Hong Kong Monetary Authority's US Dollar Purchases: Maintaining The Currency Peg

Table of Contents

The Hong Kong dollar's peg to the US dollar is a cornerstone of Hong Kong's economic stability. This seemingly simple mechanism, however, relies on the complex and often unseen interventions of the Hong Kong Monetary Authority (HKMA). This article delves into the crucial role of the HKMA and its actions, specifically its US dollar purchases, in maintaining this vital currency peg. We'll explore the mechanics of this system, the challenges it faces, and the implications for Hong Kong's financial landscape.

The Linked Exchange Rate System Explained

Hong Kong operates under a linked exchange rate system, where the Hong Kong dollar (HKD) is pegged to the US dollar (USD) within a narrow band of 7.75 to 7.85 HKD per USD. This means the HKMA commits to maintaining the HKD within this range. The system's effectiveness hinges on the HKMA's active management of the exchange rate. Essentially, the HKMA acts as a buffer, buying or selling US dollars to influence the HKD's value and prevent it from straying outside the designated band.

This system offers several advantages:

- Stability and predictability for businesses: The stable exchange rate reduces uncertainty for businesses engaged in international trade and investment, fostering economic growth.

- Reduced exchange rate risk: Businesses can confidently engage in international transactions without worrying about significant fluctuations in exchange rates.

- Low inflation: The peg helps to control inflation by anchoring price levels to the relatively stable US dollar.

However, the system also presents limitations:

- Potential for loss of monetary policy independence: The need to maintain the peg can restrict the HKMA's ability to independently adjust interest rates to address domestic economic conditions.

- Vulnerability to external shocks affecting the US dollar: Economic or political events impacting the USD can indirectly affect the HKD, potentially requiring significant HKMA intervention.

The HKMA's Role in Maintaining the Peg

The HKMA bears the primary responsibility for maintaining the HKD's peg. Its actions are crucial in keeping the exchange rate within the designated band. When the HKD weakens towards the upper limit of 7.85 HKD/USD, the HKMA intervenes by buying HKD and selling USD, increasing demand for HKD and pushing its value back up. Conversely, if the HKD strengthens towards the lower bound of 7.75 HKD/USD, the HKMA sells HKD and buys USD to weaken the HKD.

The HKMA employs several key tools and mechanisms to achieve this:

- Intervention in the foreign exchange market: This involves direct buying and selling of USD and HKD to influence the exchange rate.

- Adjusting the interest rate to align with US rates: This helps to manage capital flows and maintain the peg. A higher interest rate in Hong Kong attracts capital inflows, strengthening the HKD, while a lower rate encourages outflows.

- Management of foreign currency reserves: The HKMA maintains substantial foreign currency reserves, primarily in USD, to facilitate its interventions in the foreign exchange market.

Recent US Dollar Purchases by the HKMA and Their Significance

While the HKMA doesn't publicly announce every intervention, periods of significant US dollar purchases often indicate pressure on the peg. For example, during periods of heightened market volatility or significant capital outflows, the HKMA may need to intervene more aggressively. Analyzing the volume and timing of these interventions can provide valuable insights into market dynamics and the pressures faced by the currency peg. (Note: Specific examples of recent purchases and their associated contexts would require real-time data from reputable financial news sources and HKMA publications.) The impact of these purchases ripples throughout the Hong Kong economy.

- Impact on interest rates: Increased demand for USD can influence interest rates in Hong Kong, potentially impacting borrowing costs for businesses and consumers.

- Influence on inflation: Changes in exchange rates and interest rates directly impact inflation levels.

- Effects on capital flows: HKMA interventions can affect capital flows into and out of Hong Kong, influencing the availability of investment capital.

Challenges and Future Outlook for the Currency Peg

The Hong Kong dollar's peg is not without its challenges. Several factors could potentially threaten its stability:

- External economic shocks: Global economic downturns or major shifts in the US economy can put pressure on the peg.

- Geopolitical events: Political instability or major geopolitical events can lead to capital flight and put pressure on the HKD.

The long-term sustainability of the current system is a topic of ongoing debate. Potential future scenarios include:

- Maintaining the status quo: Continuing with the existing linked exchange rate system with ongoing HKMA interventions.

- Potential adjustments to the band: Slightly widening or narrowing the exchange rate band to better manage volatility.

- Exploring alternative exchange rate regimes: Consideration of a more flexible exchange rate system in the long term.

Conclusion

The Hong Kong Monetary Authority's strategic management of US dollar purchases is vital for maintaining the stability of the Hong Kong dollar's peg to the US dollar. The linked exchange rate system, while offering benefits like stability and predictability, also presents challenges that necessitate continuous monitoring and adaptation by the HKMA. Understanding the intricacies of this system is crucial for anyone involved in Hong Kong's financial markets, from investors to businesses. Stay informed about the Hong Kong Monetary Authority's actions and their impact on the Hong Kong dollar's peg. Continue researching the HKMA's US dollar purchases and their influence on the Hong Kong economy for a deeper understanding of this critical aspect of Hong Kong's financial system.

