How Effective Are Film Tax Credits In Attracting Productions To Minnesota?

Table of Contents

Minnesota's Film Tax Credit Program: A Deep Dive

Minnesota offers a film tax credit program designed to incentivize film and television production within its borders. Understanding its intricacies is crucial to assessing its effectiveness.

Structure and Benefits

The Minnesota film tax credit program provides a credit against Minnesota state income tax for eligible production expenses.

- Credit Percentage: The credit percentage offered varies depending on several factors, including location and the type of production.

- Eligibility Requirements: To qualify, productions must meet specific criteria, including minimum spending thresholds within Minnesota. These thresholds ensure substantial investment within the state's economy. Generally, productions must meet certain requirements regarding hiring Minnesota residents, and spending on local goods and services. The program is generally more generous for productions that film in rural areas of Minnesota.

- Application Process: The application process involves submitting detailed budget information, demonstrating compliance with eligibility requirements, and providing documentation of expenditures.

- Qualifying Expenses: Eligible expenses typically include labor costs (cast and crew), equipment rentals, location fees, post-production services, and other production-related expenses incurred within Minnesota.

Budgetary Allocation and Funding Sources

The annual budget allocated to the Minnesota film tax credit program varies from year to year. Funding primarily comes from the state's general fund, meaning it is subject to legislative appropriations. This means there are potential limits on the total amount of credits that can be claimed annually. This can impact the program's ability to attract larger productions.

Recent Changes and Updates

The Minnesota film tax credit program has undergone revisions throughout the years. Recent changes might include adjustments to credit percentages, eligibility requirements, or reporting procedures. These updates often aim to enhance the program's effectiveness and address any shortcomings. Tracking these modifications is essential for accurate assessment of the program's current impact.

Impact on Film Production in Minnesota

Analyzing the program's impact requires examining its effect on the number of productions, economic activity, and specific successful projects.

