Highway 407 East Tolls And Ontario Gas Tax: A Permanent Solution?

Table of Contents

The Current State of Highway 407 East Tolls

Toll Rates and their Impact on Commuters

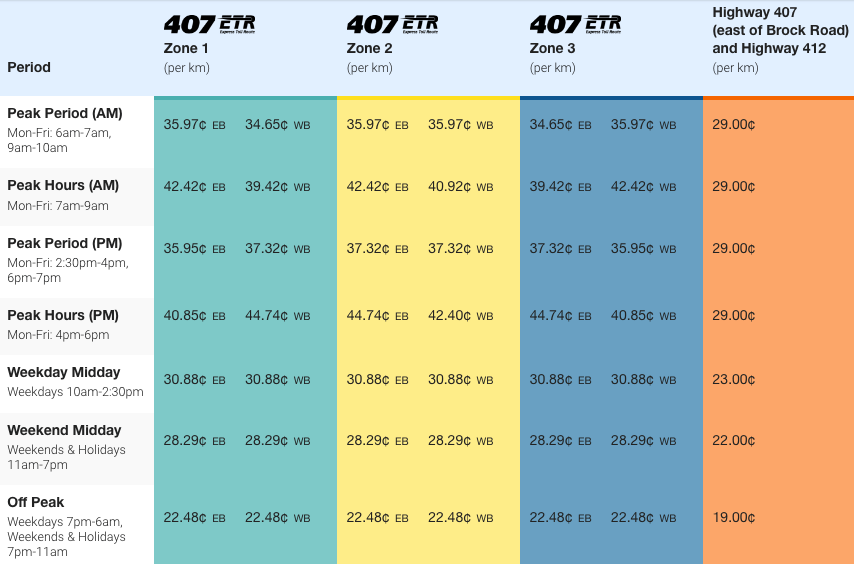

The Highway 407 East toll structure is complex, varying significantly based on distance travelled and time of day. This dynamic pricing system, while designed to manage traffic flow, can lead to unpredictable and sometimes exorbitant costs for drivers.

- Example 1: A short trip during off-peak hours might cost a few dollars, while the same trip during rush hour could easily cost ten times more.

- Example 2: A longer commute from Pickering to Toronto can easily reach $20 or more during peak periods, significantly impacting daily budgets.

- Comparison: Compared to other toll highways in Ontario and across North America, the 407 ETR tolls are often considered among the highest.

This variability in Highway 407 East tolls makes budgeting difficult for many drivers, leading to financial uncertainty and frustration. Understanding the nuances of 407 ETR tolls and their impact on personal finances is crucial for commuters.

Transparency and Predictability of Tolls

While the 407 ETR website provides online tools and apps for estimating toll costs, the accuracy and ease of use of these tools remain a subject of debate. Many drivers find calculating their precise 407 toll costs challenging, especially for infrequent users.

- Online tools: While the 407 ETR toll calculator exists, its accuracy can vary depending on the inputted information and real-time traffic conditions.

- App limitations: Mobile apps, while convenient, often require a stable internet connection for accurate cost estimations.

- Improvements needed: Greater transparency, possibly through clearer visual representations of toll costs based on time and distance, could significantly improve user experience and predictability.

Improving the transparency of 407 ETR pricing and simplifying the toll calculation process is essential for building driver confidence and ensuring fair pricing.

Ontario's Gas Tax and its Role in Highway Funding

Allocation of Gas Tax Revenue

Ontario's gas tax revenue plays a crucial role in funding highway maintenance and new construction projects. However, tracking the precise allocation of these funds to specific projects can be challenging.

- Revenue distribution: A portion of the gas tax revenue is earmarked for specific highway projects outlined in the provincial budget.

- Recent projects: Examples of recent infrastructure projects funded partially or wholly by the gas tax include highway resurfacing, bridge repairs, and the expansion of certain highway segments.

- Transparency challenges: The lack of detailed public reporting on how gas tax revenue is allocated makes it difficult to assess the efficiency and effectiveness of this funding mechanism.

Ensuring transparency in the allocation of Ontario gas tax revenue is critical for public accountability and effective infrastructure management.

The Equity of Gas Tax Funding

The equity of using gas tax to fund highway infrastructure is a complex issue. While the gas tax contributes significantly to highway funding, its impact is not evenly distributed across income groups.

- Disproportionate impact: Lower-income individuals, who often rely more heavily on their vehicles for commuting and transportation, are disproportionately affected by higher gas prices.

- Income disparity: Higher-income drivers, who may have alternative transportation options or are less sensitive to fuel price fluctuations, bear a relatively smaller burden.

- Alternative considerations: This disparity raises questions about the fairness of solely relying on gas tax for highway funding, prompting exploration of alternative funding models that distribute the financial burden more equitably.

Alternative Funding Models for Highway Infrastructure

Public-Private Partnerships

Public-private partnerships (P3s) offer an alternative approach to highway funding and construction. These partnerships involve collaboration between the government and private sector companies.

- Advantages: P3s can leverage private sector expertise and capital, potentially accelerating project completion and reducing upfront government spending.

- Disadvantages: P3s can be complex to negotiate and manage, and the long-term financial implications for taxpayers need careful consideration.

- Examples: Ontario has a mixed record with P3s; some have been successful, while others have faced criticism regarding cost overruns and delays.

Careful analysis of the potential benefits and risks associated with P3 highway funding is necessary for informed decision-making.

Increased Investment in Public Transit

Investing in public transit offers a potentially transformative approach to reducing traffic congestion and the need for extensive highway expansion.

- Reduced reliance on vehicles: Improved public transit systems can reduce reliance on personal vehicles, decreasing demand for highway infrastructure and lowering overall transportation costs.

