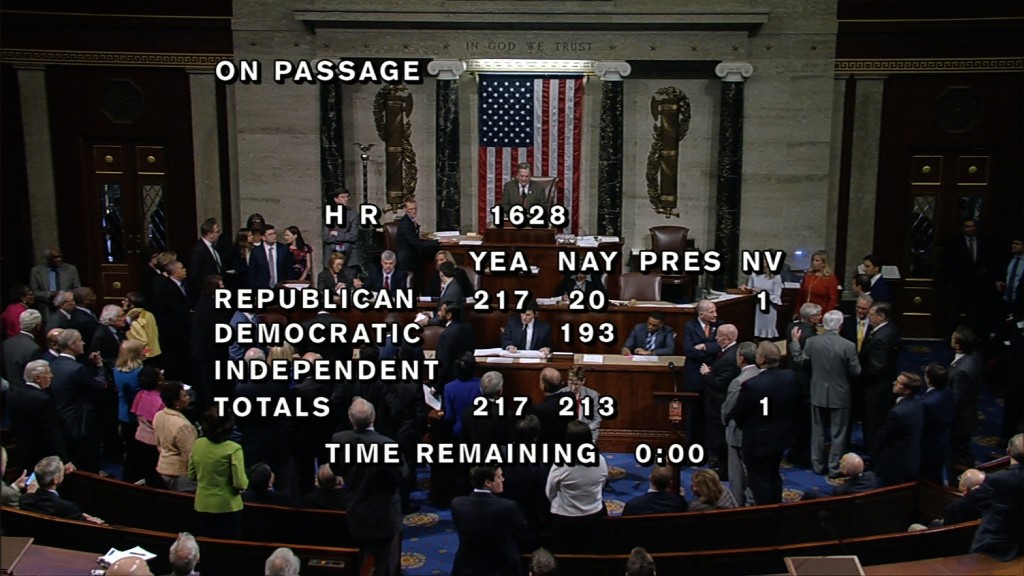

House Tax Bill Passes: Impact On Stock Market, Bonds, And Bitcoin

Table of Contents

Impact on the Stock Market

The House tax bill's passage could significantly alter the trajectory of the stock market. The potential consequences are multifaceted, requiring careful consideration.

Potential for Increased Corporate Profits

Tax cuts are often touted as a catalyst for increased corporate profits. This is because lower tax rates increase after-tax earnings, potentially leading to:

- Higher Stock Prices: Increased profitability often translates to higher dividends and increased stock buybacks, both of which can drive stock prices upward. The overall market valuation could see a boost.

- Increased Repatriation of Overseas Profits: Companies holding significant cash reserves overseas may be incentivized to bring these funds back to the domestic market, potentially fueling further investment and economic growth, ultimately benefiting the stock market.

- Market Volatility: However, the uncertainty surrounding future tax policies and the long-term economic effects of the bill could introduce considerable volatility into the stock market. Sudden shifts in investor sentiment are a real possibility.

- Sector-Specific Impacts: The impact of the tax bill won't be uniform across all sectors. Manufacturing, energy, and other sectors heavily reliant on corporate tax rates could see disproportionate gains or losses depending on the specifics of the legislation. Careful sector-specific analysis is needed.

Investor Sentiment and Market Volatility

The initial reaction to the bill's passage might be a surge in investor confidence, leading to a short-term market rally. However, the long-term effects are far less certain.

- Investor Confidence: The immediate impact depends largely on investor sentiment and how the market interprets the tax bill's provisions.

- Increased Volatility: The complexity of the legislation and differing interpretations of its impact could lead to increased market volatility in the coming months and years.

- Monitoring Key Indices: Closely monitoring key market indices like the S&P 500 and the Dow Jones Industrial Average will be crucial for gauging the real-time impact of the House tax bill.

- Portfolio Diversification: Diversifying your investment portfolio across various asset classes is a critical strategy to mitigate the risks associated with market fluctuations stemming from the House Tax Bill.

Impact on the Bond Market

The bond market is also likely to experience significant shifts due to the House tax bill.

Rising Interest Rates

The tax cuts included in the bill could potentially lead to increased government borrowing to finance the reduced tax revenue. This increased demand for funds could push interest rates higher.

- Lower Bond Prices: Higher interest rates generally lead to lower bond prices, as existing bonds become less attractive compared to newly issued bonds with higher yields. This impacts the return on investment for bondholders.

- Impact on Bond Types: The impact on different types of bonds, such as government bonds and corporate bonds, may vary depending on their risk profile and maturity dates.