Featured Posts

-

Unrecognizable Lizzos Post Weight Loss Transformation At The Oscars

May 04, 2025

Unrecognizable Lizzos Post Weight Loss Transformation At The Oscars

May 04, 2025 -

Crypto Party Revelations A Two Day Chronicle

May 04, 2025

Crypto Party Revelations A Two Day Chronicle

May 04, 2025 -

Even Marvel Knows Its Movies And Shows Need Improvement

May 04, 2025

Even Marvel Knows Its Movies And Shows Need Improvement

May 04, 2025 -

Emma Stones Popcorn Butt Lift Dress Snl Red Carpet Look Sparks Online Debate

May 04, 2025

Emma Stones Popcorn Butt Lift Dress Snl Red Carpet Look Sparks Online Debate

May 04, 2025 -

Hidden Treasure Bookstore Uncovers 45 000 Rare Novel

May 04, 2025

Hidden Treasure Bookstore Uncovers 45 000 Rare Novel

May 04, 2025

Latest Posts

-

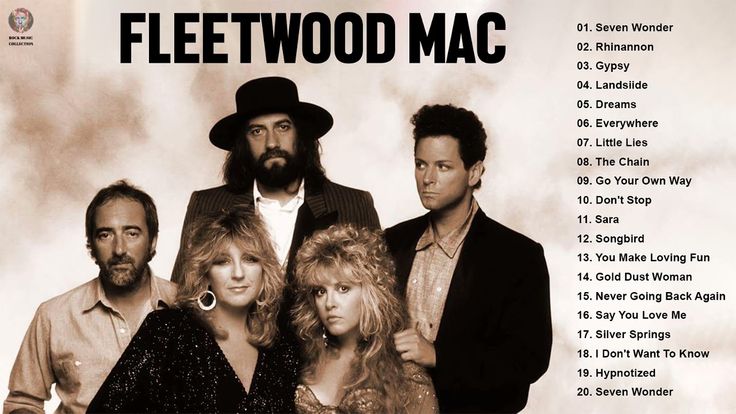

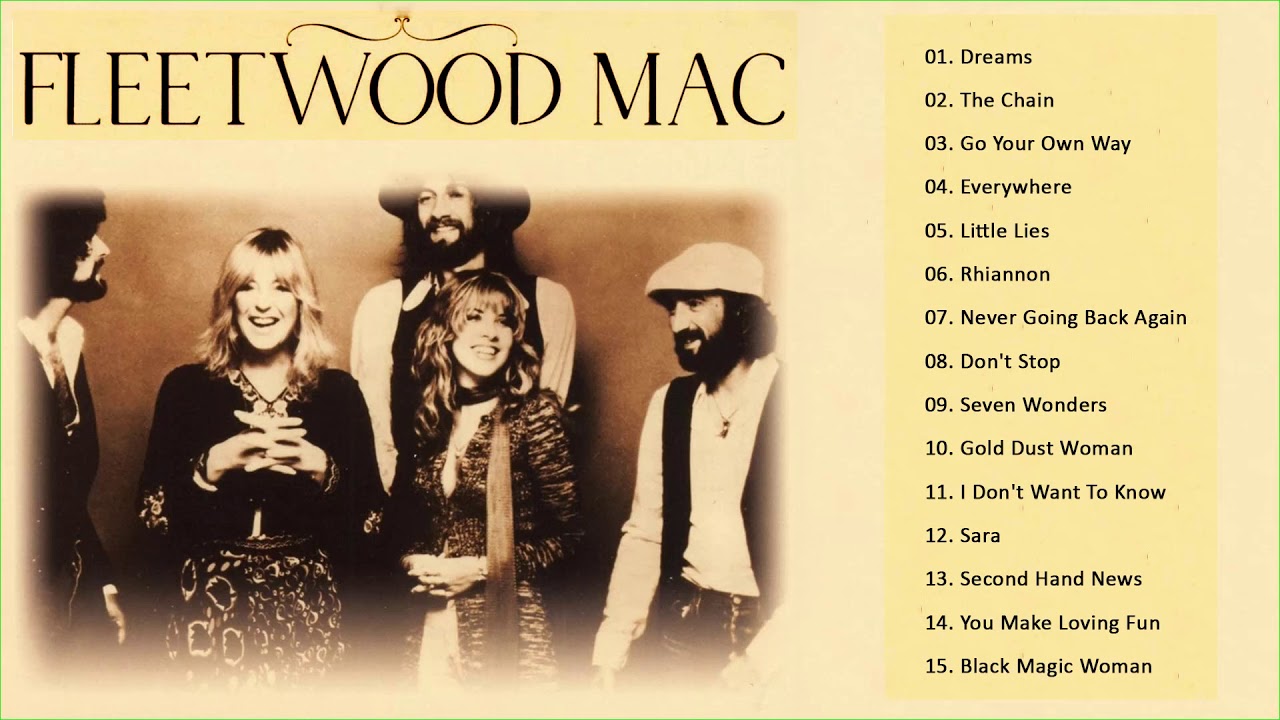

Ranking Fleetwood Macs Iconic Tracks

May 04, 2025

Ranking Fleetwood Macs Iconic Tracks

May 04, 2025 -

Fleetwood Mac Tribute Concert Seventh Wonder With Bloom Perth Mandurah Albany

May 04, 2025

Fleetwood Mac Tribute Concert Seventh Wonder With Bloom Perth Mandurah Albany

May 04, 2025 -

The Most Popular Fleetwood Mac Songs Of All Time

May 04, 2025

The Most Popular Fleetwood Mac Songs Of All Time

May 04, 2025 -

Dope Girls Film Review Exploring Themes Of War Drugs And Glamour

May 04, 2025

Dope Girls Film Review Exploring Themes Of War Drugs And Glamour

May 04, 2025 -

Fleetwood Macs Greatest Songs Ranking Their Classics

May 04, 2025

Fleetwood Macs Greatest Songs Ranking Their Classics

May 04, 2025