High Stock Valuations: BofA's Case For Investor Confidence

Table of Contents

H2: BofA's Rationale for High Stock Valuations:

BofA's bullish outlook isn't based on blind optimism. Their analysis points to several fundamental factors supporting current valuations, despite the seemingly high price tags on many stocks. Let's examine the key pillars of their argument:

H3: Strong Corporate Earnings and Profitability:

BofA's case rests heavily on the strength of corporate fundamentals. They highlight robust earnings growth and increased profitability across numerous sectors, suggesting that valuations, while high, are justified by underlying performance. This isn't simply a matter of opinion; they back their claims with data.

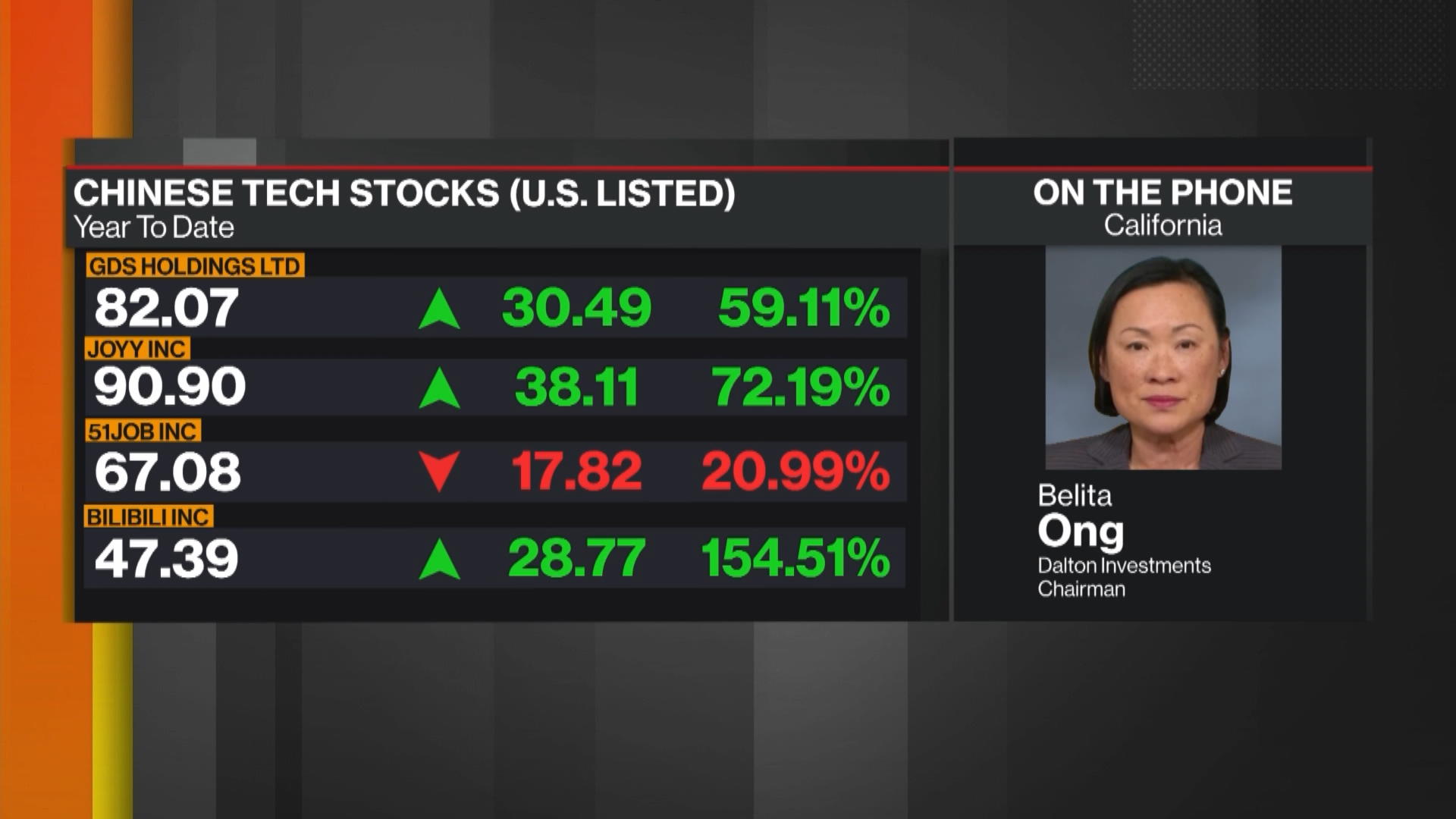

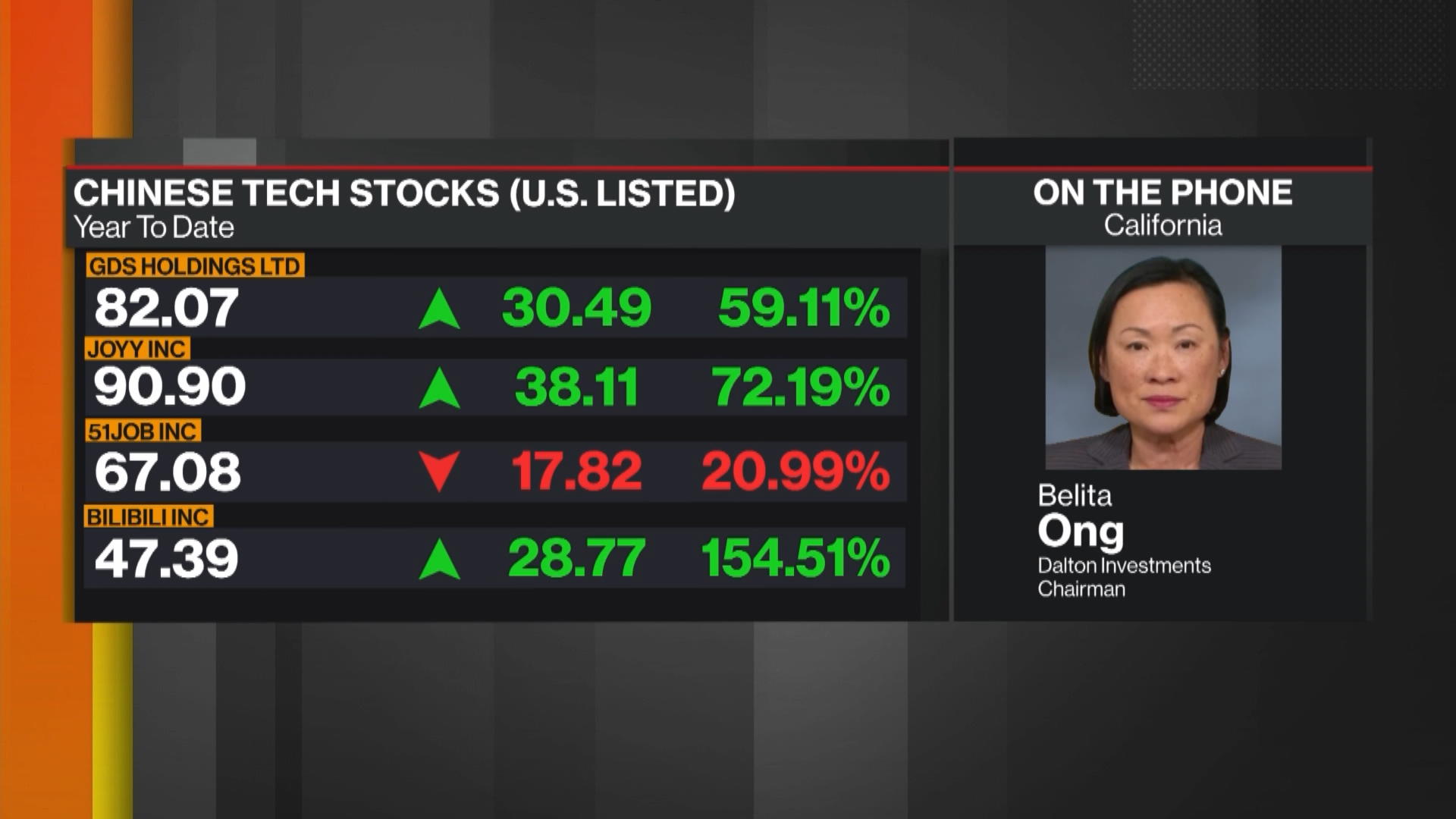

- Examples of strong earnings growth: The technology sector, particularly companies involved in cloud computing and artificial intelligence, have shown exceptional earnings growth. Similarly, certain segments of the consumer staples and healthcare industries demonstrate consistent profitability.

- Data Sources: BofA cites its own proprietary research, including detailed earnings forecasts and analysis of financial statements from a wide range of publicly traded companies. Their reports frequently reference S&P 500 data, providing context to broader market trends.

