Hong Kong Monetary Authority Intervention: HKD/USD And Interest Rate Impact

Table of Contents

The Hong Kong Monetary Authority (HKMA) Intervention is a critical factor influencing Hong Kong's economy. Its actions to maintain the Hong Kong dollar (HKD) peg against the US dollar (USD) directly impact interest rates and the HKD/USD exchange rate, creating ripple effects for businesses and investors. This article explores the mechanisms of HKMA intervention, its consequences, and what it means for you.

<h2>The Linked Exchange Rate System and HKMA's Role</h2>

Hong Kong operates under a linked exchange rate system, pegging the HKD to the USD within a narrow band of 7.75 to 7.85 HKD per USD. The HKMA holds the primary responsibility for maintaining this peg, ensuring stability and confidence in the currency. This role is crucial for Hong Kong's status as an international financial center. The HKMA achieves this stability through several key actions:

- Buying or selling USD: When the HKD weakens (approaches 7.85 HKD/USD), the HKMA buys USD to increase demand for the HKD, strengthening its value. Conversely, it sells USD if the HKD strengthens excessively (approaches 7.75 HKD/USD).

- Adjusting the base rate: The HKMA's base rate influences the Hong Kong Interbank Offered Rate (HIBOR), impacting borrowing costs across the economy. Adjustments to this rate are a powerful tool to manage liquidity and indirectly influence the exchange rate.

- Maintaining sufficient foreign reserves: The HKMA holds substantial foreign currency reserves to support its interventions. These reserves act as a buffer against significant market pressures.

Deviations from the band, though rare, can signal economic instability and trigger substantial HKMA intervention to restore the peg. Understanding these actions is crucial for businesses managing foreign exchange risk.

<h2>HKMA Intervention Mechanisms</h2>

The HKMA employs various mechanisms to intervene in the forex market and maintain the HKD/USD peg. These interventions aim to manage liquidity and influence interest rates. Key methods include:

- Repurchase agreements (repos): The HKMA uses repos to inject or withdraw liquidity from the banking system. By lending or borrowing funds, it influences the HKD interest rate, thereby impacting the exchange rate.

- Direct buying/selling of USD: This direct intervention in the foreign exchange market is the most visible form of HKMA action. It directly impacts the supply and demand of both currencies, influencing the exchange rate.

- Changes to the base rate: Adjustments to the base rate are a powerful tool to manage liquidity and influence interest rates across the Hong Kong banking sector. This impacts the HIBOR, which influences borrowing costs for businesses and consumers.

Past interventions have varied in scale and method, depending on market conditions and the level of pressure on the HKD/USD peg. Analyzing these past actions provides insights into the HKMA's strategies and the effectiveness of its interventions.

<h2>Impact on Interest Rates in Hong Kong</h2>

HKMA interventions have a direct and significant impact on Hong Kong's interest rates. The base rate, the benchmark interest rate controlled by the HKMA, directly affects the HIBOR, the interbank lending rate. This, in turn, influences other lending rates in the economy:

- Impact on borrowing costs for businesses: Changes in interest rates directly affect borrowing costs for businesses, impacting investment decisions and profitability.

- Impact on savings and investment decisions: Higher interest rates incentivize saving, while lower rates encourage investment and borrowing.

- Correlation with the US Federal Funds Rate: While Hong Kong maintains a degree of independence, the US federal funds rate significantly influences the HKMA's base rate, creating a close correlation between the two.

The potential for interest rate divergence from the US is limited by the currency peg. However, significant shifts in US monetary policy could necessitate adjustments to the Hong Kong base rate to maintain the peg.

<h2>Consequences for HKD/USD Exchange Rate</h2>

The HKMA's interventions directly impact the HKD/USD exchange rate, working to keep it within the designated band. However, external factors and market speculation play a role:

- Effect of increased USD buying: When the HKMA buys USD, it increases demand for USD and reduces the supply of HKD, supporting the HKD/USD exchange rate.

- Role of market sentiment and global economic conditions: Global economic events and market sentiment can put pressure on the exchange rate, requiring HKMA intervention to maintain the peg.

