High Stock Market Valuations: BofA's Argument For Investor Calm

Table of Contents

BofA's Rationale for High Valuations

BofA's argument for the current high stock market valuations rests on several key pillars. They believe that a combination of strong corporate performance, supportive monetary policy, and promising long-term growth prospects justifies the current market levels, despite appearing high historically. Let's break down each of these factors.

Strong Corporate Earnings and Profitability

BofA points to robust corporate earnings and strong profit margins as a primary justification for higher stock prices. Many companies are exceeding expectations, driving overall market valuations upward.

- Highlighting High-Performing Sectors: The technology sector, particularly within software and cloud computing, has shown exceptional growth. Similarly, the healthcare and consumer staples sectors have also delivered strong earnings, contributing significantly to overall market strength. These sectors are less susceptible to short-term economic downturns.

- Technological Advancements and Efficiency Improvements: Technological innovation across various sectors is boosting productivity and lowering costs, translating directly into increased profits and higher stock valuations. Automation, AI, and big data analytics are prime examples.

- Earnings Growth Data: While precise figures change constantly, the overall trend indicates consistent year-over-year earnings growth exceeding expectations in many sectors. Analysts' projections for future earnings growth also remain largely positive, supporting BofA's optimistic view. This positive trend contributes to investor confidence and higher stock market valuations.

Low Interest Rates and Monetary Policy

The current low-interest-rate environment significantly supports high stock market valuations. Easy monetary policy from central banks globally has injected liquidity into the markets, making it cheaper for companies to borrow and invest, and driving up demand for stocks.

- Impact of Quantitative Easing and Central Bank Policies: Years of quantitative easing (QE) and accommodative monetary policies have kept interest rates low, fueling investment and boosting asset prices, including stocks. This influx of capital into the market has supported higher valuations.

- Low Borrowing Costs Encourage Investment: Low borrowing costs incentivize companies to expand, invest in new projects, and increase hiring, contributing to economic growth and further supporting higher stock prices. This creates a virtuous cycle of economic growth and increased stock value.

- Future Monetary Policy Changes: While the current environment is favorable, any significant shift toward tighter monetary policy could impact stock market valuations. However, BofA's assessment likely considers the gradual nature of potential future rate hikes and their expected limited impact on the overall market.

Long-Term Growth Potential

BofA emphasizes the long-term growth potential of the global economy, focusing on emerging markets as a key driver. This long-term perspective helps to justify current valuations despite short-term concerns.

- Key Drivers of Long-Term Growth: Technological innovation remains a major driver, coupled with evolving demographics in many developing nations. The rise of the middle class in emerging economies presents significant opportunities for businesses and drives sustained growth.

- Expansion in Specific Sectors: The renewable energy sector is poised for significant expansion, driven by environmental concerns and technological advancements. Similarly, advancements in healthcare and biotechnology offer exceptional long-term growth potential.

- Geopolitical Factors: While geopolitical events can introduce volatility, BofA's assessment likely incorporates an evaluation of these risks and their potential impact on long-term growth prospects. Careful consideration of geopolitical factors is essential for a nuanced market analysis.

Addressing Investor Concerns About Market Volatility

While BofA's outlook is positive, the firm acknowledges investor concerns about market volatility in the face of high stock market valuations. Addressing these concerns effectively is crucial for maintaining investor confidence.

Managing Risk in a High-Valuation Market

Even with a positive outlook, managing risk in a potentially volatile market remains essential. BofA likely advocates for a strategic and cautious approach.

- Diversification Strategies: Diversifying across different asset classes (stocks, bonds, real estate, etc.) is crucial to mitigate risk. Spreading investments reduces the impact of any single asset class underperforming.

- Long-Term Investment Horizon: Maintaining a long-term investment horizon helps to weather short-term market fluctuations. Focusing on long-term growth minimizes the influence of short-term volatility.

- Risk Assessment and Tolerance: Understanding and managing your own risk tolerance is paramount. Investors should only invest in assets that align with their comfort level and long-term financial goals.

