Hong Kong Intervenes In FX Market To Defend US Dollar Peg

Table of Contents

Understanding the Hong Kong Dollar Peg

Hong Kong operates under a linked exchange rate system, pegging the HKD to the USD within a narrow band. This HKD/USD peg, managed by the Hong Kong Monetary Authority (HKMA), is a cornerstone of Hong Kong's economic stability. Established in 1983, this currency board system has delivered significant benefits, including low inflation and a stable environment for trade and investment.

- Mechanism: The currency board system functions by maintaining sufficient USD reserves to back every HKD in circulation. The HKMA buys or sells USD to maintain the peg within the specified band.

- Benefits: The peg has provided Hong Kong with significant advantages, fostering low inflation, attracting foreign investment, and promoting confidence in the HKD. This has created a stable macroeconomic environment conducive to business growth.

- Risks: Maintaining the peg isn't without challenges. External shocks, capital flight, or significant shifts in the USD value can put pressure on the system, necessitating interventions like the one recently observed. Large speculative attacks could, in theory, deplete the currency board's reserves.

The Recent FX Market Intervention

Recent events, [insert specific triggering event, e.g., increased USD strength, significant capital outflow], prompted the HKMA to intervene in the FX market. The HKMA utilized its considerable USD reserves to buy HKD and sell USD, thereby increasing demand for the HKD and supporting the peg. This intervention aimed to stabilize the HKD/USD exchange rate and prevent it from breaching the permitted fluctuation band.

- Dates and Amounts: [Insert specifics on dates and approximate amounts of intervention if available, citing credible sources].

- Effect on HKD/USD: The intervention successfully [describe the effect, e.g., narrowed the spread, prevented a significant depreciation].

- HKMA Statements: [Quote any official statements released by the HKMA regarding the intervention].

Economic Implications and Market Reactions

The intervention's short-term impact included a stabilization of the HKD/USD exchange rate and a calming effect on market volatility. However, the long-term economic consequences require further analysis. The intervention may have implications for interest rates and inflationary pressures, depending on the scale and duration of the intervention.

- Effectiveness: The intervention's effectiveness can be judged by its success in maintaining the peg within the desired band and in restoring market confidence.

- Concerns: Some economists have expressed concerns about [mention any potential drawbacks, e.g., depletion of reserves, potential for future pressure].

- Future Interventions: The need for further interventions depends on the persistence of the underlying pressures on the HKD.

The Future of the Hong Kong Dollar Peg

The long-term sustainability of the HKD peg to the USD hinges on several factors, including global economic uncertainties, geopolitical risks, and the stability of the US economy. Capital flight, large speculative attacks, and shifts in China's economic policies could all pose challenges.

- Potential Reforms: The HKMA might consider reforms to enhance the resilience of the peg, perhaps adjusting the intervention mechanisms or expanding the reserve capacity.

- China's Role: China's economic policy and its relationship with Hong Kong's economy significantly impact the peg's future viability.

- Expert Opinions: [Include summaries of opinions from leading economists on the long-term outlook].

Conclusion: Analyzing Hong Kong's Continued Commitment to the US Dollar Peg

Hong Kong's recent FX market intervention demonstrates its unwavering commitment to maintaining the US dollar peg. This peg remains crucial for Hong Kong's economic stability, attracting foreign investment and providing a stable environment for business. While the recent intervention successfully defended the peg, the future holds challenges that require ongoing vigilance and potential adjustments to the monetary policy. Stay informed about developments concerning Hong Kong's US dollar peg and the FX market interventions by subscribing to updates or following reputable financial news sources. Understanding the dynamics of this vital currency peg is essential for anyone interested in Hong Kong's economic future and the global financial landscape.

Featured Posts

-

Months Long Lingering Of Toxic Chemicals In Buildings After Ohio Train Derailment

May 05, 2025

Months Long Lingering Of Toxic Chemicals In Buildings After Ohio Train Derailment

