Higher Market Prices Despite Investor Concerns: Is More Pain Ahead?

Table of Contents

Analyzing the Current Market Upturn

The current market upturn, marked by higher market prices, presents a perplexing paradox. While investor sentiment remains largely negative, reflecting significant market volatility, asset values continue to rise. Understanding this disconnect is crucial for navigating the current investment climate.

Factors Contributing to Higher Prices

Several factors contribute to these higher prices, despite widespread investor anxiety:

- Unexpected Economic Resilience: Stronger-than-expected employment numbers and sustained consumer spending have defied recessionary predictions. For example, the recent unemployment rate in [Insert Country/Region] fell to [Insert Data], exceeding analyst expectations. This robust economic activity fuels investor confidence, albeit cautiously.

- Corporate Earnings Surpassing Expectations: Certain sectors, particularly [mention specific sectors, e.g., technology, energy], have reported surprisingly strong corporate earnings, bolstering market sentiment. This positive news counteracts some of the negative narratives driving investor anxieties.

- Government Intervention and Stimulus Packages: Government interventions, including continued stimulus measures in some economies, have injected liquidity into the market, supporting asset prices. The impact of these measures is a complex issue, debated extensively among economists.

- Geopolitical Events and Their Impact on Investment Flows: Geopolitical events, while creating uncertainty, can also drive investment flows into specific sectors or assets deemed safe havens, ultimately influencing overall market prices. For instance, the ongoing conflict in [mention specific geopolitical event] has led to increased investment in [mention specific asset class].

- Inflationary Pressures and Their Effect on Asset Values: While inflation is a significant concern for investors, it can also drive up asset prices as investors seek to protect their purchasing power. The recent inflation rate of [Insert Data] has prompted investors to re-evaluate their portfolios.

Investor Sentiment and its Contradiction

Despite the upward trend in market prices, investor sentiment remains overwhelmingly cautious.

- Surveys Indicating Widespread Concern: Numerous investor surveys reveal widespread concerns about a looming recession or market correction. [Cite specific survey data].

- Increased Allocation to Safe Haven Assets: Investors are increasingly allocating funds to safe-haven assets like gold and government bonds, indicating a preference for preserving capital over pursuing higher returns.

- Bearish Market Predictions: Many leading analysts continue to predict a market downturn, highlighting the prevailing bearish sentiment. [Cite examples of analyst predictions].

- Gap Between Sentiment and Behavior: The gap between negative investor sentiment and actual market behavior underscores the complexity of the current market dynamics. This divergence may be attributed to factors such as algorithmic trading and short-term speculation, influencing market price increases irrespective of investor sentiment.

Understanding Investor Concerns

The current market situation is fraught with legitimate concerns that are driving investor anxiety and contributing to market volatility.

Inflationary Pressures and Interest Rate Hikes

Rising interest rates, implemented to combat inflation, pose a significant challenge for investors.

- Impact on Borrowing Costs: Higher interest rates increase borrowing costs for businesses and consumers, potentially hindering economic growth.

- Potential for Recession: Aggressive monetary policy aimed at curbing inflation increases the risk of triggering a recession.

- Inflation Data Analysis: The trajectory of inflation remains uncertain, making it difficult to predict the future path of interest rates.

Geopolitical Instability and Uncertainty

Geopolitical instability and uncertainty add another layer of complexity to the current market landscape.

- Global Conflicts and Tensions: Ongoing global conflicts and political tensions introduce significant uncertainty into the market, contributing to volatility.

- Supply Chain Disruptions: Supply chain disruptions caused by geopolitical events exacerbate inflationary pressures and impact market stability.

- Geopolitical Risk Assessment: The overall assessment of geopolitical risks and their potential consequences for investors remains a critical factor influencing market behavior and investor decisions.

Predicting Future Market Trends: Is More Pain Ahead?

Predicting the future direction of the market remains challenging, given the interplay of various economic and geopolitical factors.

Scenario Analysis

Several potential market scenarios are plausible:

- Soft Landing: A scenario where inflation gradually decreases without a significant economic downturn.

- Mild Recession: A relatively short and shallow recession with a limited impact on market prices.

- Sharp Downturn: A severe economic contraction leading to a significant market correction.

The likelihood of each scenario depends on several factors, including the effectiveness of monetary policy, the evolution of geopolitical events, and the resilience of the global economy. The potential impact on different asset classes would vary significantly depending on the chosen scenario.

Strategies for Navigating Market Uncertainty

Navigating this period of uncertainty requires a cautious approach:

- Diversification: Diversifying investments across different asset classes can help mitigate risk.

- Long-Term Horizon: Maintaining a long-term investment horizon helps weather short-term market fluctuations.

- Risk Management: Implementing robust risk management strategies is crucial for protecting capital. This includes regular portfolio reviews and adjustments based on market conditions. Consider setting stop-loss orders to limit potential losses.

Conclusion: Higher Market Prices Despite Investor Concerns – Navigating the Future

In conclusion, the current market presents a paradoxical situation: higher market prices despite widespread investor concerns. This is driven by a confluence of factors, including unexpected economic resilience, strong corporate earnings in specific sectors, government intervention, geopolitical events, and inflationary pressures. However, significant uncertainties remain, including the potential for a recession triggered by rising interest rates and ongoing geopolitical instability. The future trajectory of the market remains uncertain, and investors must exercise caution. Diversification, a long-term investment horizon, and proactive risk management are key strategies for navigating the current market climate characterized by higher market prices despite investor concerns. Consult with a financial advisor to develop a personalized investment plan that addresses your specific concerns and risk tolerance related to higher market prices despite investor concerns. Stay informed about market trends and adapt your investment strategy accordingly.

