How Increasing Federal Debt Affects Your Mortgage Payment

Table of Contents

The Relationship Between Federal Debt and Interest Rates

The connection between increasing federal debt and your mortgage payment is largely indirect, but significant. It primarily works through its influence on interest rates.

How Government Borrowing Impacts Rates

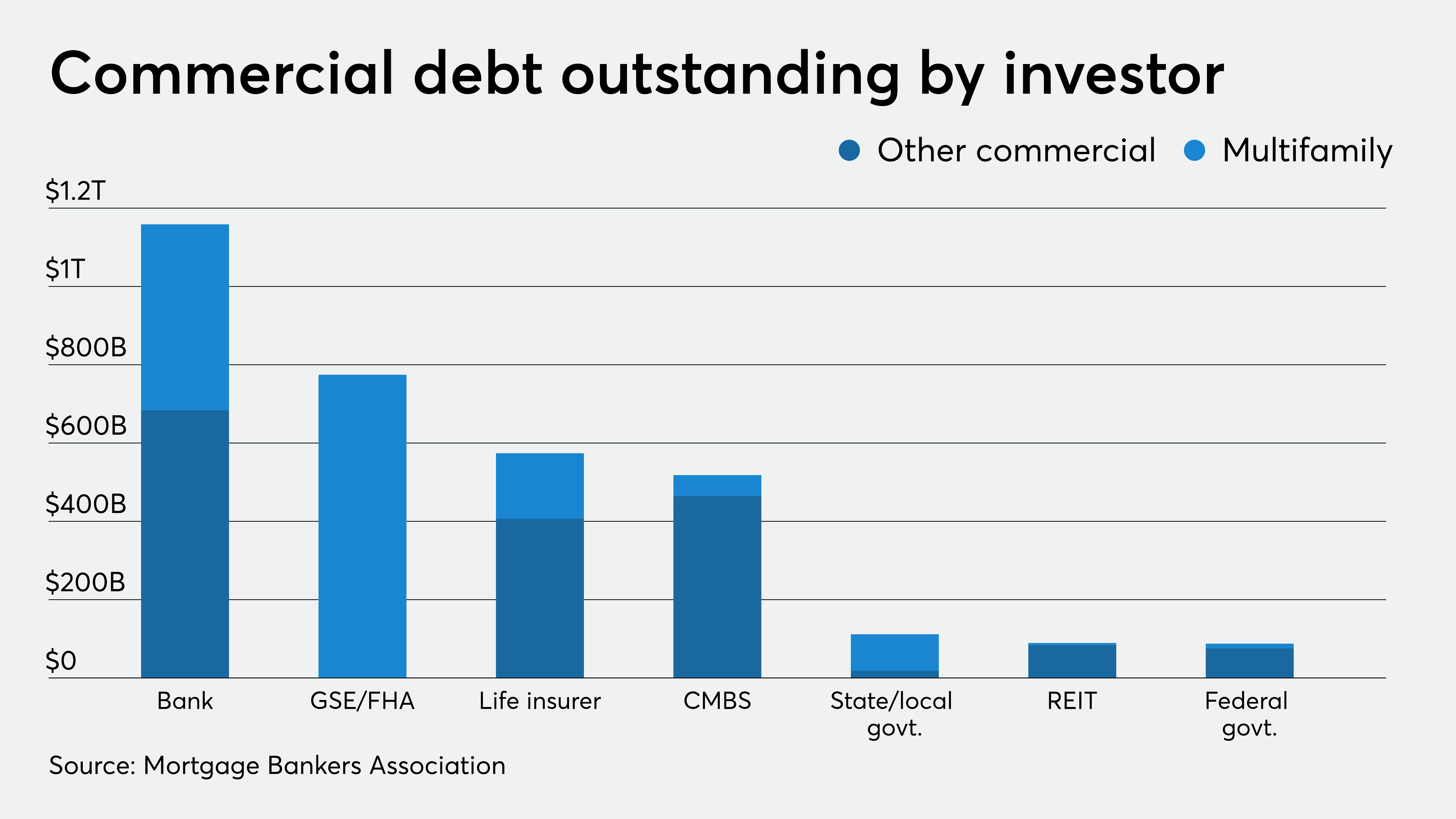

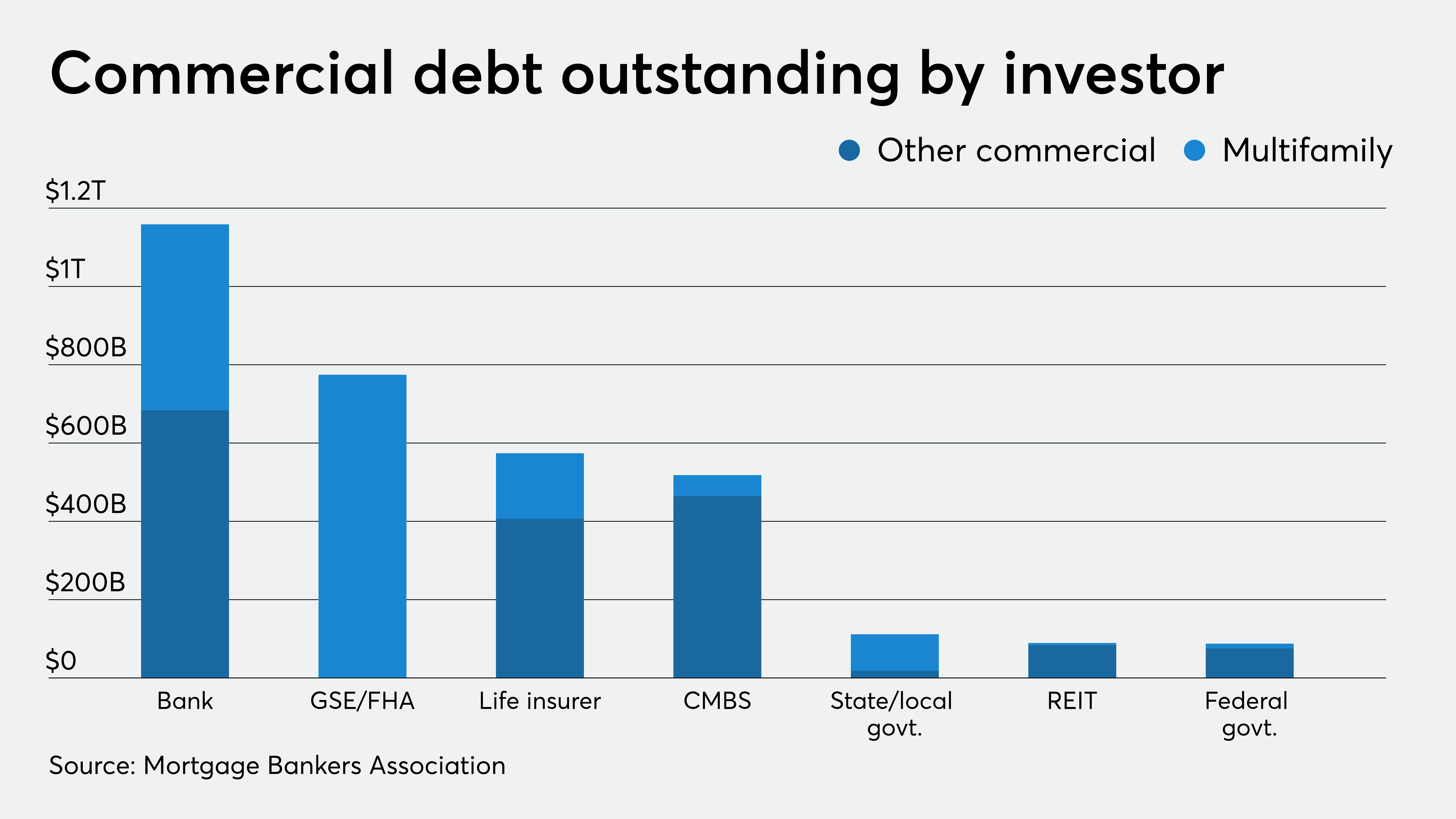

The U.S. government finances its debt by issuing Treasury bonds. When the government borrows more money, it increases the demand for loans in the bond market. This increased demand, all else being equal, pushes up interest rates. These higher rates aren't limited to government bonds; they ripple through the entire financial system, impacting borrowing costs for businesses and consumers, including mortgage rates.

