Home Sales Crisis: Realtors Report Sagging Market

Table of Contents

Declining Sales Figures and Market Slowdown

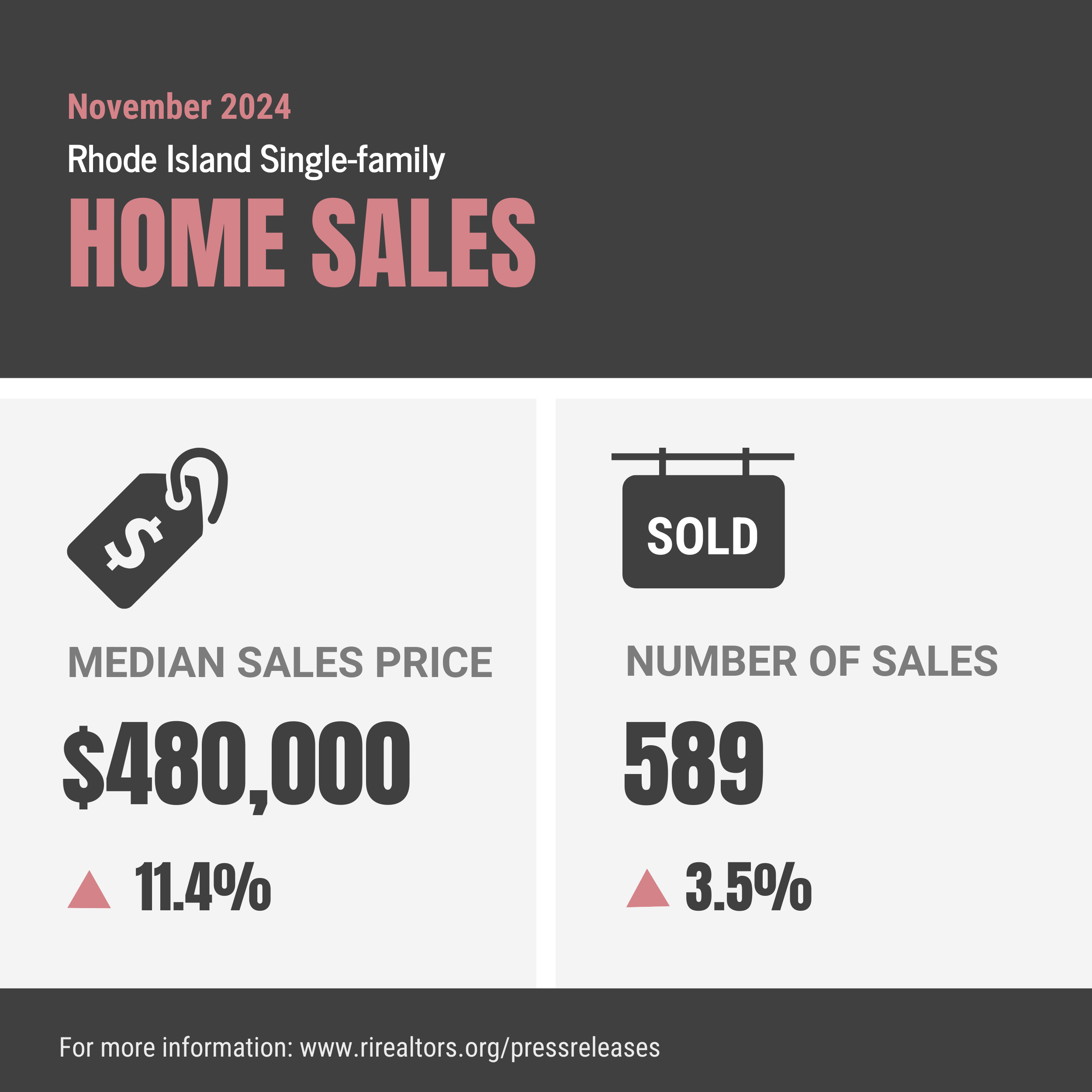

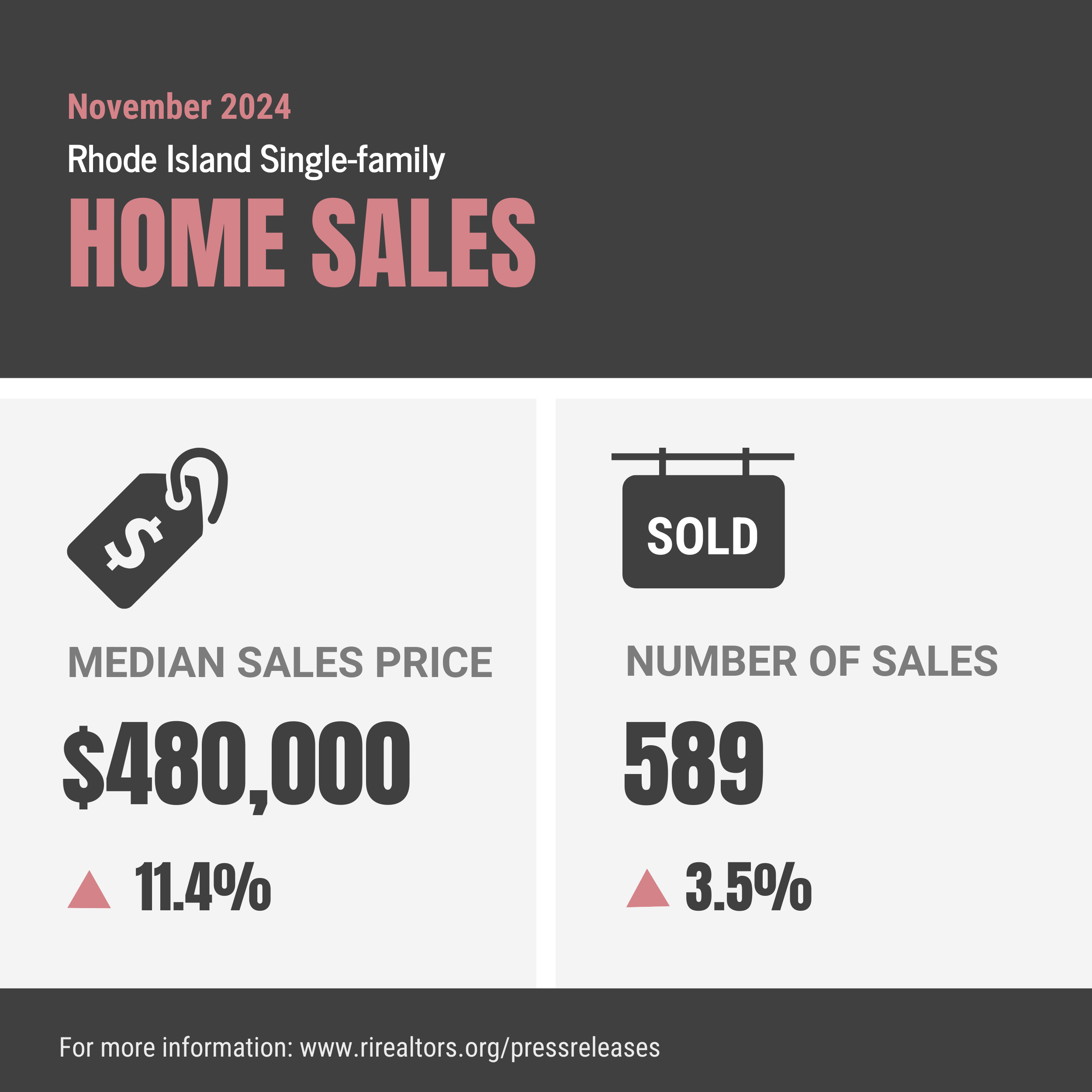

The home sales crisis is evident in the stark reality of plummeting sales figures. Data from reputable sources like the National Association of Realtors (NAR) and Zillow paint a grim picture of a significantly slowed housing market slowdown. Compared to previous years, we're seeing a dramatic decrease in the number of homes sold, indicating a substantial shift in market dynamics. This decreased home sales trend isn't uniform across the board; certain sectors are experiencing steeper declines than others.

