High Stock Valuations And Investor Concerns: BofA's Analysis

Table of Contents

BofA's Key Findings on High Stock Valuations

BofA's recent reports paint a picture of a market grappling with historically high stock valuations, presenting both risks and opportunities for investors. Their analysis focuses on several key factors contributing to this elevated market.

Elevated Price-to-Earnings Ratios

One of BofA's primary concerns centers on elevated Price-to-Earnings (P/E) ratios. These ratios, which compare a company's stock price to its earnings per share, are significantly higher than historical averages across numerous sectors. BofA's data reveals exceptionally high P/E ratios, particularly within the technology and consumer discretionary sectors. This suggests that these sectors may be overvalued compared to their earnings potential.

- High P/E ratios across technology and consumer discretionary sectors: BofA's research pinpoints specific companies and indices exhibiting exceptionally high P/E multiples, exceeding long-term averages by a considerable margin.

- Comparison of current P/E ratios to long-term averages: BofA's analysts highlight the divergence between current P/E ratios and historical norms, emphasizing the potential for a mean reversion – a return to more historically typical valuations.

- Potential for mean reversion in overvalued sectors: This raises concerns about potential market corrections, where stock prices could fall to reflect more sustainable earnings multiples. BofA suggests investors should carefully consider this risk.

The Role of Low Interest Rates

Low interest rates are a significant contributor to inflated stock valuations. These low rates, fueled by quantitative easing (QE) and other accommodative monetary policies, have pushed investors towards higher-yielding assets, including stocks. The low discount rate used to calculate the present value of future earnings significantly inflates the perceived value of companies.

- Low discount rates increase present value of future earnings: Lower interest rates reduce the discount rate applied to future cash flows, making future earnings seem more valuable in present terms. This artificially inflates valuations.

- Impact of near-zero interest rates on investor behavior: Near-zero interest rates have incentivized investors to seek higher returns in the stock market, pushing up demand and valuations.

- BofA's forecast for interest rate hikes and their effect on valuations: BofA's predictions regarding future interest rate increases are crucial. Higher rates could decrease the attractiveness of stocks, potentially leading to a decline in valuations.

Concerns about Inflation and Economic Growth

BofA also expresses concerns about the interplay between inflation, economic growth, and stock valuations. Rising inflation erodes corporate profit margins, potentially impacting future earnings and justifying lower valuations. Simultaneously, a slowdown in economic growth could further dampen earnings and investor sentiment.

- Rising inflation eroding corporate profit margins: Inflation increases input costs for businesses, squeezing profit margins and negatively impacting earnings.

- Potential for supply chain disruptions impacting growth: Ongoing supply chain disruptions could further impede economic growth and corporate profitability.

- BofA's outlook on GDP growth and its influence on stock prices: BofA's predictions for GDP growth directly influence their outlook on stock prices. Slower-than-expected growth could lead to lower valuations.

Investor Concerns and Strategies

The high stock valuations identified by BofA necessitate careful risk management and strategic investment approaches.

Risk Management Strategies in a High-Valuation Environment

In a market characterized by high stock valuations, employing robust risk management strategies is paramount.

- Diversification across different asset classes: Diversification is crucial to mitigate risk and reduce exposure to any single sector or asset class. BofA suggests diversifying across stocks, bonds, real estate, and other assets.

- Focus on value investing and undervalued companies: Value investing, which focuses on identifying companies trading below their intrinsic value, is a key strategy in a high-valuation market.

- Considering hedging strategies to protect against market downturns: Hedging strategies, such as using options or short selling, can help protect portfolios from potential market declines.

Opportunities Amidst High Stock Valuations

While the market presents challenges, opportunities still exist for discerning investors.

- Sectors with strong fundamentals and future growth potential: BofA’s analysis suggests some sectors might be less overvalued and offer attractive growth prospects.

- Companies with robust balance sheets and strong cash flow: Companies with strong financial health are better positioned to weather economic downturns and maintain profitability.

- Strategies for identifying companies trading below intrinsic value: Thorough fundamental analysis is key to identifying companies whose stock prices don't reflect their true worth.

Conclusion

BofA's analysis underscores significant concerns regarding high stock valuations, stemming from low interest rates and potential economic headwinds. Investors must carefully consider these risks and implement robust risk management strategies. While high stock valuations present challenges, opportunities remain for investors who employ a strategic and diversified approach. By focusing on diversification, value investing, and a deep understanding of BofA's insights on current market conditions, investors can navigate this complex landscape. Stay informed about factors influencing high stock valuations and adjust your investment strategies accordingly. Effectively managing your portfolio in the face of high stock valuations requires continuous monitoring and proactive adjustments.