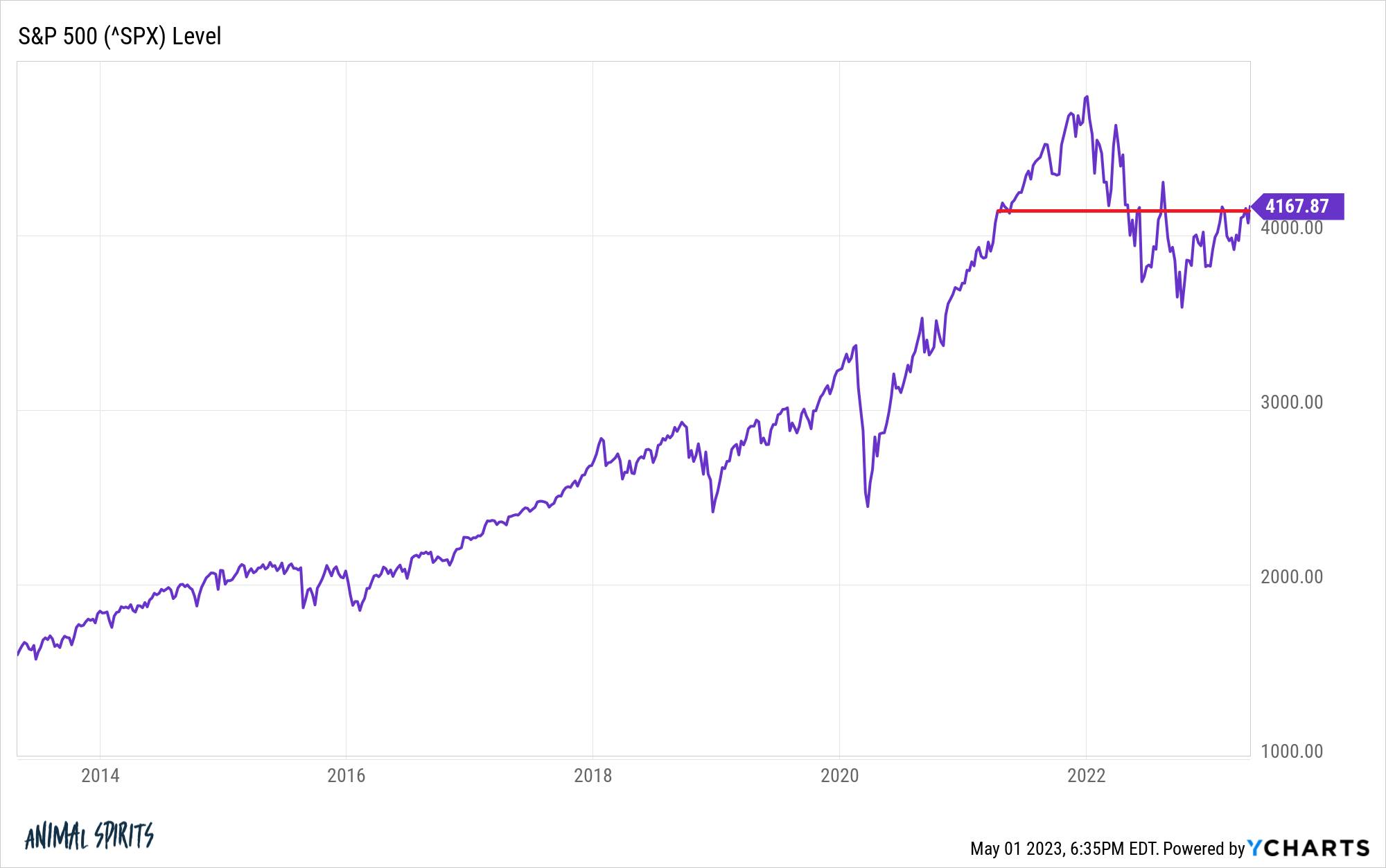

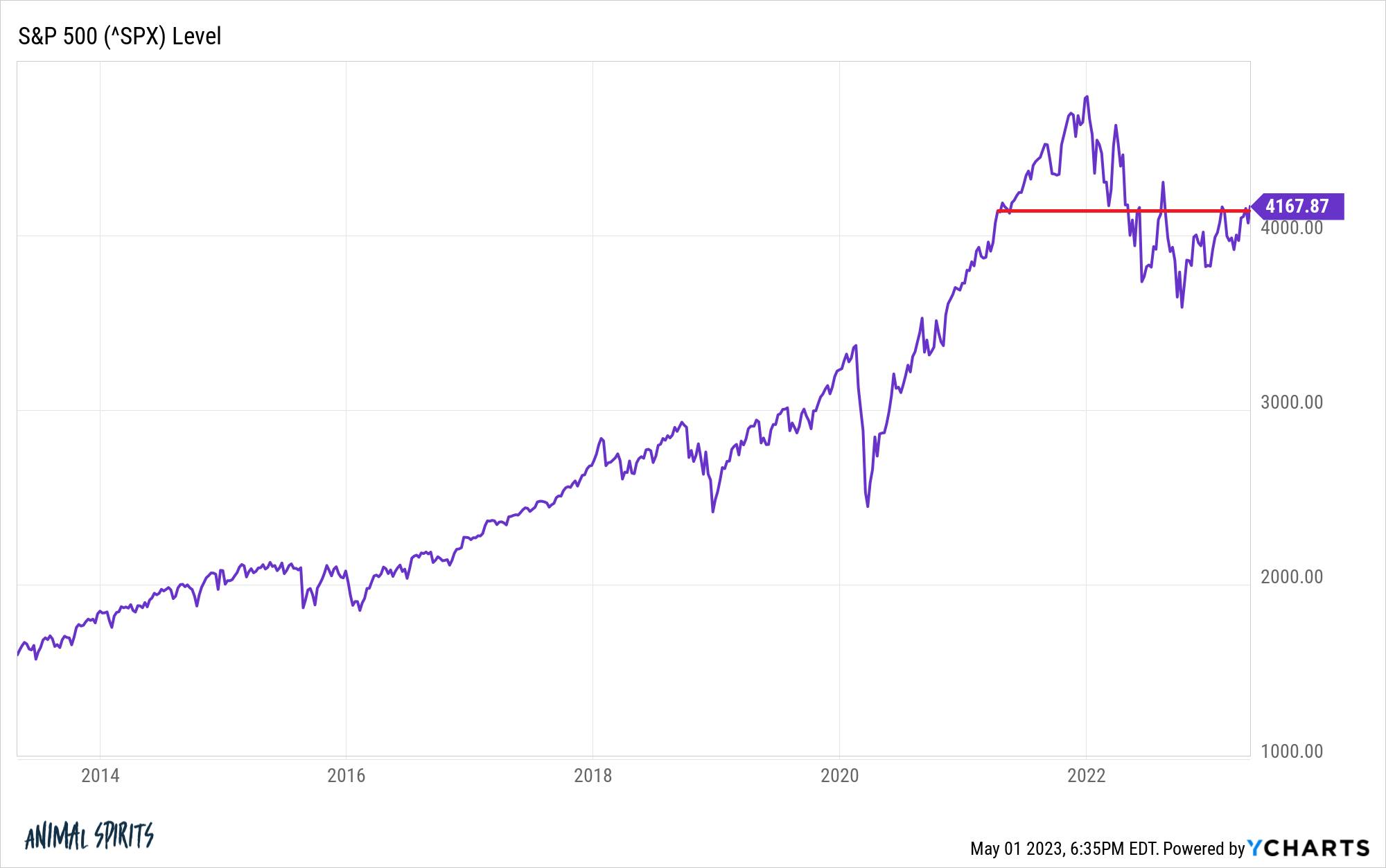

Historical Context and Market Corrections

Putting current valuations in historical context can alleviate some fears. Markets have experienced periods of high valuations in the past, followed by corrections, and subsequently recovered and experienced further growth.

- Comparing Current Valuations to Previous Peaks: Comparing current price-to-earnings ratios (P/E) and other valuation metrics to previous market peaks provides valuable perspective. This helps to understand the extent of the current valuations in a broader historical context.

- Examples of Past Market Corrections and Recoveries: Historical data showcases numerous instances of market corrections, followed by periods of significant recovery and growth. This demonstrates the cyclical nature of the market and emphasizes the importance of a long-term perspective.

- Short-Term Volatility vs. Long-Term Trends: It's vital to distinguish between short-term volatility and long-term market trends. While short-term fluctuations are inevitable, focusing on the long-term growth potential reduces the impact of short-term market corrections.

Conclusion

While high stock market valuations are a legitimate concern for investors, BofA's analysis suggests a nuanced perspective. Factors such as strong corporate earnings, low interest rates, and long-term growth potential contribute to their argument for maintaining a calm and strategic approach. Managing risk through diversification and adopting a long-term investment outlook is crucial. Understanding the arguments surrounding high stock market valuations, including the counterpoints, is crucial for making sound decisions.