- Increased Treasury bond issuance: A higher national debt necessitates issuing more bonds, increasing the supply of debt instruments.

- Higher demand for capital: Increased borrowing by the government competes with private sector borrowing for available capital, driving up interest rates.

- Federal Reserve's influence: The Federal Reserve (the Fed) plays a crucial role in managing interest rates. While it aims for stable growth and low inflation, the government's borrowing activities can significantly influence the Fed's policy decisions.

Inflation's Role

High and persistent inflation is another significant factor. Increasing federal debt can contribute to inflation. When the government spends more without raising taxes or cutting spending elsewhere, it can lead to an increase in the money supply, which fuels inflation. In response to rising inflation, the Federal Reserve often raises interest rates to cool down the economy. This, in turn, leads to higher mortgage rates.

- Inflationary pressures: Government borrowing and spending can increase the money supply, contributing to higher inflation.

- Federal Reserve response: The Fed typically raises interest rates to combat inflation, which directly impacts mortgage rates.

- The inflation-interest rate relationship: Higher inflation generally leads to higher interest rates as lenders seek to protect their returns against the erosion of purchasing power.

Direct and Indirect Effects on Mortgage Rates

The impact of increasing federal debt on your mortgage payment manifests both directly and indirectly.

Direct Impact on Mortgage Rates

Rising interest rates, driven by increased federal debt and inflation, directly translate into higher monthly mortgage payments. Even a small increase in the interest rate can significantly affect your overall cost.

- Higher monthly payments: A higher interest rate on a mortgage means higher monthly payments over the loan's life.

- Increased total interest paid: Over the loan's term, the higher interest rate will result in a substantially larger amount of interest paid.

- Example: A 0.5% increase in interest rate on a $300,000, 30-year mortgage can increase monthly payments by several hundred dollars.

Indirect Impacts on the Housing Market

The impact extends beyond your monthly payment. Rising interest rates cool down the housing market by decreasing buyer demand. This can lead to a decline in home values, which can impact your ability to refinance your mortgage later.

- Reduced buyer demand: Higher mortgage rates make homeownership less affordable, reducing the number of potential buyers.

- Lower home values: Decreased demand can lead to a decrease in home prices, potentially affecting your home equity.

- Refinancing challenges: If you were hoping to refinance your mortgage at a lower rate in the future, rising rates might make that less feasible.

Protecting Yourself from Rising Mortgage Payments

While you can't control government debt levels, you can take steps to protect yourself from rising mortgage payments.

Financial Planning Strategies

Proactive financial planning is essential.

- Create a realistic budget: Track your income and expenses to understand your financial situation.

- Explore refinancing options (when beneficial): If interest rates drop, refinancing could lower your monthly payment. However, carefully weigh the fees involved.

- Build an emergency fund: Having savings can provide a buffer if your financial situation changes.

- Manage debt effectively: Paying down high-interest debt can improve your financial health and make you less vulnerable to rising rates.

Monitoring Economic Indicators

Staying informed about economic trends is crucial.

- Follow economic news: Pay attention to news reports about inflation, interest rate changes, and government debt levels.

- Understand economic indicators: Familiarize yourself with key economic indicators, like the Consumer Price Index (CPI) and the Federal Funds Rate.

- Consult financial professionals: Consider consulting with a financial advisor for personalized advice.

Conclusion

Understanding how increasing federal debt affects your mortgage payment is crucial for responsible financial planning. Rising federal debt often leads to higher interest rates, directly impacting mortgage payments and the overall housing market. Stay informed, manage your budget, and take proactive steps to protect your financial future. Consider exploring resources like the Federal Reserve website for economic data and financial planning tools to help you navigate these economic challenges.

