HMRC Debt: Thousands Unknowingly Owe On Savings Accounts

Table of Contents

How Unreported Savings Interest Leads to HMRC Debt

The UK tax system requires you to declare all income, including interest earned on savings accounts. This applies to various accounts, not just high-interest options. Failure to declare this income accurately on your self-assessment tax return can lead directly to HMRC debt.

Several situations can contribute to unreported savings interest:

- Multiple Accounts: Managing interest from numerous accounts – be it regular savings accounts, high-interest accounts, or even forgotten dormant accounts – can easily lead to errors in calculations and reporting.

- Complex Financial Arrangements: If you have intricate financial structures, such as trusts or joint accounts, accurately tracking and reporting interest can be complex and prone to errors.

- Changes in Circumstances: Life events like marriage, divorce, or changes in employment status can impact your tax code and potentially lead to inaccurate reporting of savings interest.

Common mistakes that lead to unreported savings interest include:

- Failure to declare interest on self-assessment tax returns: This is the most common reason for accumulating HMRC debt related to savings.

- Incorrectly completing tax forms related to savings: Even minor errors on tax forms can trigger discrepancies.

- Unclaimed savings from dormant accounts: Forgotten accounts often accrue interest unnoticed, leading to unexpected tax liabilities.

- Lack of awareness about tax implications of savings accounts: Many people are simply unaware of their obligations regarding declaring savings interest.

Identifying if You Owe HMRC on Your Savings

The first step in addressing potential HMRC debt is to check your records. This process involves thoroughly examining your past tax returns and current HMRC account.

Here's how to check for potential HMRC debt:

- Review previous self-assessment tax returns: Scrutinize your past tax returns for any discrepancies or missing information concerning savings interest.

- Check your HMRC online account for any outstanding payments: Your online HMRC account provides a comprehensive overview of your tax affairs, including any outstanding payments or demands.

- Contact your bank for details of interest earned on savings accounts: Your bank statements will show the precise amount of interest earned on your accounts in each tax year.

- Consult with a tax advisor if you are unsure: If you're struggling to understand your tax obligations, seeking professional advice is always recommended.

Resolving Your HMRC Savings Account Debt

If you discover you owe HMRC on your savings, it's crucial to act swiftly. Ignoring the debt will only lead to accumulating penalties and interest, making the situation significantly worse.

Options for resolving HMRC debt include:

- Contacting HMRC directly to discuss payment options: Contacting HMRC directly is the first step. They may offer payment plans tailored to your circumstances.

- Setting up a payment plan to manage the debt: HMRC frequently offers flexible payment plans to help taxpayers manage their debt.

- Seeking professional help from a tax advisor or accountant: A tax professional can provide guidance on navigating the complexities of HMRC debt resolution.

- Understanding potential penalties for late payment: Be aware that late payments attract significant penalties and interest, adding considerably to the initial debt.

Preventing Future HMRC Debt from Savings

Preventing future HMRC debt related to savings requires proactive and diligent record-keeping.

Preventative measures include:

- Accurate and timely completion of tax returns: Ensure your self-assessment tax returns are completed accurately and submitted by the deadline.

- Regularly review your savings interest and tax obligations: Make it a habit to review your savings interest and ensure your tax declarations are correct.

- Understand the tax implications of different savings accounts: Familiarize yourself with the tax implications of the various savings accounts you hold.

- Consider seeking professional advice for complex financial situations: If your financial situation is complex, consulting a tax professional is advisable. They can help you avoid errors.

Conclusion: Take Control of Your Savings and Avoid HMRC Debt

Many unknowingly face HMRC debt due to unreported savings interest. This often results from simple oversights or a lack of awareness about tax regulations. However, promptly addressing any outstanding debt is vital to avoid accumulating penalties and interest. Check your HMRC account today, review your savings interest, and take control of your tax obligations. Don't let unexpected HMRC debt from savings surprise you. Take action now to ensure your financial wellbeing.