Featured Posts

-

Dy Te Vdekur Pas Sulmit Me Thike Ne Qender Tregtare Te Cekise

May 02, 2025

Dy Te Vdekur Pas Sulmit Me Thike Ne Qender Tregtare Te Cekise

May 02, 2025 -

Medias Definitie Van Een Zware Auto Een Geen Stijl Analyse

May 02, 2025

Medias Definitie Van Een Zware Auto Een Geen Stijl Analyse

May 02, 2025 -

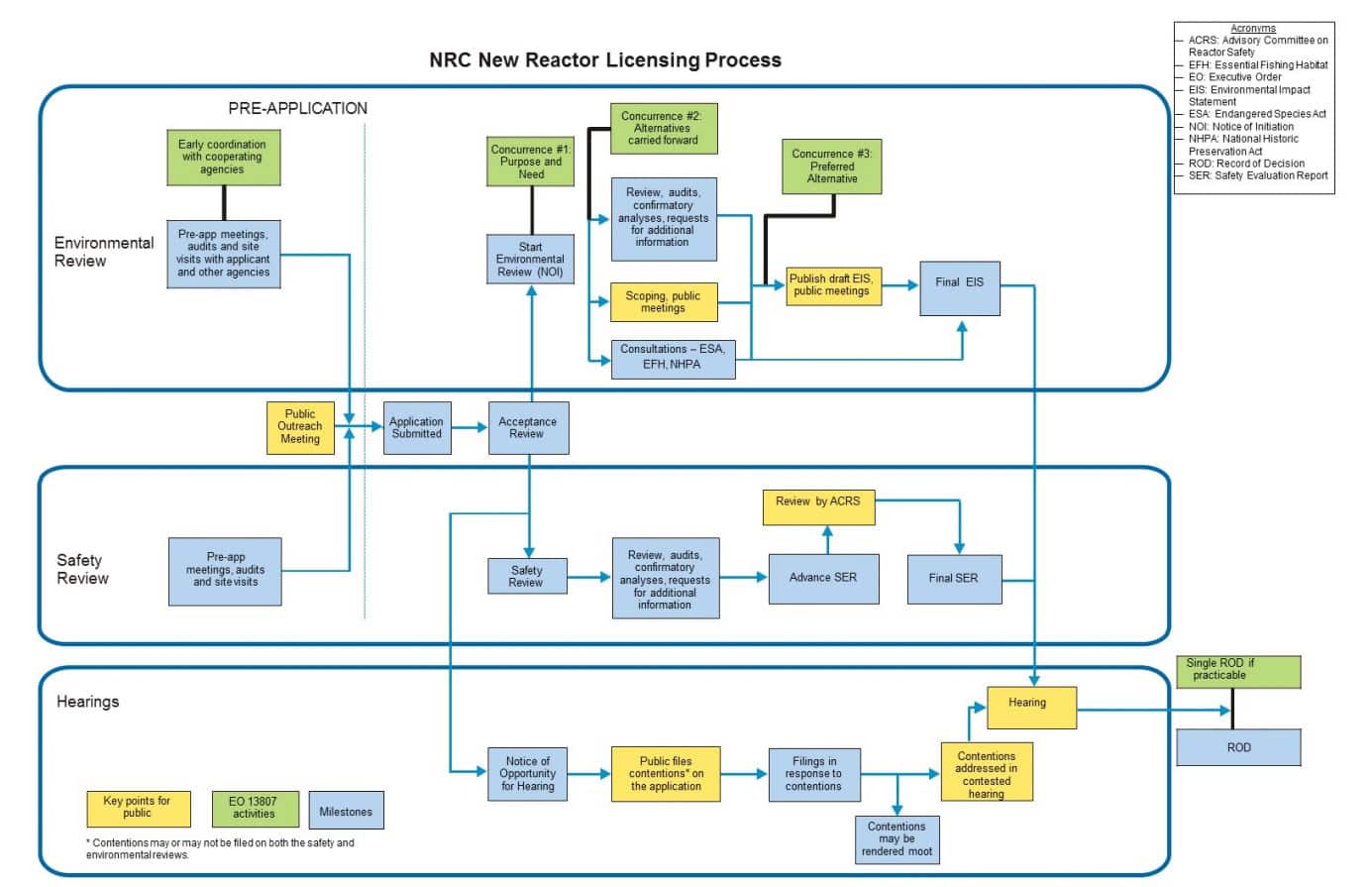

Nrc Reactor Power Uprate Timeline Requirements And Best Practices

May 02, 2025

Nrc Reactor Power Uprate Timeline Requirements And Best Practices

May 02, 2025 -

North Carolina Supreme Court Gop Candidate Challenges Recent Orders

May 02, 2025

North Carolina Supreme Court Gop Candidate Challenges Recent Orders

May 02, 2025 -

Ziaire Williams Nba Redemption A Second Chance Story

May 02, 2025

Ziaire Williams Nba Redemption A Second Chance Story

May 02, 2025

Latest Posts

-

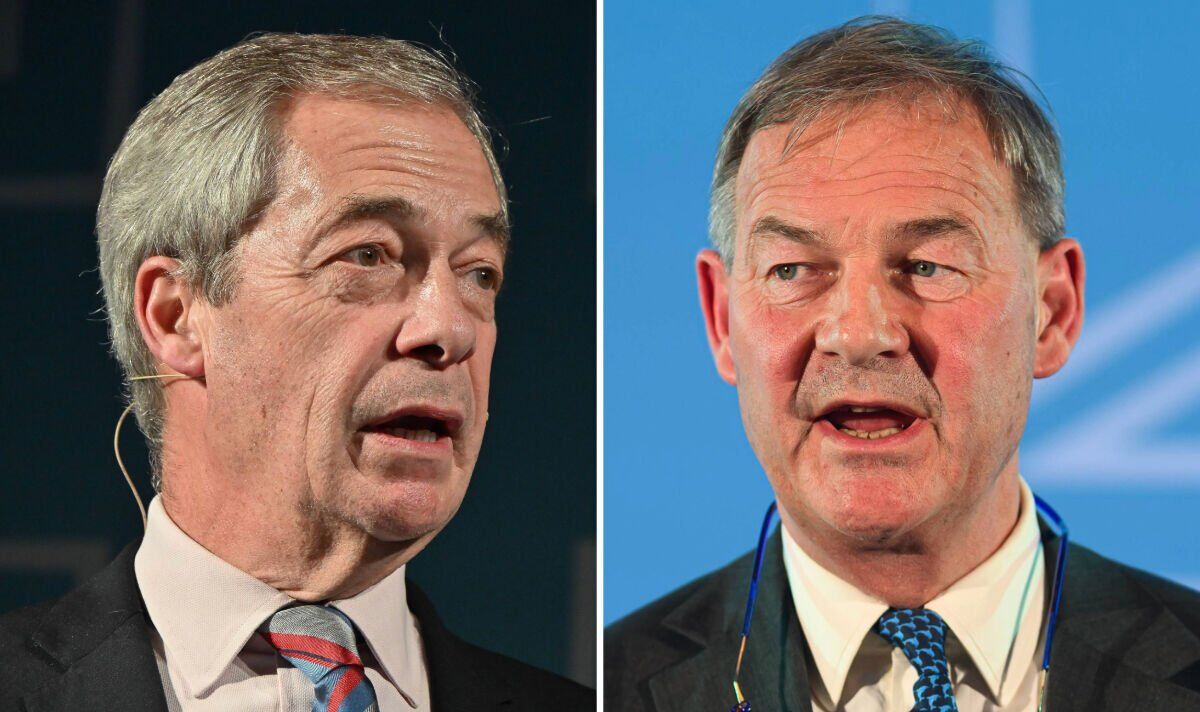

