HMRC Payslip Check: Claim Your Potential Refund Today

Table of Contents

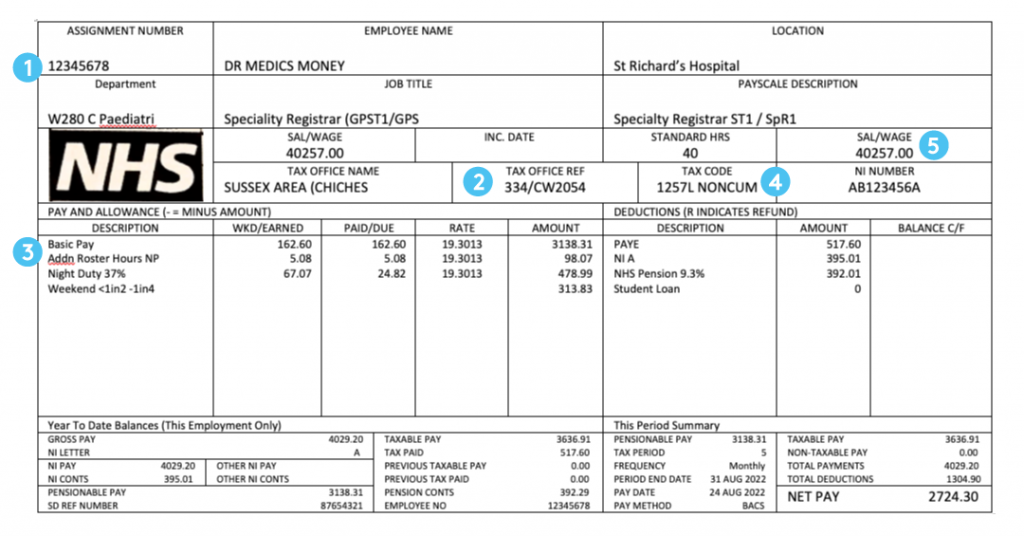

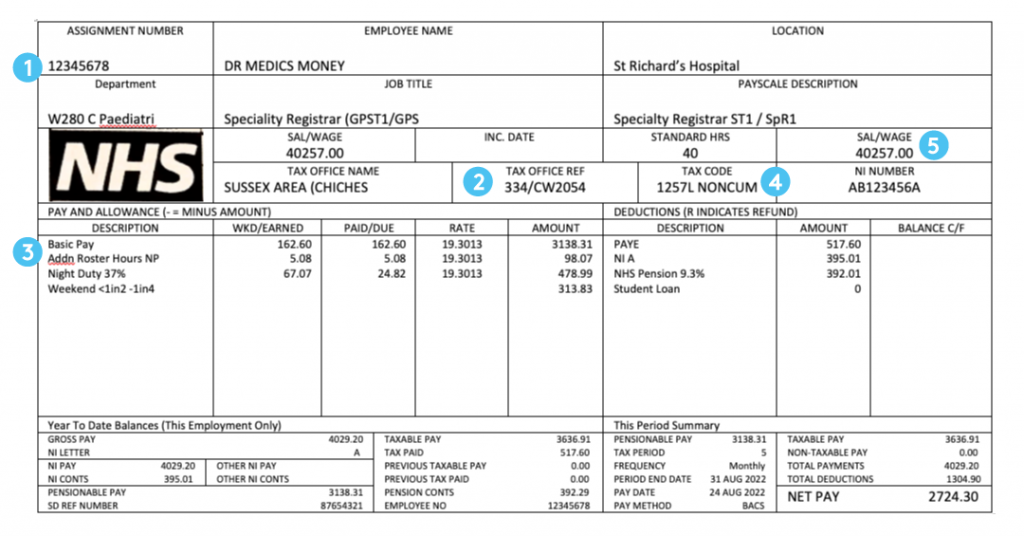

Understanding Your Payslip and Tax Codes

Understanding your payslip is crucial for identifying potential tax overpayments. Your payslip details your gross pay, deductions (including tax), and net pay (your take-home pay). Focusing on the tax deductions section is key for an HMRC payslip check. This section shows how much income tax your employer has deducted from your earnings.

Common tax codes, like 1257L, 1100L, or BR, determine your tax-free allowance. These codes are based on your personal circumstances and are essential for accurate tax calculations. An incorrect tax code can easily lead to overpayment.

- Identify your tax code: This is usually found prominently on your payslip.

- Understand your tax-deductible allowances: These reduce your taxable income.

- Recognize potential errors in tax calculations: Discrepancies in your payslip might indicate an overpayment.

Incorrect tax codes are a frequent reason for overpaying tax. For instance, if your tax code is incorrectly assigned as a lower value than it should be, more tax will be deducted than necessary. This can accumulate over time, resulting in a substantial overpayment. For a detailed explanation of tax codes, visit the official HMRC website: [Insert HMRC Tax Code Explanation Link Here].

