House Republicans Release Details Of Trump Tax Cut Bill

Table of Contents

Key Provisions of the Proposed Trump Tax Cut Bill

The proposed Trump tax cut bill features several key provisions designed to stimulate the economy and benefit taxpayers. However, the long-term implications and effects on different income brackets remain a topic of ongoing debate. Let's examine the core elements:

Individual Income Tax Changes

The bill proposes lowering individual income tax rates across the board. This would mean lower tax burdens for many Americans. However, the extent of the benefit varies depending on income level and family structure.

-

Lowered Individual Income Tax Rates: The proposed bill outlines specific percentage reductions for different tax brackets. For example, the highest tax bracket might see a reduction from X% to Y%, while lower brackets experience a reduction from A% to B%. (Note: Replace X, Y, A, and B with actual proposed percentages if available).

-

Changes to Standard Deduction and Itemized Deductions: The bill may alter the standard deduction amount, potentially impacting whether taxpayers itemize or take the standard deduction. This could affect deductions for things like mortgage interest and charitable contributions.

-

Impact on Tax Credits: The bill might also modify existing tax credits, such as the child tax credit. Changes to these credits could significantly affect families with children.

-

Impact Based on Income and Family Structure: A single individual earning $50,000 might see a different percentage reduction than a married couple earning $200,000, and the impact will be further modified by the number of dependents claimed.

Corporate Tax Rate Reductions

A central element of the proposed Trump tax cut bill involves significantly decreasing the corporate tax rate. This reduction aims to boost business investment and spur economic growth.

-

Proposed Corporate Tax Rate Reduction: The bill proposes reducing the corporate tax rate from the current rate (currently 21%) to a lower percentage (e.g., 15%).

-

Impact on Business Investment and Economic Growth: Proponents argue that lower corporate taxes will incentivize businesses to invest more, leading to job creation and economic expansion. Opponents contend that such reductions may disproportionately benefit large corporations without generating substantial job growth.

-

International Comparison: The proposed rate would compare to corporate tax rates in other developed countries, potentially impacting international competitiveness.

-

Impact on Corporate Profits and Shareholder Returns: Lower taxes could translate to increased corporate profits and higher shareholder returns, but this may not directly translate to higher wages for employees.

-

Sectoral Impact: The effects of the reduced corporate tax rate might vary across different business sectors, with some benefiting more than others.

Impact on the National Debt

The proposed tax cuts are projected to significantly increase the national debt due to decreased tax revenue. This increase in the national debt raises concerns about long-term economic stability.

-

Projected Debt Increase: Economic models predict substantial increases in the national debt over the next decade, with potential negative consequences for future generations. Specific projections need to be cited from relevant sources.

-

Long-Term Economic Consequences: Increased debt could lead to higher interest rates, reduced government spending in other areas, and potentially slower economic growth.

-

Comparison to Previous Tax Cuts: The projected increase in the national debt should be compared to the impact of previous tax cut legislation, providing context for the potential consequences.

-

Economic Model Analysis: Various economic models will generate differing projections about the long-term impact of the tax cuts on the national debt. These discrepancies should be acknowledged and discussed.

-

Projected Debt Increase Over Time: Providing specific figures, even if estimations, on the projected increase in the national debt over 5, 10, and 20 years, will further illuminate the scale of the potential problem.

Reactions and Analysis of the Trump Tax Cut Bill Proposal

The proposed Trump tax cut bill has generated significant debate and differing reactions from various stakeholders. Let's analyze the key perspectives:

Republican Support and Strategy

Republicans largely support the bill, framing it as crucial for economic growth and job creation. Their strategy involves emphasizing the benefits for businesses and individual taxpayers.

-

Republican Rationale: Republicans generally justify the bill by pointing to supply-side economics, arguing that tax cuts will stimulate economic activity.

-

Political Impact: The bill’s passage or failure could significantly influence the upcoming elections, as it represents a key policy objective for the party.

-

Statements by Key Lawmakers: Summarize and cite public statements made by prominent Republican lawmakers concerning the bill, including their justification for their stance.

-

Republican Viewpoints: Summarize the key arguments and justifications used by Republican supporters of the bill.

Democratic Opposition and Counterarguments

Democrats largely oppose the bill, criticizing its potential to exacerbate income inequality and increase the national debt.

-

Democratic Critique: Democrats argue the tax cuts disproportionately benefit wealthy individuals and corporations, while providing minimal relief for the middle class and low-income earners.

-

Counterproposals: Outline any alternative proposals or counter-arguments presented by the Democrats, such as targeted tax relief for specific groups or investments in social programs.

-

Statements by Key Lawmakers: Summarize and cite public statements made by prominent Democratic lawmakers, highlighting their concerns and criticisms.

-

Democratic Concerns: Clearly outline the key criticisms and concerns raised by Democratic opponents of the bill.

Expert Opinions and Economic Forecasts

Economists and financial experts offer diverse opinions on the bill’s potential impact, with varying economic forecasts.

-

Expert Analysis: Summarize the analyses and predictions from various economists and financial experts on the potential effects of the bill on economic growth, job creation, and income inequality.

-

Economic Forecasting Models: Discuss different economic forecasting models and their predictions for various economic indicators under the proposed tax cuts.

