House Tax Bill Passes: Impact On Stock Market Today & Bitcoin

Table of Contents

Stock Market Reactions to the House Tax Bill

Short-Term Volatility

The passage of the House tax bill is likely to cause immediate fluctuations in the stock market. The specific direction and magnitude of these movements will depend heavily on the bill's details, particularly regarding corporate tax rates, capital gains taxes, and deductions. We can expect increased trading volume as investors react to the news and reassess their portfolios.

- Increased trading volume expected: The uncertainty surrounding the new tax regime will likely lead to increased trading activity as investors try to adjust their positions.

- Potential for sector-specific rallies or dips: Sectors particularly affected by the bill, such as energy, technology, or real estate, may experience more pronounced price swings. For example, changes to tax incentives for renewable energy could significantly impact related stocks.

- Uncertainty could lead to cautious investor behavior: Until the long-term implications are fully understood, many investors may adopt a wait-and-see approach, leading to more cautious trading and potentially lower overall market volume.

Long-Term Implications for Stock Market Growth

The long-term impact of the House tax bill on stock market growth hinges on several factors. The changes to corporate tax rates will directly affect corporate profits, influencing investor confidence and future investment decisions. Changes to capital gains taxes will also play a crucial role, influencing investment strategies and potentially altering the attractiveness of certain asset classes.

- Impact on corporate tax rates and their effect on earnings: Lower corporate tax rates could boost corporate profits, leading to higher stock prices. However, if the bill includes provisions that offset these benefits, the overall impact might be muted or even negative.

- Changes in dividend taxation and their influence on income-oriented investments: Changes to dividend taxation could make income-oriented investments more or less attractive, shifting investor preferences and affecting the prices of dividend-paying stocks.

- Potential effects on mergers and acquisitions activity: Tax implications for mergers and acquisitions could influence corporate restructuring activity, indirectly impacting stock prices in various sectors.

Bitcoin's Response to the House Tax Bill Passage

Immediate Price Fluctuations

The passage of the House tax bill could trigger significant price volatility in the Bitcoin market. Investor sentiment plays a critical role; if the bill is perceived as negatively impacting the overall economy, investors might seek refuge in assets perceived as safe havens, such as Bitcoin, potentially driving its price upward. Conversely, a positive market reaction could lead to a decrease in demand for Bitcoin.

- Safe-haven status of Bitcoin and its potential appeal during economic uncertainty: Bitcoin's reputation as a safe haven asset might lead to increased demand if investors perceive the tax bill as creating economic instability.

- Correlation (or lack thereof) between Bitcoin price and traditional market movements: The relationship between Bitcoin and traditional markets is complex and often shows low correlation. The impact of the House tax bill on Bitcoin's price will depend on its overall impact on investor confidence and the perception of Bitcoin's future prospects.

- Impact of regulatory clarity (or lack thereof) on Bitcoin's price: Any clarification or changes in cryptocurrency regulation within the bill could significantly influence investor confidence and Bitcoin's price.

Long-Term Outlook for Bitcoin Under the New Tax Regime

The long-term impact of the House tax bill on Bitcoin will depend largely on how the bill addresses the taxation of cryptocurrency transactions and investments. Clearer regulatory frameworks could enhance investor confidence, potentially boosting Bitcoin adoption and price. Conversely, ambiguous or unfavorable tax treatment could dampen investor enthusiasm and negatively impact the market.

- Tax treatment of Bitcoin gains and losses: The specific tax treatment of Bitcoin gains and losses under the new legislation will significantly influence investment decisions and potentially alter market dynamics.

- Potential impact on cryptocurrency exchanges and trading platforms: The bill's provisions regarding cryptocurrency exchanges and trading platforms could affect their operations and influence the overall market liquidity and stability.

- Overall impact on investor confidence in Bitcoin as an asset class: The long-term outlook for Bitcoin hinges heavily on investor confidence. A clear and predictable tax regime could foster investor confidence, while unclear regulations could lead to uncertainty and reduced investment.

