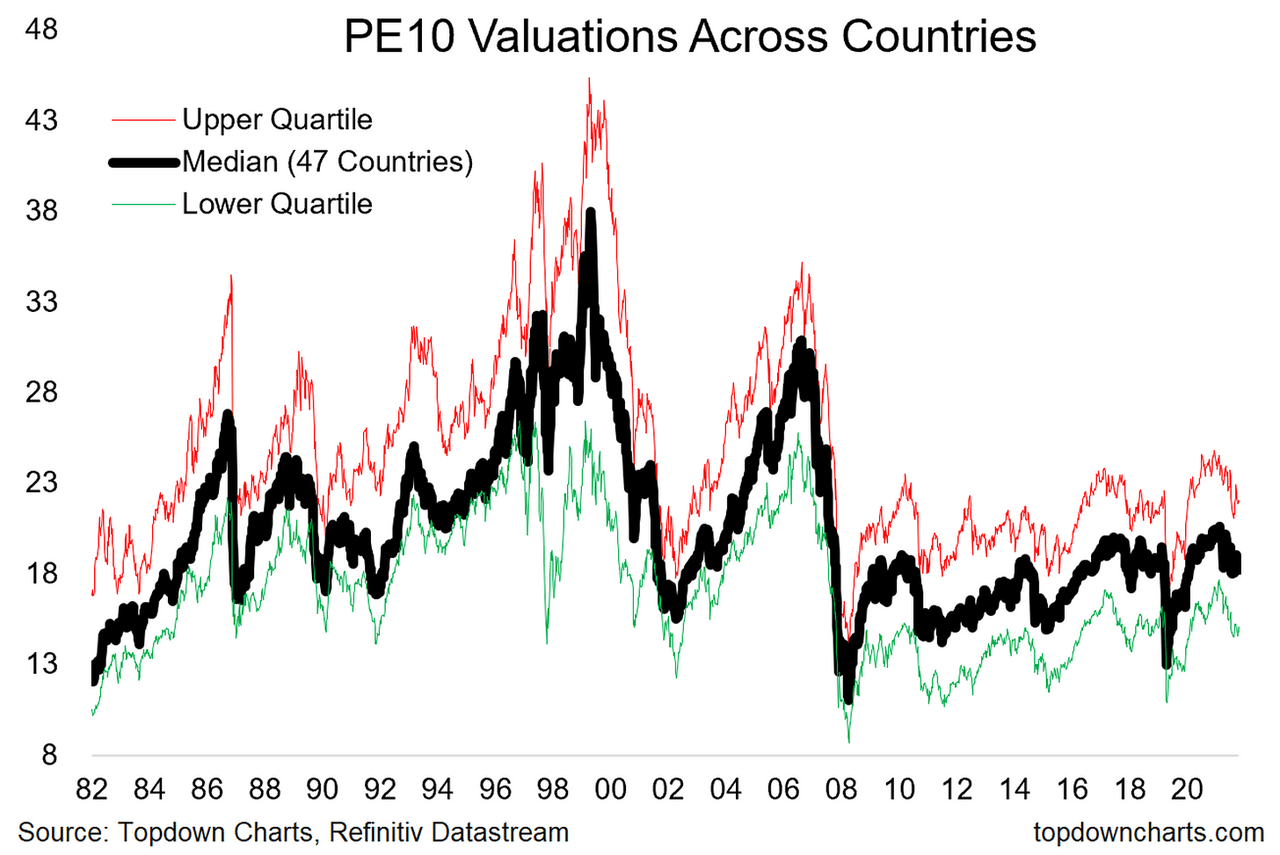

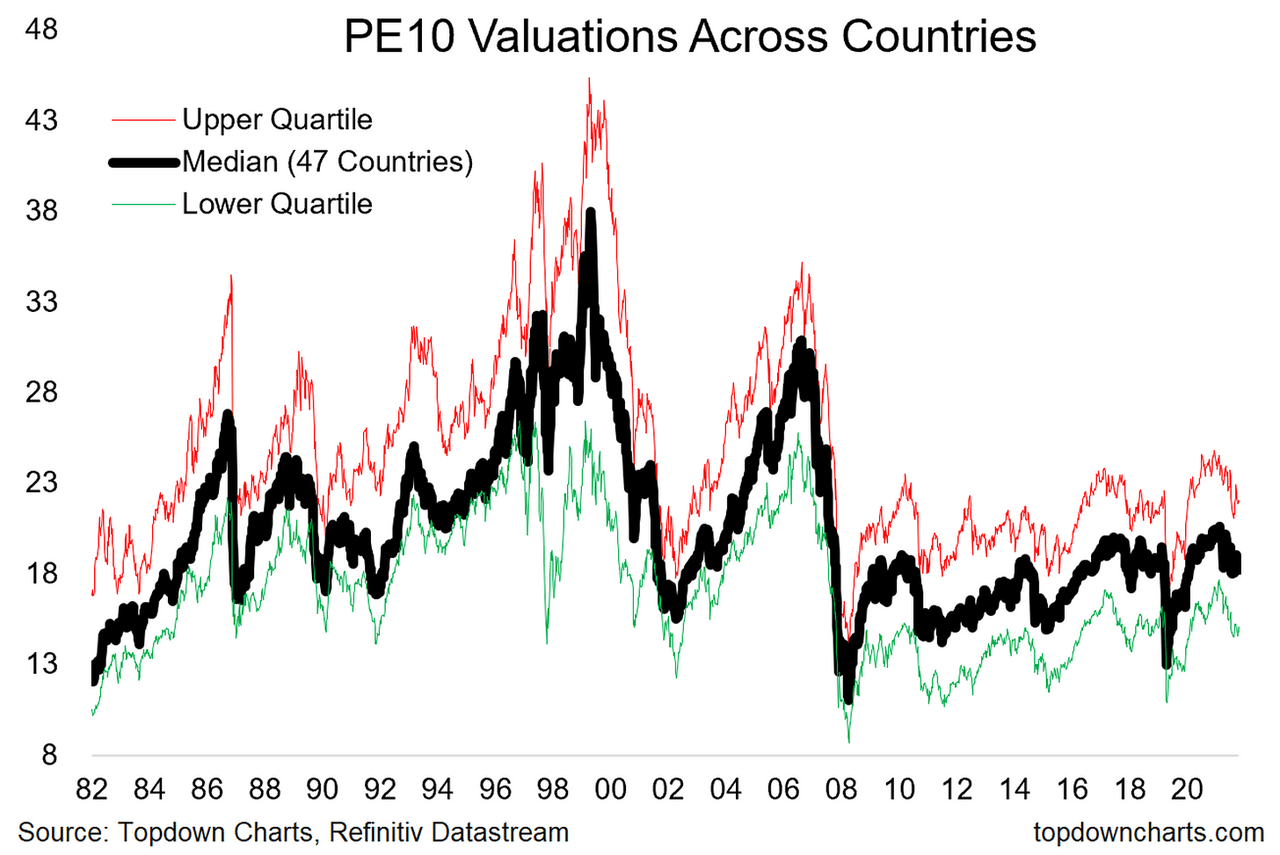

Bank of America's Global Research regularly publishes reports analyzing equity market valuation. Their recent analyses have highlighted elevated stock market valuations, often referencing metrics like Price-to-Earnings (P/E) ratios and market capitalization relative to GDP. While specific data points fluctuate, the overall message consistently points towards a market trading at a premium compared to historical averages.

-

Summary of BofA's key findings regarding current market valuation levels: BofA generally notes that while valuations are high, they are not necessarily at unsustainable levels, especially considering factors such as low interest rates and robust corporate earnings. However, they emphasize the need for caution and a thorough risk assessment.

-

Specific sectors or indices BofA highlights as overvalued or undervalued: Past BofA reports often identify specific sectors (e.g., technology, consumer discretionary) as potentially overvalued based on their P/E ratios and future earnings expectations, while others (e.g., certain value stocks) may be seen as relatively undervalued. It's important to note that these assessments are dynamic and subject to change.

-

BofA's methodology and assumptions used in their analysis: BofA utilizes sophisticated quantitative models, incorporating various economic indicators, financial data, and forward-looking estimates to assess market valuations. Their assumptions regarding future economic growth, interest rates, and corporate profitability directly impact their conclusions.

-

Mention any potential risks or uncertainties identified by BofA: BofA typically acknowledges significant risks, including the potential for a market correction, rising inflation, and changes in monetary policy. These risks are factored into their overall valuation assessments and investment recommendations.