Investigation Launched Police Question Mp Rupert Lowe

May 02, 2025

Investigation Launched Police Question Mp Rupert Lowe

May 02, 2025 -

Tory Infighting Andersons Attack On Lowe Exposes Deep Party Divisions

May 02, 2025

Tory Infighting Andersons Attack On Lowe Exposes Deep Party Divisions

May 02, 2025 -

Civil War In The Conservative Party Lee Anderson And Rupert Lowe Clash

May 02, 2025

Civil War In The Conservative Party Lee Anderson And Rupert Lowe Clash

May 02, 2025 -

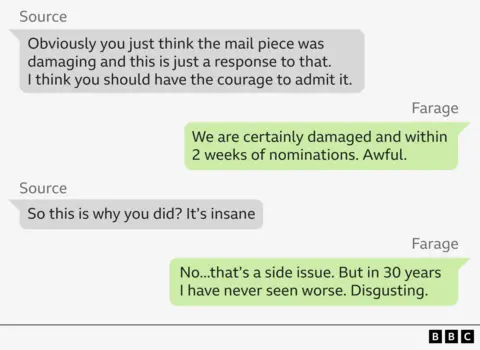

Reform Party Divided Leaked Farage Messages Expose Internal Strife

May 02, 2025

Reform Party Divided Leaked Farage Messages Expose Internal Strife

May 02, 2025 -

Credible Evidence Of Unlawful Harassment The Rupert Lowe And Reform Shares Case

May 02, 2025

Credible Evidence Of Unlawful Harassment The Rupert Lowe And Reform Shares Case

May 02, 2025