- Long-term perspective: BofA emphasizes the importance of a long-term investment horizon. They argue that short-term market fluctuations should not overshadow the underlying strength of many companies and the potential for continued growth.

H3: Low Interest Rates and Monetary Policy:

Low interest rates play a significant role in influencing stock valuations. When borrowing costs are low, investors are more likely to seek higher returns in the equity markets, pushing up stock prices. BofA acknowledges this dynamic and, while acknowledging potential risks associated with low interest rates, projects a continued period of low rates, at least in the near term.

- Low Rates and P/E Ratios: Low interest rates contribute to higher Price-to-Earnings (P/E) ratios. This is because investors are willing to pay more for a company's earnings when the cost of borrowing is low, driving up stock valuations.

- Potential Risks of Low Interest Rates: BofA does acknowledge potential risks, such as increased inflation or asset bubbles. However, their analysis suggests these risks are currently manageable, at least in the context of their broader economic outlook.

- Future Monetary Policy: BofA's predictions for future monetary policy influence their valuation assessments. While the exact timing and magnitude of interest rate increases remain uncertain, their projection of gradual increases supports their relatively bullish outlook.

H3: Innovation and Technological Advancements:

Technological disruption is a key driver of high stock valuations in certain sectors. BofA highlights the transformative potential of technologies such as artificial intelligence, cloud computing, and biotechnology, emphasizing the growth prospects these advancements offer.

- Technology's Impact on Stock Prices: Companies at the forefront of technological innovation often command high valuations due to their growth potential and market dominance. Examples include prominent companies in the cloud computing sector that have seen significant stock price appreciation in recent years.

- Examples of Benefiting Companies: BofA points to specific examples of companies that have profited substantially from technological advancements, further substantiating their view on the importance of innovation in driving higher stock valuations.

- Long-term Implications: The long-term impact of technological trends on stock valuations is significant. BofA suggests that these advancements will continue to drive growth and justify, at least partially, the current high valuations.

H3: Addressing Valuation Concerns and Risks:

BofA acknowledges the legitimate concerns about high stock valuations. The potential for market bubbles, inflationary pressures, and geopolitical uncertainty are all valid points.

- Valuation Metrics: BofA's analysis considers various valuation metrics, including P/E ratios, Shiller P/E (CAPE) ratios, and other relevant indicators to provide a more nuanced perspective. They emphasize that no single metric provides a complete picture.

- Potential Risks and Uncertainties: BofA carefully addresses the risks, including the potential for interest rate hikes, inflation, and global economic slowdowns, highlighting how these uncertainties could affect stock market performance.

- Risk Mitigation Strategies: BofA recommends diversification, careful due diligence, and a long-term investment horizon as key strategies for mitigating risk in the current market. They advise investors to maintain a balanced approach, considering their individual risk tolerance and financial goals.

3. Conclusion: Investing with Confidence in the Face of High Stock Valuations

BofA's analysis suggests that while stock valuations are high, several fundamental factors support their current levels. Strong corporate earnings, low interest rates, and technological advancements contribute significantly to this view. However, potential risks, such as inflation and geopolitical uncertainty, should be carefully considered.

Key Takeaways: Understanding the interplay of these factors is crucial for investors. BofA emphasizes the importance of a long-term perspective and suggests that current high valuations are, at least partly, justified by underlying economic strength and innovation.

Call to Action: While understanding the complexities of high stock valuations is crucial, BofA's analysis provides valuable insights for navigating the current market. Learn more about mitigating risk and making informed decisions in the face of high stock valuations by reviewing BofA's research reports and seeking professional financial advice.

Future Outlook: The future trajectory of stock valuations depends on several factors, including future interest rate hikes, the pace of economic growth, and the continued success of innovative technologies. Ongoing monitoring of economic indicators and corporate performance remains crucial.