Conclusion

The House tax bill's passage is a significant event with far-reaching consequences for both the stock market and the cryptocurrency market. While short-term volatility is expected, the long-term effects depend on how various sectors and investors adapt to the changes. Bitcoin's reaction will hinge on its perceived status as a safe-haven asset and the implications for cryptocurrency regulation. Understanding the nuances of this House tax bill and its potential impact is crucial for all investors.

Call to Action: Stay informed on the evolving impact of the House tax bill on your investments. Continue to monitor the market fluctuations of both the stock market and Bitcoin, and consider consulting a financial advisor for personalized guidance regarding the House Tax Bill and its effect on your portfolio. Understanding the implications of this new House tax legislation is key to navigating the complexities of the current financial landscape.

Featured Posts

-

Boises Acero Boards And Bottles A Neal Mc Donough Sighting

May 23, 2025

Boises Acero Boards And Bottles A Neal Mc Donough Sighting

May 23, 2025 -

Itv Faces Another Countdown After Holly Willoughbys Shocking Departure

May 23, 2025

Itv Faces Another Countdown After Holly Willoughbys Shocking Departure

May 23, 2025 -

Australia Out Of Bjk Cup Kazakhstan To Contest Final

May 23, 2025

Australia Out Of Bjk Cup Kazakhstan To Contest Final

May 23, 2025 -

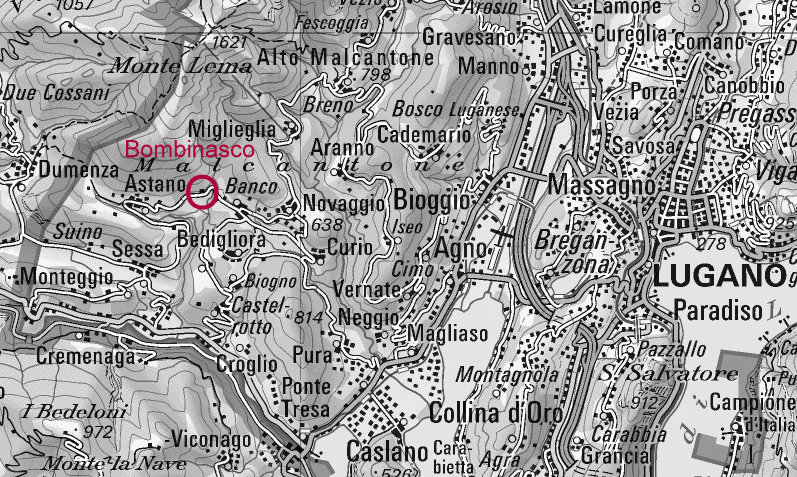

Swiss Alps Landslide Risk Forces Emergency Livestock Relocation

May 23, 2025

Swiss Alps Landslide Risk Forces Emergency Livestock Relocation

May 23, 2025 -

A Photographic Retrospective James Wiltshires 10th Anniversary At The Border Mail

May 23, 2025

A Photographic Retrospective James Wiltshires 10th Anniversary At The Border Mail

May 23, 2025

Latest Posts

-

Lea Michele Daniel Radcliffe And More Celebrate Jonathan Groffs Broadway Debut

May 23, 2025

Lea Michele Daniel Radcliffe And More Celebrate Jonathan Groffs Broadway Debut

May 23, 2025 -

Jonathan Groffs Broadway Opening Lea Michele And Friends Show Support

May 23, 2025

Jonathan Groffs Broadway Opening Lea Michele And Friends Show Support

May 23, 2025 -

Jonathan Groff And Just In Time A Broadway Milestone In The Making

May 23, 2025

Jonathan Groff And Just In Time A Broadway Milestone In The Making

May 23, 2025 -

Jonathan Groffs Just In Time Performance A Potential Tony Awards Milestone

May 23, 2025

Jonathan Groffs Just In Time Performance A Potential Tony Awards Milestone

May 23, 2025 -

Jonathan Groff Could Just In Time Lead To A Historic Tony Award Win

May 23, 2025

Jonathan Groff Could Just In Time Lead To A Historic Tony Award Win

May 23, 2025