- Specific percentage decrease in home sales year-over-year: The NAR reported a 20% year-over-year decline in existing home sales in Q3 2023 (replace with actual data for accuracy).

- Geographic areas most severely impacted: Coastal regions and major metropolitan areas have seen the most significant drops in sales, likely due to higher prices and increased competition before the downturn.

- Types of properties experiencing the biggest drops: Luxury homes and higher-priced properties have been particularly affected, reflecting the impact of rising interest rates on affordability.

Rising Interest Rates and Their Impact

The dramatic increase in mortgage rates is a primary driver of the home sales crisis. Interest rate hikes by the Federal Reserve have made mortgages significantly more expensive, impacting affordability and reducing buyer demand. This increased cost directly influences home prices, creating a ripple effect throughout the market.

- Current average interest rates for mortgages: As of October 26, 2023, the average 30-year fixed-rate mortgage is around 7.5% (replace with actual data for accuracy). This is a significant increase compared to rates in previous years.

- Impact on monthly mortgage payments: A higher interest rate translates to substantially higher monthly payments, pricing many potential buyers out of the market. A $300,000 mortgage at 7.5% will have a significantly higher monthly payment than at 3%.

- How rising rates are discouraging potential buyers: Many prospective buyers are delaying their purchase decisions, waiting for interest rates to stabilize or for prices to adjust.

Inventory Shortages and Their Contribution

The current home sales crisis is further exacerbated by persistent housing shortage issues and low inventory levels. The limited supply of homes on the market is fueling competition and contributing to the overall market slowdown. Several factors contribute to this lack of inventory:

- Current months' supply of inventory: The current months' supply of inventory is significantly lower than previous years, indicating a tight market. (Replace with actual data for accuracy)

- Comparison to previous years: This represents a sharp decline compared to, for instance, the pre-pandemic market, where inventory levels were considerably higher.

- Impact on buyer competition and bidding wars: Low inventory has historically led to intense buyer competition and bidding wars, but current economic uncertainty dampens this effect, though it still creates pressure on prices.

Buyer Hesitancy and Economic Uncertainty

Buyer apprehension is palpable, significantly contributing to the home sales crisis. Economic downturn fears, fueled by inflation and potential recession, are causing many potential buyers to hesitate before making such a large financial commitment. This market uncertainty is further discouraging purchases.

- Consumer confidence index data: The consumer confidence index reflects a decrease in consumer sentiment, indicating a lack of certainty about the future economy. (Replace with actual data for accuracy).

- Impact of inflation on purchasing power: Inflation erodes purchasing power, making it harder for buyers to afford homes, even with lower prices.

- Concerns about job security and potential layoffs: Concerns about job security and potential layoffs are also contributing to buyer hesitancy, as many are reluctant to commit to a large mortgage payment in an uncertain economic climate.

Conclusion: Navigating the Home Sales Crisis

In summary, the current home sales crisis is a complex issue driven by a confluence of factors: significantly declining sales figures, substantially rising interest rates impacting affordability, persistent inventory shortages creating intense competition (even though subdued compared to before), and widespread buyer hesitancy fueled by economic uncertainty. The outlook for the housing market remains uncertain, with potential scenarios ranging from a prolonged slowdown to a more rapid recovery depending on several economic factors.

Understanding the intricacies of this home sales crisis is crucial. Consult with a qualified realtor today to get expert advice tailored to your specific needs and navigate the challenges of this shifting market. Staying informed about market trends and seeking professional guidance are essential to making sound decisions in this dynamic environment.

