High Stock Market Valuations: Why BofA Thinks Investors Shouldn't Worry

Table of Contents

BofA's Arguments Against Immediate Market Correction

BofA's reassuring stance isn't based on blind optimism; it's grounded in a careful analysis of several key economic indicators and market trends. Their argument rests on three primary pillars: strong corporate earnings, the impact of low interest rates, and the promise of long-term growth potential.

Strong Corporate Earnings and Profitability

BofA highlights robust corporate earnings growth as a key justification for current valuations. This isn't merely speculation; it's backed by tangible evidence.

- Strong revenue growth: Many companies are experiencing significant increases in revenue, driven by both organic growth and strategic acquisitions. This reflects a healthy underlying economy and strong consumer demand.

- Efficient cost management: Companies have become increasingly adept at managing costs, leading to improved profit margins even in the face of inflationary pressures. This efficiency boosts profitability and contributes to higher stock prices.

- Improving profit margins: Despite economic headwinds, many sectors are showing improvements in profit margins, demonstrating the resilience and adaptability of corporate strategies.

- Sustained high demand in several sectors: Despite concerns about a potential recession, several key sectors continue to exhibit strong demand, supporting robust earnings growth.

These factors support higher stock prices, even if traditional valuation metrics suggest otherwise. The strength of corporate fundamentals provides a solid foundation for the current market valuations.

Low Interest Rates and Ample Liquidity

Monetary policy plays a significant role in supporting asset prices, and BofA acknowledges this. The current environment of low interest rates and ample liquidity continues to fuel investor appetite for riskier assets like stocks.

- Low borrowing costs encourage investment: Low interest rates make it cheaper for businesses to borrow money, encouraging investment and expansion, further driving economic growth and corporate earnings.

- Abundant liquidity fuels market demand: The ample liquidity in the financial system provides fuel for market demand, pushing up stock prices. This liquidity acts as a buffer against potential economic shocks.

- Potential for further rate cuts if economic conditions warrant: Central banks retain the ability to further stimulate the economy through additional rate cuts should economic conditions deteriorate. This acts as a safety net for the market.

This environment impacts investors' appetite for risk, encouraging participation in the stock market even with elevated valuations.

Long-Term Growth Potential

BofA's perspective extends beyond short-term fluctuations; they focus on the long-term growth prospects of the economy. This long-term view helps contextualize current valuations.

- Technological innovation: Rapid advancements in technology are driving productivity growth and creating new industries and opportunities, fueling long-term economic expansion.

- Demographic shifts: Changes in demographics, such as an aging population in some countries and a growing working-age population in others, create both challenges and opportunities for investment.

- Emerging markets growth: Emerging markets continue to present significant growth potential, attracting investment and expanding the global economy.

- Government infrastructure spending: Increased government spending on infrastructure projects can stimulate economic activity and boost long-term growth.

These factors justify premium valuations for growth stocks and the market as a whole, as investors anticipate the benefits of these long-term trends.

Addressing Concerns About Overvaluation

While acknowledging the apparent high valuations, BofA addresses concerns by offering a more nuanced perspective.

Alternative Valuation Metrics

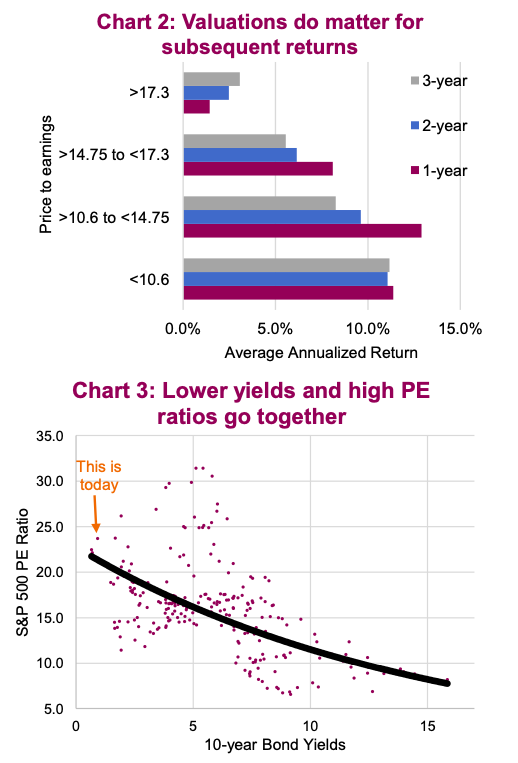

Relying solely on price-to-earnings ratios (P/E) can be misleading. BofA suggests considering alternative metrics for a more comprehensive picture.