-

Differing Viewpoints: Present different viewpoints and perspectives on the bill's likely effectiveness and its long-term consequences.

-

Key Predictions: Summarize key predictions about GDP growth, job creation, inflation, and other relevant economic variables.

Conclusion

The proposed Trump tax cut bill represents a substantial change to the US tax code, potentially impacting individuals and businesses nationwide. The bill’s effects on the national debt, economic growth, and income inequality remain highly debated. Understanding the details of this proposed legislation – including the changes to individual and corporate taxes and the projected impact on the national debt – is essential for informed political participation.

Call to Action: Stay informed on the progress of the House Republicans' Trump tax cut bill and engage in the discussion surrounding this crucial legislation. Understanding tax reform is essential; this article provides only a starting point for your further research into this important topic. Learn more about the details of the Trump tax cut bill and its potential impact on you and your community.

Featured Posts

-

Foto Investigasi Penipuan Online Internasional Di Myanmar Ribuan Korban Termasuk Warga Indonesia

May 13, 2025

Foto Investigasi Penipuan Online Internasional Di Myanmar Ribuan Korban Termasuk Warga Indonesia

May 13, 2025 -

The Crucial Role Of Indigenous Scientists In Data Protection And Cultural Heritage

May 13, 2025

The Crucial Role Of Indigenous Scientists In Data Protection And Cultural Heritage

May 13, 2025 -

A Forgotten Scarlett Johansson And Chris Evans Comedy Now On Netflix

May 13, 2025

A Forgotten Scarlett Johansson And Chris Evans Comedy Now On Netflix

May 13, 2025 -

Lishenie Roditelskikh Prav Syna Tatyany Kadyshevoy Podrobnosti Skandala

May 13, 2025

Lishenie Roditelskikh Prav Syna Tatyany Kadyshevoy Podrobnosti Skandala

May 13, 2025 -

A Fathers Courage A Message From Hostage To Son

May 13, 2025

A Fathers Courage A Message From Hostage To Son

May 13, 2025

Latest Posts

-

Sabalenkas Dubai Defeat Paolinis Reign Ends

May 14, 2025

Sabalenkas Dubai Defeat Paolinis Reign Ends

May 14, 2025 -

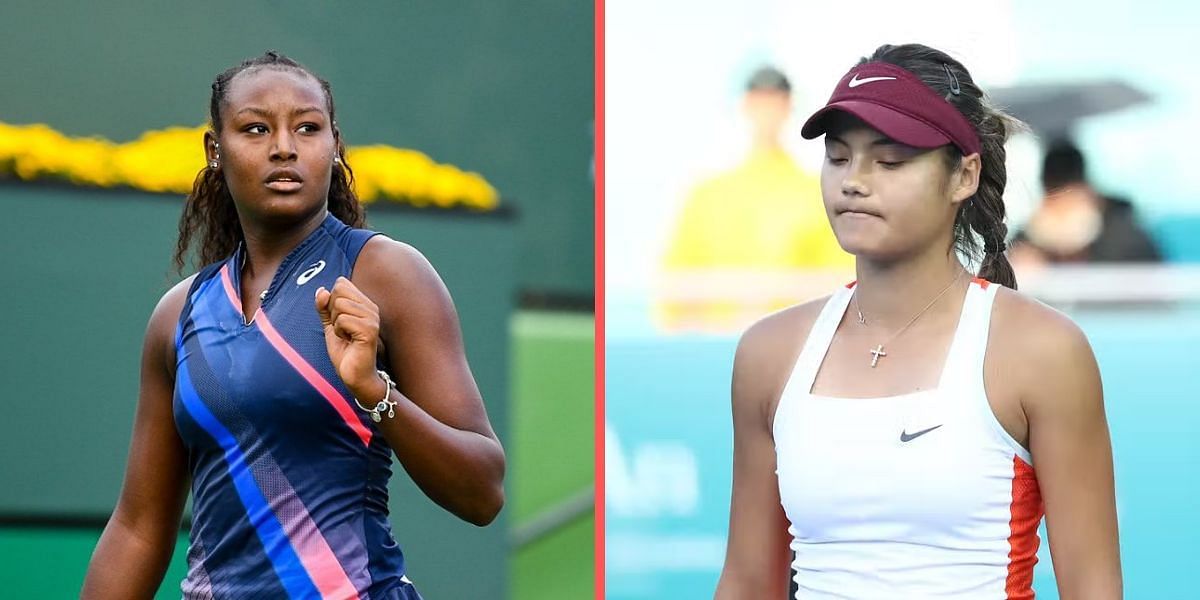

Muchova Defeats Raducanu At Dubai Tennis Championships

May 14, 2025

Muchova Defeats Raducanu At Dubai Tennis Championships

May 14, 2025 -

Wta News Stearns Early Departure In Austin

May 14, 2025

Wta News Stearns Early Departure In Austin

May 14, 2025 -

Two Weeks And Out Raducanus Coaching Search Continues

May 14, 2025

Two Weeks And Out Raducanus Coaching Search Continues

May 14, 2025 -

Raducanus Dubai Defeat Muchova Triumphs

May 14, 2025

Raducanus Dubai Defeat Muchova Triumphs

May 14, 2025