Featured Posts

-

Istoria Toy Patriarxikoy Sylleitoyrgoy Sto Golgotha

May 19, 2025

Istoria Toy Patriarxikoy Sylleitoyrgoy Sto Golgotha

May 19, 2025 -

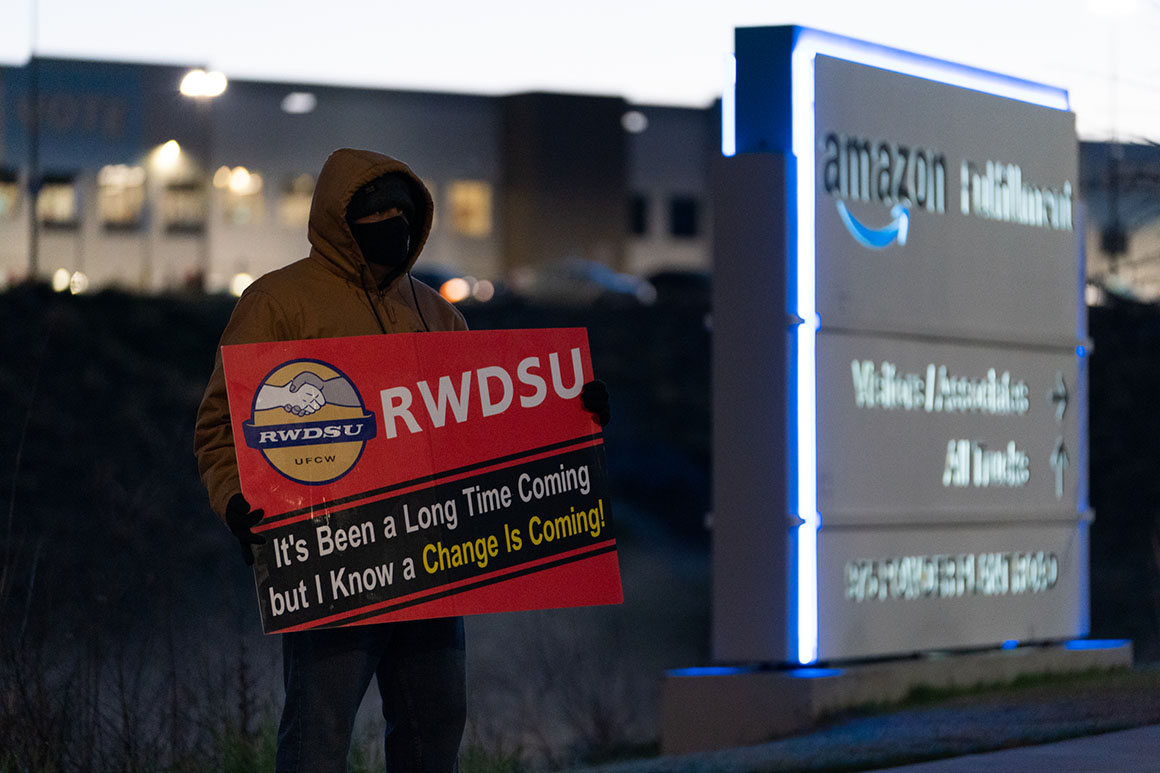

Amazon Faces Union Challenge Over Quebec Warehouse Closure Decisions

May 19, 2025

Amazon Faces Union Challenge Over Quebec Warehouse Closure Decisions

May 19, 2025 -

Jennifer Lawrence And Cooke Maroney Spotted Out Following Second Baby Rumors

May 19, 2025

Jennifer Lawrence And Cooke Maroney Spotted Out Following Second Baby Rumors

May 19, 2025 -

Cr Edit Mutuel Am Geopolitique Et Risques Environnementaux Maritimes

May 19, 2025

Cr Edit Mutuel Am Geopolitique Et Risques Environnementaux Maritimes

May 19, 2025 -

Gensek Oon Neformalnaya Vstrecha Po Kipru V Zheneve

May 19, 2025

Gensek Oon Neformalnaya Vstrecha Po Kipru V Zheneve

May 19, 2025