- Cyclically adjusted price-to-earnings ratio (CAPE): This metric smooths out short-term fluctuations in earnings, providing a longer-term perspective on valuation.

- Price-to-sales ratio: This ratio compares a company's stock price to its revenue, offering a different valuation perspective, particularly useful for companies with high growth potential but currently low or negative earnings.

- Dividend yield: This metric measures the annual dividend payment relative to the stock price, offering a measure of income return.

These alternative metrics offer a more nuanced view, potentially justifying the current market levels.

Comparison to Historical Market Cycles

Analyzing current valuations within the context of past market cycles provides valuable perspective.

- Identifying periods with similar valuation levels: History shows periods with similarly high valuations, some of which were followed by corrections, while others continued to appreciate.

- Analyzing subsequent market performance: A careful study of past cycles reveals that simply high valuations don't automatically predict an imminent crash. Other factors, such as economic conditions and investor sentiment, play crucial roles.

- Highlighting differences in economic conditions: It's essential to acknowledge differences in macroeconomic conditions between the current environment and those of previous cycles.

Historical context helps mitigate concerns about immediate corrections, emphasizing that high valuations alone aren't a reliable predictor of market crashes.

Managing Risk and Diversification

Even in a potentially overvalued market, strategic risk management is crucial.

- Asset allocation: A well-diversified portfolio, spread across various asset classes, reduces overall portfolio risk.

- Diversification across sectors and asset classes: Don't put all your eggs in one basket. Spread investments across different sectors and asset classes to mitigate risk.

- Strategic rebalancing: Regularly rebalance your portfolio to maintain your target asset allocation, taking advantage of market fluctuations.

These strategies help investors protect themselves even in a potentially overvalued market.

Conclusion

BofA's analysis suggests that while high stock market valuations are a valid concern, they shouldn't trigger immediate panic. Strong corporate earnings, low interest rates, and the promise of long-term growth provide a counter-narrative. However, investors should acknowledge the inherent uncertainties in the market and adopt a well-informed and diversified investment strategy. Don't panic about high stock market valuations; instead, adopt a strategy that considers BofA's analysis, understands the nuances of market valuation, and incorporates robust risk management techniques. Thoroughly research and understand your investments before making any significant decisions. A balanced approach, considering both the potential risks and rewards, is key to navigating the complexities of today's market.

Featured Posts

-

Flstyn Tfasyl Hjwm Washntn Wmtalb Mutlq Alnar

May 23, 2025

Flstyn Tfasyl Hjwm Washntn Wmtalb Mutlq Alnar

May 23, 2025 -

The Power Of C Beebies Bedtime Stories Improving Sleep Habits In Children

May 23, 2025

The Power Of C Beebies Bedtime Stories Improving Sleep Habits In Children

May 23, 2025 -

Zimbabwes Away Test Win In Sylhet A 2 Year Drought Ends

May 23, 2025

Zimbabwes Away Test Win In Sylhet A 2 Year Drought Ends

May 23, 2025 -

Exclusive Report Trumps Private Talks Reveal Putins Ukraine Plans

May 23, 2025

Exclusive Report Trumps Private Talks Reveal Putins Ukraine Plans

May 23, 2025 -

En Tutumlu 3 Burc Paranizi Nasil Korurlar

May 23, 2025

En Tutumlu 3 Burc Paranizi Nasil Korurlar

May 23, 2025

Latest Posts

-

A Couples Fight Joe Jonass Response A Funny Story

May 23, 2025

A Couples Fight Joe Jonass Response A Funny Story

May 23, 2025 -

Joe Jonas And The Couples Hilarious Argument

May 23, 2025

Joe Jonas And The Couples Hilarious Argument

May 23, 2025 -

Joe Jonas And The Hilarious Fight Over Him The Best Response

May 23, 2025

Joe Jonas And The Hilarious Fight Over Him The Best Response

May 23, 2025 -

The Jonas Brothers Couples Argument And Joes Reaction

May 23, 2025

The Jonas Brothers Couples Argument And Joes Reaction

May 23, 2025 -

Joe Jonas Responds To Married Couples Public Dispute

May 23, 2025

Joe Jonas Responds To Married Couples Public Dispute

May 23, 2025