High Stock Valuations: BofA Explains Why Investors Shouldn't Panic

Table of Contents

High stock valuations are a frequent cause for investor anxiety. The market's upward trajectory often leads to questions about whether a correction or even a crash is imminent. Recently, Bank of America (BofA) has offered insights suggesting that a panic sell-off might be premature. This article explores BofA's reasoning, examining the key factors contributing to current market conditions and explaining why a measured approach could be more beneficial than reacting to perceived risk. We'll delve into the nuances of high stock valuations and provide perspective on how investors can navigate this market environment effectively.

BofA's Rationale: Understanding the Underlying Factors

BofA's assessment of high stock valuations doesn't dismiss the concerns entirely; instead, it highlights several underlying factors that temper the immediate need for panic. These factors provide context and suggest a more nuanced understanding of the current market situation is needed.

Low Interest Rates and Their Impact

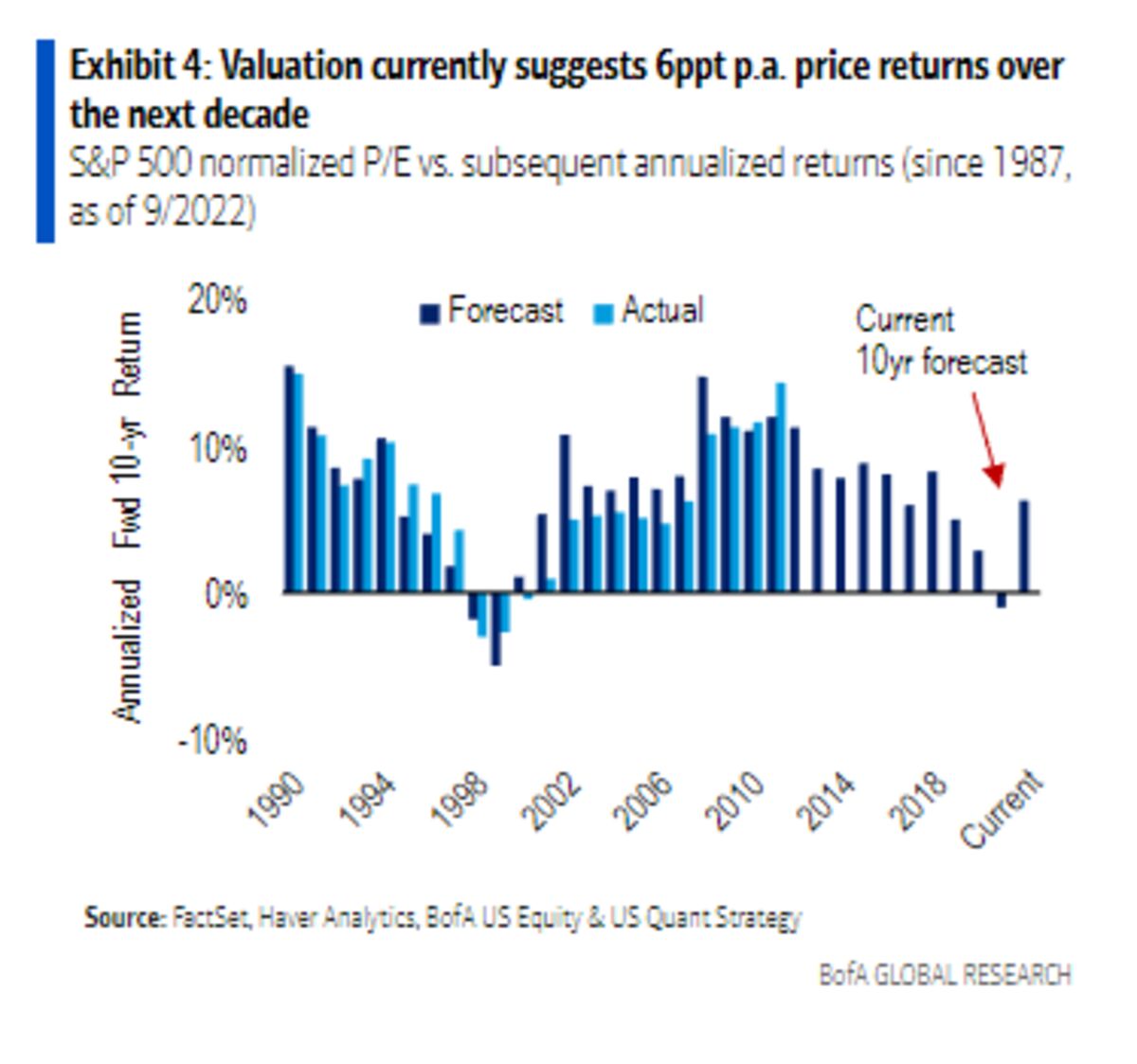

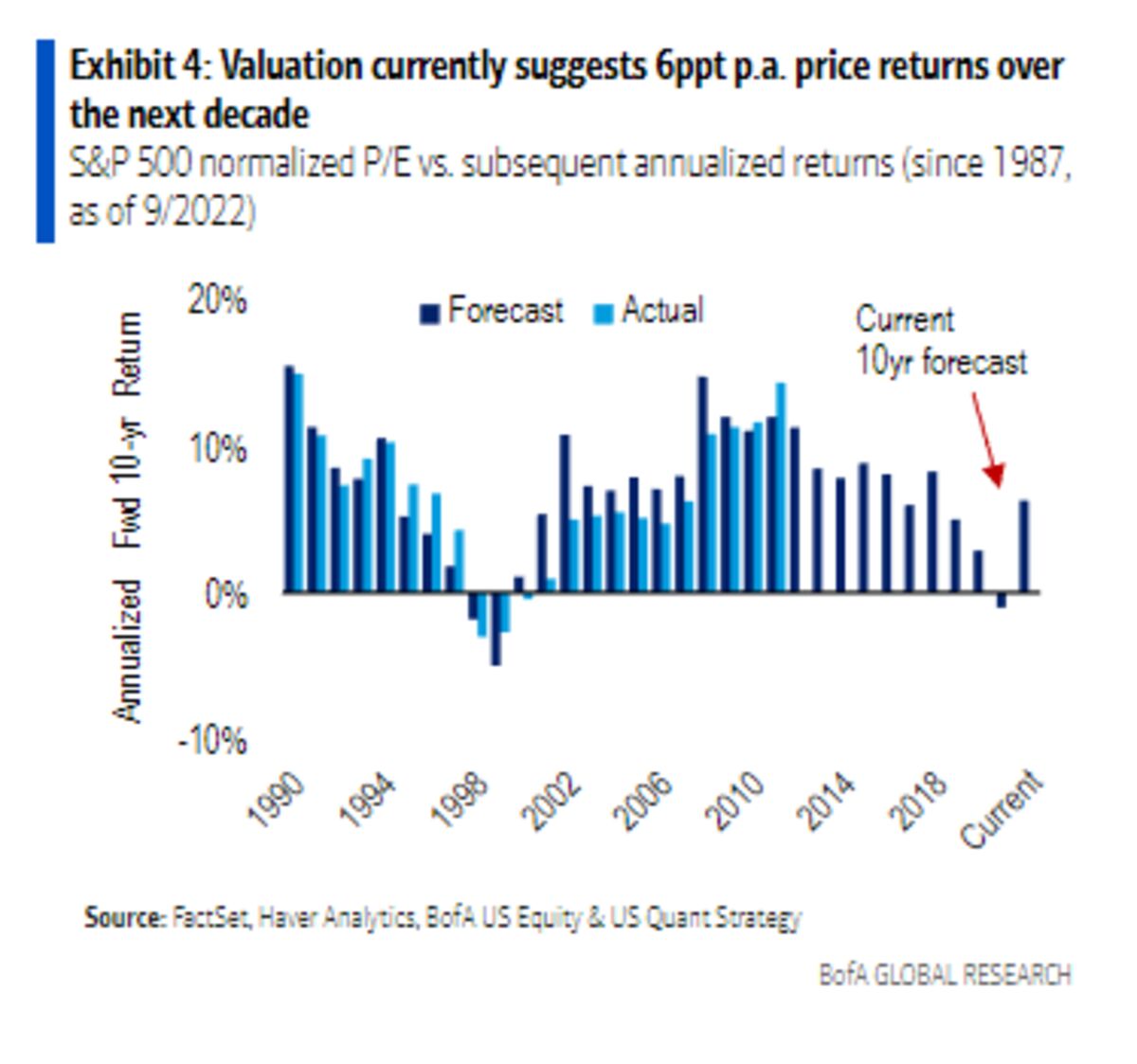

Historically low interest rates significantly influence stock valuations. These low rates make higher price-to-earnings (P/E) ratios seem less alarming compared to historical norms.

- Discounted Cash Flow Valuations: Low interest rates decrease the discount rate used in discounted cash flow (DCF) models. This, in turn, increases the present value of future earnings, resulting in higher valuations.

- Investor Risk Appetite: Low interest rates incentivize investors to seek higher returns in riskier assets, like stocks, driving up demand and prices. The reduced attractiveness of low-yield bonds pushes capital towards equities.