Factors Contributing to High Stock Market Valuations

Several intertwined factors contribute to the current high stock market valuations. Understanding these forces is crucial for informed investment decision-making.

-

Low interest rates and their impact on stock valuations: Historically low interest rates reduce the attractiveness of fixed-income investments, pushing investors towards higher-yielding assets like stocks. This increased demand fuels higher stock prices and valuations.

-

Strong corporate earnings growth and its influence on market sentiment: Sustained corporate earnings growth enhances investor confidence and willingness to pay higher prices for stocks, boosting overall market valuations.

-

Increased investor confidence and risk appetite: Periods of economic stability and positive market sentiment often lead to increased risk-taking, pushing investors to accept higher valuations in anticipation of further growth.

-

The role of quantitative easing and other monetary policies: Central bank policies like quantitative easing inject liquidity into the market, further increasing demand for assets and contributing to elevated valuations.

-

Potential impact of inflation on stock valuations: Rising inflation can erode the purchasing power of future earnings, potentially impacting stock valuations. BofA's analysis likely incorporates inflation expectations into its valuation models.

Investor Strategies for Navigating High Stock Market Valuations

Even with high stock market valuations, investors can employ strategies to manage risk and potentially benefit from market opportunities.

-

Diversification strategies to mitigate risk: Diversifying across different asset classes (stocks, bonds, real estate), sectors, and geographies helps reduce the impact of market fluctuations on a portfolio.

-

Importance of long-term investment horizons: A long-term investment perspective allows investors to ride out short-term market volatility and benefit from the long-term growth potential of the market.

-

Value investing approaches for identifying undervalued stocks: Value investing involves identifying companies trading below their intrinsic value, offering potential for capital appreciation even in a high-valuation market.

-

Considering alternative asset classes (e.g., bonds, real estate): Allocating a portion of the portfolio to alternative asset classes can provide diversification and potentially offset losses in the equity market.

-

The role of dollar-cost averaging: Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market fluctuations, reducing the risk of investing a large sum at a market peak.

BofA's Recommendations and Reassurance

BofA's overall recommendations generally emphasize a cautious yet balanced approach. While acknowledging the high stock market valuations, they often highlight the importance of maintaining a diversified portfolio and considering the long-term outlook.

-

Key takeaways from BofA's recommendations for investors: BofA’s recommendations typically stress the need for thorough due diligence, risk management, and diversification across asset classes.

-

Address any concerns raised by BofA about potential market corrections: BofA often acknowledges the possibility of market corrections, but they tend to view these as normal parts of the market cycle, emphasizing the importance of long-term investing.

-

Explain BofA's outlook for the future of the stock market: BofA's outlook on the stock market is usually nuanced, reflecting the interplay of various economic and market factors. Their forecasts are typically probabilistic rather than deterministic, acknowledging inherent uncertainties.

Conclusion

While high stock market valuations present challenges, BofA's analysis offers valuable insights and reassurance for investors. By understanding the factors contributing to these valuations and employing sound investment strategies, investors can navigate this environment effectively. Remember to diversify your portfolio, maintain a long-term perspective, and consider BofA's recommendations as you plan your investment approach to manage your exposure to these high stock market valuations. Don't hesitate to consult with a financial advisor for personalized guidance.

Featured Posts

-

Asylum Seekers From Three Countries Face Uk Crackdown

May 09, 2025

Asylum Seekers From Three Countries Face Uk Crackdown

May 09, 2025 -

Young Thug Drops Clues About Uy Scuti Album Release

May 09, 2025

Young Thug Drops Clues About Uy Scuti Album Release

May 09, 2025 -

Anchorages Newest Additions Candle Studio Alaska Airlines Lounge Korean Bbq And Eye Tooth Restaurant

May 09, 2025

Anchorages Newest Additions Candle Studio Alaska Airlines Lounge Korean Bbq And Eye Tooth Restaurant

May 09, 2025 -

New Funding For Madeleine Mc Cann Case A Significant Development

May 09, 2025

New Funding For Madeleine Mc Cann Case A Significant Development

May 09, 2025 -

Materialists Treiler Ithopoioi Kai Plirofories Gia Tin Komenti Tis Selin Songk

May 09, 2025

Materialists Treiler Ithopoioi Kai Plirofories Gia Tin Komenti Tis Selin Songk

May 09, 2025