High Stock Market Valuations: BofA's View And Why Investors Shouldn't Panic

Table of Contents

BofA's Assessment of Current High Stock Market Valuations

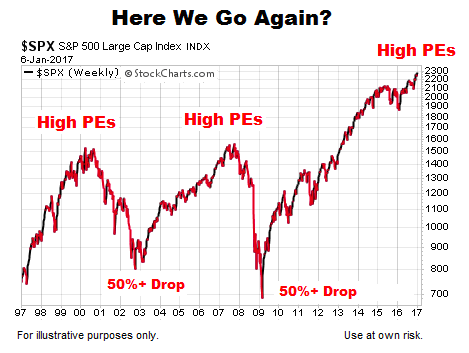

BofA's assessment of current high stock market valuations typically involves analyzing various market capitalization figures and utilizing key stock valuation metrics. Their reports often highlight concerns about specific sectors or indices showing signs of overvaluation. While the specifics vary depending on the report's release date, BofA frequently employs metrics such as the price-to-earnings ratio (P/E ratio), including the cyclically adjusted price-to-earnings ratio (Shiller P/E), and other market multiples to gauge market health.

- Key Findings (Illustrative Example): A hypothetical BofA report might indicate that the technology sector shows elevated P/E ratios compared to historical averages, suggesting potential overvaluation. Meanwhile, more defensive sectors might appear more reasonably valued.

- Valuation Metrics: BofA's analysis likely involves a comprehensive review of P/E ratios across different market segments, alongside other metrics like price-to-sales ratios and dividend yields. They consider these metrics in relation to historical data and compare them across various global markets.

- Caveats: It's crucial to remember that BofA's reports usually include caveats. They acknowledge the influence of factors like low interest rates and strong corporate earnings on valuations, making a straightforward "overvalued" or "undervalued" declaration challenging. Their analysis often presents a nuanced view, highlighting both risks and potential opportunities.

- Data Points (Illustrative): A hypothetical BofA report might show that the S&P 500's Shiller P/E ratio is currently above its long-term average, indicating potentially rich valuations relative to historical norms. However, they might also point out strong earnings growth as a counterbalancing factor.

Factors Contributing to High Stock Market Valuations

Several interconnected factors fuel the current high stock market valuations. Understanding these dynamics is critical for informed investment decisions.

- Low Interest Rates: Historically low interest rates make bonds less attractive, driving investors toward higher-yielding assets like stocks. This increased demand pushes stock prices up, even if underlying fundamentals don't fully justify the higher valuations.

- Quantitative Easing (QE): Central banks' QE programs inject liquidity into the market, increasing the money supply and lowering borrowing costs. This excess liquidity can inflate asset prices, including stocks.

- Inflation and Economic Growth: Moderate inflation and sustained economic growth can boost corporate earnings, justifying higher stock prices to some extent. However, excessively high inflation can erode purchasing power and negatively impact future earnings, thereby affecting valuations.

- Strong Corporate Earnings: Robust corporate earnings reports can support higher stock valuations. Companies demonstrating consistent growth and profitability attract more investment, driving demand and price increases.

- Investor Sentiment and Market Speculation: Positive investor sentiment and market speculation can amplify price increases, leading to a bubble-like effect where prices rise beyond what's fundamentally justified.

Why Investors Shouldn't Panic (Despite High Valuations)

While high stock market valuations present legitimate concerns, a panicked response is usually counterproductive. A calm, measured approach, grounded in a long-term perspective, is generally more effective.

- Long-Term Investment Horizon: Market volatility is inherent. A long-term investment strategy helps to weather short-term fluctuations, allowing the portfolio to benefit from the market's long-term growth potential.

- Diversification: Diversifying across different asset classes (stocks, bonds, real estate, etc.) reduces the overall portfolio risk. If one asset class underperforms, others can potentially offset losses.

- Dollar-Cost Averaging (DCA): DCA involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. This mitigates the risk of investing a lump sum at a market peak.

- Historical Context: Market corrections are a normal part of the market cycle. History demonstrates that even after significant drops, the market typically recovers and continues its upward trend over the long term.

- Risk Tolerance and Investment Goals: Investment decisions should always align with individual risk tolerance and long-term financial objectives. Aggressive investors might tolerate higher risk for potentially higher returns, while conservative investors prioritize capital preservation.

Alternative Investment Strategies in a High-Valuation Market

When stock market valuations appear high, exploring alternative strategies can be beneficial.

- Value Investing: Focusing on undervalued companies with strong fundamentals offers the potential for higher returns when the market eventually recognizes their true worth.

- Dividend Investing: Investing in companies that pay regular dividends provides a steady income stream, mitigating some of the risks associated with market volatility.

- Defensive Stocks: Defensive stocks, representing companies in less cyclical industries, are generally less vulnerable to market downturns.

- Alternative Assets: Diversifying into alternative assets such as real estate or bonds can offer lower correlation with the stock market, reducing overall portfolio volatility. Careful consideration of the specific asset and related risks is necessary.

- Strategic Asset Allocation: Adjusting the allocation between different asset classes based on market conditions helps to optimize risk and return.

