Hong Kong Dollar Interest Rate Fall: Significant HKD/USD Implications

Table of Contents

Factors Contributing to the HKD Interest Rate Fall

Several interconnected factors contribute to the recent decline in Hong Kong Dollar interest rates. Understanding these factors is crucial for predicting future trends in the HKD/USD exchange rate.

-

Lower US Interest Rates: The United States' monetary policy heavily influences Hong Kong's interest rates due to the linked exchange rate mechanism. When US interest rates fall, the Hong Kong Monetary Authority (HKMA) often adjusts its own rates to maintain the HKD peg to the USD, leading to a corresponding decrease in HKD interest rates. This ensures the peg remains stable and prevents significant HKD/USD fluctuations.

-

Increased Market Liquidity: Abundant liquidity in the Hong Kong market has also contributed to lower borrowing costs. This increased availability of funds reduces the demand for loans, leading to a decrease in interest rates. This increased liquidity can be attributed to various factors, including global capital flows and the HKMA's own monetary policy interventions.

-

Global Economic Slowdown: The global economic slowdown significantly impacts Hong Kong's economy, affecting interest rates. Reduced economic activity decreases demand for credit, resulting in lower interest rates as lenders compete for borrowers. This interconnectedness highlights the global nature of financial markets and the transmission of interest rate changes across borders.

-

The Role of the HKMA: The Hong Kong Monetary Authority plays a vital role in managing interest rates and maintaining the currency peg. The HKMA's actions are crucial in determining the direction of HKD interest rates and influencing the HKD/USD exchange rate. Its interventions aim to maintain the stability of the Hong Kong dollar within the pre-defined band against the US dollar.

-

Inflationary Pressures: Inflationary pressures and their management also influence HKD interest rates. If inflation rises, the HKMA might raise interest rates to curb spending and control inflation. Conversely, low inflation or deflation might allow for lower interest rates. The balance between economic growth and inflation management is a key consideration for the HKMA's monetary policy.

Impact on the HKD/USD Exchange Rate

The fall in HKD interest rates has clear implications for the HKD/USD exchange rate. Understanding this relationship is vital for businesses and investors operating in the Hong Kong market.

-

Historical Relationship: Historically, there has been a close correlation between HKD interest rates and the HKD/USD exchange rate. Lower HKD interest rates, all else being equal, tend to put downward pressure on the HKD against the USD.

-

Potential HKD Depreciation: The interest rate differential between the HKD and USD can lead to HKD depreciation against the USD. Investors may seek higher returns in USD-denominated assets, increasing demand for USD and potentially weakening the HKD.

-

HKMA Interventions: The HKMA actively intervenes in the forex market to maintain the currency peg. These interventions can offset some of the pressure from interest rate differentials. However, significant discrepancies can still lead to fluctuations within the permitted band.

-

Market Speculation: Market speculation plays a substantial role in HKD/USD volatility. Traders' expectations about future interest rate movements and economic conditions influence the exchange rate, creating potential for significant short-term fluctuations.

-

Short-term and Long-term Outlook: The short-term outlook for the HKD/USD exchange rate depends on various factors, including the pace of economic recovery in Hong Kong and globally, and the future direction of US and HKD interest rates. The long-term outlook remains subject to the continued stability of the currency peg.

Implications for Businesses and Investors

The changing interest rate environment and its effect on the HKD/USD exchange rate have significant implications for businesses and investors in Hong Kong.

