How Margin Pressure Is Affecting Westpac (WBC) Profits

Table of Contents

The Impact of Rising Interest Rates on Westpac's NIM

The Reserve Bank of Australia (RBA)'s recent series of interest rate hikes has created a complex scenario for Westpac's profitability. While these increases are designed to curb inflation, they have also significantly increased Westpac's funding costs. This means the bank is paying more to secure the funds it lends out.

- Increased funding costs due to RBA rate hikes: The RBA's monetary policy directly impacts the cost of funds for banks like Westpac. Higher interest rates translate to increased borrowing costs for the bank itself.

- Lagging impact on lending rates, impacting NIM: Westpac, like other banks, doesn't immediately pass on these increased funding costs to borrowers. This lag creates a squeeze on its net interest margin, the difference between the interest earned on loans and the interest paid on deposits.

- Difficulty in passing on increased costs to borrowers: In a competitive market, raising lending rates too aggressively can risk losing customers to competitors offering more attractive rates. This creates a delicate balancing act for Westpac.

- Analysis of Westpac's reported NIM and its recent trends: Examining Westpac's financial reports reveals a clear downward trend in its NIM, highlighting the direct impact of rising interest rates. A detailed analysis of these figures provides a concrete illustration of the pressure.

- Comparison of Westpac's NIM performance against competitors: Benchmarking Westpac's NIM against its competitors (e.g., Commonwealth Bank, ANZ, NAB) provides valuable context and reveals whether this margin pressure is a sector-wide issue or specific to Westpac.

Heightened Competition in the Australian Banking Sector

The Australian banking sector is far from static. Increasing competition, particularly from new digital banks and fintech companies, is putting immense pressure on Westpac's margins.

- Emergence of new digital banks and fintech companies: The rise of digital-only banks and innovative fintech solutions offers customers alternative banking options, often with lower fees and more attractive interest rates.

- Increased competition for mortgages and other lending products: This heightened competition intensifies the pressure on Westpac to offer competitive pricing on mortgages, personal loans, and other financial products, eating into their profitability.

- Pressure to offer competitive interest rates, impacting margins: To retain and attract customers, Westpac is forced to offer competitive interest rates, further reducing its NIM.

- Strategies employed by Westpac to retain customers and market share: Westpac is actively trying to counter this through various initiatives, such as enhanced customer service, loyalty programs, and innovative digital banking solutions.

- Impact of increased competition on customer acquisition costs: The battle for market share has led to a rise in customer acquisition costs, impacting profitability and further squeezing margins.

Economic Headwinds and Their Effect on Westpac's Profits

The current Australian economic climate presents further challenges for Westpac. Inflation, slowing consumer spending, and potential increases in loan defaults all contribute to margin pressure.

- Impact of inflation on consumer spending and borrowing behavior: High inflation erodes purchasing power, leading to reduced consumer spending and impacting demand for loans.

- Slowdown in credit growth affecting lending income: Slower economic growth translates to reduced demand for credit, negatively affecting Westpac's lending income.

- Potential rise in loan defaults due to economic uncertainty: Economic uncertainty can increase the risk of loan defaults, impacting Westpac's profitability and requiring increased provisions for bad debts.

- Westpac's strategic response to the economic climate: Westpac is likely adapting its lending practices and risk management strategies to navigate the current economic headwinds.

- Analysis of Westpac's financial reports to showcase the effects: A close examination of Westpac’s financial reports will reveal the tangible impact of these economic factors on key financial metrics.

Westpac's Strategies to Mitigate Margin Pressure

Westpac is actively implementing various strategies to counteract the pressure on its margins. These include cost-cutting measures, efficiency improvements, and strategic diversification.

- Cost-cutting measures implemented by Westpac to improve efficiency: Westpac is likely streamlining operations, reducing redundancies, and optimizing its branch network to improve overall efficiency and reduce costs.

- Strategies to increase revenue streams beyond traditional banking: The bank may be exploring new revenue opportunities through wealth management, insurance, or other financial services.

- Investment in technology and digital transformation: Investing in technology and digital transformation can improve efficiency, reduce operational costs, and enhance customer experience.

- Initiatives to improve customer retention and satisfaction: Improving customer retention reduces customer acquisition costs and builds a more loyal customer base.

- Assessment of the effectiveness of these strategies: The long-term success of Westpac will depend heavily on the effectiveness of these strategies in mitigating margin pressure and driving sustainable profitability.

Conclusion

Margin pressure is undeniably impacting Westpac's (WBC) profitability. The confluence of rising interest rates, intensified competition, and challenging economic conditions is significantly squeezing the bank's net interest margin, directly affecting its bottom line. While Westpac is actively implementing strategies to mitigate these pressures, the long-term effectiveness of these measures remains to be seen. Understanding these dynamics is crucial for investors and stakeholders seeking to make informed decisions regarding Westpac and the broader Australian banking sector.

Call to Action: Stay informed about how margin pressure continues to affect Westpac (WBC) profits by regularly reviewing financial news, analyzing Westpac's financial reports, and monitoring independent industry analyses. Understanding these dynamics is vital for making sound investment decisions related to Westpac and the broader Australian banking sector. Keep a close eye on Westpac’s strategic responses and the evolving economic landscape to stay up-to-date on this complex situation.