- Yield Curve Analysis: A careful analysis of the yield curve, which plots the yields of bonds with different maturities, is essential for navigating the bond market in this environment of potential change due to the House Tax Bill.

Inflationary Pressures

Increased government spending and the overall economic stimulus potentially generated by the tax bill could contribute to inflationary pressures.

- Inflation's Impact on Bonds: Inflation erodes the purchasing power of bond returns, especially for long-term bonds. Investors need to carefully consider this factor in their investment strategies.

- Inflation-Protected Securities: Investors might consider shifting towards inflation-protected securities, such as TIPS (Treasury Inflation-Protected Securities), to mitigate the impact of rising prices.

- Monitoring Inflation Indices: Monitoring key inflation indices, like the Consumer Price Index (CPI), is crucial for making informed decisions in a potentially inflationary environment.

Impact on Bitcoin

The cryptocurrency market, especially Bitcoin, faces a unique set of challenges and opportunities as a result of the House tax bill.

Regulatory Uncertainty

The bill's provisions regarding cryptocurrency taxation are still somewhat unclear, creating significant regulatory uncertainty.

- Bitcoin Market Volatility: This uncertainty could lead to considerable volatility in the Bitcoin market, impacting its price significantly.

- Capital Gains Taxes: Changes in capital gains taxes could significantly impact Bitcoin investments, influencing investor behavior.

- Staying Informed: Staying informed about evolving regulations and clarifications on cryptocurrency taxation is essential for investors in Bitcoin.

Safe-Haven Asset Potential

Bitcoin has sometimes been touted as a safe-haven asset during times of economic uncertainty. However, its inherent volatility needs to be considered.

- Volatility vs. Safe Haven: The reality is that its price fluctuations make it a very risky investment, despite its potential as a safe haven.

- Impact on Safe Haven Status: The long-term effects of the tax bill on Bitcoin's role as a safe haven asset are yet to be fully determined.

- Diversification: Maintaining a diversified portfolio across various asset classes, with a well-considered allocation to cryptocurrencies, is crucial for managing risk.

Conclusion

The House tax bill's passage presents a multifaceted scenario with potential impacts on the stock market, bond market, and Bitcoin. Understanding the potential effects on corporate profits, interest rates, inflation, and regulatory uncertainty is vital for investors. Careful analysis of market trends, the implementation of robust diversification strategies, and staying updated on the evolving regulations related to the House Tax Bill impact will allow for better-informed investment decisions. Keep monitoring the news and market trends to navigate these changes effectively. Stay informed about the ongoing House Tax Bill impact on your portfolio! Take control of your financial future by understanding how this legislation affects your investments.

Featured Posts

-

Gaga And Polansky Couples Arrival At Snl Afterparty

May 24, 2025

Gaga And Polansky Couples Arrival At Snl Afterparty

May 24, 2025 -

Unveiling Burys Forgotten M62 Relief Road Project

May 24, 2025

Unveiling Burys Forgotten M62 Relief Road Project

May 24, 2025 -

Frances National Rally Evaluating The Strength Of Le Pens Support Following Sundays Demonstration

May 24, 2025

Frances National Rally Evaluating The Strength Of Le Pens Support Following Sundays Demonstration

May 24, 2025 -

Ferrari 296 Speciale Potencia Hibrida E Desempenho Aprimorado

May 24, 2025

Ferrari 296 Speciale Potencia Hibrida E Desempenho Aprimorado

May 24, 2025 -

West Ham Submits Bid For Southamptons Kyle Walker Peters

May 24, 2025

West Ham Submits Bid For Southamptons Kyle Walker Peters

May 24, 2025

Latest Posts

-

Couples Hilarious Fight Over Joe Jonas His Response

May 24, 2025

Couples Hilarious Fight Over Joe Jonas His Response

May 24, 2025 -

A Couples Fight Joe Jonass Response The Viral Moment

May 24, 2025

A Couples Fight Joe Jonass Response The Viral Moment

May 24, 2025 -

Joe Jonas And The Couples Argument The Full Story

May 24, 2025

Joe Jonas And The Couples Argument The Full Story

May 24, 2025 -

Joe Jonass Mature Response To A Fan Couples Argument

May 24, 2025

Joe Jonass Mature Response To A Fan Couples Argument

May 24, 2025 -

A Couples Argument Over Joe Jonas His Classy Response

May 24, 2025

A Couples Argument Over Joe Jonas His Classy Response

May 24, 2025