Call to Action: Understanding the arguments for and against high stock market valuations is vital for informed investment decisions. Learn more about BofA's perspective and develop a robust investment strategy that aligns with your risk tolerance and long-term financial goals. Don't let fear of high stock market valuations paralyze your investment strategy. Take control and make informed decisions based on a thorough understanding of the current market conditions. Remember, a long-term perspective and a well-diversified portfolio can help you navigate the complexities of high stock market valuations effectively.

Featured Posts

-

Trump Administration To Slash Another 1 Billion In Harvard Funding Amid Growing Tensions

Apr 22, 2025

Trump Administration To Slash Another 1 Billion In Harvard Funding Amid Growing Tensions

Apr 22, 2025 -

Who Will Bear The Cost Of Trumps Economic Policies

Apr 22, 2025

Who Will Bear The Cost Of Trumps Economic Policies

Apr 22, 2025 -

Key Economic Issues Highlighted In The English Language Leaders Debate

Apr 22, 2025

Key Economic Issues Highlighted In The English Language Leaders Debate

Apr 22, 2025 -

Exclusive Harvards Funding Crisis Deepens With 1 Billion In Potential Cuts

Apr 22, 2025

Exclusive Harvards Funding Crisis Deepens With 1 Billion In Potential Cuts

Apr 22, 2025 -

Open Ais Chat Gpt Faces Ftc Probe What It Means

Apr 22, 2025

Open Ais Chat Gpt Faces Ftc Probe What It Means

Apr 22, 2025

Latest Posts

-

Celtics Dominant Victory Secures Division Title

May 12, 2025

Celtics Dominant Victory Secures Division Title

May 12, 2025 -

Celtics Clinch Division After Magic Blowout Win

May 12, 2025

Celtics Clinch Division After Magic Blowout Win

May 12, 2025 -

Celtics Division Title Clinched In Commanding Fashion

May 12, 2025

Celtics Division Title Clinched In Commanding Fashion

May 12, 2025 -

Dominant Performance Celtics Claim Division Title

May 12, 2025

Dominant Performance Celtics Claim Division Title

May 12, 2025 -

Celtics Secure Division Crown After Impressive Win

May 12, 2025

Celtics Secure Division Crown After Impressive Win

May 12, 2025