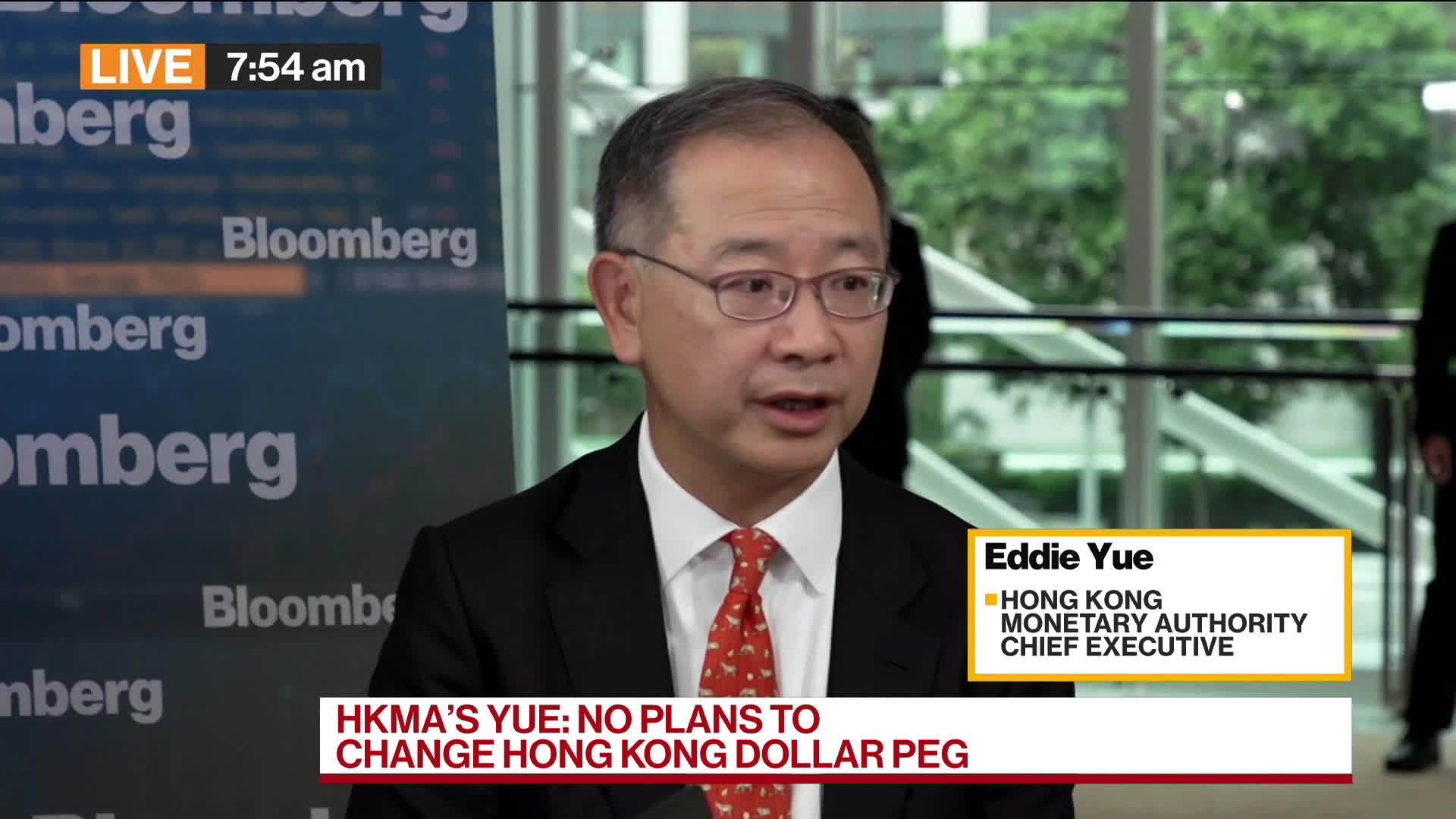

HKMA Buys US Dollars To Uphold Hong Kong Dollar Peg

Table of Contents

Understanding the Hong Kong Dollar Peg

The Hong Kong dollar (HKD) is pegged to the US dollar (USD) under a linked exchange rate system. This means the HKD is allowed to fluctuate within a narrow trading band against the USD, currently between 7.75 and 7.85 HKD per USD. This band provides a degree of flexibility while maintaining the essential stability of the peg. The significance of this trading band is that it allows for minor market adjustments without triggering major HKMA interventions.

The benefits of this peg are substantial. It offers:

- Stability for businesses and investors: Predictable exchange rates facilitate international trade and investment.

- Reduced exchange rate risk: Businesses can plan with confidence, knowing the exchange rate will remain relatively stable.

However, the system also presents drawbacks:

- Potential limitations on monetary policy independence: Hong Kong's interest rates tend to follow those in the US, limiting the HKMA's ability to independently manage monetary policy to address specific domestic economic challenges.

- Vulnerability to external shocks affecting the USD: A decline in the value of the USD can indirectly weaken the HKD, requiring HKMA intervention.