- Risk-Free Rate Influence: The "risk-free rate," typically represented by government bond yields, is a key component of many stock valuation models. Lower risk-free rates imply investors are accepting lower returns for less risk, potentially justifying higher valuations for riskier assets like stocks.

Strong Corporate Earnings and Future Growth Projections

Robust corporate earnings and positive future growth projections are crucial justifications for current valuations. Many companies have shown impressive performance, supporting the higher stock prices.

- High-Performing Sectors: Strong performance across various sectors, including technology, healthcare, and consumer staples, contributes to overall market strength and higher valuations.

- Earnings Growth Trends: Analyzing earnings growth trends provides valuable insights into the sustainability of current valuations. Consistent growth signals a healthy market, supporting higher prices.

- Forward-Looking Projections: Forward-looking projections, based on anticipated future growth, play a significant role in valuation models. Positive outlooks justify higher valuations even if current P/E ratios appear high.

Inflation and its Influence on Asset Prices

Inflation is a key concern for investors, and its impact on stock valuations is complex. BofA's perspective acknowledges this complexity.

- Inflation's Impact on Interest Rates: Inflation often leads to increased interest rates, potentially impacting stock valuations negatively as discount rates rise. However, current inflation levels and central bank responses are highly debated.

- Inflation and Corporate Profitability: The impact of inflation on corporate profitability is variable and depends on the ability of companies to pass on increased costs to consumers. BofA’s analysis likely considers the sector-specific effects.

- BofA's Inflation Outlook: BofA's analysis likely includes a forecast for future inflation and its potential effect on stock prices. This forward-looking view is crucial for assessing the long-term implications of inflation on valuations.

Alternative Investment Strategies During High Valuations

Even during periods of high valuations, investors can employ several strategies to mitigate risk and potentially enhance returns.

Diversification and Portfolio Rebalancing

A well-diversified portfolio is crucial for mitigating risk during periods of high valuations. This involves spreading investments across various assets.

- Diversification Strategies: Diversification strategies can include diversifying across sectors (technology, energy, healthcare), geographies (domestic vs. international stocks), and asset classes (stocks, bonds, real estate).

- Portfolio Rebalancing: Regular portfolio rebalancing involves adjusting your asset allocation to maintain your target percentages. This helps manage risk and take advantage of market fluctuations.

- Asset Allocation: Strategic asset allocation involves carefully choosing the proportions of different asset classes in your portfolio based on your risk tolerance and investment goals.

Value Investing and Identifying Undervalued Assets

Value investing focuses on identifying undervalued assets, regardless of overall market conditions. This approach can be effective even in a high-valuation environment.

- Fundamental Analysis: Fundamental analysis involves examining a company's financial statements, business model, and competitive landscape to determine its intrinsic value.

- Due Diligence: Thorough due diligence, including research and analysis, is critical for identifying potentially undervalued companies.

- Undervaluation Indicators: Indicators of potential undervaluation might include low P/E ratios relative to industry peers, strong cash flows, or positive growth prospects that aren't fully reflected in the stock price.

Conclusion

BofA's analysis suggests that while high stock valuations are a valid concern, they aren't necessarily a reason for immediate panic. Factors such as low interest rates, strong corporate earnings, and future growth potential contribute to the current market landscape. A cautious yet measured approach, focusing on diversification and strategic investing, is likely a more prudent response than rash actions. Don't let high stock valuations cause unnecessary anxiety. Understand the underlying factors driving market conditions and implement a balanced investment strategy. Learn more about navigating high stock valuations and making informed decisions for your portfolio.

Featured Posts

-

Paige Buecker Jersey Where To Buy Before Her Debut Game

May 19, 2025

Paige Buecker Jersey Where To Buy Before Her Debut Game

May 19, 2025 -

Saturday Night Live Fan Concerns Over Potential Cast Member Departure

May 19, 2025

Saturday Night Live Fan Concerns Over Potential Cast Member Departure

May 19, 2025 -

Will Mairon Santos Fight With Sodiq Yusuff Determine His Permanent Move To Lightweight

May 19, 2025

Will Mairon Santos Fight With Sodiq Yusuff Determine His Permanent Move To Lightweight

May 19, 2025 -

The Classic French Chocolate Salami A Traditional Dessert Recipe

May 19, 2025

The Classic French Chocolate Salami A Traditional Dessert Recipe

May 19, 2025 -

Biological Parents Arrested Following Dalfsen Amber Alert Child Rescue

May 19, 2025

Biological Parents Arrested Following Dalfsen Amber Alert Child Rescue

May 19, 2025