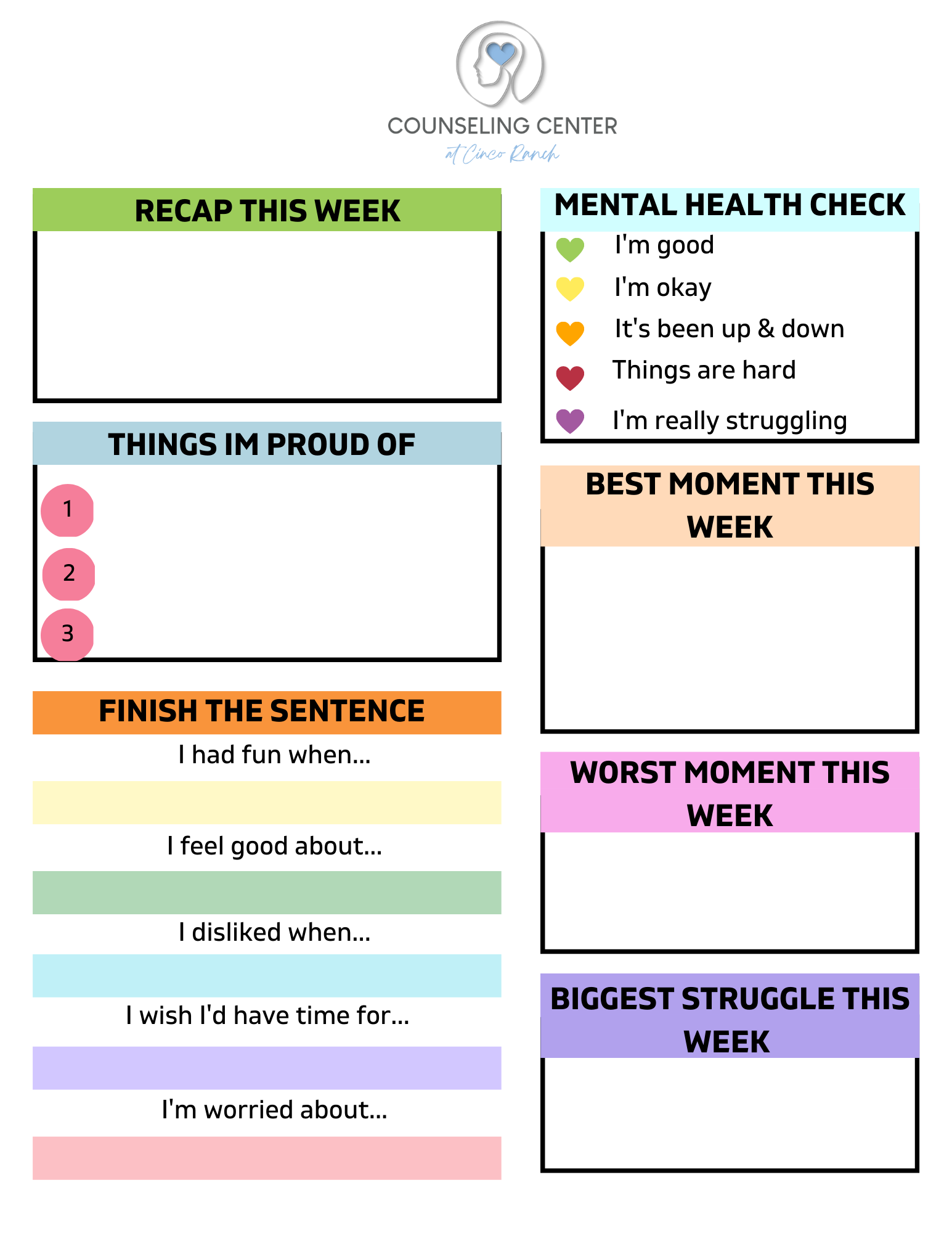

- Environmental benefits: Shifting towards public transit also offers significant environmental benefits by reducing greenhouse gas emissions.

- Strategic allocation: Diverting some funds from highway expansion to improvements in public transit could offer a more sustainable and equitable transportation solution in the long run.

Conclusion: Highway 407 East Tolls and Ontario Gas Tax: A Long-Term Solution?

The current system of Highway 407 East tolls and Ontario's gas tax presents a complex picture. While the tolls generate revenue for highway maintenance and expansion, their variability and potential for high costs raise concerns about equity and affordability. Similarly, the gas tax, while contributing significantly to highway funding, disproportionately impacts lower-income drivers. Alternative models, such as public-private partnerships and increased investment in public transit, warrant serious consideration. The debate surrounding Highway 407 East tolls and Ontario's gas tax demands further discussion. Let's work together to find a sustainable and equitable solution for the future of Ontario's highway infrastructure.

Featured Posts

-

Get The Inside Scoop On The La Lakers With Vavel

May 16, 2025

Get The Inside Scoop On The La Lakers With Vavel

May 16, 2025 -

Vont Weekend Recap April 4th 6th 2025 96 1 Kissfm

May 16, 2025

Vont Weekend Recap April 4th 6th 2025 96 1 Kissfm

May 16, 2025 -

Cubs Vs Padres In Mesa Spring Training Game Preview March 4th 2 05 Ct

May 16, 2025

Cubs Vs Padres In Mesa Spring Training Game Preview March 4th 2 05 Ct

May 16, 2025 -

This Mlb All Star Explains His Issues With The Torpedo Bat

May 16, 2025

This Mlb All Star Explains His Issues With The Torpedo Bat

May 16, 2025 -

Baby Name Trends 2024 Predicting The Years Top Choices

May 16, 2025

Baby Name Trends 2024 Predicting The Years Top Choices

May 16, 2025