May 05, 2025 -

When Is The Partial Solar Eclipse On Saturday In Nyc

May 05, 2025

When Is The Partial Solar Eclipse On Saturday In Nyc

May 05, 2025 -

Indy Car Series The Fox Broadcast Details

May 05, 2025

Indy Car Series The Fox Broadcast Details

May 05, 2025 -

Dr Ethan Chois Return In Chicago Med Season 10 Episode 14

May 05, 2025

Dr Ethan Chois Return In Chicago Med Season 10 Episode 14

May 05, 2025 -

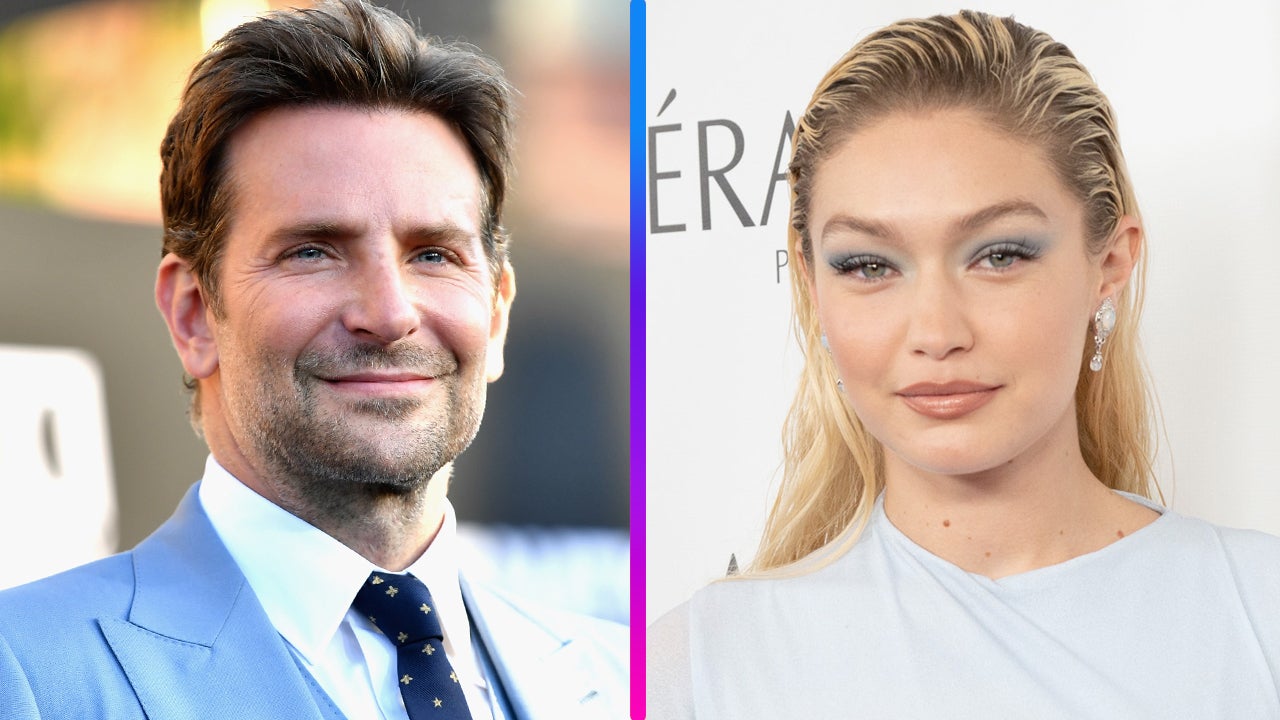

Bradley Cooper And Leonardo Di Caprio Gigi Hadids Dating Dilemma

May 05, 2025

Bradley Cooper And Leonardo Di Caprio Gigi Hadids Dating Dilemma

May 05, 2025

Latest Posts

-

Exclusive Gigi Hadid Discusses Bradley Cooper In Rare Interview

May 05, 2025

Exclusive Gigi Hadid Discusses Bradley Cooper In Rare Interview

May 05, 2025 -

Bradley Cooper Directs Will Arnett On Is This Thing On Nyc Set Exclusive Photos

May 05, 2025

Bradley Cooper Directs Will Arnett On Is This Thing On Nyc Set Exclusive Photos

May 05, 2025 -

Eksklyuziv Dzhidzhi Khadid O Romane S Kuperom

May 05, 2025

Eksklyuziv Dzhidzhi Khadid O Romane S Kuperom

May 05, 2025 -

Gigi Hadid On Bradley Cooper Rare Insights Revealed

May 05, 2025

Gigi Hadid On Bradley Cooper Rare Insights Revealed

May 05, 2025 -

Dzhidzhi Khadid Podtverdila Roman S Kuperom

May 05, 2025

Dzhidzhi Khadid Podtverdila Roman S Kuperom

May 05, 2025