Featured Posts

-

Marcelo Rios Dios Del Tenis Segun Un Tenista Argentino

May 30, 2025

Marcelo Rios Dios Del Tenis Segun Un Tenista Argentino

May 30, 2025 -

Nissan Primera Electric Revival Is It Happening

May 30, 2025

Nissan Primera Electric Revival Is It Happening

May 30, 2025 -

Virginia Reports Second Measles Case In 2025 Health Officials Investigate

May 30, 2025

Virginia Reports Second Measles Case In 2025 Health Officials Investigate

May 30, 2025 -

Emission Integrale Europe 1 Soir Du 19 Mars 2025

May 30, 2025

Emission Integrale Europe 1 Soir Du 19 Mars 2025

May 30, 2025 -

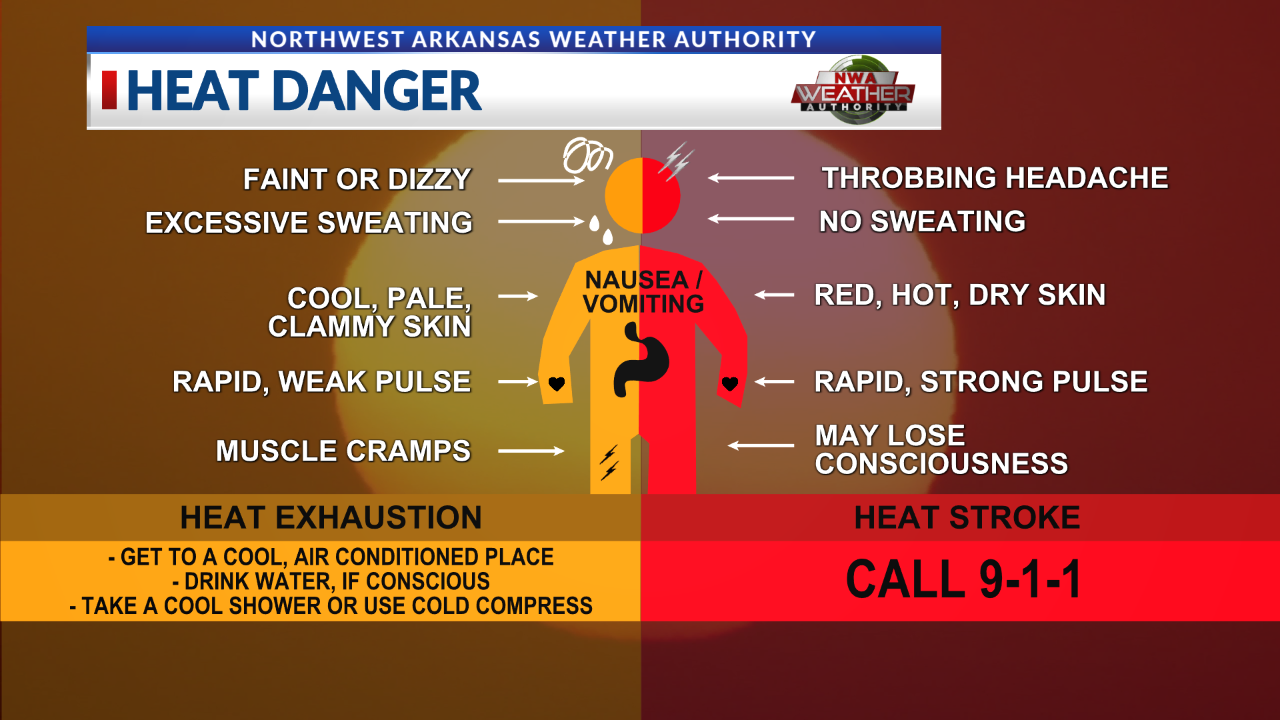

Understanding The Absence Of Excessive Heat Warnings In Weather Reports

May 30, 2025

Understanding The Absence Of Excessive Heat Warnings In Weather Reports

May 30, 2025

Latest Posts

-

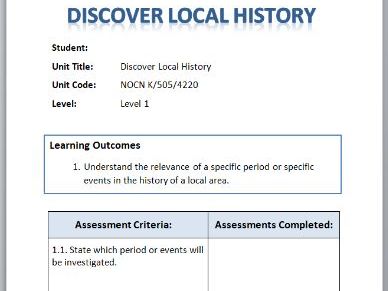

Discover Local History In Depth Coverage From Kpc News

May 31, 2025

Discover Local History In Depth Coverage From Kpc News

May 31, 2025 -

Understanding The Past Historical Resources From Kpc News

May 31, 2025

Understanding The Past Historical Resources From Kpc News

May 31, 2025 -

The Francis Scott Key Bridge Disaster A Look Back At March 26 1968

May 31, 2025

The Francis Scott Key Bridge Disaster A Look Back At March 26 1968

May 31, 2025 -

Kpc News Delving Into The Rich History Of Location

May 31, 2025

Kpc News Delving Into The Rich History Of Location

May 31, 2025 -

Report Details High Fentanyl Levels In Princes System March 26th

May 31, 2025

Report Details High Fentanyl Levels In Princes System March 26th

May 31, 2025