Featured Posts

-

La France Un Manque De Participation Citoyenne Dans Les Decisions Militaires Importantes

May 05, 2025

La France Un Manque De Participation Citoyenne Dans Les Decisions Militaires Importantes

May 05, 2025 -

Ufc 314 Volkanovski Vs Lopes Who Won And Lost At Ufc 314

May 05, 2025

Ufc 314 Volkanovski Vs Lopes Who Won And Lost At Ufc 314

May 05, 2025 -

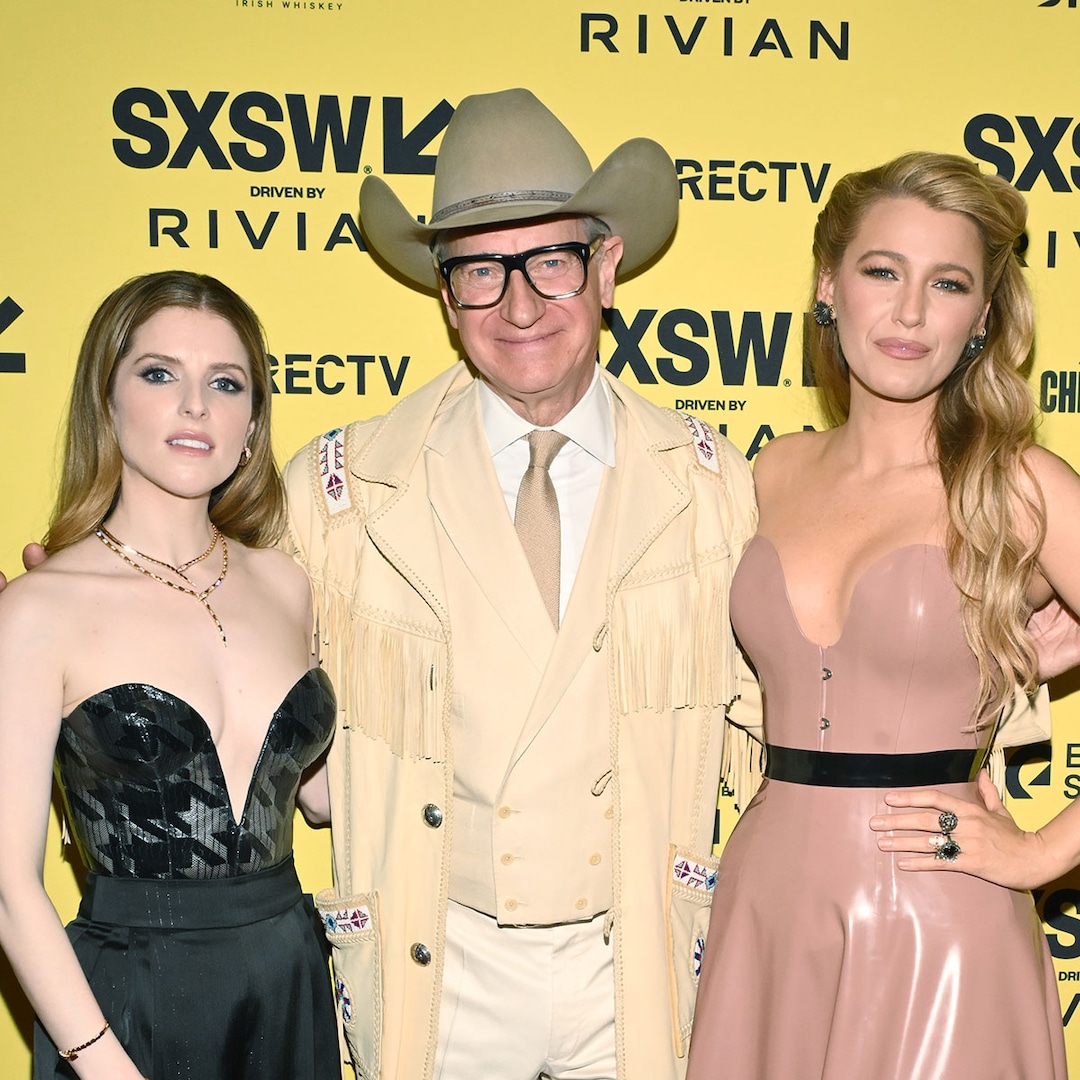

Blake Lively And Anna Kendrick Body Language Expert Decodes Awkward Interactions Amid Feud Rumors

May 05, 2025

Blake Lively And Anna Kendrick Body Language Expert Decodes Awkward Interactions Amid Feud Rumors

May 05, 2025 -

Predicting Ufc Kansas City Main Card Fights Odds And Expert Breakdown

May 05, 2025

Predicting Ufc Kansas City Main Card Fights Odds And Expert Breakdown

May 05, 2025 -

Georgetown Womans Kentucky Derby Festival Queen Victory A 2025 Triumph

May 05, 2025

Georgetown Womans Kentucky Derby Festival Queen Victory A 2025 Triumph

May 05, 2025

Latest Posts

-

Mindy Kalings Dramatic Weight Loss A New Look At The Premiere

May 06, 2025

Mindy Kalings Dramatic Weight Loss A New Look At The Premiere

May 06, 2025 -

Mindy Kalings Dramatic Weight Change Before And After

May 06, 2025

Mindy Kalings Dramatic Weight Change Before And After

May 06, 2025 -

Fans React To Mindy Kalings Transformed Appearance

May 06, 2025

Fans React To Mindy Kalings Transformed Appearance

May 06, 2025 -

Mindy Kalings Slim Figure Stuns Fans At Series Premiere

May 06, 2025

Mindy Kalings Slim Figure Stuns Fans At Series Premiere

May 06, 2025 -

Red Carpet Ready Mindy Kalings Slim Figure At Series Premiere

May 06, 2025

Red Carpet Ready Mindy Kalings Slim Figure At Series Premiere

May 06, 2025