The HKMA's Role in Maintaining the Peg

The HKMA is responsible for maintaining the HKD's peg to the USD. Its mandate includes ensuring the stability of the Hong Kong dollar and maintaining confidence in the currency. The HKMA employs several mechanisms to achieve this, primarily:

- Intervention in the foreign exchange market: This is where the phrase "HKMA buys US dollars to uphold Hong Kong dollar peg" directly applies. When the HKD weakens toward the upper limit of the trading band (7.85 HKD/USD), the HKMA buys US dollars, increasing demand for USD and supporting the HKD. Conversely, if the HKD strengthens, it sells US dollars.

- Adjusting interest rates to align with US rates: The HKMA often adjusts its interest rates to match those in the US to discourage capital outflows and maintain the peg.

- Managing the supply and demand of both currencies: The HKMA carefully monitors market conditions and intervenes as needed to balance supply and demand for both the HKD and USD.

- Transparency and communication of its actions: Open communication helps maintain market confidence and reduces speculation. The HKMA regularly publishes information on its interventions and market outlook. This transparency is crucial for maintaining the integrity of the peg.

Recent Interventions and Market Conditions

The HKMA has intervened numerous times in the past to maintain the HKD peg. While precise figures for individual interventions are often not publicly released for strategic reasons, public statements from the HKMA often indicate periods of increased intervention activity. These interventions are typically triggered by factors such as:

- Significant capital flows: Large-scale capital inflows or outflows can put pressure on the HKD/USD exchange rate.

- Speculation: Market speculation can also drive fluctuations, necessitating HKMA intervention to counter destabilizing market forces.

Analyzing past interventions helps assess the effectiveness of the HKMA's strategies and anticipate future challenges. Future scenarios might include increased global volatility impacting the USD, which could test the resilience of the peg. The HKMA's likely response would involve a combination of the strategies outlined above, adapting to the specific circumstances.

Implications for Businesses and Investors

The HKMA's actions to maintain the peg have significant implications for Hong Kong's businesses and investors. For businesses:

- Stability for importers and exporters: Predictable exchange rates simplify international trade transactions.

- Reduced risk for foreign investment: The stability encourages foreign direct investment.

For investors:

- Effects on interest rates and borrowing costs: Interest rates mirroring US rates impact borrowing costs for businesses and individuals.

- Potential opportunities and challenges for businesses: The stability also presents opportunities for businesses while simultaneously posing challenges in navigating a potentially less flexible monetary policy environment.

Conclusion: The HKMA's Commitment to the Hong Kong Dollar Peg

The HKMA plays a vital role in maintaining the Hong Kong dollar peg to the US dollar, a system crucial for Hong Kong's economic stability. By skillfully managing the supply and demand for both currencies and adjusting interest rates as needed, the HKMA works to ensure the stability of the HKD and minimize exchange rate risks for businesses and investors. Understanding the HKMA's role in the Hong Kong dollar peg is essential for navigating Hong Kong's financial landscape. Stay informed about the HKMA's actions to maintain the peg, including monitoring the HKD/USD exchange rate and HKMA press releases, to better manage your investments and business operations in Hong Kong. Paying close attention to the HKMA's efforts to ensure Hong Kong dollar peg stability is crucial for all stakeholders.

Featured Posts

-

Financing A 270 M Wh Bess In Belgiums Complex Merchant Market

May 04, 2025

Financing A 270 M Wh Bess In Belgiums Complex Merchant Market

May 04, 2025 -

1 2 Inches Of Spring Snow Possible In Some Nyc Suburbs Tomorrow

May 04, 2025

1 2 Inches Of Spring Snow Possible In Some Nyc Suburbs Tomorrow

May 04, 2025 -

Grand Parc De Batteries Eneco A Au Roeulx Une Avancee Majeure Pour Le Stockage D Energie

May 04, 2025

Grand Parc De Batteries Eneco A Au Roeulx Une Avancee Majeure Pour Le Stockage D Energie

May 04, 2025 -

Greg Olsens Third Emmy Nod A Win Against Tom Brady

May 04, 2025

Greg Olsens Third Emmy Nod A Win Against Tom Brady

May 04, 2025 -

White House Cocaine Found Secret Service Investigation Concludes

May 04, 2025

White House Cocaine Found Secret Service Investigation Concludes

May 04, 2025

Latest Posts

-

Fleetwood Mac And The Evolution Of The Supergroup Phenomenon

May 04, 2025

Fleetwood Mac And The Evolution Of The Supergroup Phenomenon

May 04, 2025 -

Fleetwood Mac Groundbreaking Supergroup Or Popular Myth

May 04, 2025

Fleetwood Mac Groundbreaking Supergroup Or Popular Myth

May 04, 2025 -

The Case For Fleetwood Mac As The Original Supergroup

May 04, 2025

The Case For Fleetwood Mac As The Original Supergroup

May 04, 2025 -

The Story Behind Fleetwood Macs Rumours 48 Years Of Success And Internal Conflict

May 04, 2025

The Story Behind Fleetwood Macs Rumours 48 Years Of Success And Internal Conflict

May 04, 2025 -

Were Fleetwood Mac Truly The Worlds First Supergroup A Deep Dive

May 04, 2025

Were Fleetwood Mac Truly The Worlds First Supergroup A Deep Dive

May 04, 2025