- Potential risks associated with maintaining the peg: Maintaining the peg is not without risk. Persistent pressure on the HKD could require significant intervention, potentially depleting foreign reserves.

Businesses engaged in international trade are particularly affected by fluctuations in the HKD/USD exchange rate, even within the narrow band. Managing currency risk is crucial for these companies.

<h2>Conclusion</h2>

The Hong Kong Monetary Authority's interventions are a cornerstone of Hong Kong's monetary policy. The HKMA's actions to maintain the HKD/USD linked exchange rate directly impact both interest rates in Hong Kong and the HKD/USD exchange rate. Understanding the complexities of Hong Kong Monetary Authority intervention is crucial for navigating Hong Kong's unique financial landscape. By closely monitoring HKMA actions and economic indicators, businesses and investors can better manage their currency risks and make informed financial decisions. Stay informed about future Hong Kong Monetary Authority interventions to optimize your financial strategies.

Featured Posts

-

Mark Hamills New Role First Trailer For Stephen Kings The Long Walk

May 08, 2025

Mark Hamills New Role First Trailer For Stephen Kings The Long Walk

May 08, 2025 -

Greenlands Strategic Importance Understanding Trumps Concerns

May 08, 2025

Greenlands Strategic Importance Understanding Trumps Concerns

May 08, 2025 -

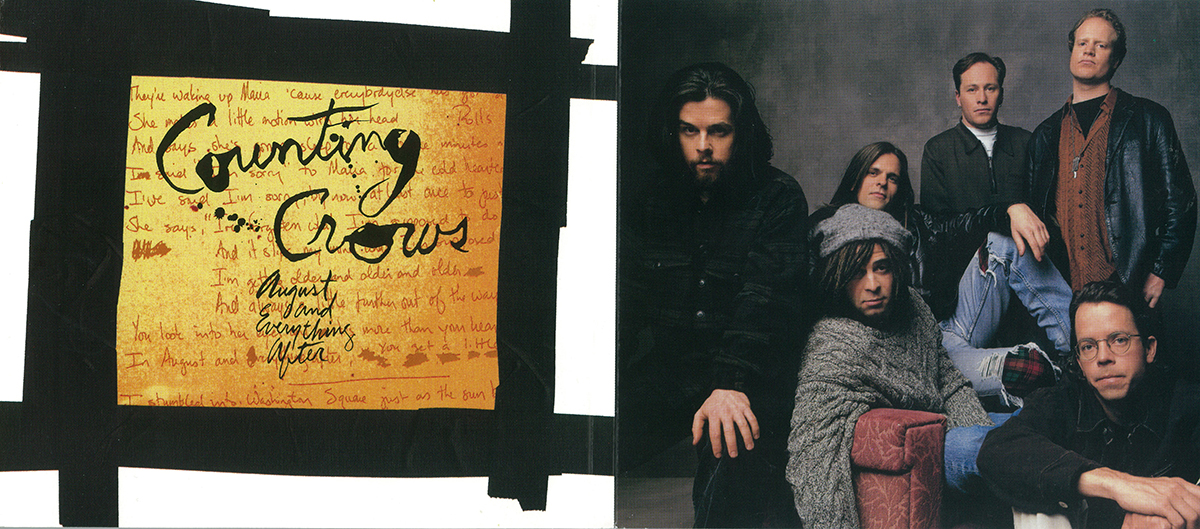

Saturday Night Live And Counting Crows How A Single Performance Changed Everything

May 08, 2025

Saturday Night Live And Counting Crows How A Single Performance Changed Everything

May 08, 2025 -

Leveraging Technology Ahsans Vision For Made In Pakistan On The World Stage

May 08, 2025

Leveraging Technology Ahsans Vision For Made In Pakistan On The World Stage

May 08, 2025 -

Jayson Tatums Bone Bruise Game 2 Status Update And Report

May 08, 2025

Jayson Tatums Bone Bruise Game 2 Status Update And Report

May 08, 2025