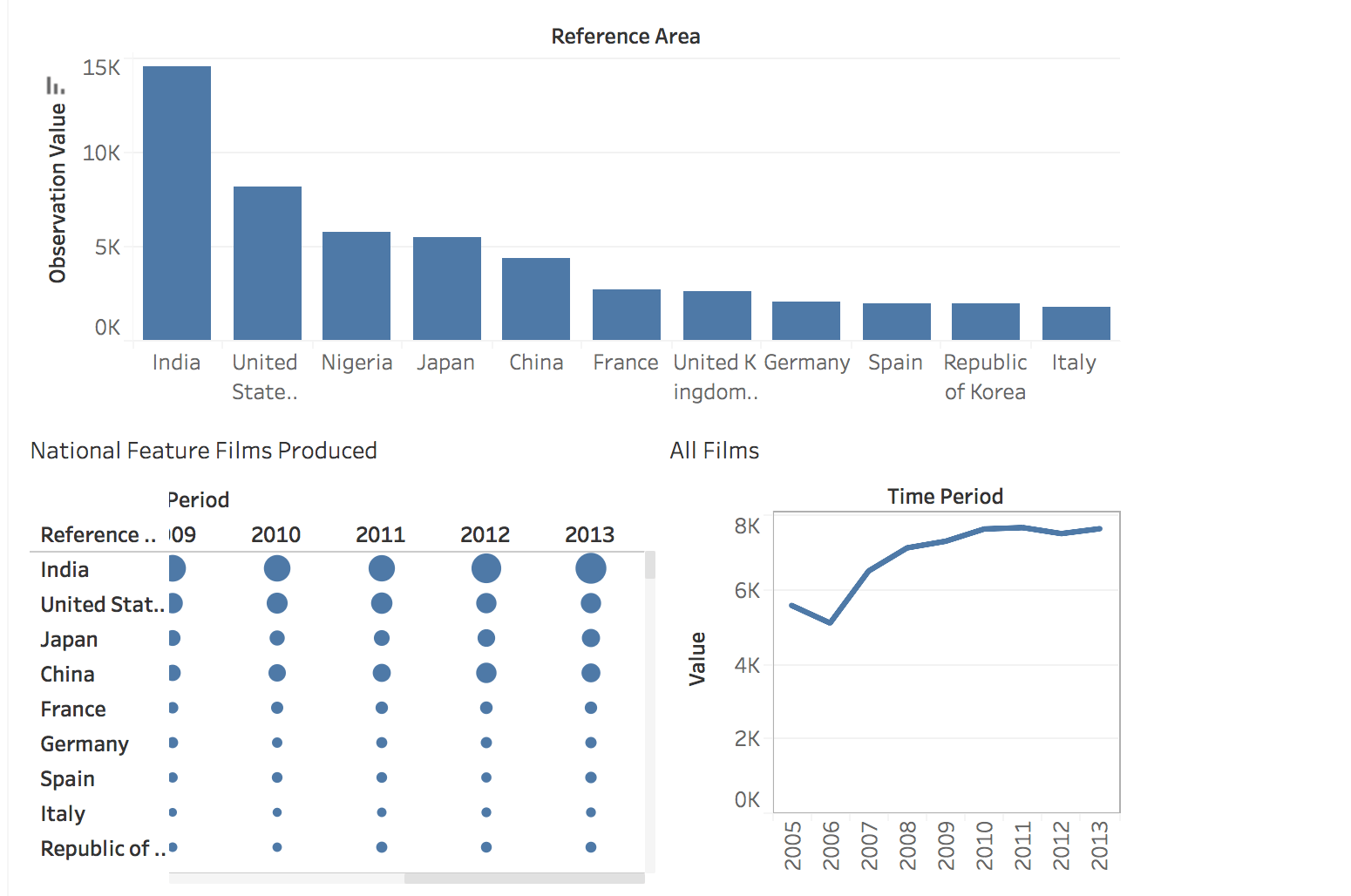

Number of Productions Attracted

Since the implementation of the film tax credit program, there has been a noticeable increase (or decrease – depending on data) in the number of film and television productions choosing Minnesota as their filming location. Comparing this to pre-credit numbers reveals the extent to which the program has influenced production choices. Data from the Minnesota Film Office should be consulted for accurate figures.

Economic Impact Assessment

Independent economic impact studies can quantify the program's effects. These studies typically analyze job creation (both direct and indirect), revenue generated from production spending, and the ripple effect on related industries such as hospitality, transportation, and local businesses. For instance, a study might show how much revenue was generated by hotels, restaurants and other local businesses as a result of a film crew choosing to film in a specific Minnesota town. This data helps determine the program's return on investment for the state.

Case Studies of Successful Productions

Highlighting specific productions that chose Minnesota due, at least in part, to the tax credits provides concrete examples of the program's success. These case studies can showcase the economic contributions of these productions, including job creation, direct spending, and positive publicity for the state. For instance, highlighting the economic impact of a major film production on a specific Minnesota city can further showcase the benefits of the program.

Comparison with Other States' Film Incentive Programs

To gauge Minnesota's competitiveness, a comparative analysis with other states' programs is necessary.

Benchmarking Against Similar Programs

Comparing Minnesota's program to those in neighboring states or other states known for film production reveals its strengths and weaknesses. This involves examining credit amounts, eligibility criteria, and the overall structure of competing incentive programs. This comparison helps determine whether Minnesota's program is competitive enough to attract productions that might otherwise film in other states.

Analysis of Different Incentive Models

Different states use various incentive models, including tax credits, rebates, and grants. Analyzing these different models and their effectiveness in attracting productions provides context for understanding Minnesota's approach. Each model has its advantages and disadvantages in terms of attracting productions, administration, and economic impact.

Factors Beyond Tax Credits

It's crucial to acknowledge that tax credits are not the sole factor influencing production location decisions. Other critical factors include skilled workforce availability, infrastructure (studio space, equipment access), location diversity, and overall production costs.

Challenges and Future of Minnesota's Film Tax Credit Program

Despite its potential benefits, the film tax credit program faces several challenges.

Program Sustainability

The long-term sustainability of the program depends on continued legislative support and sufficient budgetary allocation. Fluctuations in funding can impact the program's effectiveness and predictability for production companies.

Addressing Potential Concerns

Potential criticisms may include concerns about fairness in distributing benefits, ensuring accountability, and the overall effectiveness in generating a sufficient return on investment for the state. Addressing these concerns through transparency and program evaluation is essential for long-term success.

Recommendations for Improvement

Potential improvements may include refining eligibility criteria, streamlining the application process, enhancing marketing efforts to attract more productions, and exploring innovative incentive strategies to maximize the program's impact. Regular evaluations and adjustments are crucial for ensuring the program remains effective and competitive.

Conclusion

Minnesota's film tax credit program has played a role in attracting productions, stimulating economic activity, and boosting the state's profile as a filming location. However, its effectiveness is contingent on various factors, including budgetary allocations, program design, and competition from other states. Continuous evaluation, improvement, and sufficient funding are essential for ensuring the program’s long-term success in attracting film productions and boosting the state's economy. Learn more about the benefits of Minnesota's film tax credits and how they can help your production by visiting the Minnesota Film Office website.

Featured Posts

-

Older Adults And You Tube A New Era Of Television Viewing

Apr 29, 2025

Older Adults And You Tube A New Era Of Television Viewing

Apr 29, 2025 -

North Carolina University Campus Shooting Casualties Reported

Apr 29, 2025

North Carolina University Campus Shooting Casualties Reported

Apr 29, 2025 -

Tik Tok And Adhd Separating Fact From Fiction

Apr 29, 2025

Tik Tok And Adhd Separating Fact From Fiction

Apr 29, 2025 -

Yukon Mine Manager Faces Contempt Charges Over Refusal To Testify

Apr 29, 2025

Yukon Mine Manager Faces Contempt Charges Over Refusal To Testify

Apr 29, 2025 -

Blue Origins New Shepard Launch Cancelled Technical Glitch

Apr 29, 2025

Blue Origins New Shepard Launch Cancelled Technical Glitch

Apr 29, 2025