Conclusion

While BofA's analysis and other reports acknowledge the high valuations in the current stock market, a knee-jerk reaction of panic selling is rarely the optimal strategy. Understanding the factors driving these valuations, combined with a well-diversified, long-term investment approach, empowers investors to navigate periods of market uncertainty more effectively. By adopting a measured strategy and considering your individual risk tolerance and investment goals, you can position yourself for long-term success.

Call to Action: Don't let concerns about high stock market valuations paralyze your investment decisions. Develop a robust, long-term investment strategy tailored to your financial goals. Learn more about mitigating risk in a high-valuation market and start planning your investment approach today.

Featured Posts

-

77 Inch Lg C3 Oled The Good The Bad And The Verdict

Apr 24, 2025

77 Inch Lg C3 Oled The Good The Bad And The Verdict

Apr 24, 2025 -

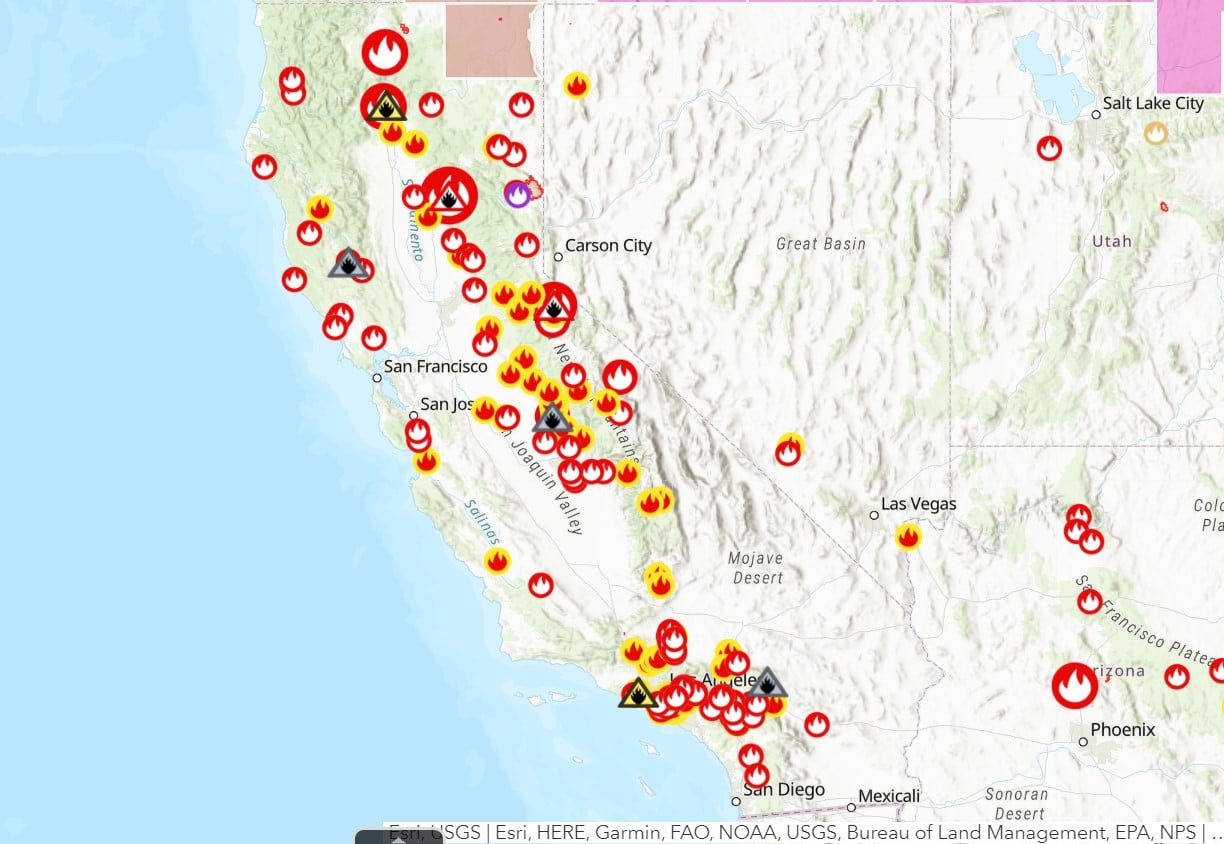

California Wildfires Impact On Celebrities In The Palisades

Apr 24, 2025

California Wildfires Impact On Celebrities In The Palisades

Apr 24, 2025 -

Google Fis New 35 Unlimited Plan Everything You Need To Know

Apr 24, 2025

Google Fis New 35 Unlimited Plan Everything You Need To Know

Apr 24, 2025 -

B And B Wednesday April 9 Recap Steffy Bill Finn And Liams Shocking Developments

Apr 24, 2025

B And B Wednesday April 9 Recap Steffy Bill Finn And Liams Shocking Developments

Apr 24, 2025 -

Post Roe America How Otc Birth Control Reshapes Reproductive Healthcare

Apr 24, 2025

Post Roe America How Otc Birth Control Reshapes Reproductive Healthcare

Apr 24, 2025