Common Reasons for Overpayment

Several scenarios can lead to overpaying tax, making an HMRC payslip check even more vital.

- Incorrect tax code allocation: This is the most common reason. A wrong tax code can significantly impact your tax liability.

- Changes in personal circumstances: Getting married, having children, or starting a pension can affect your tax code and allowances. If these changes aren't reported to HMRC, your tax code might not accurately reflect your circumstances, leading to overpayment.

- Errors in employer's payroll processing: While rare, mistakes in payroll can result in incorrect tax deductions.

- Missing tax relief claims: Many tax reliefs are available, such as marriage allowance and pension contribution relief. Failing to claim these reliefs results in a higher tax liability.

For example, someone incorrectly allocated a single person's tax code instead of a married person's could easily overpay by hundreds of pounds annually. Similarly, forgetting to claim marriage allowance could mean losing several hundred pounds each year.

How to Conduct an HMRC Payslip Check

Conducting a thorough HMRC payslip check involves carefully reviewing your payslips over time.

- Compare payslips over a period of time: Look at your payslips from the past three years, or even longer if possible.

- Verify tax deductions against your expected tax liability: Use online tax calculators or seek professional advice to estimate your expected tax liability based on your income and circumstances.

- Cross-reference with your P60: Your P60 summarises your earnings and tax deductions for the tax year. Ensure the information aligns with your payslips.

- Utilize online payslip portals: Many employers provide online access to payslips, facilitating easier record-keeping and review.

Accurate record-keeping is crucial. Keep all your payslips and P60s in a safe and easily accessible place. If you don't have access to older payslips, contact your employer to request copies.

Using HMRC's Online Services

HMRC provides online services for accessing your tax information securely. Using the official HMRC website is vital to avoid scams.

- Logging into your personal tax account: Access your account using your Government Gateway credentials.

- Accessing your tax summaries and payslip information: This section will provide a detailed overview of your tax history.

- Checking for any discrepancies: Compare the online information to your own records to identify any inconsistencies.

Claiming Your Refund

Once you've identified a potential overpayment through your HMRC payslip check, you can claim a refund.

- Gather necessary documents: This includes your payslips, P60s, and any supporting documentation.

- Complete the relevant HMRC forms: Use the appropriate forms for your specific situation.

- Submit your claim online or via post: HMRC offers both online and postal submission options.

- Understand the timeframe for receiving your refund: This usually takes several weeks, but can vary depending on the complexity of your claim.

[Insert links to relevant HMRC forms and online submission portals here]. If your claim is delayed, contact HMRC to inquire about its status.

Conclusion

Conducting an HMRC payslip check is a simple yet powerful way to ensure you're not leaving money on the table. By carefully reviewing your payslips and utilizing the resources provided by HMRC, you can potentially reclaim significant tax overpayments. Don't delay – take control of your finances and claim your potential refund today! Start your HMRC payslip check now and see how much you could get back.

Featured Posts

-

Mick Schumacher Separacion Y Nueva Vida Amorosa En Aplicacion De Citas

May 20, 2025

Mick Schumacher Separacion Y Nueva Vida Amorosa En Aplicacion De Citas

May 20, 2025 -

Eurovision 2025 Ranking The Finalists From Hypnotic To Atrocious

May 20, 2025

Eurovision 2025 Ranking The Finalists From Hypnotic To Atrocious

May 20, 2025 -

Jaminet Rembourse Le Stade Toulousain Detail De L Accord

May 20, 2025

Jaminet Rembourse Le Stade Toulousain Detail De L Accord

May 20, 2025 -

Marc Lievremont A Millau Un Souvenir Inoubliable

May 20, 2025

Marc Lievremont A Millau Un Souvenir Inoubliable

May 20, 2025 -

Nyt Mini Crossword March 15 Solutions

May 20, 2025

Nyt Mini Crossword March 15 Solutions

May 20, 2025

Latest Posts

-

Fenerbahce De Tadic Doenemi Basarilar Ve Gelecek

May 20, 2025

Fenerbahce De Tadic Doenemi Basarilar Ve Gelecek

May 20, 2025 -

Fenerbahce Nin Yeni Transfer Hedefi Tadic Talisca Tartismasinin Etkisi

May 20, 2025

Fenerbahce Nin Yeni Transfer Hedefi Tadic Talisca Tartismasinin Etkisi

May 20, 2025 -

Fenerbahces Harde Reactie Op Tadic Na Ajax Contact

May 20, 2025

Fenerbahces Harde Reactie Op Tadic Na Ajax Contact

May 20, 2025 -

Dusan Tadic In Fenerbahce Performansi Tarihe Gecen Anlar

May 20, 2025

Dusan Tadic In Fenerbahce Performansi Tarihe Gecen Anlar

May 20, 2025 -

Fenerbahce Wil Keihard Optreden Tegen Tadic Na Contact Met Ajax

May 20, 2025

Fenerbahce Wil Keihard Optreden Tegen Tadic Na Contact Met Ajax

May 20, 2025