-

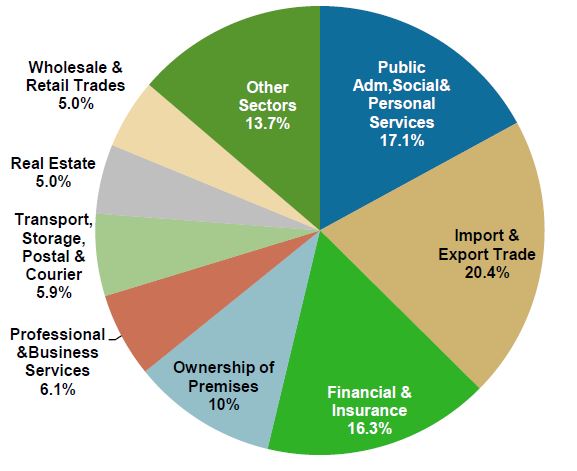

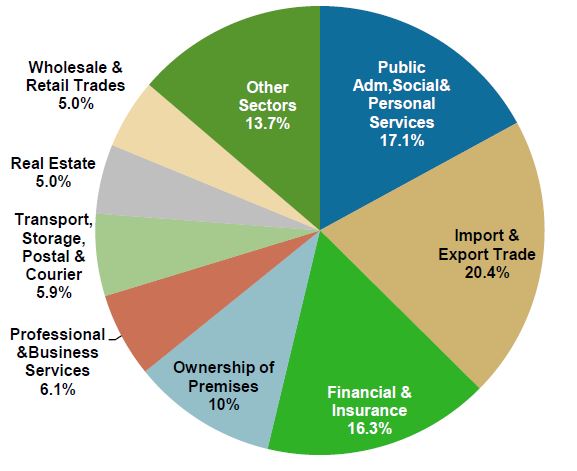

International Trade: Hong Kong businesses involved in international trade are directly affected by exchange rate fluctuations. Changes in the HKD/USD rate impact import and export costs, affecting profitability and competitiveness.

-

Investment Returns: Investors holding HKD-denominated assets will experience changes in the value of their investments as the HKD fluctuates against the USD. This impacts returns and necessitates careful portfolio management.

-

Hedging Strategies: Businesses can mitigate exchange rate risks through hedging strategies like forward contracts or options. These instruments allow businesses to lock in exchange rates for future transactions, reducing uncertainty.

-

Foreign Investment: Foreign investors in the Hong Kong market need to carefully consider the implications of HKD/USD exchange rate movements on their investment returns. Understanding the risks is crucial for informed decision-making.

-

Long-Term Planning: Businesses operating in Hong Kong need to incorporate exchange rate risk into their long-term financial planning. This involves forecasting potential currency fluctuations and adjusting strategies accordingly.

Conclusion

The recent fall in Hong Kong Dollar interest rates has significant implications for the HKD/USD exchange rate. The interconnectedness of global and local financial markets, the role of the HKMA, and the influence of market speculation all contribute to the complexity of the situation. Businesses and investors must carefully monitor these developments and implement appropriate strategies to manage the associated risks.

Call to Action: Stay informed about fluctuations in the Hong Kong Dollar interest rate and their impact on the HKD/USD exchange rate. Regularly monitor market trends and consider implementing appropriate hedging strategies to manage currency risk effectively. Understanding the dynamics of the HKD/USD pair is crucial for making sound financial decisions in the Hong Kong market.

Featured Posts

-

Ravens Free Agency Acquisition De Andre Hopkins

May 08, 2025

Ravens Free Agency Acquisition De Andre Hopkins

May 08, 2025 -

Lotto 6aus49 Vom 9 4 2025 Alle Gewinnzahlen Im Ueberblick

May 08, 2025

Lotto 6aus49 Vom 9 4 2025 Alle Gewinnzahlen Im Ueberblick

May 08, 2025 -

Analyzing Matt Damons Career Through Ben Afflecks Lens

May 08, 2025

Analyzing Matt Damons Career Through Ben Afflecks Lens

May 08, 2025 -

Counting Crows Snl Appearance A Career Turning Point

May 08, 2025

Counting Crows Snl Appearance A Career Turning Point

May 08, 2025 -

Pogoda V Permi I Permskom Krae V Kontse Aprelya 2025 Prognoz Pokholodaniya I Snegopadov

May 08, 2025

Pogoda V Permi I Permskom Krae V Kontse Aprelya 2025 Prognoz Pokholodaniya I Snegopadov

May 08, 2025