Featured Posts

-

Alcarazs Hard Fought Monte Carlo Masters Victory

May 30, 2025

Alcarazs Hard Fought Monte Carlo Masters Victory

May 30, 2025 -

Compra De Entradas Simplificada Colaboracion Setlist Fm Y Ticketmaster

May 30, 2025

Compra De Entradas Simplificada Colaboracion Setlist Fm Y Ticketmaster

May 30, 2025 -

Milei And The Tuttle Twins A Free Market Curriculum For Argentina

May 30, 2025

Milei And The Tuttle Twins A Free Market Curriculum For Argentina

May 30, 2025 -

Unreleased Selena Gomez Song Storms The Top 10 Charts

May 30, 2025

Unreleased Selena Gomez Song Storms The Top 10 Charts

May 30, 2025 -

Programma Tv Ti Na Deite To Savvato 12 Aprilioy

May 30, 2025

Programma Tv Ti Na Deite To Savvato 12 Aprilioy

May 30, 2025

Latest Posts

-

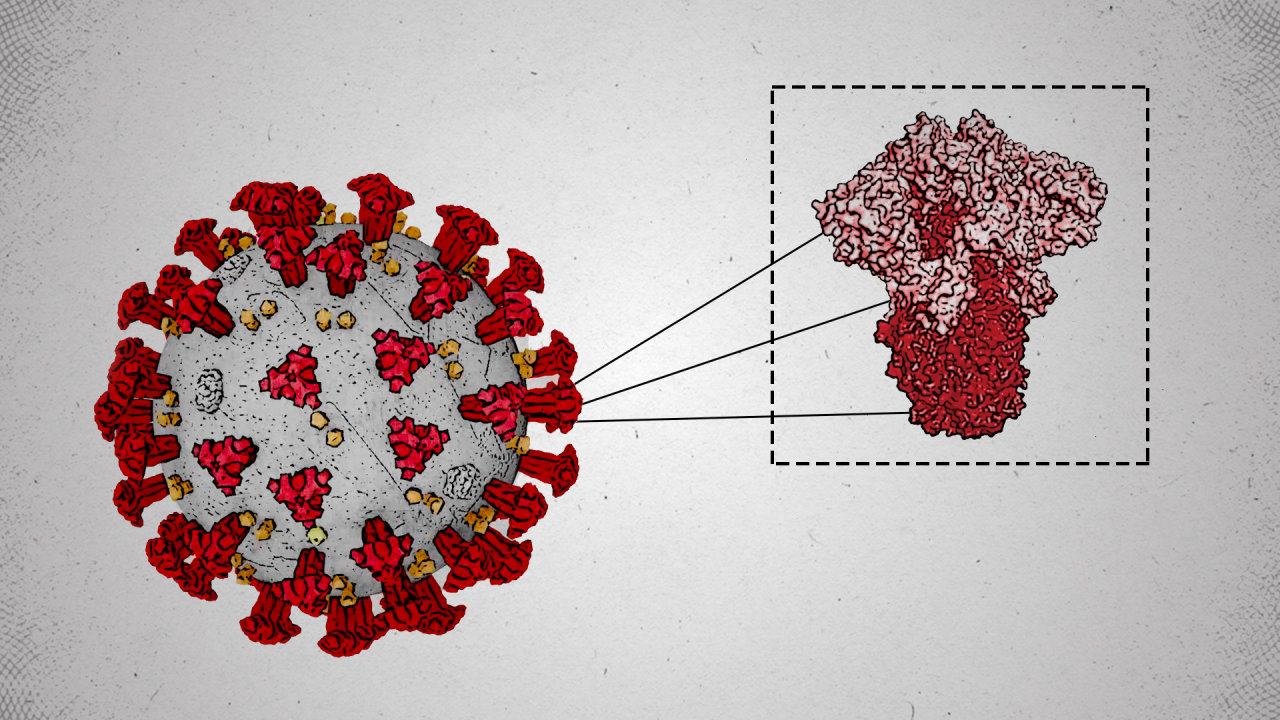

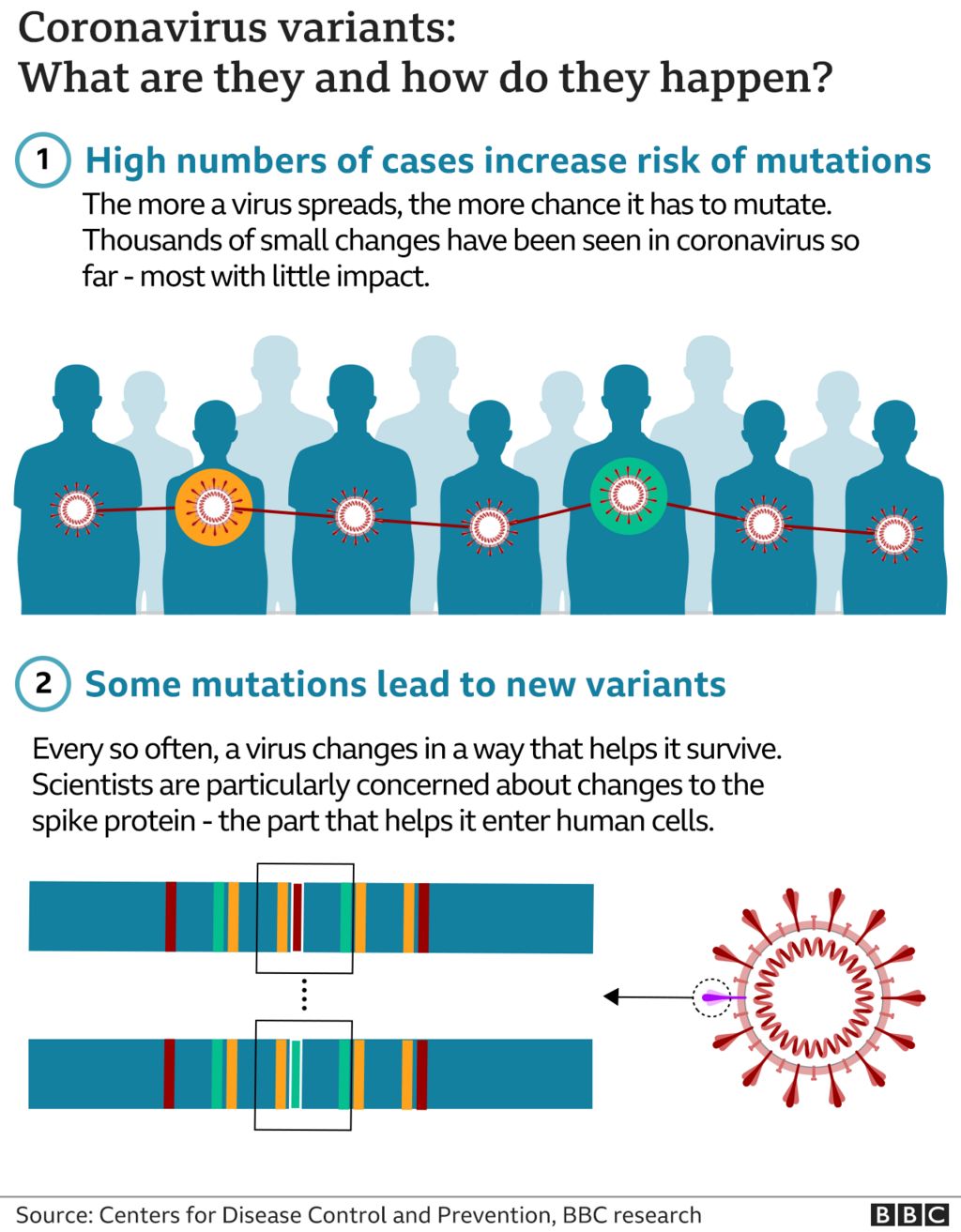

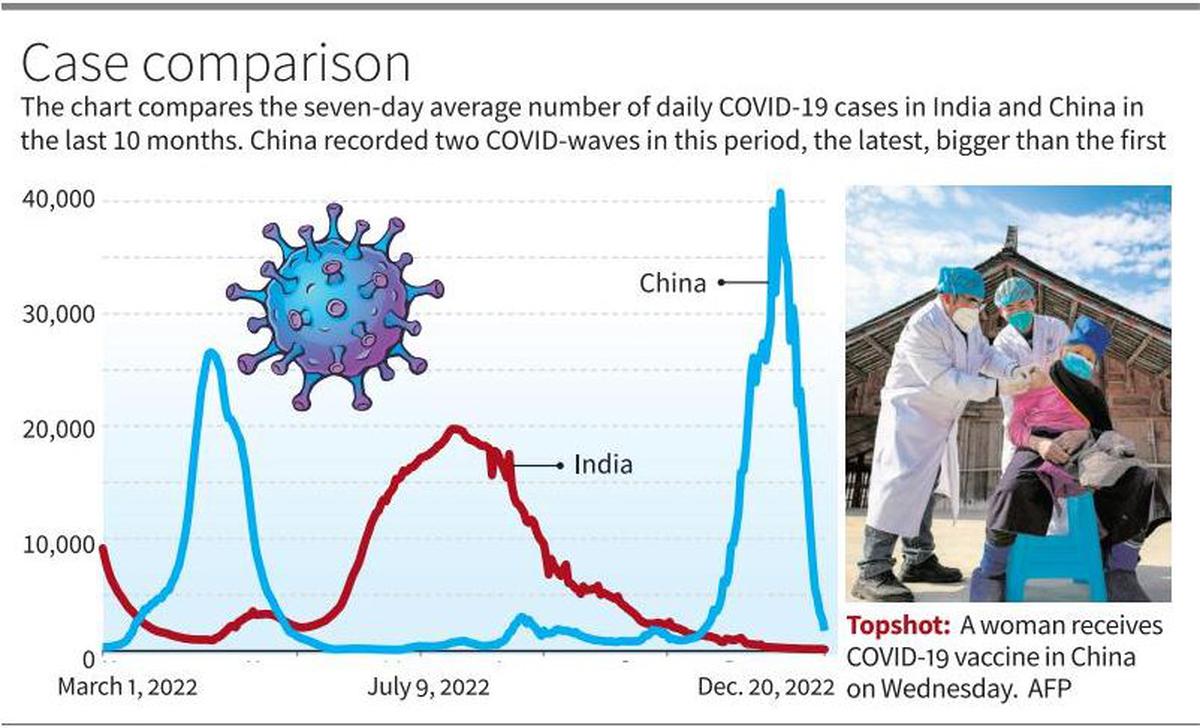

Rising Covid 19 Cases Is A New Variant To Blame

May 31, 2025

Rising Covid 19 Cases Is A New Variant To Blame

May 31, 2025 -

New Covid 19 Variant A Global Health Concern

May 31, 2025

New Covid 19 Variant A Global Health Concern

May 31, 2025 -

Who Warns New Covid 19 Variant Fueling Case Surges Globally

May 31, 2025

Who Warns New Covid 19 Variant Fueling Case Surges Globally

May 31, 2025 -

Tracking The Spread New Covid 19 Variant And Rising Case Numbers Nationally

May 31, 2025

Tracking The Spread New Covid 19 Variant And Rising Case Numbers Nationally

May 31, 2025 -

National Increase In Covid 19 Cases A New Variant Emerges

May 31, 2025

National Increase In Covid 19 Cases A New Variant Emerges

May 31, 2025