Featured Posts

-

Pan Nordic Defense The Role Of Swedish Tanks And Finnish Troops

Apr 22, 2025

Pan Nordic Defense The Role Of Swedish Tanks And Finnish Troops

Apr 22, 2025 -

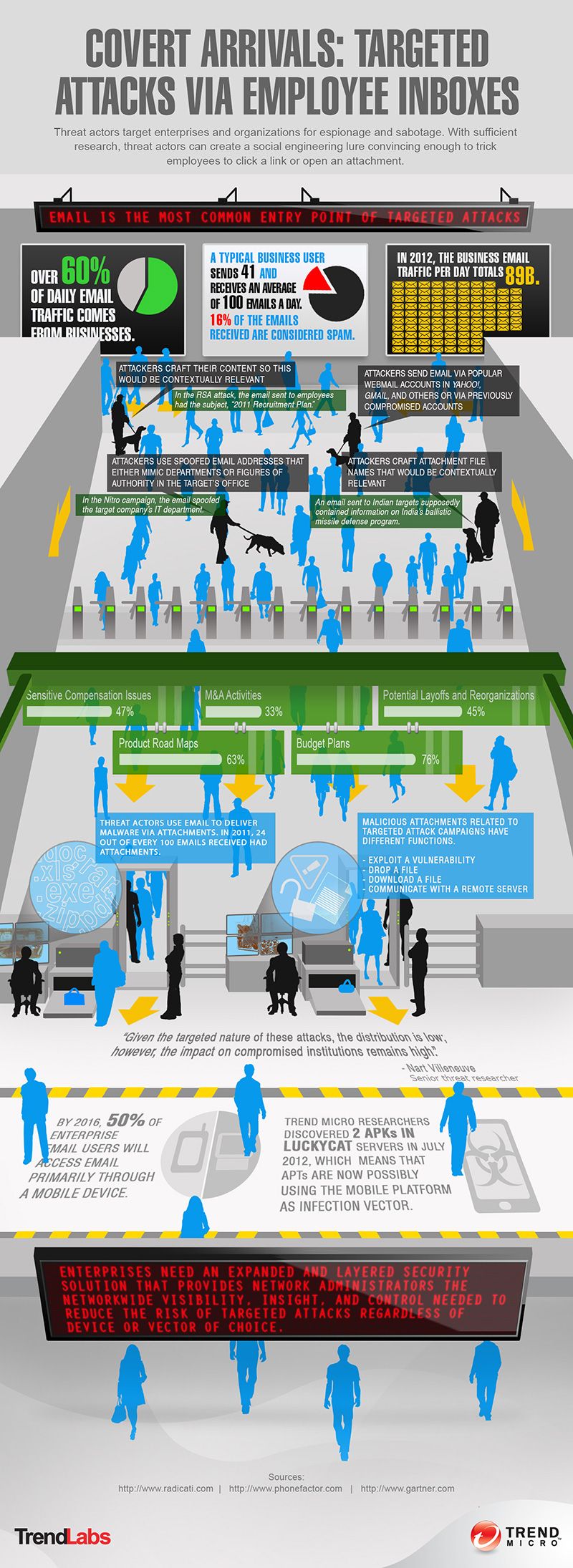

Massive Office365 Data Breach Executive Inboxes Targeted Millions Stolen

Apr 22, 2025

Massive Office365 Data Breach Executive Inboxes Targeted Millions Stolen

Apr 22, 2025 -

Cassidy Hutchinson Key Witness To Reveal All In Upcoming Memoir

Apr 22, 2025

Cassidy Hutchinson Key Witness To Reveal All In Upcoming Memoir

Apr 22, 2025 -

Gambling On Calamity Examining The Market For Wildfire Bets In Los Angeles

Apr 22, 2025

Gambling On Calamity Examining The Market For Wildfire Bets In Los Angeles

Apr 22, 2025 -

500 Million Bread Price Fixing Settlement Canadian Hearing Set For May

Apr 22, 2025

500 Million Bread Price Fixing Settlement Canadian Hearing Set For May

Apr 22, 2025

Latest Posts

-

Review Of Adidas 3 D Printed Sneakers Are They Worth The Hype

May 12, 2025

Review Of Adidas 3 D Printed Sneakers Are They Worth The Hype

May 12, 2025 -

Figmas Ceo On His New Ai Strategy

May 12, 2025

Figmas Ceo On His New Ai Strategy

May 12, 2025 -

Adidas 3 D Printed Sneaker Review A Detailed Look

May 12, 2025

Adidas 3 D Printed Sneaker Review A Detailed Look

May 12, 2025 -

Conquer Your Devices The Ultimate Guide To Universal Remotes

May 12, 2025

Conquer Your Devices The Ultimate Guide To Universal Remotes

May 12, 2025 -

Streamline Your Tech The One Controller Solution

May 12, 2025

Streamline Your Tech The One Controller Solution

May 12, 2025