Featured Posts

-

Ecowas Economic Affairs Strategic Planning In Niger

May 20, 2025

Ecowas Economic Affairs Strategic Planning In Niger

May 20, 2025 -

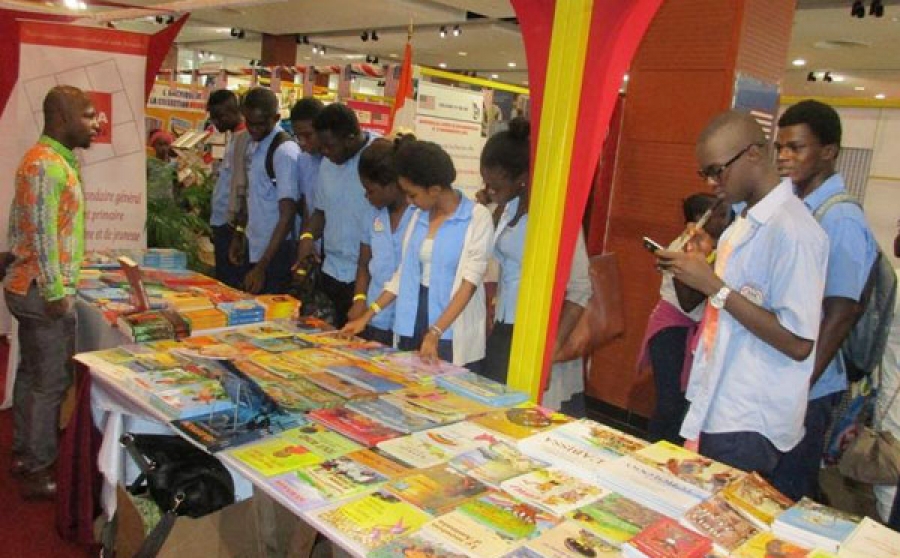

Salon International Du Livre D Abidjan Lancement De La 15eme Edition

May 20, 2025

Salon International Du Livre D Abidjan Lancement De La 15eme Edition

May 20, 2025 -

Jennifer Lawrence Apos O Parto Aparencia Fisica E Os Rumores Do Segundo Filho

May 20, 2025

Jennifer Lawrence Apos O Parto Aparencia Fisica E Os Rumores Do Segundo Filho

May 20, 2025 -

Lewis Hamilton Ve Charles Leclerc Diskalifiye Edildi Ferrari Icin Bueyuek Darbe

May 20, 2025

Lewis Hamilton Ve Charles Leclerc Diskalifiye Edildi Ferrari Icin Bueyuek Darbe

May 20, 2025 -

Filmo Bado Zaidynes Zvaigzde Jennifer Lawrence Ir Antras Vaikas Vardai Ir Detales

May 20, 2025

Filmo Bado Zaidynes Zvaigzde Jennifer Lawrence Ir Antras Vaikas Vardai Ir Detales

May 20, 2025

Latest Posts

-

Ginger Zee Of Gma Visits Wlos To Promote Asheville Rising Helene Special

May 20, 2025

Ginger Zee Of Gma Visits Wlos To Promote Asheville Rising Helene Special

May 20, 2025 -

Good Morning Americas Ginger Zee Visits Wlos Ahead Of Asheville Rising Helene Special

May 20, 2025

Good Morning Americas Ginger Zee Visits Wlos Ahead Of Asheville Rising Helene Special

May 20, 2025 -

Behind The Scenes At Good Morning America Job Cuts And Staff Concerns

May 20, 2025

Behind The Scenes At Good Morning America Job Cuts And Staff Concerns

May 20, 2025 -

Job Cuts At Good Morning America Amidst Backstage Drama

May 20, 2025

Job Cuts At Good Morning America Amidst Backstage Drama

May 20, 2025 -

Gma Shakeup Robin Roberts Getting Fancy Message Explained

May 20, 2025

Gma Shakeup Robin Roberts Getting Fancy Message Explained

May 20, 2025